projectfinance

Step up your finance game.

Option Exercise and Assignment Explained w/ Visuals

Last updated on February 11th, 2022 , 06:38 am

Buyers of options have the right to exercise their option at or before the option’s expiration. When an option is exercised, the option holder will buy (for exercised calls) or sell (for exercised puts) 100 shares of stock per contract at the option’s strike price.

Conversely, when an option is exercised, a trader who is short the option will be assigned 100 long (for short puts) or short (for short calls) shares per contract.

- Long American style options can exercise their contract at any time.

- Long calls transfer to +100 shares of stock

- Long puts transfer to -100 shares of stock

- Short calls are assigned -100 shares of stock.

- Short puts are assigned +100 shares of stock.

- Options are typically only exercised and thus assigned when extrinsic value is very low.

- Approximately only 7% of options are exercised.

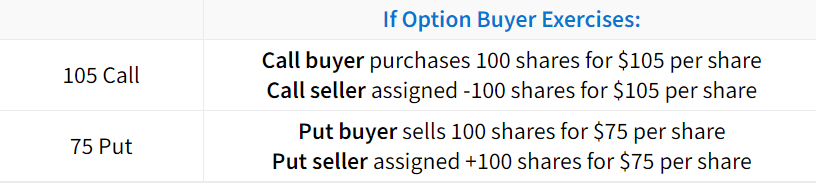

The following sequences summarize exercise and assignment for calls and puts (assuming one option contract ):

Call Buyer Exercises Option ➜ Purchases 100 shares at the call’s strike price.

Call Seller Assigned ➜ Sells/shorts 100 shares at the call’s strike price.

Put Buyer Exercises Option ➜ Sells/shorts 100 shares at the put’s strike price.

Put Seller Assigned ➜ Purchases 100 shares at the put’s strike price.

Let’s look at some specific examples to drill down on this concept.

Exercise and Assignment Examples

In the following table, we’ll examine how various options convert to stock positions for the option buyer and seller:

As you can see, exercise and assignment is pretty straightforward: when an option buyer exercises their option, they purchase (calls) or sell (puts) 100 shares of stock at the strike price . A trader who is short the assigned option is obligated to fulfill the opposite position as the option exerciser.

Automatic Exercise at Expiration

Another important thing to know about exercise and assignment is that standard in-the-money equity options are automatically exercised at expiration. So, traders may end up with stock positions by letting their options expire in-the-money.

An in-the-money option is defined as any option with at least $0.01 of intrinsic value at expiration . For example, a standard equity call option with a strike price of 100 would be automatically exercised into 100 shares of stock if the stock price is at $100.01 or higher at expiration.

What if You Don't Have Enough Available Capital?

Even if you don’t have enough capital in your account, you can still be assigned or automatically exercised into a stock position. For example, if you only have $10,000 in your account but you let one 500 call expire in-the-money, you’ll be long 100 shares of a $500 stock, which is a $50,000 position. Clearly, the $10,000 in your account isn’t enough to buy $50,000 worth of stock, even on 4:1 margin.

If you find yourself in a situation like this, your brokerage firm will come knocking almost instantaneously. In fact, your brokerage firm will close the position for you if you don’t close the position quickly enough.

Why Options are Rarely Exercised

At this point, you understand the basics of exercise and assignment. Now, let’s dive a little deeper and discuss what an option buyer forfeits when they exercise their option.

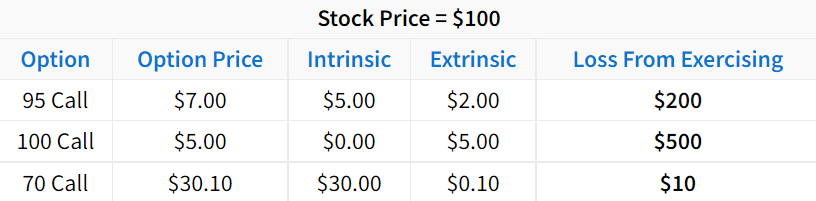

When an option is exercised, the option is converted into long or short shares of stock. However, it’s important to note that the option buyer will lose the extrinsic value of the option when they exercise the option. Because of this, options with lots of extrinsic value remaining are unlikely to be exercised. Conversely, options consisting of all intrinsic value and very little extrinsic value are more likely to be exercised.

The following table demonstrates the losses from exercising an option with various amounts of extrinsic value:

As we can see here, exercising options with lots of extrinsic value is not favorable.

Why? Consider the 95 call trading for $7. Exercising the call would result in an effective purchase price of $102 because shares are bought at $95, but $7 was paid for the right to buy shares at $95.

With an effective purchase price of $102 and the stock trading for $100, exercising the option results in a loss of $2 per share, or $200 on 100 shares.

Even if the 95 call was previously purchased for less than $7, exercising an option with $2 of extrinsic value will always result in a P/L that’s $200 lower (per contract) than the current P/L. F

or example, if the trader initially purchased the 95 call for $2, their P/L with the option at $7 would be $500 per contract. However, if the trader decided to exercise the 95 call with $2 of extrinsic value, their P/L would drop to +$300 because they just gave up $200 by exercising.

7% Of Options Are Exercised

Because of the fact that traders give up money by exercising an option with extrinsic value, most options are not exercised. In fact, according to the Options Clearing Corporation, only 7% of options were exercised in 2017 . Of course, this may not factor in all brokerage firms and customer accounts, but it still demonstrates a low exercise rate from a large sample size of trading accounts.

So, in almost all cases, it’s more beneficial to sell the long option and buy or sell shares instead of exercising. We like to call this approach a “synthetic exercise.”

Congrats! You’ve learned the basics of exercise and assignment. If you’d like to know how the exercise and assignment process actually works, continue to the next section!

Who Gets Assigned When an Option is Exercised?

With thousands of traders long and short options in the market, who actually gets assigned when one of the traders exercises their option?

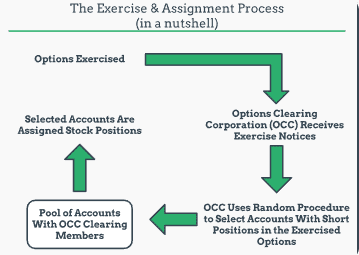

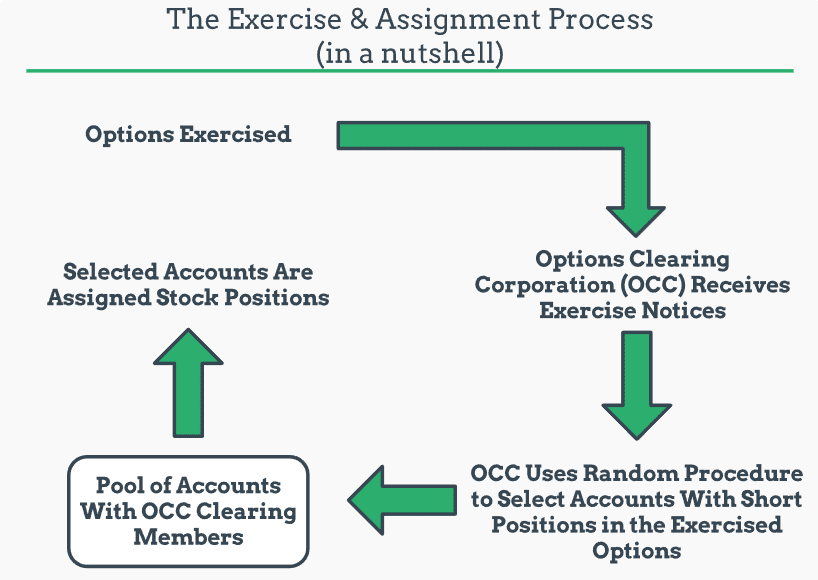

In this section, we’ll run through the exercise and assignment process for options so you know how the assignment decision occurs.

If a trader is short a single option, how do they get assigned if one of a thousand other traders exercises that option?

The short answer is that the process is random. For example, if there are 5,000 traders who are long a call option and 5,000 traders who are short that call option, an account with the short option will be randomly assigned the exercise notice. The random process ensures that the option assignment system is fair

Visualizing Assignment and Exercise

The following visual describes the general process of exercise and assignment:

If you’d like, you can read the OCC’s detailed assignment procedure here (warning: it’s intense!).

Now you know how the assignment procedure works. In the final section, we’ll discuss how to quickly gauge the likelihood of early assignment on short options.

Assessing Early Option Assignment Risk

The final piece of understanding exercise and assignment is gauging the risk of early assignment on a short option.

As mentioned early, only 7% of options were exercised in 2017 (according to the OCC). So, being assigned on short options is rare, but it does happen. While a specific probability of getting assigned early can’t be determined, there are scenarios in which assignment is more or less likely.

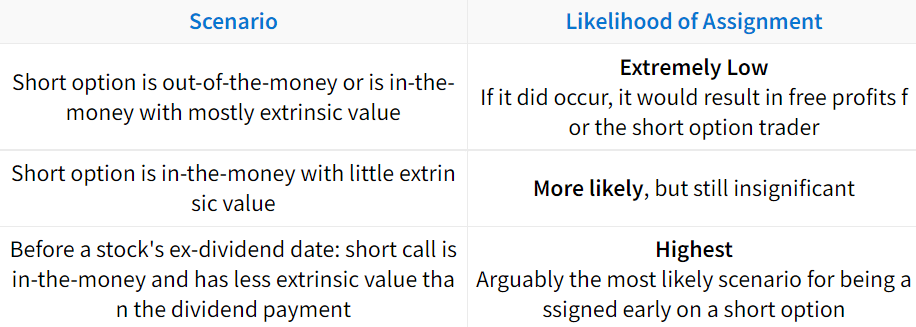

The following scenarios summarize broad generalizations of early assignment probabilities in various scenarios:

In regards to the dividend scenario, early assignment on in-the-money short calls with less extrinsic value than the dividend is more likely because the dividend payment covers the loss from the extrinsic value when exercising the option.

All in all, the risk of being assigned early on a short option is typically very low for the reasons discussed in this guide. However, it’s likely that you will be assigned on a short option at some point while trading options (unless you don’t sell options!), but at least now you’ll be prepared!

Next Lesson

Options Trading for Beginners

Intrinsic and Extrinsic Value in Options Trading Explained

Option Greeks Explained: Delta, Gamma, Theta & Vega

Additional resources.

Exercise and Assignment – CME Group

Learn About Exercise and Assignment – CME Group

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

The Mechanics of Option Trading, Exercise, and Assignment

Options were originally traded in the over-the-counter ( OTC ) market , where the terms of the contract were negotiated. The advantage of the OTC market over the exchanges is that the option contracts can be tailored: strike prices, expiration dates, and the number of shares can be specified to meet the needs of the option buyer. However, transaction costs are greater and liquidity is less.

Option trading really took off when the first listed option exchange — the Chicago Board Options Exchange ( CBOE )— was organized in 1973 to trade standardized contracts, greatly increasing the market and liquidity of options. The CBOE was the original exchange for options, but, by 2003, it has been superseded in size by the electronic Nasdaq International Securities Exchange (ISE), based in New York. Most options sold in Europe are traded through electronic exchanges. Other exchanges for options in the United States include: New York Stock Exchange , and the NASDAQtrader.com .

Option exchanges are central to the trading of options:

- they establish the terms of the standardized contracts

- they provide the infrastructure — both hardware and software — to facilitate trading, which is increasingly computerized

- they link together investors, brokers, and dealers on a centralized system, so that traders get the best bid/ask prices

- they guarantee trades by taking the opposite side of each transaction

- they establish the trading rules and procedures

Options are traded just like stocks — the buyer buys at the ask price and the seller sells at the bid price . The settlement time for option trades is 1 business day ( T+1 ). However, to trade options, an investor must have a brokerage account and be approved for trading options and must also receive a copy of the booklet Characteristics and Risks of Standardized Options .

The option holder, unlike the holder of the underlying stock, has no voting rights in the corporation, and is not entitled to any dividends. Brokerage commissions are still charged for options even though the commissions for stocks have been free for a while. Prices for most options range from $0.65 to $1 per contract .

The Options Clearing Corporation (OCC)

The Options Clearing Corporation ( OCC ) is the counterparty to all option trades. The OCC issues, guarantees, and clears all option trades involving its member firms, including all U.S. option exchanges, and ensures that sales are transacted according to the current rules. The OCC is jointly owned by its member firms — the exchanges that trade options — and issues all listed options, and controls and effects all exercises and assignments. To provide a liquid market, the OCC guarantees all trades by acting as the other party to all purchases and sales of options.

The OCC, like other clearing companies, is the direct participant in every purchase and sale of an option contract. When an option writer or holder sells his contracts to someone else, the OCC serves as an intermediary in the transaction. The option writer sells his contract to the OCC and the option buyer buys it from the OCC.

The OCC publishes statistics, news on options, and any notifications about changes in the trading rules, or the adjustment of certain option contracts because of a stock split or that were subjected to unusual circumstances, such as a merger of companies whose stock was the underlying security to the option contracts.

The OCC operates under the jurisdiction of both the Securities and Exchange Commission ( SEC ) and the Commodities Futures Trading Commission ( CFTC ). Under its SEC jurisdiction, OCC clears transactions for put and call options on common stocks and other equity issues, stock indexes, foreign currencies, interest rate composites and single-stock futures . As a registered Derivatives Clearing Organization ( DCO ) under CFTC jurisdiction, the OCC clears and settles transactions in futures and options on futures .

The Exercise of Options by Option Holders and the Assignment to Fulfill the Contract to Option Writers

When an option holder wants to exercise his option, he must notify his broker of the exercise, and if it is the last trading day for the option, the broker must be notified before the exercise cut-off time , which will probably be earlier than on trading days before the last day, and the cut-off time may differ for different option classes or for index options. Although policies differ among brokerages, it is the duty of the option holder to notify his broker to exercise the option before the cut-off time.

When the broker is notified, then the exercise instructions are sent to the OCC, which then assigns the exercise to one of its Clearing Members who are short in the same option series as is being exercised. The Clearing Member will then assign the exercise to one of its customers who is short in the option. The customer is selected by a specific procedure, usually on a first-in, first-out basis, or some other fair procedure approved by the exchanges. Thus, there is no direct connection between an option writer and a buyer.

To ensure contract performance, option writers are required to post margin, the amount depending on how much the option is in the money. If the margin is deemed insufficient, then the option writer will be subjected to a margin call. Option holders don't need to post margin because they will only exercise the option if it is in the money. Options, unlike stocks, cannot be bought on margin.

Because the OCC is always a party to an option transaction, an option writer can close out his position by buying the same contract back, even while the contract buyer retains his position, because the OCC draws from a pool of contracts with no connection to the original contract writer and buyer.

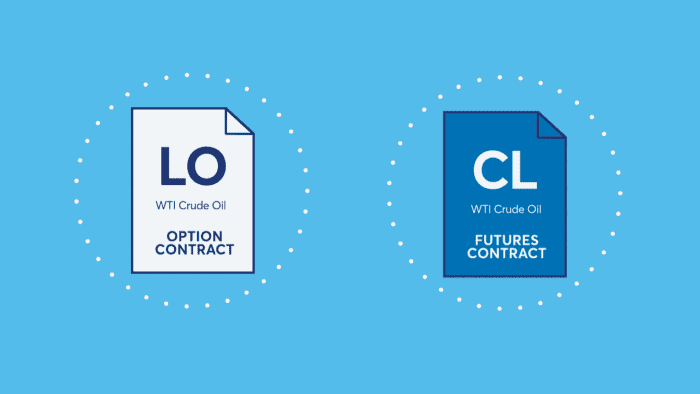

A diagram outlining the exercise and assignment of a call.

Example: No Direct Connection between Investors Who Write Options and those Who Buy Them

John Call-Writer writes an option that legally obligates him to provide 100 shares of JXYZ for the price of $30 until April. The OCC buys the contract, adding it to the millions of other option contracts in its pool. Sarah Call-Buyer buys a contract that has the same terms that John Call-Writer wrote — in other words, it belongs to the same option series . However, option contracts have no name on them. Sarah buys from the OCC, just as John sold to the OCC, and she just gets a contract giving her the right to buy 100 shares of JXYZ for $30 per share until April.

Scenario 1 — Exercises of Options are Assigned According to Specific Procedures

In February, the price of JXYZ rises to $35, and Sarah thinks it might go higher in the long run, but since March and April generally are volatile times for most stocks, she decides to exercise her call (sometimes called calling the stock ) to buy JXYZ stock at $30 per share to hold the stock indefinitely. She instructs her broker to exercise her call; her broker forwards the instructions to the OCC, which then assigns the exercise to one of its participating members who provided the call for sale; the participating member, in turn, assigns it to an investor who wrote such a call; in this case, it happened to be John's brother, Sam Call-Writer. John got lucky this time. Sam, unfortunately, either must turn over his appreciated shares of JXYZ, or he'll have to buy them in the open market to provide them. This is the risk that an option writer must take — an option writer never knows when he'll be assigned an exercise when the option is in the money.

Scenario 2 — Closing Out an Option Position by Buying Back the Contract

John Call-Writer decides that JXYZ might climb higher in the coming months, and so decides to close out his short position by buying a call contract with the same terms that he wrote — one that is in the same option series. Sarah, on the other hand, decides to maintain her long position by keeping her call contract until April. This can happen because there are no names on the option contracts. John closes his short position by buying the call back from the OCC at the market price, which may be higher or lower than what he paid, resulting in either a profit or a loss. Sarah can keep her contract because when she sells or exercises her contract, it will be with the OCC, not with John, and Sarah can be sure that the OCC will fulfill the terms of the contract if she exercises it later.

Thus, the OCC allows each investor to act independently of the other .

When the assigned option writer must deliver stock, she can deliver stock already owned, buy it on the market for delivery, or ask her broker to go short on the stock and deliver the borrowed shares. However, finding borrowed shares to short may not always be possible, so this method may not be available.

If the assigned call writer buys the stock in the market for delivery, the writer only needs the cash in his brokerage account to pay for the difference between what the stock cost and the strike price of the call, since the writer will immediately receive cash from the call holder for the strike price. Similarly, if the writer is using margin, then the margin requirements apply only to the difference between the purchase price and the strike price of the option. Full margin requirements, however, apply to shorted stock.

An assigned put writer will need either the cash or the margin to buy the stock at the strike price, even if he intends to sell the stock immediately after the exercise of the put. When the call holder exercises, he can keep the stock or immediately sell it. However, he must have the margin, if he has a margin account, or cash, for a cash account, to pay for the stock, even if he sells it immediately. He can also use the delivered stock to cover a short in the stock. (Note: equity requirements differ because an assigned call writer immediately receives the cash upon delivery of the shares, whereas a put writer or a call holder who purchased the shares may decide to keep the stock.)

Example: Fulfilling a Naked Call Exercise

A call writer receives an exercise notice on 10 call contracts with a strike of $30 per share on JXYZ stock on which she is still short. The stock currently trades at $35 per share. She does not own the stock, so, to fulfill her contract, she must buy 1,000 shares of stock in the market for $35,000 then sell it for $30,000, resulting in an immediate loss of $5,000 minus the commissions of the stock purchase and assignment.

Both the exercise and assignment incur brokerage commissions for both holder and assigned writer. Generally, the commission is smaller to sell the option than it is to exercise it. However, there may be no choice if it is the last day of trading before expiration. Both the buying and selling of options and the exercise or assignment are settled in 1 business day after the trade ( T+1 ).

Often, a writer will want to cover his short by buying the written option back on the open market. However, once he receives an assignment, then it is too late to cover his short position by closing the position with a purchase. Assignment is usually selected from writers still short at the end of the trading day. A possible assignment can be anticipated if the option is in the money at expiration, the option is trading at a discount, or the underlying stock is about to pay a large dividend.

The OCC automatically exercises any option that is in the money by at least $0.01 ( automatic exercise , Exercise-by-Exception , Ex-by-Ex ), unless notified by the broker not to. A customer may not want to exercise an option that is only slightly in the money if the transaction costs would exceed the net profit from the exercise. Despite the automatic exercise by the OCC, the option holder should notify his broker by the exercise cut-off time , which may be before the end of the trading day, of an intent to exercise. Exact procedures depend on the broker.

Any option that is sold on the last trading day before expiration would likely be bought by a market maker. Because a market maker's transaction costs are lower than for retail customers, a market maker may exercise an option even if it is only a few cents in the money. Thus, any option writer who does not want to be assigned should close out his position before expiration day if there is any chance that it will be in the money even by a few pennies.

Early Exercise

Sometimes, an option will be exercised before its expiration day — called early exercise , or premature exercise . Because options have a time value in addition to intrinsic value, most options are not exercised early. However, there is nothing to prevent someone from exercising an option, even if it is not profitable to do so, and sometimes it does occur, which is why anyone who is short an option should expect the possibility of being assigned early.

When an option is trading below parity (below its intrinsic value), then arbitrageurs can take advantage of the discount to profit from the difference, because their transaction costs are very low. An option with a high intrinsic value will have little time value, and so, because of the difference between supply and demand in the market at any given moment, the option could be trading for less than its true worth. An arbitrageur will almost certainly take advantage of the price discrepancy for an instant profit. Anyone who is short an option with a high intrinsic value should expect a good possibility of being assigned an exercise.

Example: Early Exercise by Arbitrageurs Profiting from an Option Discount

JXYZ stock is currently at $40 per share. Calls on the stock with a strike of $30 are selling for $9.80. This is a difference of $0.20 per share, enough of a difference for an arbitrageur, whose transaction costs are typically much lower than for a retail customer, to profit immediately by selling short the stock at $40 per share, then covering his short by exercising the call for a net of $0.20 per share minus the arbitrageur's small transaction costs.

Option discounts will only occur when the time value of the option is small, because either it is deep in the money or the option will soon expire.

Option Discounts Arising from an Imminent Dividend Payment on the Underlying Stock

When a large dividend is paid by the underlying stock, its price drops on the ex-dividend date, resulting in a lower value for the calls. The stock price may remain lower after the payment, because the dividend payment lowers the book value of the company. This causes many call holders to either exercise early to collect the dividend, or to sell the call before the drop in stock price. When many call holders sell at once, the calls sell at a discount to the underlying, creating opportunities for arbitrageurs to profit from the price difference. However, there is risk the transaction will lose money, because the dividend payment and drop in stock price may not equal the premium paid for the call, even if the dividend exceeds the time value of the call.

Example: Arbitrage Profit/Loss Scenario for a Dividend-Paying Stock

JXYZ stock is currently trading at $40 per share and will pay a dividend of $1 the next day. A call with a $30 strike is selling for $10.20, the $0.20 being the time value of the premium. So an arbitrageur decides to buy the call and exercise it to collect the dividend. Since the dividend is $1, but the time value is only $0.20, this could lead to a profit of $0.80 per share, but on the ex-dividend date, the stock drops to $39. Adding the $1 dividend to the share price yields $40, which is still less than buying the stock for $30 + $10.20 for the call. It might be profitable if the stock does not drop as much on the ex-date or it recovers after the ex-date sufficiently to make it profitable. But this is a risk for the arbitrageur, and this transaction is, thus, called risk arbitrage , because the profit is not guaranteed.

2019 Statistics for the Fate of Options

Data Source: https://www.optionseducation.org/referencelibrary/faq/options-exercise

All option writers who didn't close out their position earlier by buying an offsetting contract made the maximum profit — the premium — on those contracts that expired. Option writers have lost at least something when the option is exercised, because the option holder wouldn't exercise it unless it was in the money. The more the exercised option was in the money, the greater the loss is for the assigned option writer and the greater the profits for the option holder. A closed out transaction could be at a profit or a loss for both holders and writers of options, but closing out a transaction is usually done either to maximize profits or to minimize losses, based on expected changes in the price of the underlying security until expiration.

Get the Reddit app

Let's Talk About: Exchange Traded Financial Options -- Options Fundamentals -- The Greeks -- Strategies -- Current Plays and Ideas -- Q&A -- **New Traders**: See the Options Questions Safe Haven weekly thread

Help Needed on Futures Options Assignment Type

Futures Option Traders, need some guidance. I tried reading the option specs in CME but I still don't have a clear picture. My question is which options in the Option chain is European Style(can only be exercised at expiry) and which is American Style? I am still learning Future Options and need a way to tell looking at the option chain which on is European and which is American. Below are some TOS option chain screen for /ES, /GC and /CL, I will be grateful for your guidance.

By continuing, you agree to our User Agreement and acknowledge that you understand the Privacy Policy .

Enter the 6-digit code from your authenticator app

You’ve set up two-factor authentication for this account.

Enter a 6-digit backup code

Create your username and password.

Reddit is anonymous, so your username is what you’ll go by here. Choose wisely—because once you get a name, you can’t change it.

Reset your password

Enter your email address or username and we’ll send you a link to reset your password

Check your inbox

An email with a link to reset your password was sent to the email address associated with your account

Choose a Reddit account to continue

- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

Chat

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

The Risks of Options Assignment

Any trader holding a short option position should understand the risks of early assignment. An early assignment occurs when a trader is forced to buy or sell stock when the short option is exercised by the long option holder. Understanding how assignment works can help a trader take steps to reduce their potential losses.

Understanding the basics of assignment

An option gives the owner the right but not the obligation to buy or sell stock at a set price. An assignment forces the short options seller to take action. Here are the main actions that can result from an assignment notice:

- Short call assignment: The option seller must sell shares of the underlying stock at the strike price.

- Short put assignment: The option seller must buy shares of the underlying stock at the strike price.

For traders with long options positions, it's possible to choose to exercise the option, buying or selling according to the contract before it expires. With a long call exercise, shares of the underlying stock are bought at the strike price while a long put exercise results in selling shares of the underlying stock at the strike price.

When a trader might get assigned

There are two components to the price of an option: intrinsic 1 and extrinsic 2 value. In the case of exercising an in-the-money 3 (ITM) long call, a trader would buy the stock at the strike price, which is lower than its prevailing price. In the case of a long put that isn't being used as a hedge for a long stock position, the trader shorts the stock for a price higher than its prevailing price. A trader only captures an ITM option's intrinsic value if they sell the stock (after exercising a long call) or buy the stock (after exercising a long put) immediately upon exercise.

Without taking these actions, a trader takes on the risks associated with holding a long or short stock position. The question of whether a short option might be assigned depends on if there's a perceived benefit to a trader exercising a long option that another trader has short. One way to attempt to gauge if an option could be potentially assigned is to consider the associated dividend. An options seller might be more likely to get assigned on a short call for an upcoming ex-dividend if its time value is less than the dividend. It's more likely to get assigned holding a short put if the time value has mostly decayed or if the put is deep ITM and close to expiration with a wide bid/ask spread on the stock.

It's possible to view this information on the Trade page of the thinkorswim ® trading platform. Review past dividends, the price of the short call, and the price of the put at the call's strike price. While past performance cannot be relied upon to continue, this information can help a trader determine whether assignment is more or less likely.

Reducing the risk associated with assignment

If a trader has a covered call that's ITM and it's assigned, the trader will deliver the long stock out of their account to cover the assignment.

A trader with a call vertical spread 4 where both options are ITM and the ex-dividend date is approaching may want to exercise the long option component before the ex-dividend date to have long stock to deliver against the potential assignment of the short call. The trader could also close the ITM call vertical spread before the ex-dividend date. It might be cheaper to pay the fees to close the trade.

Another scenario is a call vertical spread where the ITM option is short and the out-of-the-money (OTM) option is long. In this case, the trader may consider closing the position or rolling it to a further expiration before the ex-dividend date. This move can possibly help the trader avoid having short stock on the ex-dividend date and being liable for the dividend.

Depending on the situation, a trader long an ITM call might decide it's better to close the trade ahead of the ex-dividend date. On the ex-dividend date, the price of the stock drops by the amount of the dividend. The drop in the stock price offsets what a trader would've earned on the dividend and there would still be fees on top of the price of the put.

Assess the risk

When an option is converted to stock through exercise or assignment, the position's risk profile changes. This change could increase the margin requirements, or subject a trader to a margin call, 5 or both. This can happen at or before expiration during early assignment. The exercise of a long option position can be more likely to trigger a margin call since naked short option trades typically carry substantial margin requirements.

Even with early exercise, a trader can still be assigned on a short option any time prior to the option's expiration.

1 The intrinsic value of an options contract is determined based on whether it's in the money if it were to be exercised immediately. It is a measure of the strike price as compared to the underlying security's market price. For a call option, the strike price should be lower than the underlying's market price to have intrinsic value. For a put option the strike price should be higher than underlying's market price to have intrinsic value.

2 The extrinsic value of an options contract is determined by factors other than the price of the underlying security, such as the dividend rate of the underlying, time remaining on the contract, and the volatility of the underlying. Sometimes it's referred to as the time value or premium value.

3 Describes an option with intrinsic value (not just time value). A call option is in the money (ITM) if the underlying asset's price is above the strike price. A put option is ITM if the underlying asset's price is below the strike price. For calls, it's any strike lower than the price of the underlying asset. For puts, it's any strike that's higher.

4 The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month.

5 A margin call is issued when the account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when buying power is exceeded. Margin calls may be met by depositing funds, selling stock, or depositing securities. A broker may forcibly liquidate all or part of the account without prior notice, regardless of intent to satisfy a margin call, in the interests of both parties.

Just getting started with options?

More from charles schwab.

Today's Options Market Update

Weekly Trader's Outlook

Long Options | 8-22-24

Related topics.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the options disclosure document titled Characteristics and Risks of Standardized Options before considering any options transaction. Supporting documentation for any claims or statistical information is available upon request.

With long options, investors may lose 100% of funds invested.

Spread trading must be done in a margin account.

Multiple leg options strategies will involve multiple commissions.

Commissions, taxes and transaction costs are not included in this discussion, but can affect final outcome and should be considered. Please contact a tax advisor for the tax implications involved in these strategies.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Financial Freestyle

- Capitol Gains

- Living Not So Fabulously

- Decoding Retirement

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Cme group inc. (cme).

In The Money

| Contract Name | Last Trade Date (EDT) | Strike | Last Price | Bid | Ask | Change | % Change | Volume | Open Interest | Implied Volatility |

|---|---|---|---|---|---|---|---|---|---|---|

| 7/16/2024 2:37 PM | 50.00 | 53.70 | 57.80 | 0.00 | 0.00% | 1 | 6 | 0.00% | ||

| 2/14/2024 5:28 PM | 58.20 | 59.50 | 63.50 | 0.00 | 0.00% | 5 | 5 | 152.56% | ||

| 7/26/2024 6:00 PM | 36.95 | 40.40 | 44.50 | 0.00 | 0.00% | 1 | 1 | 0.00% | ||

| 7/26/2024 6:00 PM | 27.35 | 30.50 | 34.80 | 0.00 | 0.00% | 1 | 6 | 0.00% | ||

| 3/14/2024 2:04 PM | 42.60 | 33.70 | 35.40 | 0.00 | 0.00% | 4 | 6 | 0.00% | ||

| 7/31/2024 1:55 PM | 14.71 | 28.70 | 33.00 | 0.00 | 0.00% | 1 | 39 | 68.04% | ||

| 8/30/2024 6:26 PM | 25.04 | 23.80 | 27.80 | 0.00 | 0.00% | 1 | 50 | 57.61% | ||

| 9/3/2024 5:25 PM | 16.98 | 19.00 | 23.30 | 0.00 | 0.00% | 2 | 114 | 53.92% | ||

| 9/3/2024 1:55 PM | 14.50 | 14.10 | 18.20 | 3.93 | 37.18% | 2 | 257 | 44.32% | ||

| 9/4/2024 6:44 PM | 5.96 | 6.20 | 8.30 | 1.36 | 29.57% | 26 | 2,435 | 26.44% | ||

| 9/4/2024 7:58 PM | 1.50 | 1.35 | 1.60 | 0.80 | 114.29% | 123 | 2,622 | 17.64% | ||

| 9/3/2024 2:04 PM | 0.04 | 0.00 | 0.30 | -0.06 | -60.00% | 2 | 742 | 20.41% | ||

| 9/4/2024 5:53 PM | 0.20 | 0.00 | 0.20 | 0.15 | 300.00% | 203 | 303 | 28.22% | ||

| 8/21/2024 4:42 PM | 0.05 | 0.00 | 0.70 | 0.00 | 0.00% | 3 | 91 | 47.12% | ||

| 8/12/2024 7:49 PM | 0.04 | 0.00 | 0.30 | 0.00 | 0.00% | 1 | 3 | 47.90% | ||

| 3/25/2024 1:56 PM | 0.61 | 0.00 | 0.00 | 0.00 | 0.00% | 1 | 3 | 25.00% |

| Contract Name | Last Trade Date (EDT) | Strike | Last Price | Bid | Ask | Change | % Change | Volume | Open Interest | Implied Volatility |

|---|---|---|---|---|---|---|---|---|---|---|

| 8/19/2024 2:26 PM | 0.10 | 0.00 | 0.05 | 0.00 | 0.00% | 2 | 0 | 121.09% | ||

| 3/18/2024 7:51 PM | 0.48 | 0.00 | 0.75 | 0.00 | 0.00% | 1 | 1 | 106.25% | ||

| 7/1/2024 1:30 PM | 0.15 | 0.00 | 0.00 | 0.00 | 0.00% | 1 | 4 | 50.00% | ||

| 8/26/2024 4:05 PM | 0.22 | 0.00 | 0.30 | 0.00 | 0.00% | 1 | 15 | 79.49% | ||

| 6/7/2024 1:56 PM | 0.85 | 0.00 | 2.35 | 0.00 | 0.00% | 1 | 3 | 105.54% | ||

| 8/13/2024 5:53 PM | 0.15 | 0.00 | 1.70 | 0.00 | 0.00% | 1 | 2 | 90.58% | ||

| 8/20/2024 7:50 PM | 0.05 | 0.00 | 0.35 | 0.00 | 0.00% | 1 | 60 | 62.31% | ||

| 8/28/2024 2:53 PM | 0.05 | 0.00 | 0.35 | 0.00 | 0.00% | 10 | 16 | 56.25% | ||

| 8/26/2024 7:32 PM | 0.09 | 0.00 | 0.35 | 0.00 | 0.00% | 1 | 65 | 50.29% | ||

| 8/28/2024 3:37 PM | 0.05 | 0.00 | 0.15 | 0.00 | 0.00% | 5 | 417 | 43.46% | ||

| 8/28/2024 6:56 PM | 0.08 | 0.10 | 0.40 | 0.00 | 0.00% | 2 | 195 | 45.17% | ||

| 9/4/2024 6:14 PM | 0.12 | 0.05 | 0.25 | -0.13 | -52.00% | 2 | 503 | 35.25% | ||

| 9/3/2024 5:48 PM | 0.32 | 0.20 | 0.30 | 0.00 | 0.00% | 1 | 500 | 30.42% | ||

| 9/4/2024 6:44 PM | 0.35 | 0.30 | 0.40 | -0.15 | -30.00% | 121 | 529 | 25.98% | ||

| 9/4/2024 7:38 PM | 1.50 | 1.40 | 1.60 | -1.25 | -45.45% | 37 | 337 | 21.84% | ||

| 9/4/2024 2:50 PM | 7.32 | 4.30 | 6.50 | 1.12 | 18.06% | 1 | 53 | 23.07% | ||

| 8/8/2024 7:02 PM | 25.50 | 12.90 | 17.50 | 0.00 | 0.00% | 2 | 2 | 47.18% |

Related Tickers

From Interactive Brokers

Asset Classes

- More Campus

Finance Courses and Lessons

Featured Lessons

Economic Forecast Contracts from ForecastEx

Financial News and Market Commentary

Featured Articles

Question du Jour – “What’s Wrong with NVDA?”

Reading, Writing, Math and Equity Losses: Sep. 3, 2024

Quantitative Code and News

Quant Articles

Data Science - Python Development

Mean Reversion Strategies: Introduction, Trading, Strategies and More – Part I

TensorFlow: Variational Autoencoder (VAE) for MNIST Digits

Webinars from Financial Professionals

Webinar Topics

Latest Webinars

Sep / 05 / 2024 - 10:00 am - EDT

China Market Update: Insights From On The Ground

Sep / 05 / 2024 - 6:00 pm - SGT

Tailoring Index Futures and Options to Any Market Outlook

Financial Market Commentary Podcasts

Listen to IBKR Podcasts on

Featured Podcasts

- IBKR Podcasts

Corporate Actions Unveiled: Strategies for Smart Investing

US Treasury Becomes Activist Debt Issuer to Juice the Economy

API Tools from Interactive Brokers

FIX Protocol

Third-Party Integrations

Featured API Articles

- Python Development

Using Pandas for Market Data Management

Python Development - REST Development

Handling Options Chains

Intro to the TWS API

Free investment financial education

Learn more about IBKR accounts

Low Commissions 1 , Global Access, Premiere Technology

Finance Training in the Classroom

Sample Curricula

The IBKR Advantage

Real-world experience for your classroom

IBKR Glossary of Financial Terms

Find by letter or search

Useful Tools and Information

Newsletter Signup

Multilingual content from IBKR

Getting Started at IBKR

- All Finance Courses

- Beginner Courses

- Intermediate Courses

- Advanced Courses

- Other Trading Products

- IBKR Student Trading Lab

- Fundamentals

- Intro to IBKR Tools

- Advanced IBKR Tools

- Institutions

- Chinese (Simplified)

- French (Canadian)

- Spanish – Español

- Traders’ Insight Home

- IBKR Economic Landscape

- IBKR Commentary

- Fixed Income

- Commodities

- Securities Lending

- Technical Analysis

- IBKR Quant Home

- Data Science

- Quant Development

- Conferences

- C# Development

- C++ Development

- Java Development

- Julia Development

- R Development

- REST Development

- TWS Excel API

- Upcoming Webinars

- Webinars Aired

- Webinar Contributors

- AI & Machine Learning

- Alternative Investments

- Cryptocurrency

- Energy Sector

- Financial Spotlight

- International

- Women in Finance

- Podcasts Home

- Cents of Security

- Podcasts En Español

- Contributor Podcasts

- Leave a Review

- IBKR-API Home

- Documentation Changelog

- Getting Started

- Market Data Subscriptions

- Order Types

- Web API Documentation

- Web API Reference

- Web API v1.0 Documentation

- TWS API Documentation

- TWS API Reference

- Excel ActiveX

- Available/Existing Integrations

- Prospective Integrations

- Stocks Education

- Options Education

- Futures Education

- Bonds Education

- Forex Education

- For Teachers

- For Students

- Educator Trading Lab

- Simulated Competition

- Stock Trading Sample Assignments

- Option Trading Sample Assignments

- Futures Trading Sample Assignments

- Forex Trading Sample Assignments

- Computer Science Sample Assignments

- Economics Sample Assignments

- ESG Sample Assignment

- All Glossary Terms

- IBKR Quant Terms

More Campus Resources

- About The IBKR Campus

- IBKR Campus Contributors

- IBKR Campus Authors

- IBKR Guides

- Live Charting

- IBKR Campus Newsletter

- Traders’ Insight Newsletter

- IBKR Webinars Newsletter

- IBKR Quant Newsletter

- IBKR API Newsletter

- Commencer chez IBKR

- Introdução à IBKR

- Introducción a IBKR

- IBKR Podcasts Español

CME Micro WTI Crude Oil Futures

Trading course, level beginner.

Learn about micro futures and futures options on CME Group’s Micro WTI Crude Oil contracts, and understand how they can be used to trade and hedge with respect to the price of crude oil.

Contributed by

Micro wti crude oil futures overview.

Great ideas transcend asset classes. CME Group is launching a new, smaller-sized futures contract on its global benchmark, WTI Crude Oil.

Option Hedging with Micro WTI Crude Oil futures

Precision hedging of a Crude Oil options position is one of the many features and benefits of NYMEX Micro WTI Crude Oil futures.

Managing expiration of the Micro WTI Crude Oil futures contract

Micro WTI Crude Oil futures contracts, from CME Group, are listed monthly and expire one day prior to the expiration of the corresponding contract month of the standard WTI Crude Oil futures contract.

Understanding options on Micro WTI Crude Oil futures

CME Group is launching a new, smaller sized option contracts on its global WTI Crude Oil benchmark. Micro WTI Crude Oil options will be 1/10th the size of the standard sized WTI Crude Oil option, providing market participants an efficient and cost-effective method to gain exposure to the crude oil market.

Basic principles of Micro WTI Crude Oil options

Have you ever wanted to express your view on the crude oil market but were hesitant because of the large contract sizes or premiums? Now you can trade smaller sized options on CME Group’s global WTI Crude Oil benchmark with Micro WTI Crude Oil options.

IBKR Campus Newsletters

Bi-weekly newsletter.

Get updates on podcasts, webinars, courses, and more from our IBKR pillars.

Daily Newsletter

View the latest financial news articles from the top voices in the industry.

Weekly Newsletter

For those wanting to trade markets using computer-power by coders and developers.

Monthly Newsletter

Hear about the latest tools and techniques from our own IBKR API staff.

This website uses cookies to collect usage information in order to offer a better browsing experience. By browsing this site or by clicking on the "ACCEPT COOKIES" button you accept our Cookie Policy.

Traders' Insight RSS

To add ibkr traders’ insight to your rss feed, please paste the following link into your reader:, ibkr quant rss, to add ibkr quant to your rss feed, please paste the following link into your reader:, this page contains information regarding options trading.

To view this page, you must acknowledge that you have received the Characteristics & Risks of Standardized Options, also known as the options disclosure document (ODD). Options involve risk and are not suitable for all investors. For more information, click here to read the " Characteristics and Risks of Standardized Options " or visit: ibkr.com/occ

By acknowledging this disclosure you are also allowing this website to use "functional" cookies on your browser. To find out more about cookies, see our privacy settings.

Privacy Preference Center

Your privacy.

When you visit any website it may use cookies and web beacons to store or retrieve information on your browser. This information might be about you, your preferences or your device and is typically used to make the website work as expected. The information does not usually directly identify you, but can provide a personalized browsing experience. Because we respect your right to privacy, you can choose not to allow some types of cookies and web beacons. Please click on the different category headings to find out more and change our default settings. However, blocking some types of cookies may impact your experience on our website and limit the services we can offer.

Strictly Necessary Cookies

Strictly necessary cookies are necessary for the website to function and cannot be switched off in our systems. They are typically set in response to actions made by you which amount to a request for services, such as setting your privacy preferences, logging in or filling in forms. While you can set your browser to block or alert you about these cookies, some parts of the website will not work. These cookies do not store any personally identifiable information.

ALWAYS ACTIVE

Performance Cookies

Performance cookies and web beacons allow us to count visits and traffic sources so we can measure and improve website performance. They help us to know which pages are the most and least popular and see how visitors navigate around our website. All information these cookies and web beacons collect is aggregated and anonymous. If you do not allow these cookies and web beacons we will not know when you have visited our website and will not be able to monitor its performance.

Allow Performance Cookies:

Functional Cookies

Functional cookies enable our website to provide enhanced functionality and personalization. They may be set by us or by third party providers whose services we have added to our pages. If you do not allow these cookies then some or all of these services may not function properly.

Allow Functional Cookies:

Marketing Cookies and Web Beacons

Marketing Cookies and web beacons may be set through our website by our advertising partners. They may be used by those companies to build a profile of your interests and show you relevant adverts on other websites. They do not directly store personal information, but uniquely identify your browser and internet device. If you do not allow these cookies and web beacons, you will experience less targeted advertising. Our website does not track users when they cross to third party websites, does not provide targeted advertising to them and therefore does not respond to "Do Not Track" signals.

Allow Marketing Cookies:

Interactive Brokers Group Cookie Policy

What are Cookies and Web Beacons?

Cookies are pieces of data that a website transfers to a user's hard drive for record-keeping purposes. Web beacons are transparent pixel images that are used in collecting information about website usage, e-mail response and tracking. Generally, cookies may contain information about your Internet Protocol ("IP") addresses, the region or general location where your computer or device is accessing the internet, browser type, operating system and other usage information about the website or your usage of our services, including a history of the pages you view.

How We Use Cookies and Web Beacons

Interactive Brokers Group collects information from cookies and web beacons and stores it in an internal database. This information is retained in accordance with our Privacy Policy. This website uses the following cookies and web beacons:

These cookies are necessary for the website to function and cannot be switched off in our systems. They are usually only set in response to actions made by you which amount to a request for services, such as setting your privacy preferences, logging in or filling in forms. You can configure your browser to block or alert you about these cookies, but certain areas of the site will not function properly. These cookies do not store any personal data.

Performance Cookies and Web Beacons

These cookies and web beacons allow us to count visits and traffic sources so we can measure and improve the performance of our site. They help us to know which pages are the most and least popular and see how visitors move around the site. All information that these cookies and web beacons collect is aggregated and, therefore, anonymous. If you do not allow these cookies and web beacons our aggregated statistics will not have a record of your visit. The website uses Google Analytics, a web analytics service provided by Google, Inc. ("Google"). Google Analytics uses cookies to help analyse how you use this website. The information generated by the cookie about your use of this website (including your IP address) will be transmitted to and stored by Google on servers in the United States. Google will use this information for the purposes of evaluating your use of the website, compiling reports on website activity for website operators and providing other services relating to website activity and internet usage. Google may also transfer this information to third parties where required to do so by law, or where such third parties process the information on Google's behalf. Google will not associate your IP address with any other data held by Google.

These cookies enable the website to provide enhanced functionality and personalization. They may be set by us or by third party providers whose services we have added to our pages. If you do not allow these cookies, some or all of these services may not function properly.

These cookies and web beacons may be set throughout our site by our advertising partners. They may be used by those companies to build a profile of your interests and show you relevant advertisements on other sites. They do not store personal information that could identify you directly, but are based on uniquely identifying your browser and internet device. If you do not allow these cookies and web beacons, you will experience less targeted advertising. The website does not track users when they cross to third party websites, does not provide targeted advertising to them and therefore does not respond to Do Not Track ("DNT") signals.

Managing Your Cookie Preferences

You have many choices with regards to the management of cookies on your computer. All major browsers allow you to block or delete cookies from your system. However, if you do decide to disable cookies you may not be able to access some areas of our website or the website may function incorrectly. To learn more about your ability to manage cookies and web beacons and how to disable them, please consult the privacy features in your browser or visit www.allaboutcookies.org. This website may link through to third party websites which may also use cookies and web beacons over which we have no control. We recommend that you check the relevant third parties privacy policy for information about any cookies and web beacons that may be used.

IBKR LLC (U.S.)

We are redirecting you to the Interactive Brokers LLC (U.S.) Website. Should you decide to open an account, you will be redirected to the account application for your region. You can also find the website of the IBKR entity for your region at the bottom of this page.

CME Options on Futures Specifications

Unlike equity options, options on futures are a whole other animal. Below is a table of the per contract fees charged for Exchange and Regulatory when trading it, Exercise & Assignment, and Futures Exercise & Assignment. To view our commissions and fees breakdown, click here .

Futures Options Summary Table

Below is the list of futures options that are supported at tastytrade . If the area below is blank, please give it one moment to load . Options on micro futures contracts are displayed in white rows. Please refer to the sections below for definitions.

Futures Options Settlement Prices

To view cme final settlement prices (fixing prices) for options, please click here ..

- ^ Final settlement based on the last trade price.

- * Open price based on Special Opening Quotation (SOQ)

- Final settlements are based on Volume Weighted Average Pricing (VWAP). Additionally, you may trade the contract anytime up until the time of settlement on the date of expiration.

Contract Definitions

Exercise and assignment handling for options on futures.

Below are the definitions of the columns and terms listed on the Futures Options Summary Table above.

- American Style: The long holder can exercise ITM options, or submit do-not-exercise requests (if contrary exercise is allowed) at any time up until the expiration

- European Style: The long holder can only exercise an option, or submit a do-not-exercise (if contrary exercise is allowed) at expiration.

- Contrary Exercise: Allows options holders to exercise OTM options, and DNE ITM options

- Future - Future contract is delivered.

- Cash - Cash (financially) settled.

- Future to Cash - Futures contract is delivered, and immediately cash (financially) settled.

- Exercise & Assignment Fee: CME passthrough fee associated with the processing of an exercise or assignment of a futures option.

- Futures Exercise & Assignment Fee: CME passthrough fee associated with the delivery of a futures contract.

CME Exercise and Assignment

The deliverable method determines the total fees charged for an exercise or assignment. Any exercise or assignment fee will list with the respective line item on the History tab (orange arrow). Any futures exercise & assignment fees will list with the outright contract line item (yellow arrow). Additionally, the CME also charges a $0.10/contract fee for any options on futures contract on agricultural or treasuries that expires worthless. When applicable, a $0.10 charge will list on the expiration line item in the History tab (blue arrow).

Example of the $0.10 fee the CME charges on a /ZN options on futures contract that expired worthless.

Exercise and Assignment Fees for CME Options on Futures

The fees associated with each options on futures deliverable method. The fees listed below correspond with the fee columns listed in the Futures Options Summary Table above.

- Exercise & Assignment Fee

- Futures Exercise & Assignment Fee

- Outright futures/micro-futures commissions: $1.25/contract or $0.85/contract, respectively.

CME Contract Specifications

| /ZC | |

| /ZS | |

| /ZW | |

| /6A | |

| /6B | |

| /6C | |

| /6E | |

| /6J | |

| /CL (Quarterly) | |

| /CL (Fri. Weekly) | |

| /MCL (Monthly) | |

| /MCL (Fri. Weekly) | |

| /NG (European) | |

| /ES (Quarterly) | |

| /ES (Mon. Weekly) | |

| /ES (Wed. Weekly) | |

| /ES (Fri. Weekly) | |

| /ES (EOM) | |

| /MES (Quarterly) | |

| /MES (Weekly) | |

| /MES (EOM) | |

| /NQ (Quarterly) | |

| /NQ (Fri. Weekly) | |

| /MNQ (Quarterly) | |

| /MNQ (Fri. Weekly) | |

| /MNQ (EOM) | |

| /RTY (Quarterly) | |

| /RTY (Fri. Weekly) | |

| /ZT | |

| /ZF | |

| /ZN | |

| /ZB | |

| /GE | |

| /GC | |

| /SI | |

| /ETH | |

| /HE | |

| /LE |

- Margin Requirements for Futures (Overnight Requirement & SPAN)

- Available Products to Trade at tastytrade

- Futures Statements (tastytrade Daily Statement)

- How to Roll a Futures Contract

- Market Trading Hours

- CME Outright Futures Contracts

- Upgrading to IRA The Works

- How to Place a Futures Trade

- Market Holiday Calendar and Schedule

- What Affects an Account’s Cash Balance?

CME Options on Futures Specifications Print

Modified on: Tue, 13 Jun, 2023 at 8:22 AM

Did you find it helpful? Yes No

Related Articles

- Stock Market Overview

- Market Momentum

- Market Performance

- Top 100 Stocks

- Today's Price Surprises

- New Highs & Lows

- Economic Overview

- Earnings Within 7 Days

- Earnings & Dividends

- Stock Screener

- Today's Top Stock Pick

- All Top Stock Picks

- Percent Change

- Price Change

- Range Change

- Gap Up & Gap Down

- Five Day Gainers

- Pre-Market Trading

- Post-Market Trading

- Volume Leaders

- Price Volume Leaders

- Volume Advances

- Trading Liquidity

- Market Indices

- S&P Indices

- S&P Sectors

- Dow Jones Indices

- Nasdaq Indices

- Russell Indices

- Volatility Indices

- Commodities Indices

- US Sectors Indices

- World Indices

- New Recommendations

- Top Stocks to Own

- Top Signal Strength

- Top Signal Direction

- Stock Signal Upgrades

- Stock Market Sectors

- Major Markets Heat Map

- Industry Rankings

- Industry Heat Map

- Industry Performance

- Stocks by Grouping

- Options Market Overview

- Unusual Options Activity

- IV Rank and IV Percentile

- Most Active Options

- Unusual Options Volume

- Highest Implied Volatility

- %Change in Volatility

- Options Volume Leaders

- Change in Open Interest

- %Chg in Open Interest

- Upcoming Earnings

- Options Strategy Indexes

- Options Price History

- Options Flow

Options Calculator

- Options Time & Sales

- Options Learning Center

- Options Screener

- Long Call Screener

- Long Put Screener

- Covered Call

- Married Put

- Protective Collar

- Bull Call Spread

- Bear Call Spread

- Bear Put Spread

- Bull Put Spread

- Long Call Calendar

- Long Put Calendar

- Long Call Diagonal

- Short Call Diagonal

- Long Put Diagonal

- Short Put Diagonal

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Long Call Butterfly

- Short Call Butterfly

- Long Put Butterfly

- Short Put Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Long Call Condor

- Short Call Condor

- Long Put Condor

- Short Put Condor

- Long Iron Condor

- Short Iron Condor

- ETF Market Overview

- Popular ETFs

- Top 100 ETFs

- Top Dividend ETFs

- ETF Screener

- Top ETFs to Own

- ETFs Signal Upgrades

- Performance

- Funds Screener

- Futures Market Overview

- Long Term Trends

- Highs & Lows

- Futures Market Map

- Performance Leaders

- Most Active Futures

- Prices by Exchange

- Commodities Prices

- Mini & Micro Futures

- Trading Guide

- Historical Performance

- Commitment of Traders

- Legacy Report

- Disaggregated Report

- Financial TFF Report

- Contract Specifications

- Futures Expirations

- First Notice Dates

- Options Expirations

- Economic Calendar

- Cash Markets Overview

- Corn Indexes

- Soybean Indexes

- Euro Futures Overview

- Power Futures

- Carbon Futures

- European Trading Guide

- Forex Market Overview

- Forex Market Map

- Currency Converter

- Crypto Market Overview

- Market Capitalizations

- Bitcoin Futures

- Popular Cross Rates

- Australian Dollar

- British Pound

- Canadian Dollar

- Japanese Yen

- Swiss Franc

- Metals Rates

- All Forex Markets

- Popular Coins

- Bitcoin-Cash

- Today’s Investing Ideas

- Top Performing Stocks

- Top Trending Tickers

- Barchart Screeners

- Insider Trading Activity

- Politician Insider Trading

- Chart of the Day

- Top Stock Pick

- Futures Trading Guide

- Biotechnology Stocks

- Blockchain Stocks

- Bullish Moving Averages

- Candlestick Patterns

- Cannabis Stocks

- Cathie Wood Stocks

- Clean Energy Stocks

- Cybersecurity Stocks

- Dividend Stocks

- eMACD Buy Signals

- Gold Stocks

- Hot Penny Stocks

- Power Infrastructure

- REIT Stocks

- SPAC Stocks

- Standout Stocks

- Top Stocks Under $10

- TTM Squeeze

- Warren Buffett Stocks

- World Markets

- Markets Today

- Barchart News

- Contributors

- Alan Brugler

- Andrew Hecht

- Angie Setzer

- Darin Newsom

- Gavin McMaster

- Jim Van Meerten

- Josh Enomoto

- Oleksandr Pylypenko

- Rich Asplund

- Rick Orford

- All Authors

- All Commodities

- Food & Beverage

- All Financials

- Interest Rates

- Stock Market

- Top Stories

- All Press Releases

- My Watchlist

- My Portfolio

- Investor Portfolio

- Dashboard (BETA)

- Symbol Notes

- Alert Center

- Alert Templates

- My Charts (BETA)

- Custom Views

- Chart Templates

- Compare Stocks

- Daily Prices Download

- Historical Data Download

- Watchlist Emails

- Portfolio Emails

- Investor Portfolio Emails

- Screener Emails

- End-of-Day My Charts

- End-of-Day Reports

- Organize Watchlists

- Organize Portfolios

- Organize Investor Portfolios

- Organize Screeners

- Organize My Charts

- Site Preferences

- Author Followings

- Upcoming Webinars

- Archived Webinars

- Popular Webinars

- Market on Close

- Market on Close Archive

- Site Education

- Free Newsletters

- Technical Indicators

- Barchart Trading Signals

- Time & Sales Conditions

- Barchart Special Symbols

- Barchart Data Fields

- Barchart Premier

- Barchart Plus

- Membership Comparison

- Barchart for Excel

- Create Free Account

Market Pulse

Option screeners, income strategies, protection strategies, vertical spreads, horizontal strategies, straddle and strangle, butterfly strategies, condor strategies, [[ symboldata.symbolname ]] ([[ symboldata.symbol ]]), [[ symboldata.lastprice ]] [[ symboldata.pricechange ]] ( [[ symboldata.percentchange ]] ) [[ symboldata.tradetime ]] ([[ symboldata.exchange ]]), select the option for calculation. the input parameters may be overridden below., input parameters, calculated theoretical values.

- Theoretical Price [[ bsm.theoretical || '--' ]]

- Delta [[ bsm.delta || '--' ]]

- Gamma [[ bsm.gamma || '--' ]]

- Vega [[ bsm.vega || '--' ]]

- Theta [[ bsm.theta || '--' ]]

- Rho [[ bsm.rho || '--' ]]

IV Calculation

- Option [[ optionData.optionType || (optType === 'call' ? 'Call' : 'Put') || '--' ]]

- Market Option Price Last Bid Ask

- Implied Volatility [[ bsm.iv || '--' ]]%

Want to use this as your default charts setting?

Switch the market flag, want streaming chart updates, need more chart options, free barchart webinar.

IMAGES

VIDEO

COMMENTS

Brochure describing exercise and assignment process for options trades on CME Group exchanges: Chicago Board of Trade (CBOT), Chicago Mercantile Exchange (CME), Commodity Exchange (COMEX), and New York Mercantile Exchange (NYMEX). Includes an overview of the contrary options exercise process.

Introduction This note describes the exercise and assignment process for the options on futures that trade on the CME Group designated contract markets — Chicago Board of Trade (CBOT), Chicago Mercantile Exchange (CME), Commodity Exchange (COMEX), and New York Mercantile Exchange (NYMEX). In all instances CME Clearing is responsible for pairing the long position holders who exercise their ...

Understand the process of exercise and assignment in when buying and selling options contracts. Learn more.

Understand the process of exercise and assignment in when buying and selling options contracts. Learn more.This information is reproduced by permission of CM...

In this guide, you'll learn about exercise and assignment, which explain an option's conversion to shares of stock.

Assignment of ES Options. I know at expiration, if in the money, options on ES futures settle into a position in the futures. If I buy a vertical spread on calls (say buy 10, 4410 strike, sell 10, 4415 strike), I would hope that it would act like an SPX cash-settled spread, since my futures position would be neutral.

The Mechanics of Option Trading, Exercise, and Assignment Options were originally traded in the over-the-counter (OTC) market, where the terms of the contract were negotiated. The advantage of the OTC market over the exchanges is that the option contracts can be tailored: strike prices, expiration dates, and the number of shares can be specified to meet the needs of the option buyer. However ...

Learn how to navigate options exercise, assignment, and expiration, plus explore the mechanics of options expiration before your first options trade.

Yes, futures options exercise into the underlying futures contract. I've wondered about this one also on how many lots are actually assigned if you are assigned on the eminis or the micros for each option contract... futures margin requirement and leverage is insane if it's anymore than 1 lot assignment per contract.

Explore options on futures across all major asset classes, with benchmark products, deep liquidity, nearly 24-hour access, and extensive trading resources.

Call Option A call option gives the holder (buyer) the right to buy (go long) a futures contract at a specific price on or before an expiration date. For example, a September CME® Japanese Yen 85 call option gives the holder (buyer) the right to buy or go long a yen futures contract at a price of 85 (short-hand for $.0085/yen) anytime between purchase and September expiration. Even if yen ...

This note describes the exercise and assignment process for the options on futures that trade on the CME Group designated contract markets — Chicago Board of Trade (CBOT), Chicago Mercantile Exchange (CME), Commodity Exchange (COMEX), and New York Mercantile Exchange (NYMEX). In all instances CME Clearing is responsible for pairing the long position holders who exercise their options with ...

Help Needed on Futures Options Assignment Type Futures Option Traders, need some guidance. I tried reading the option specs in CME but I still don't have a clear picture. My question is which options in the Option chain is European Style (can only be exercised at expiry) and which is American Style?

Futures Options Specs (CME Products) Unlike equity options, options on futures are a whole other animal. Below is a table of the per contract fees charged for Exchange and Regulatory when trading it, Exercise & Assignment, and Futures Exercise & Assignment. To view our commissions and fees breakdown, click here .

Before entering an options trade, traders should consider the possibility of early assignment. Learn more about assignment and how to help reduce the risks associated with it.

FX Options Trader Handbook Understanding the relationship between CME FX Options on Futures and OTC Options. As the world's leading and most diverse derivatives marketplace, CME Group (cmegroup.com) is where the world comes to manage risk.

All About Options. Increase your knowledge about options on futures trading with this curriculum, designed to provide an overview of what you need to know to trade options. All About Options is a compilation of several individual options courses from CME Institute, linked together to provide you the most educational journey in a path that walks ...

View the basic CME option chain and compare options of CME Group Inc. on Yahoo Finance.

View Contrary Options Reports, produced after the various exercise submission deadlines and reflecting submitted instructions from clearing firms.

Learn about micro futures and futures options on CME Group's Micro WTI Crude Oil contracts, and understand how they can be used to trade and hedge.

Unlike equity options, options on futures are a whole other animal. Below is a table of the per contract fees charged for Exchange and Regulatory when trading it, Exercise & Assignment, and Futures Exercise & Assignment. To view our commissions a...

Customize your input parameters by entering the option type, strike price, days to expiration (DTE), and risk-free rate, volatility, and (optional) dividend yield% for equities. The calculator uses the latest price for the underlying symbol. Theoretical values and IV calculations are performed using the Black 76 Pricing model, which is ...

E-mini S&P 500 options Enjoy greater choice and flexibility for trading E-mini S&P futures and options with more expiries and new enhancements, including the introduction of ES options blocks.