Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Investment Company Business Plan

Start your own investment company business plan

Investment Company

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">.

This sample plan was created for a hypothetical investment company that buys other companies as investments. In this sample, the hypothetical Venture Capital firm starts with $20 million as an initial investment fund. In its early months of existence, it invests $5 million each in four companies. It receives a management fee of two percent (2%) of the fund value, paid quarterly. It pays salaries to its partners and other employees, and office expenses, from the management fee.

The investments show up in the Cash Flow table as the purchase of long-term assets, which also puts them into the balance sheet as long-term assets. You can see them in this sample plan, in the first few months.

In the third year, one of the target companies fails, so $5 million is written off as failure. You’ll see how that looks as a $5 million sale of long-term assets in the cash flow, and a balancing entry of $5 million in costs of sales in the profit and loss, making for a loss and write-off that year. The result is a tax loss, and the balance of investments goes to $15 million.

In the fifth year, one of the target companies is transacted at $50 million. You’ll see in the sample how that shows up as a $45 million equity appreciation in the sales forecast, plus a $5 million sale of long-term assets in the cash flow. At that point there’s been a $45 million profit, and the balance of long-term assets goes down to $10 million.

This is a simplified example. The business model holds long-term assets and waits for them to appreciate. It doesn’t show appreciation of assets until they are finally sold, and it doesn’t show write-down of assets until they fail. Sales and cost of sales are the appreciation and write-down of assets, plus the management fees.

The explanation above has been broken down and copied into key topics in the outline that are linked to corresponding tables. These topics are:

- 2.2 Start-up Summary

- 5.5.1 Sales Forecast

- 6.4 Personnel

- 7.4 Projected Profit and Loss

- 7.5 Projected Cash Flow

- 7.6 Projected Balance Sheet

Company Summary company overview ) is an overview of the most important points about your company—your history, management team, location, mission statement and legal structure.">

Content has been omitted from this sample plan topic, and following sub-topics. This sample plan has an abbreviated plan outline. With the exception of the Executive Summary, only those topics linked to key tables have been used.

The focus of this sample plan is to show the financials for this type of company. Brief descriptions can be found in the topics associated with key tables.

2.1 Start-up Summary

This hypothetical Venture Capital firm starts with $20 million as an initial investment fund. The venture capital partners invest $100,000 as working capital needed to balance the cash flow from quarter to quarter.

Market Analysis Summary how to do a market analysis for your business plan.">

Strategy and implementation summary, sales forecast forecast sales .">.

Management Summary management summary will include information about who's on your team and why they're the right people for the job, as well as your future hiring plans.">

7.1 personnel plan.

This hypothetical company pays salaries to its partners and other employees, and office expenses, from the management fee of two percent (2%).

Financial Plan investor-ready personnel plan .">

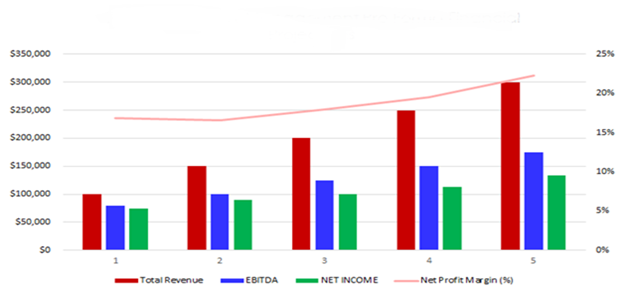

8.1 projected profit and loss.

Please note that in the third year one investment is written off as a failure, producing a $5 million cost which ends up showing a loss for the year of nearly $5 million. The sale of equity at the end of the period enters the sales forecast and the profit and loss statement as a $45 million gain.

8.2 Projected Cash Flow

The Cash Flow shows four $5 million investments made in the first few months of the plan.

In the third year, one of the target companies fails, so $5 million is written off as failure. You’ll see that shows as a $5 million sale of long-term assets in the cash flow, and a balancing entry of $5 million in costs of sales in the profit and loss, making for a loss and write-off that year. The result is a tax loss, and the balance of investments goes to $15 Million.

In the fifth year, another investment is transacted at $50 million. This shows up as a $5 million equity appreciation in the Sales Forecast, plus a $5 million sale of long-term assets in the Cash Flow. At that point there’s been a $45 million profit and the balance of long-term assets goes down to $10 million.

The partners invest an additional $100,000 in the fourth year as additional working capital to balance the cash flow of the company.

8.3 Projected Balance Sheet

You can see in the balance sheet how the ending balances for long-term assets were not re-valued. They remain at the original purchase price until they are sold, or written off as a complete loss. There is a $5 million write-off in the third year, and a sale of $5 million worth of assets in the last year. That sale of $5 million in assets produces the $5 million sale at book value plus the $45 million gain in the sales forecast and profit and loss table.

8.4 Business Ratios

The Standard Industry Code (SIC) for this type of business is 7389, Business Services. The Industry Data is provided in the final column of the Ratios table.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Investment Company Business Plan Template

Written by Dave Lavinsky

Investment Company Business Plan

Over the past 20+ years, we have helped over 1,000 entrepreneurs and business owners create business plans to start and grow their investment companies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through an investment company business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is an Investment Company Business Plan?

A business plan provides a snapshot of your investment company as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for an Investment Company

If you’re looking to start an investment company, or grow your existing investment company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your investment company in order to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Investment Companies

With regards to funding, the main sources of funding for an investment company are bank loans and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Investors, grants, personal investments, and bank loans are the most common funding paths for investment companies.

Finish Your Business Plan Today!

How to write a business plan for an investment company.

If you want to start an investment company or expand your current one, you need a business plan. Below we detail what you should include in each section of your own business plan:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of investment company you are operating and the status. For example, are you a startup, do you have an investment company that you would like to grow, or are you operating investment companies in multiple markets?

Next, provide an overview of each of the subsequent sections of your business plan. For example, give a brief overview of the investment company industry. Discuss the type of investment company you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of investment company you are operating.

For example, you might operate one of the following types of investment companies:

- Closed-End Funds Investment Company : this type of investment company issues a fixed number of shares through a single IPO to raise capital for its initial investments.

- Mutual Funds (Open-End Funds) Investment Company: this type of investment company is a diversified portfolio of pooled investor money that can issue an unlimited number of shares.

- Unit Investment Trusts (UITs) Investment Company: this type of investment company offers a fixed portfolio, generally of stocks and bonds, as redeemable units to investors for a specific period of time.

In addition to explaining the type of investment company you will operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of investments made, number of client positive reviews, reaching X amount of clients invested for, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the investment industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the investment industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your business plan:

- How big is the investment industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your investment company? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: companies or employees in specific industries, couples with double income, families with kids, small business owners, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of investment company you operate. Clearly, couples with families and double income would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Investment Company Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

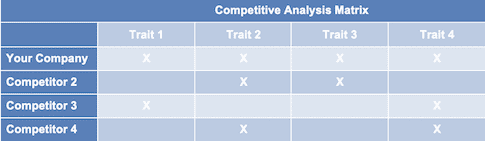

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other investment companies.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes robo investors and advisors, company 401Ks, etc. You need to mention such competition as well.

With regards to direct competition, you want to describe the other investment companies with which you compete. Most likely, your direct competitors will be investment companies located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of clients do they serve?

- What type of investment company are they and what certifications do they have?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide better investment strategies?

- Will you provide services that your competitors don’t offer?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For an investment company, your marketing plan should include the following:

Product : In the product section, you should reiterate the type of company that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to an investment company, will you provide insurance products, website and app accessibility, quarterly or annual investment reviews, and any other services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the services you offer and their prices.

Place : Place refers to the location of your company. Document your location and mention how the location will impact your success. For example, is your investment company located in a busy retail district, a business district, a standalone office, etc. Discuss how your location might be the ideal location for your customers.

Promotions : The final part of your investment company marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Commercials and billboards

- Reaching out to websites

- Social media marketing

- Local radio advertising

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your investment company, including researching the stock market, keeping abreast of all investment industry knowledge, updating clients on any new activity, answering client phone calls and emails, networking to attract potential new clients.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to land your Xth client, or when you hope to reach $X in revenue. It could also be when you expect to expand your investment business to a new city.

Management Team

To demonstrate your investment company’s ability to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in managing investment companies. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing an investment company or successfully advised clients who have achieved a successful net worth.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement : an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you take on one new client at a time or multiple new clients? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets : Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your investment company, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing an investment company:

- Cost of investor licensing..

- Cost of equipment and supplies

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or list of clients that you have acquired.

Putting together a business plan for your investment company is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the investment industry, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful investment company.

Don’t you wish there was a faster, easier way to finish your Investment Company business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to hire someone to write a business plan for you from Growthink’s team.

Other Helpful Business Plan Articles & Templates

- Sample Business Plans

Investment Company Business Plan

The possibility for substantial financial gains is one of the main advantages of an investment company. As the company expands and gains customers, it has the potential to generate large fees and commissions based on investment portfolios.

Are you looking for the same rewards? Then go on with planning everything first.

Need help writing a business plan for your investment company? You’re at the right place. Our investment company business plan template will help you get started.

Free Business Plan Template

Download our free investment company business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write An Investment Company Business Plan?

Writing an investment company business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

- Introduce your Business: Start your executive summary by briefly introducing your business to your readers.This section may include the name of your investment company, its location, when it was founded, the type of investment company (E.g., mutual fund companies, hedge funds, venture capital firms), etc.

- Market Opportunity: Summarize your market research, including market size, growth potential, and marketing trends. Highlight the opportunities in the market and how your business will fit in to fill the gap.

- Products and Services: Highlight the investment company services you offer your clients. The USPs and differentiators you offer are always a plus.For instance, you may include investment management, portfolio diversification, or tax planning as services and mention customized investment solutions as your USP.

- Marketing & Sales Strategies: Outline your sales and marketing strategies—what marketing platforms you use, how you plan on acquiring customers, etc.

- Financial Highlights: Briefly summarize your financial projections for the initial years of business operations. Include any capital or investment requirements, associated startup costs, projected revenues, and profit forecasts.

- Call to Action: Summarize your executive summary section with a clear CTA, for example, inviting angel investors to discuss the potential business investment.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

- Mutual fund companies

- Venture capital funds

- Private equity funds

- Asset management companies

- Pension fund managers

- Describe the legal structure of your investment company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

- Owners: List the names of your investment company’s founders or owners. Describe what shares they own and their responsibilities for efficiently managing the business. Mission Statement: Summarize your business’ objective, core principles, and values in your mission statement. This statement needs to be memorable, clear, and brief.

- Business History: If you’re an established investment company, briefly describe your business history, like—when it was founded, how it evolved over time, etc.Additionally, If you have received any awards or recognition for excellent work, describe them.

- Future Goals: It’s crucial to convey your aspirations and vision. Mention your short-term and long-term goals; they can be specific targets for revenue, market share, or expanding your services.

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

- Target market: Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.For instance, individual individuals, institutions & corporations, etc can be the target market for investment companies.

- Market size and growth potential: Describe your market size and growth potential and whether you will target a niche or a much broader market.The global investment market grew to around $3837 billion this year from around $3532 billion in 2022 at a CAGR of 8.6%.

- Competitive Analysis: Identify and analyze your direct and indirect competitors. Identify their strengths and weaknesses, and describe what differentiates your investment company services from them. Point out how you have a competitive edge in the market.

- Market Trends: Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.For instance, there is growing popularity for passive income; explain how you plan on dealing with this potential growth opportunity.

- Regulatory Environment: List regulations and licensing requirements that may affect your investment company, such as securities laws, anti-money laundering laws, KYC, market regulations, etc.

Here are a few tips for writing the market analysis section of your investment company business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

- Portfolio management

- Financial planning

- Investment research and analysis

- Wealth management

- Mutual funds and exchange-traded funds

- Investment advisory services: Investment advisory services might include professional advice on asset allocation, investment strategies, and portfolio construction. Both discretionary and non-discretionary investment advisory services available or not should be mentioned.

- Additional Services: Mention if your investment company offers any additional services. You may include services like retirement planning, estate planning & wealth transfer, business succession planning, etc.

In short, this section of your investment business plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

- Unique Selling Proposition (USP): Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.For example, customized investment solutions, expertise, or innovative investment strategies could be some of the great USPs for an investment company.

- Pricing Strategy: Describe your pricing strategy—how you plan to price your services and stay competitive in the local market. You can mention any discounts you plan on offering to attract new customers.

- Marketing Strategies: Discuss your marketing strategies to market your services. You may include some of these marketing strategies in your business plan—social media marketing, Google ads, SEO, email marketing, content marketing, etc.

- Sales Strategies: Outline the strategies you’ll implement to maximize your sales. Your sales strategies may include direct sales calls, partnering with other businesses, consultative selling, etc.

- Customer Retention: Describe your customer retention strategies and how you plan to execute them. For instance, introducing loyalty programs, discounts on annual membership, personalized service, etc.

Overall, this section of your investment company business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your investment business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

- Staffing & Training: Mention your business’s staffing requirements, including the number of employees, consultants, or data analyst needed. Include their qualifications, the training required, and the duties they will perform.

- Operational Process: Outline the processes and procedures you will use to run your investment company. Your operational processes may include portfolio management, client onboarding, investment research & analysis, trade execution & settlement, etc.

- Equipment & Software: Include the list of equipment and software required for investment business, such as servers & data storage, network equipment, trading platforms, customer relationship management software, portfolio management software, etc.Explain how these technologies help you maintain quality standards and improve the efficiency of your business operations.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your investment business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

- Founders/CEO: Mention the founders and CEO of your investment company, and describe their roles and responsibilities in successfully running the business.

- Key managers: Introduce your management and key members of your team, and explain their roles and responsibilities.It should include, key executives(e.g. COO, CMO), senior management, and other department managers (e.g. operations manager, portfolio manager, compliance manager) involved in the investment company business operations, including their education, professional background, and any relevant experience in the industry.

- Organizational structure: Explain the organizational structure of your management team. Include the reporting line and decision-making hierarchy.

- Compensation Plan: Describe your compensation plan for the management and staff. Include their salaries, incentives, and other benefits.

- Advisors/Consultants: Mentioning advisors or consultants in your business plans adds credibility to your business idea.So, if you have any advisors or consultants, include them with their names and brief information consisting of roles and years of experience.

This section should describe the key personnel for your investment company, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

- Profit & loss statement: Describe details such as projected revenue, operational costs, and service costs in your projected profit and loss statement . Make sure to include your business’s expected net profit or loss.

- Cash flow statement: The cash flow for the first few years of your operation should be estimated and described in this section. This may include billing invoices, payment receipts, loan payments, and any other cash flow statements.

- Balance Sheet: Create a projected balance sheet documenting your investment company’s assets, liabilities, and equity.

- Break-even point: Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.This exercise will help you understand how much revenue you need to generate to sustain or be profitable.

- Financing Needs: Calculate costs associated with starting an investment company, and estimate your financing needs and how much capital you need to raise to operate your business. Be specific about your short-term and long-term financing requirements, such as investment capital or loans.

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your investment firm business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample investment company business plan will provide an idea for writing a successful investment company plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our investment company business plan pdf .

Related Posts

Bookkeeping Business Plan

Concierge Services Business Plan

How to make Perfect Business Outline

Simple Business Plan Template Example

What are Business Plan Components

How to Write a Business Plan For Investors

Frequently Asked Questions

Why do you need an investment company business plan.

A business plan is an essential tool for anyone looking to start or run a successful investment business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your investment company.

How to get funding for your investment company?

There are several ways to get funding for your investment company, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

Small Business Administration (SBA) loan

Crowdfunding, angel investors.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your investment company?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your investment company business plan and outline your vision as you have in your mind.

What is the easiest way to write your investment company business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any investment company business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software .

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Turn your business idea into a solid business plan

Explore Plan Builder

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

- Group Investing 101

- Building Wealth Together

- Real Estate

- Alternative Assets

- Product Updates

- Tribe Stories

How to Start an Investment Group: 6 Common Pitfalls to Avoid

You’ve heard the benefits of investment groups: Spreading risk, pooling capital, growing your investment brain trust, and more. Now, you’re ready to learn how to start an investment group of your own.

About a decade ago, my brothers and I decided to start our own investment group while on a fishing trip together. We ended up coming out on top, investing in several real estate opportunities and even a prize-winning racehorse , but our path was bumpy, to say the least.

Thankfully, we went through that pain, so you don’t have to! And we’ve since helped over 1000 tribes avoid the biggest pitfalls that we had to overcome.

This post will outline the six top mistakes new investment groups make . Armed with this information, you’ll be ready to start an investment group the right way.

How to Start an Investment Group: Essential Steps

Before we dive into the things you shouldn’t do, let’s first establish a few essential steps you should take to start an investment group.

The first step to building a successful investment group is to choose the right partners. It’s just as easy to overthink this part of the process as underthink it. You don’t want to choose just any friends or family members to join your Tribe, but as long as you’re teaming up with like-minded people with similar investing interests and goals, you’re on the right track.

Related Read: The Beginner's Guide to Group Investing: How to Build Wealth with Friends

Your next step is to align on the purpose and goals of your group. Are you looking to make one investment and then get out, or are you planning on pursuing multiple investments together for years to come? Your goal can grow and change as your group members grow and change , but you should begin your journey aligned and on the same page.

Step three is to file your LLC and create a business entity. Once your paperwork is in order, you’ll be ready to launch your investment group with the perfect investment opportunity!

Tribevest knows a thing or two about successful investment groups —we’ve also seen the reasons why some groups fall apart. Let’s cover the top five mistakes we’ve seen new investment groups make.

1. Neglecting to Establish Rules

When you start an investment group with friends or family , it can be tempting just to keep things casual—don’t fall into that trap.

Starting an investment group comes with a number of questions. How much is each member willing to invest? How can you purchase an asset as a group? And these questions are just the beginning of an avalanche of “what-ifs” and “then whats” that will follow.

Establishing rules and formal voting procedures upfront will help with decision-making processes and help you keep the business (your investment group) separate from your personal relationships with group members.

Decide on rules and voting procedures early in your group formation process, establishing expectations and formal processes right from the get-go: Trust me, it will save you headaches.

2. Poor Communication

Another common pitfall you’ll want to avoid when starting your investment group is the pitfall of poor communication. To operate successfully as an investing group, you and your Tribe will need to start—and stay—on the same page.

The first step to combating this issue is to get aligned early and often. Some key moments of the process in which you’ll want to take a step back and realign include:

- Before forming your entity

- Before making any investment

- Before making key decisions

- Before calling a formal group vote

Aligning at all of these checkpoints will help you avoid conflict within your group. However, you should also keep lines of communication open and transparent outside of these major decision points. And when I say “open and transparent,” I mean for all group members. That means no sidebars . Segmenting your investment group into multiple sidebars is one of the quickest ways to destroy group trust, which can spell disaster for your investment group—and your personal relationships with its members.

3. Noncompliance Issues

I’ve already stressed the importance of formalizing your investment group for the sake of your relationships. Now it’s time to examine the other side of the coin: Formalizing your investment group for the sake of legal compliance.

Your investment group is a business, and you will need to treat it as such . File an LLC to formalize your business entity. Ensure that you file your LLC appropriately and take steps to keep your paperwork up-to-date.

As the group founder, you will need to take compliance into your own hands. Take responsibility for distributing annual tax forms to all group members and maintaining your LLC paperwork.

Maintaining the paperwork for your investment group can feel overwhelming. When you invest through Tribevest , we file your LLC for you and help you maintain all communication and compliance information in our tool. In short, if you decide to invest through Tribevest, this step gets a whole lot easier.

4. Unequal Participation

If you want your investment group to run smoothly, everyone in your group will need to feel like a valued, equal participant in the group’s activities. To be clear, this doesn’t mean that everyone in the group needs to invest the same dollar amount . As long as you lay out each party’s investment percentages in the beginning of your group formation process, things should still run smoothly.

When I say everyone needs to be an equal participant, I mean with regard to two things: Decision-making and enthusiasm . Is every group member an equal participant in voting processes, or are sidebar conversations taking place that cut some group members out of the decision-making process?

Related Read: Buying a House with a Friend: 3 Costly Mistakes to Avoid

Are all group members equally enthusiastic about the investment you’re pursuing as a group? Some compromise may be necessary, but if a member of your group is not invested emotionally in the group’s success, it may drag down the enthusiasm of the entire group. Ensure that you have exit clauses built into your group rules . These clauses will allow any unengaged group members to remove themselves from the opportunity without causing harm to the group’s success—or your relationships.

5. Giving In To Frustration

Starting an investment group comes with a lot of frustrating elements. Avoiding the pitfalls I’ve listed above can help you overcome most of these, but there is one frustration that you’ll likely encounter no matter how prepared you are: The frustration of finding the right deal.

When I started my investment group with my brothers, we had trouble finding the right opportunity for our group. We were irritated that deals weren’t always obvious, or served up on a silver platter for us to snap up and invest in. If we’d given up then, we never would have learned that the most rewarding part of the group investing process lies past that frustration!

Related Read: 6 High-Return Investing Ideas to Diversify your Portfolio

After a few false starts, we began to learn and grow together, gaining experience in how to find and analyze deals to choose the right investment opportunities for our group.

Don’t give up if you’re getting frustrated trying to find the right deal early on in your investment journey. Your group will level up together and uncover the best ways to find the best deals.

6. Skipping the Mission Statement

The last pitfall you’ll want to avoid when starting an investment group is skipping the mission statement. Making a mission statement might feel stuffy or overly formal, After all, you know your group members have come together to build wealth—maybe you’re even banding together with a specific investment in mind. A mission statement can seem silly in these cases, but it is essential.

Your mission statement helps shape your group’s decision-making processes and communicates the overarching goals of your group to all group members. It’s another way to ensure everyone is aligned, and it provides a touchstone for you to realign with one another down the road.

Essentially, it boils down to this: You know your mission, but do you really know the mission of the rest of your group members? Unless you get that information down in writing for everyone to see, the answer is no.

Here are a few examples of real Tribevest Tribe mission statements to get you started!

“Together, Double Play Investments will diversify our asset allocation into alternative assets such as multi-family real estate. The group will build wealth and collaborate together to identify top tier investment strategies.” -Double Play Investments mission statement

“To empower investors to fund their real estate investment deals and learn along the way.” -REI Freedom Fund mission statement

How to Start an Investment Group: Align Early and Often

Starting an investment group can feel like a daunting task, but transparency and communication are key. Ensure that all group members feel comfortable with the direction of the group and included in decision-making processes.

It’s also important to remember that your investment group is a business . That means you need to treat it as such. Handshake agreements, casual decision-making procedures, and messy text chains have no place here. You’ll need the proper paperwork and processes in place for your investment group to succeed.

Want to know a secret for how to start an investment group without breaking a sweat? Check out Tribevest’s group investing platform. You can use our platform to create your mission statement, operating agreement, and more. You’ll also be able to pool capital in a business bank account, manage group communications, and vote on key decisions all in the same convenient dashboard. What’s more: We’ll file your LLC for you !

What are you waiting for? Register your Tribe today to get started!

5 Pro Tips for Group Investing in Real Estate

How to Invest as a Group in Any Asset Class: 5 Key Steps

The Cost of Running Your Investor Group

How to Pool Money Together to Invest in 5 Simple Steps

Investment Company Business Plan Template

Written by Dave Lavinsky

Investment Company Business Plan

You’ve come to the right place to create your Investment Company business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Investment Companies.

Below is a template to help you create each section of your Investment Company business plan.

Executive Summary

Business overview.

NovaGrowth Investments is a startup investment company located in Aurora, Colorado. The company is founded by Thom Anderson, an investment broker from Colorado Springs, Colorado, who has amassed millions of dollars for his clients over ten years while working at Clear River Investments. Because Thom has gained an extensive following of clients who have already indicated they will follow him to his new investment company, he has made the initial steps into forming NovaGrowth Investments. Thom plans on recruiting a team of highly-qualified professionals to help manage the day-to-day operations of a premier investment company in every aspect of marketing and advising in the land acquisition investment company.

NovaGrowth Investments will provide a wide array of services for investors, in particular those related to the optimal attention and time needed to secure valuable investments on their behalf. Investors can feel confident and secure, knowing that Thom and his team are looking out for their interests in every aspect of the land acquisition process. What’s more, NovaGrowth offers customized guarantees of investment performance that are singular within the investment company industry.

Product Offering

The following are the services that NovaGrowth Investments will provide:

- Analysis and expansive vetting of land acquisition opportunities up to 5M acres

- Extensive market research that secures in-depth findings

- Consistent and competitive returns while managing risk effectively

- Full spectrum wealth management

- Comprehensive array of software tools/programs to capture critical intelligence

- Unique strategies tailored for each individual client

- “New investor” welcome package with goal-setting seminar included

- “Boots on the Ground” team of investment analysts who visit each location under consideration and offer a full report plus video capture of the land

- Oversight and management of each portfolio and customized suggestions

Customer Focus

NovaGrowth Investments will target individual investors. They will also target corporate investors who are seeking land acquisitions. They will target fast-growing companies known to be seeking additional tracts of land. NovaGrowth Investments will target industry partners (cattle ranchers, horse breeders, etc) that could benefit from land acquisition as an investment.

Management Team

NovaGrowth Investments will be owned and operated by Thom Anderson. He recruited Jackson Byers and Kylie Carlson to manage the day-to-day operations of the investment company and oversee human resources.

Thom Anderson is a graduate of Cambridge University in the U.K., where he graduated with an International Business bachelor’s degree. He spent five years in the U.K. sourcing land for a large investment firm as an entry-level investment advisor.

Upon his return to the U.S.,Thom obtained his investment broker’s license and was employed by Clear River Investments in Colorado Springs, Colorado. Within one year, Thom secured over 5M in investments for his clients and, within five years, he amassed over 25M in land acquisition investments on behalf of his clients.

Jackson Byers is a graduate of the University of Illinois, where he graduated with a master’s degree in Accounting. His former role at Clear River Investments was as the Associate Accountant, where he managed the normal business accounting processes for the firm. He will serve as the Staff Accountant in the startup company and will assist in overseeing the day-to-day operations of the firm.

Kylie Carlson was hired by Thom Anderson as his Assistant and worked for him at Clear River Investments for over ten years. Her new role will be the Human Resources Manager, overseeing personnel and the processes that are regulated and required by Colorado.

Success Factors

NovaGrowth Investments will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly-qualified team of NovaGrowth Investments

- “Boots on the Ground” team of investment analysts who visit each location under consideration and offer a full report plus video capture of the land.

- NovaGrowth Investments offers outstanding value for each client in both their management fees and land acquisition percentages. Their pricing denotes quality and value and their results continually substantiate it.

Financial Highlights

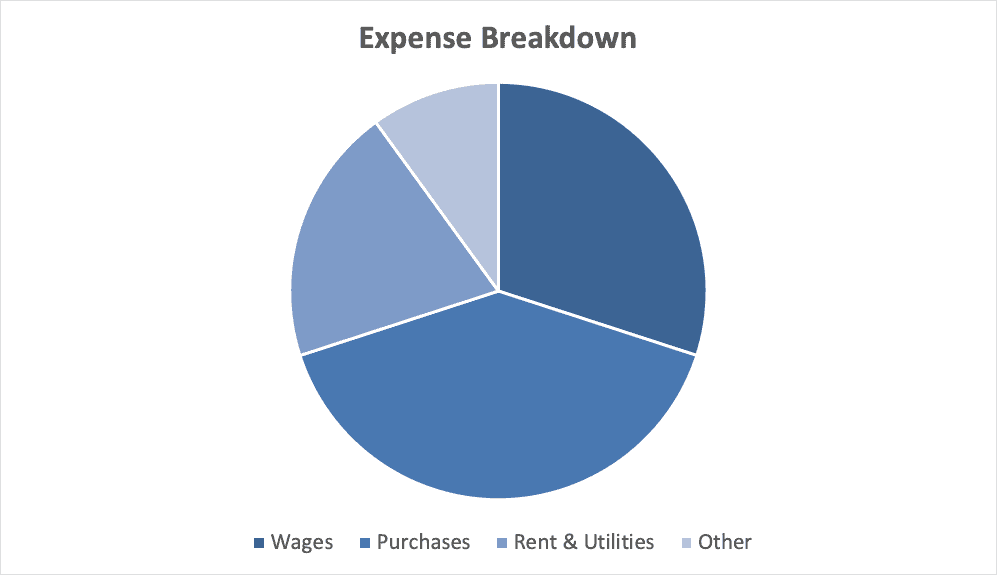

NovaGrowth Investments is seeking $200,000 in debt financing to launch its NovaGrowth Investments. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the marketing costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

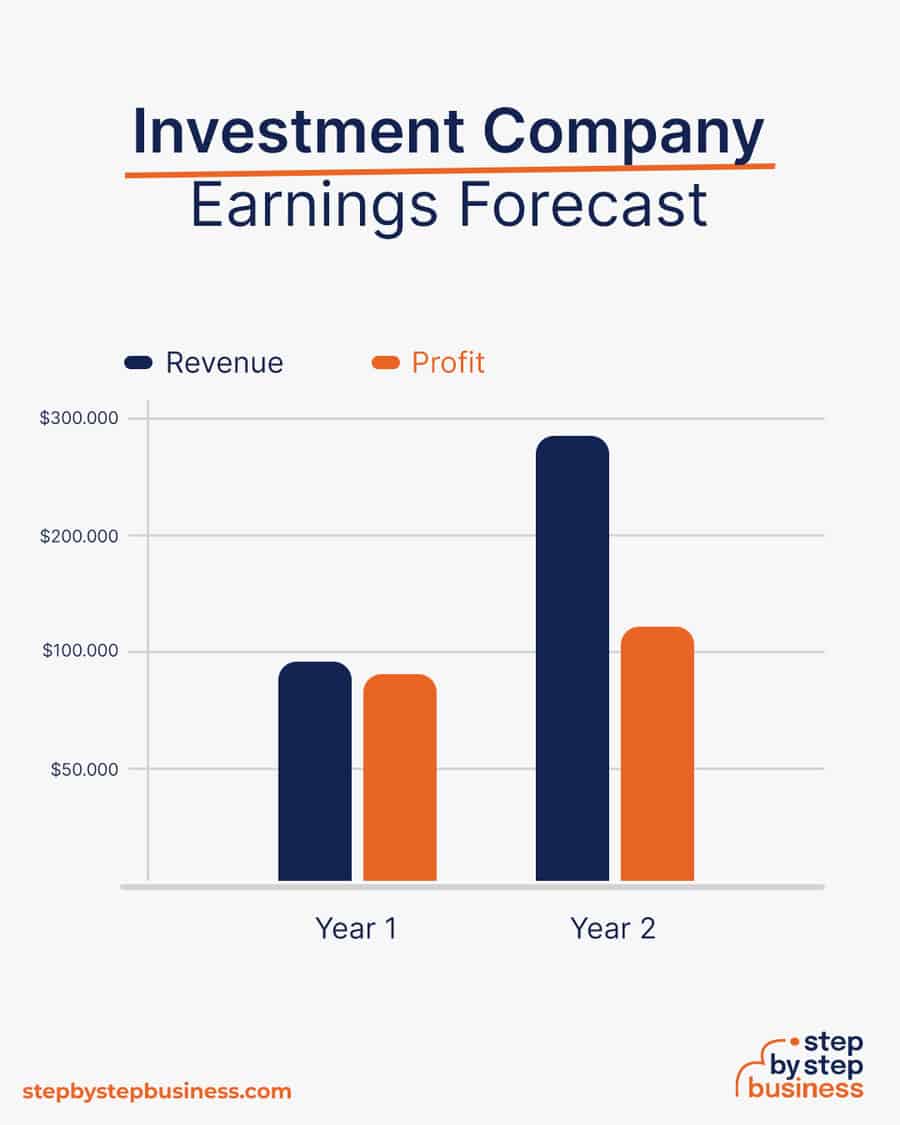

The following graph outlines the financial projections for NovaGrowth Investments.

Company Overview

Who is novagrowth investments.

NovaGrowth Investments is a newly established, full-service investment company in Aurora, Colorado. NovaGrowth Investments will be the most reliable, effective and value-driven choice for private and commercial investors in Aurora and the surrounding communities. NovaGrowth Investments will provide a comprehensive menu of portfolio and land acquisition services for any potential investor to utilize. Their full-service approach includes a comprehensive seminar and helpful introductory information for first-time investors.

NovaGrowth Investments will be able to manage the investments and acquire new investments for their clients. The team of professionals are highly qualified and experienced in investment brokerage and land acquisitions. NovaGrowth Investments removes all headaches and issues of trying to locate safe and secure investments and ensures all issues are taken care of expeditiously while delivering the best customer service.

NovaGrowth Investments History

Thom Anderson is a graduate of Cambridge University in the U.K., where he graduated with an International Business bachelor’s degree. He spent five years in the U.K. sourcing land for a large investment firm as an entry-level investment advisor. Upon his return to the U.S.,Thom obtained his investment broker’s license and was employed by Clear River Investments in Colorado Springs, Colorado. Within one year, Thom secured over 5M in investments for his clients and, within five years, he amassed over 25M in land acquisition investments on behalf of his clients.

Since incorporation, NovaGrowth Investments has achieved the following milestones:

- Registered NovaGrowth Investments, LLC to transact business in the state of Colorado.

- Has a contract in place for a 10,000 square foot office at one of the midtown buildings

- Reached out to numerous contacts to sign on with NovaGrowth Investments.

- Began recruiting a staff of seven and four office personnel to work at NovaGrowth Investments

NovaGrowth Investments Services

The following will be the services NovaGrowth Investments will provide:

Industry Analysis

The investment company industry is expected to grow over the next five years to over $1.3 trillion. The growth will be driven by ongoing vast opportunities for individuals and organizations seeking to grow their wealth The growth will be driven by new technology that navigating the complexities of the financial markets The growth will be driven by an increase in the interest of individuals in “making their own way” in the world The growth will be driven by the stability of land ownership as an on-going and important element in investment portfolios.

Costs will likely be reduced as technology continues to advance, allowing better-informed acquisition interest and supplemental risk mitigation Costs will likely be reduced as younger investors, such as Gen Z and millennials, continue to express an interest and desire for land acquisition investments, which indicates an increased number of sellers will enter the market due to favorable conditions.

Customer Analysis

Demographic profile of target market.

NovaGrowth Investments will target those potential individual investors in Aurora, Colorado. They will target businesses with a track record of land investments or a need for land due to company growth. NovaGrowth Investments will target industry partners (cattle ranchers, horse breeders, etc) that could benefit from land acquisition as an investment.

Customer Segmentation

NovaGrowth Investments will primarily target the following customer profiles:

- Individual investors

- Businesses with a record of land investments or those seeking land due to internal growth

- Industry partners seeking additional land for livestock or farming purposes

Competitive Analysis

Direct and indirect competitors.

NovaGrowth Investments will face competition from other companies with similar business profiles. A description of each competitor company is below.

CapitalMax Advisors

CapitalMax Advisors is a startup investment company in Colorado Springs, Colorado. The owner, Barry Jackson, is a graduate of Purdue University and has been an investment advisor for over ten years. He recently launched Capital Max Advisors to meet what he coined, “The Great Asset Allocation” investment opportunities within the city of Colorado Springs. Barry has hired ten associates from his former employer’s company to seek investors who are primarily interested in asset allocation investments and the company is promising reduced portfolio management rates for the first six months of business.

CapitalMax Advisors is a full-service investment company with a strong following of investors who were delighted by Barry’s performance on their behalf at his former employer. The expectation is that CapitalMax Advisors will live up to their primary purpose, which is to oversee and direct asset allocation to maximize returns in substantial numbers.

WealthWise Investments

Owned by Tamara and Loren Downs, WealthWise Investments is known for it’s assertive actions on behalf of clients. The company was founded in 2010 and currently offers a diverse range of investment products and services. They specialize in ETFs, mutual funds, and alternative investments. WealthWise Investments is known for its expertise in risk management, technology-driven investment strategies, and statewide reach beyond it’s home city of Colorado Springs.

WealthWise Investments offers excellent services to clients; however, clients have noted publicly that the fees and service charges are high in tandem with the asset allocation gains. There have been two complaints noted with the state regulatory agencies. Meanwhile, Tamara and Loren Downs continue to employ efforts to bring technology-driven tools into the investment company that will trim staff and distribute higher rates on behalf of investors.

FinTech Capital Management

FinTech Capital Management is a five-year-old company located in Denver, Colorado. The focus of the company is on financial technology investments on behalf of their client investors. Currently, the company has recorded stable and growing levels of profitability and has been tagged as an investment management firm known for its expertise in mutual funds and retirement planning They offer a sizable range of investment strategies, including equity, fixed income, and asset allocation funds. They are tech-driven and focus on research-driven investment decisions to fulfill the goals of their clients in long-term wealth creation.

In addition to tech acquisitions, FinTech Capital Management is also directed toward senior investors, with brokerage, retirement planning, wealth management, and mutual funds in their services offered. They provide a range of investment options, from individual stocks and bonds to managed portfolios and retirement accounts, many of which are perfect for those investors who have amassed a sizable portfolio, but are becoming risk-averse as they age. FinTech Capital Management is owned by The Thurgood Family Trust with the Thurgood brothers, Jonathan and Regis, responsible for day-to-day management. It has been recently suggested that the firm may be sold if the right buyers were to approach.

Competitive Advantage

NovaGrowth Investments will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

NovaGrowth Investments will offer the unique value proposition to its clientele:

- Unique investment strategies tailored for each individual client

Promotions Strategy

The promotions strategy for NovaGrowth Investments is as follows:

Word of Mouth/Referrals

Thom Anderson has built up an extensive list of contacts over the years by providing exceptional service and expertise to former clients and potential investors. The contacts and clients will follow him to his new company and help spread the word of NovaGrowth Investments.

Professional Associations and Networking

The executives within NovaGrowth Investments will begin networking in professional associations and at events within the city-wide industry groups. This will bring the new startup into focus for other companies, providing a path to increased clients and strategic partnerships within the city.

Social Media Marketing

NovaGrowth Investments will target their primary and secondary audiences with a series of text announcements via social media. The announcements will be invitations to the opening of the company, with a champagne reception and information regarding the services available at NovaGrowth Investments. The social media announcements will continue for the three weeks prior to the launch of the company.

Website/SEO Marketing

NovaGrowth Investments will fully utilize their website. The website will be well organized, informative, and list the services that NovaGrowth Investments provides. The website will also list their contact information and biographies of the executive group. The website will engage in SEO marketing tactics so that anytime someone types in the Google or Bing search engine “Investment company” or “Investment opportunities near me,” NovaGrowth Investments will be listed at the top of the search results.

The pricing of NovaGrowth Investments will be moderate and on par with competitors so customers feel they receive excellent value when purchasing their services.

Operations Plan

The following will be the operations plan for NovaGrowth Investments. Operation Functions:

- Thom Anderson will be the owner and President of the company. He will oversee all staff and manage client relations. Thom has spent the past year recruiting the following staff:

- Jackson Byers will provide all client accounting, tax payments and monthly financial reporting. His title will be Staff Accountant.

- Kylie Carlson will provide all employee onboarding and oversight as she assumes the role of Human Resources Manager.

Milestones:

NovaGrowth Investments will have the following milestones completed in the next six months.

- 5/1/202X – Finalize contract to lease office space

- 5/15/202X – Finalize personnel and staff employment contracts for NovaGrowth Investments

- 6/1/202X – Finalize contracts for NovaGrowth Investments clients

- 6/15/202X – Begin networking at industry events

- 6/22/202X – Begin moving into NovaGrowth Investments office

- 7/1/202X – NovaGrowth Investments opens its doors for business

Financial Plan

Key revenue & costs.

The revenue drivers for NovaGrowth Investments are the fees they will charge to clients for their investment acquisition and portfolio management services.

The cost drivers will be the overhead costs required in order to staff NovaGrowth Investments. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

NovaGrowth Investments is seeking $200,000 in debt financing to launch its investment company. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and association memberships. The breakout of the funding is below:

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of Clients Per Month: 175

- Average Revenue per Month: $437,500

- Office Lease per Year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, investment company business plan faqs, what is an investment company business plan.

An investment company business plan is a plan to start and/or grow your investment company business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Investment Company business plan using our Investment Company Business Plan Template here .

What are the Main Types of Investment Company Businesses?

There are a number of different kinds of investment company businesses , some examples include: Closed-End Funds Investment Company, Mutual Funds (Open-End Funds) Investment Company, and Unit Investment Trusts (UITs) Investment Company.

How Do You Get Funding for Your Investment Company Business Plan?

Investment Company businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start an Investment Company Business?

Starting an investment company business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Investment Company Business Plan - The first step in starting a business is to create a detailed investment company business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your investment company business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your investment company business is in compliance with local laws.

3. Register Your Investment Company Business - Once you have chosen a legal structure, the next step is to register your investment company business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your investment company business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Investment Company Equipment & Supplies - In order to start your investment company business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your investment company business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful investment company business:

- How to Start an Investment Company

We earn commissions if you shop through the links below. Read more

Investment Company

Back to All Business Ideas

How to Start Your Own Investment Company in 13 Steps

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on June 6, 2022

Investment range

$3,350 - $9,800

Revenue potential

$96,000 - $288,000 p.a.

Time to build

Profit potential

$86,000 - $115,000 p.a.

Industry trend

Essential points to keep in mind for a successful investment company:

- Services — Decide on the types of investment services you will offer, such as wealth management, financial planning, mutual funds, private equity, or venture capital.

- Financial regulatory licenses — Register with the appropriate regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, and get the necessary licenses to operate as an investment advisor or broker-dealer. This may include passing exams such as the Series 7, Series 65, or Series 66.

- Compliance with regulations — Ensure compliance with all relevant regulations, such as the Investment Advisers Act of 1940 in the United States, and maintain good standing with regulatory authorities.

- Choosing a location — Select a location with adequate space for offices, meeting rooms, and storage. Ensure it is easily accessible for staff and clients.

- Investment management software — Invest in high-quality investment management software to manage portfolios, track performance, and ensure compliance. Popular options include Morningstar Direct , eMoney Advisor , and Bloomberg Terminal .

- Register your business — A limited liability company (LLC) is the best legal structure for new businesses because it is fast and simple. Form your business immediately using ZenBusiness LLC formation service or hire one of the best LLC services on the market.

- Legal business aspects — Register for taxes, open a business bank account, and get an EIN .

- Hire staff — Hire experienced and licensed investment advisors, financial analysts, administrative support, and marketing professionals.

- Develop a sound investment strategy and track record — Create a well-defined investment strategy that aligns with your business’s goals and target market. This involves selecting appropriate asset classes, risk management techniques, and portfolio diversification strategies to meet your clients’ needs. Regularly review and adjust your strategy based on market conditions and performance.

Interactive Checklist at your fingertips—begin your investment company today!

You May Also Wonder:

How can I become licensed to start an investment company?

You’ll need securities licenses including Series 6, Series 7, Series 63, Series 65, and Life and Health Insurance. You must take exams for each one in your state at a physical location. You can find only study materials and courses online from places like Kaplan University . Through Kaplan you can also become a Certified Financial Planner (CFP) with more extensive study.

What are the main types of investments?

The main types of investments include stocks, bonds, mutual funds, real estate, commodities, and alternative investments such as hedge funds or private equity. Each investment type has its own characteristics, risks, and potential returns, allowing investors to diversify their portfolios based on their goals and risk tolerance.

How do I handle client accounts and maintain transparency in my investment company?

To handle client accounts and maintain transparency in an investment company, it is crucial to implement robust systems and processes. This includes accurately documenting client transactions, maintaining proper accounting records, and providing regular reports and statements to clients regarding their investments.

How can I determine the target market and potential clients for my investment company?

Start by evaluating the investment services you offer and identifying the specific demographic, financial profile, and investment objectives that align with your expertise. Conduct market research to understand the demand for investment services in your target market, identify potential clients through networking, and consider leveraging digital marketing strategies to reach a broader audience.

Is it hard to run an investment company?

Running an investment company can be challenging due to various factors such as regulatory compliance, market volatility, client expectations, and competition. It requires a strong understanding of financial markets, investment strategies, risk management, and the ability to build and maintain client relationships.

Can I start an investment company on the side?

Running an investment company demands time, expertise, and resources, so balancing it with other commitments can be challenging. Ensure that you have the necessary qualifications, experience, and knowledge to provide investment services. It is crucial to adhere to legal and regulatory requirements and establish clear boundaries between your primary employment or commitments and the investment company.

Step 1: Decide if the Business Is Right for You

First, let’s clarify the type of business being discussed. “Investment company” is a broad term that could include a company that creates its own mutual funds or other investment vehicles, a private equity firm , a real estate investment company , a venture capital firm, or an angel investor.

This article refers to an advisory firm that provides financial advice and planning, makes investment transactions for its clients, and offers investment and wealth management advice.

Pros and cons

Starting an investment company has pros and cons to consider before deciding if it’s right for you.

- Provide Value – Offer valuable advice and services that impact lives

- Good Money – A lot of money to be made in the investment industry

- Small Investment – Not a lot of cash required to get started

- Regulations – Multiple licenses required; Securities Act regulations to follow

- Volatility – Stock market fluctuations lead to worried clients

Investment industry trends

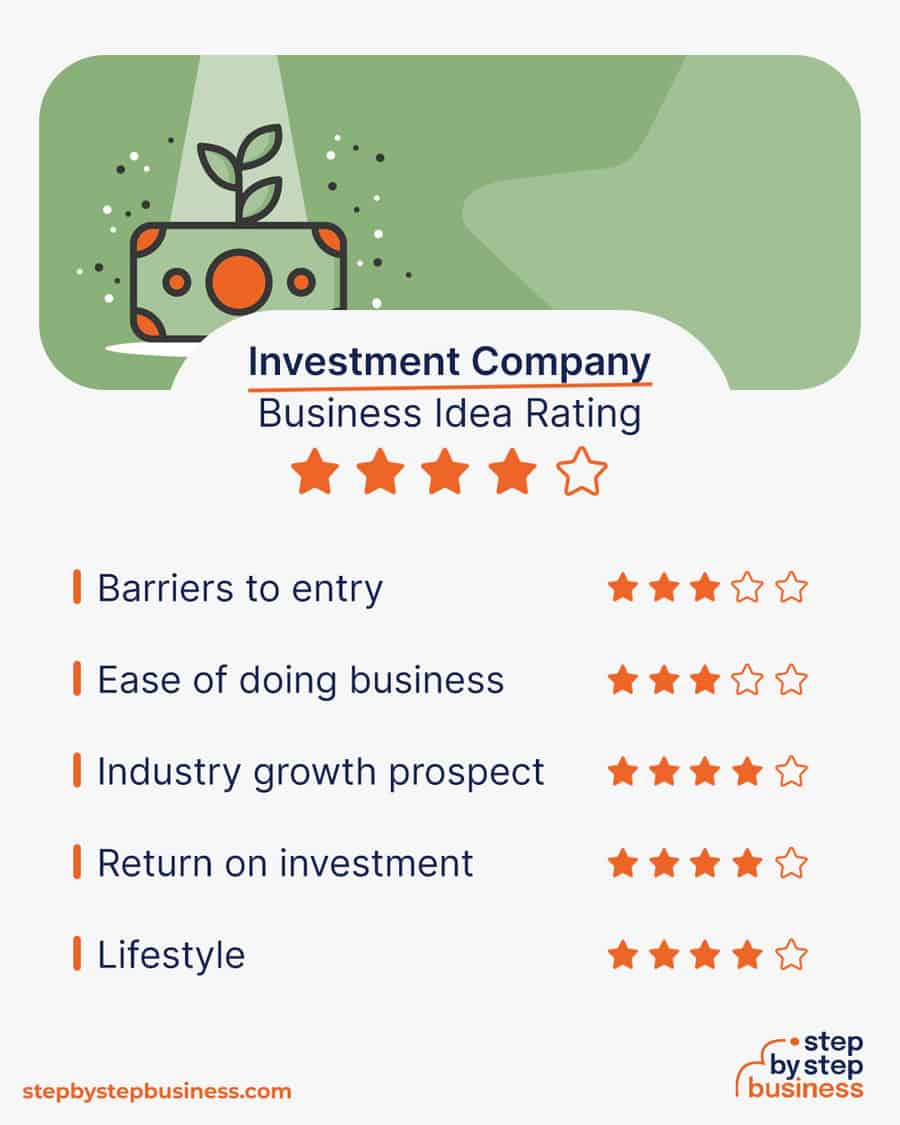

Industry size and growth.

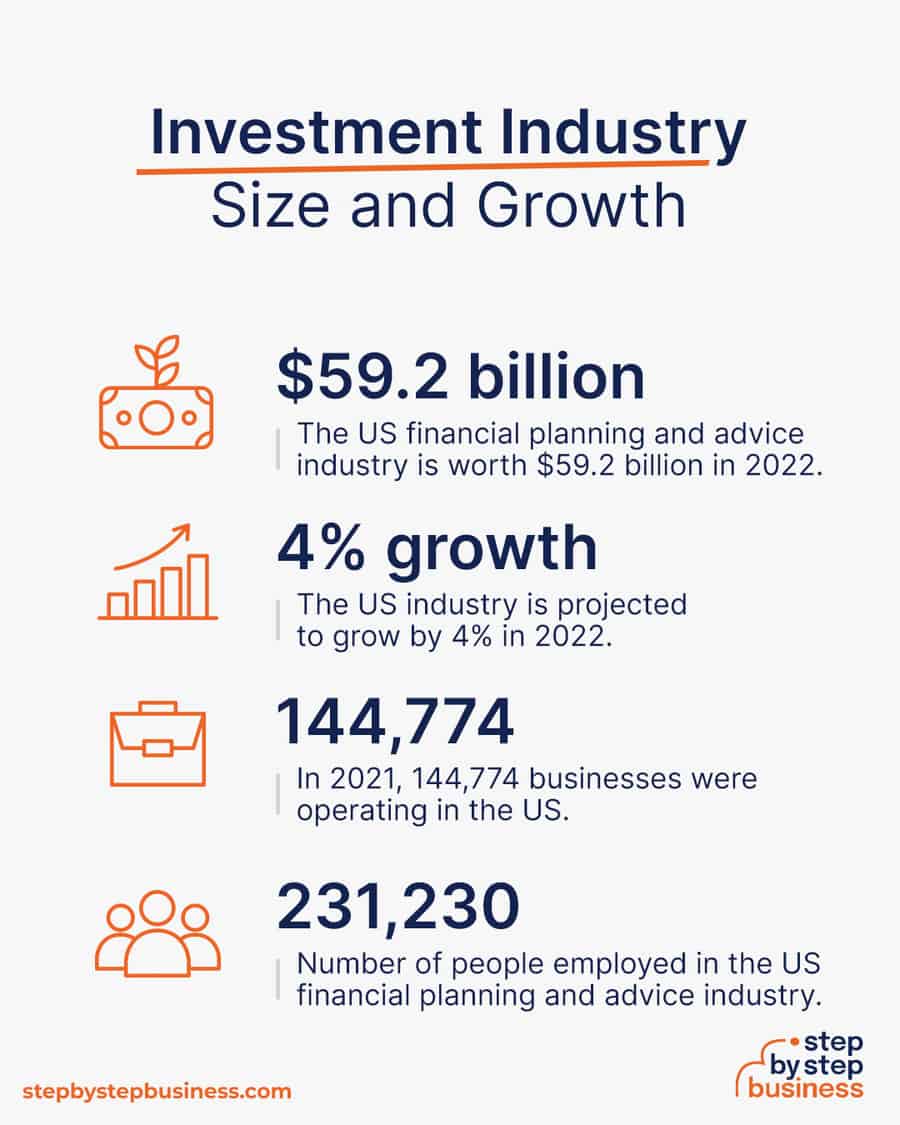

- Industry size and past growth – The US financial planning and advice industry is worth $59.2 billion in 2022 after expanding 48% in the last decade.(( https://www.ibisworld.com/industry-statistics/market-size/financial-planning-advice-united-states/ ))

- Growth forecast – The US financial planning and advice industry is projected to grow by 4% in 2022.

- Number of businesses – In 2021, 144,774 financial planning and advice businesses were operating in the US.

- Number of people employed – In 2021, the US financial planning and advice industry employed 231,230 people.(( https://www.ibisworld.com/united-states/market-research-reports/financial-planning-advice-industry/ ))

Trends and challenges

Trends in the investment industry include:

- The pandemic caused people to rethink their futures, and more want to plan for retirement so that they can enjoy that time of their life.