Need a consultation? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- E1 Treaty Trader Visa

- E2 Treaty Investor Visa

- Innovator Founder Visa

- UK Start-Up Visa

- UK Expansion Worker Visa

- Manitoba MPNP Visa

- Start-Up Visa

- Nova Scotia NSNP Visa

- British Columbia BC PNP Visa

- Self-Employed Visa

- OINP Entrepreneur Stream

- LMIA Owner Operator

- ICT Work Permit

- LMIA Mobility Program – C11 Entrepreneur

- USMCA (ex-NAFTA)

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Online Boutique

- Mobile Application

- Food Delivery

- Real Estate

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- Business Valuation

- How it works

- Business Plan Templates

How to Write a Business Plan to Start a Bank

Published Feb.29, 2024

Updated Oct.04, 2024

By: Alex Silensky

Average rating 5 / 5. Vote count: 5

No votes so far! Be the first to rate this post.

Table of Content

Bank Business Plan Checklist

A bank business plan is a document that describes the bank’s goals, strategies, operations, and financial projections. It communicates the bank’s vision and value proposition to potential investors, regulators, and stakeholders. A SBA business plan should be clear, concise, and realistic. It should also cover all the essential aspects of the bank’s business model.

Here is a checklist of the main sections that you should keep in mind while building a bank business plan:

- Executive summary

- Company description

- Industry analysis

- Competitive analysis

- Service or product list

- Marketing and sales plan

- Operations plan

- Management team

- Funding request

- Financial plan

Sample Business Plan for Bank

The following is a bank business plan template that operates in the USA. This bank business plan example is regarding ABC Bank, and it includes the following sections:

Executive Summary

ABC Bank is a new bank for California’s SMBs and individuals. We offer convenient banking services tailored to our customers’ needs and preferences. We have a large target market with over 500,000 SMBs spending billions on banking services annually. We have the licenses and approvals to operate our bank and raised $20 million in seed funding. We are looking for another $30 million in debt financing. By preparing a solid E2 visa business plan sample , entrepreneurs can utilize such banking models to secure their business immigration status in the U.S.

Our goal is to launch our bank by the end of 2024 and achieve the following objectives in the first five years of operation:

- Acquire 100,000 customers and 10% market share

- Generate $100 million in annual revenue and $20 million in net profit

- Achieve a return on equity (ROE) of 15% and a return on assets (ROA) of 1.5%

- Expand our network to 10 branches and 50 ATMs

- Increase our brand awareness and customer loyalty

Our bank has great potential to succeed and grow in the banking industry. We invite you to read the rest of our microfinance business plan to learn about how to set up a business plan for the bank and how we will achieve our goals.

Industry Analysis

California has one of the biggest and most active banking industries in the US and the world. According to the Federal Deposit Insurance Corp , California has 128 financial institutions, with total assets exceeding $560 billion.

The California banking industry is regulated and supervised by various federal and state authorities. However, they also face several risks and challenges, such as:

- High competition and consolidation

- Increasing regulation and compliance

- Rising customer demand for digital and mobile banking

- Cyberattacks and data breaches

- Environmental and social issues

The banking industry in California is highly competitive and fragmented. According to the FDIC, the top 10 banks and thrifts in California by total deposits as of June 30, 2023, were:

Customer Analysis

We serve SMBs who need local, easy, and cheap banking. We divide our customers into four segments by size, industry, location, and needs:

SMB Segment 1 – Tech SMBs in big cities of California. These are fast-growing, banking-intensive customers. They account for a fifth of our market share and a third of our revenue and are loyal and referable.

SMB Segment 2 – Entertainment SMBs in California’s entertainment hubs. These are high-profile, banking-heavy customers. They make up a sixth of our market and a fourth of our revenue and are loyal and influential.

SMB Segment 3 – Tourism SMBs in California’s tourist spots. These are seasonal, banking-dependent customers. They represent a quarter of our market and a fifth of our revenue and are loyal and satisfied.

SMB Segment 4 – Other SMBs in various regions of California. These are slow-growing, banking-light customers. They constitute two-fifths of our market and a quarter of our revenue and are loyal and stable.

Competitive Analysis

We compete with other banks and financial institutions that offer similar or substitute products and services to our target customers in our target market. We group our competitors into four categories based on their size and scope:

1. National Banks

- Key Players – Bank of America, Wells Fargo, JPMorgan Chase, Citibank, U.S. Bank

- Strengths – Large customer base, strong brand, extensive branch/ATM network, innovation, robust operations, solid financial performance

- Weaknesses – High competition, regulatory costs, low customer satisfaction, high attrition

- Strategies – Maintain dominance through customer acquisition/retention, revenue growth, efficiency

2. Regional Banks

- Key Players – MUFG Union Bank, Bank of the West, First Republic Bank, Silicon Valley Bank, East West Bank

- Strengths – Loyal customer base, brand recognition, convenient branch/ATM network, flexible operations

- Weaknesses – Moderate competition, regulatory costs, customer attrition

- Strategies – Grow market presence through customer acquisition/retention, revenue optimization, efficiency

3. Community Banks

- Key Players – Mechanics Bank, Bank of Marin, Pacific Premier Bank, Tri Counties Bank, Luther Burbank Savings

- Strengths – Small loyal customer base, reputation, convenient branches, ability to adapt

- Weaknesses – Low innovation and technology adoption

- Strategies – Maintain niche identity through customer loyalty, revenue optimization, efficiency

4. Online Banks

- Key Players – Ally Bank, Capital One 360, Discover Bank, Chime Bank, Varo Bank

- Strengths – Large growing customer base, strong brand, no branches, lean operations, high efficiency

- Weaknesses – High competition, regulatory costs, low customer satisfaction and trust, high attrition

- Strategies – Disrupt the industry by acquiring/retaining customers, optimizing revenue, improving efficiency

Market Research

Our market research shows that:

- California has a large, competitive, growing banking market with 128 banks and $560 billion in assets.

- Our target customers are the SMBs in California, which is 99.8% of the businesses and employ 7.2-7.4 million employees.

- Our main competitors are national and regional banks in California that offer similar banking products and services.

We conclude that:

- Based on the information provided in our loan officer business plan , there is a promising business opportunity for us to venture into and establish a presence in the banking market in California.

- We should focus on the SMBs in California, as they have various unmet banking needs, preferences, behavior, and a high potential for growth and profitability.

Operations Plan

Our operational structure and processes form the basis of our operations plan, and they are as follows:

- Location and Layout – We have a network of 10 branches and 50 ATMs across our target area in California. We strategically place our branches and ATMs in convenient and high-traffic locations.

- Equipment and Technology – We use modern equipment and technology to provide our products and services. We have computers and software for banking functions; security systems to protect branches and ATMs; communication systems to communicate with customers and staff; inventory and supplies to operate branches and ATMs.

- Suppliers and Vendors – We work with reliable suppliers and vendors that provide our inventory and supplies like cash, cards, paper, etc. We have supplier management systems to evaluate performance.

- Staff and Management – Our branches have staff like branch managers, customer service representatives, tellers, and ATM technicians with suitable qualifications and experience.

- Policies and Procedures – We have policies for customer service, cash handling, card handling, and paper handling to ensure quality, minimize losses, and comply with regulations. We use various tools and systems to implement these policies.

Management Team

The following individuals make up our management team:

- Earl Yao, CEO and Founder – Earl is responsible for establishing and guiding the bank’s vision, mission, strategy, and overall operations. He brings with him over 20 years of banking experience.

- Paula Wells, CFO and Co-Founder – Paula oversees financial planning, reporting, analysis, compliance, and risk management.

- Mark Hans, CTO – Mark leads our technology strategy, infrastructure, innovation, and digital transformation.

- Emma Smith, CMO – Emma is responsible for designing and implementing our marketing strategy and campaigns.

- David O’kane, COO – David manages the daily operations and processes of the bank ensuring our products and services meet the highest standards of quality and efficiency.

Financial Projections

Our assumptions and drivers form the basis of our financial projections, which are as follows:

Assumptions: We have made the following assumptions for our collection agency business plan :

- Start with 10 branches, 50 ATMs in January 2024

- Grow branches and ATMs 10% annually

- 10,000 customers per branch, 2,000 per ATM

- 5% average loan rate, 2% average deposit rate

- 80% average loan-to-deposit ratio

- $10 average fee per customer monthly

- $100,000 average operating expense per branch monthly

- $10,000 average operating expense per ATM monthly

- 25% average tax rate

Our financial projections are as per our:

- Projected Income Statement

- Projected Cash Flow Statement

- Projected Balance Sheet

- Projected Financial Ratios and Indicators

Select the Legal Framework for Your Bank

Our legal structure and requirements form the basis of our legal framework, which are as follows:

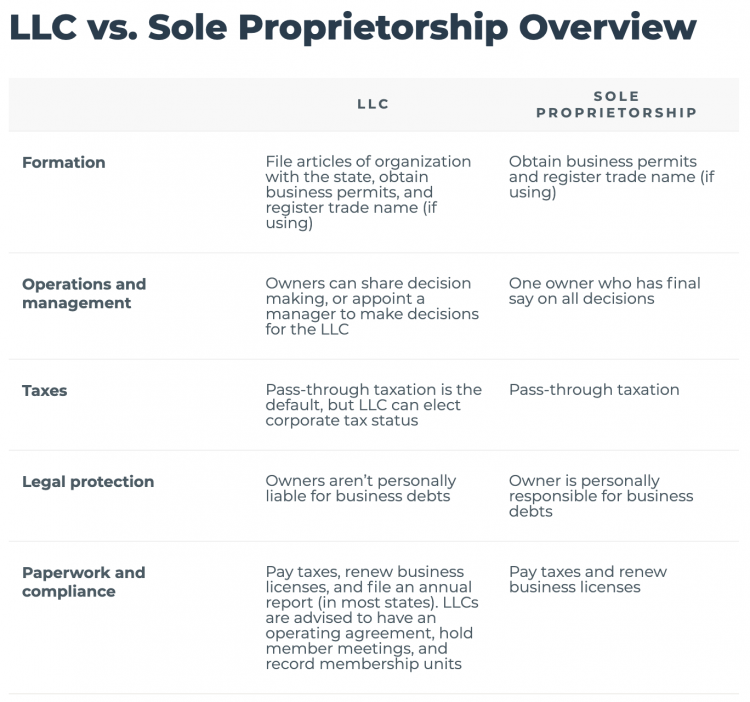

Legal Structure and Entity – We have chosen to incorporate our bank as a limited liability company (LLC) under the laws of California.

Members – We have two members who own and control our bank: Earl Yao and Paula Wells, the founders and co-founders of our bank.

Manager – We have appointed Mark Hans as our manager who oversees our bank’s day-to-day operations and activities.

Name – We have registered our bank’s name as ABC Bank LLC with the California Secretary of State. We have also obtained a trademark registration for our name and logo.

Registered Agent – We have designated XYZ Registered Agent Services LLC as our registered agent authorized to receive and handle legal notices and documents on behalf of our bank.

Licenses and Approvals – We have obtained the necessary licenses and approvals to operate our bank in California, including:

- Federal Deposit Insurance Corporation (FDIC) Insurance

- Federal Reserve System Membership

- California Department of Financial Protection and Innovation (DFPI) License

- Business License

- Employer Identification Number (EIN)

- Zoning and Building Permits

Legal Documents and Agreements – We have prepared and signed the necessary legal documents and agreements to form and operate our bank, including:

- Certificate of Formation

- Operating Agreement

- Membership Agreement

- Loan Agreement

- Card Agreement

- Paper Agreement

Keys to Success

We analyze our market, customers, competitors, and industry to determine our keys to success. We have identified the following keys to success for our bank.

Customer Satisfaction

Customer satisfaction is vital for any business, especially a bank relying on loyalty and referrals. It is the degree customers are happy with our products, services, and interactions. It is influenced by:

- Product and service quality – High-quality products and services that meet customer needs and preferences

- Customer service quality – Friendly, professional, and helpful customer service across channels

- Customer experience quality – Convenient, reliable, and secure customer access and transactions

We will measure satisfaction with surveys, feedback, mystery shopping, and net promoter scores. Our goal is a net promoter score of at least 8.

Operational Efficiency

Efficiency is key in a regulated, competitive environment. It is using resources and processes effectively to achieve goals and objectives. It is influenced by:

- Resource optimization – Effective and efficient use and control of capital, staff, and technology

- Process improvement – Streamlined, standardized processes measured for performance

- Performance management – Managing financial, operational, customer, and stakeholder performance

We will measure efficiency with KPIs, metrics, dashboards, and operational efficiency ratios. Our goal is an operational efficiency ratio below 50%.

Partner with OGSCapital for Your Bank Business Plan Success

Highly efficient service.

Highly Efficient Service! I am incredibly happy with the outcome; Alex and his team are highly efficient professionals with a diverse bank of knowledge.

Are you looking to hire business plan writers to start a bank business plan? At OGSCapital, we can help you create a customized and high-quality bank development business plan to meet your goals and exceed your expectations.

We have a team of senior business plan experts with extensive experience and expertise in various industries and markets. We will conduct thorough market research, develop a unique value proposition, design a compelling financial model, and craft a persuasive pitch deck for your business plan. We will also offer you strategic advice, guidance, and access to a network of investors and other crucial contacts.

We are not just a business plan writing service. We are a partner and a mentor who will support you throughout your entrepreneurial journey. We will help you achieve your business goals with smart solutions and professional advice. Contact us today and let us help you turn your business idea into a reality.

Frequently Asked Questions

How do I start a small bank business?

To start a small bank business in the US, you need to raise enough capital, understand how to make a business plan for the bank, apply for a federal or state charter, register your bank for taxes, open a business bank account, set up accounting, get the necessary permits and licenses, get bank insurance, define your brand, create your website, and set up your phone system.

Are banks profitable businesses?

Yes, banks are profitable businesses in the US. They earn money through interest on loans and fees for other services. The commercial banking industry in the US has grown 5.6% per year on average between 2018 and 2023.

Download Bank Business Plan Sample in pdf

OGSCapital’s team has assisted thousands of entrepreneurs with top-rated document, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

How to Write a Successful Bank Business Plan (+ Template)

Creating a business plan is essential. Still, it can be beneficial for bank s that want to improve their strategy or raise funding.

A well-crafted business plan outlines your company’s vision and documents a step-by-step roadmap of how you will accomplish it. To create an effective business plan, you must first understand the components essential to its success.

This article provides an overview of the key elements that every bank business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is a Bank Business Plan?

A bank business plan is a formal written document describing your company’s business strategy and feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a critical document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write a Bank Business Plan?

A bank business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Bank Business Plan

The following are the key components of a successful bank business plan:

Executive Summary

The executive summary of a bank business plan is a one- to two-page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your bank company

- Provide a summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast, among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started and provide a timeline of milestones your company has achieved.

You may not have a long company history if you are just starting your bank business. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company or been involved in an entrepreneurial venture before starting your bank firm, mention this.

You will also include information about your chosen bank business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an essential component of a bank business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the bank industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support your company’s success)?

You should also include sources for your information, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, a bank business’ customers may include small businesses, large corporations, and individuals. Each customer segment will have different requirements that your bank company will need to cater to.

You can include information about how your customers decide to buy from you and what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or bank services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will differ from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your bank business may have:

- Proven track record with a focus on customer service.

- Superior technology that makes banking easier and more convenient for customers.

- Range of products and services to meet the needs of different customer segments.

- Sound financial position with a commitment to responsible lending practices.

- Extensive branch and ATM network.

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, or launch a direct mail campaign. Or you may promote your bank business via PR or events.

Operations Plan

This part of your bank business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

You also need to include your company’s business policies in the operations plan. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, your Operations Plan will outline the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for a bank business include reaching $X in sales. Other examples include expanding to new markets, launching new products and services, and hiring key personnel.

Management Team

List your team members here, including their names and titles, as well as their expertise and experience relevant to your specific bank industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here, you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs and the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Bank

| Revenues | $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 |

| $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 | |

| Direct Cost | |||||

| Direct Costs | $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 |

| $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 | |

| $ 268,880 | $ 360,750 | $ 484,000 | $ 649,390 | $ 871,280 | |

| Salaries | $ 96,000 | $ 99,840 | $ 105,371 | $ 110,639 | $ 116,171 |

| Marketing Expenses | $ 61,200 | $ 64,400 | $ 67,600 | $ 71,000 | $ 74,600 |

| Rent/Utility Expenses | $ 36,400 | $ 37,500 | $ 38,700 | $ 39,800 | $ 41,000 |

| Other Expenses | $ 9,200 | $ 9,200 | $ 9,200 | $ 9,400 | $ 9,500 |

| $ 202,800 | $ 210,940 | $ 220,871 | $ 230,839 | $ 241,271 | |

| EBITDA | $ 66,080 | $ 149,810 | $ 263,129 | $ 418,551 | $ 630,009 |

| Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| EBIT | $ 60,880 | $ 144,610 | $ 257,929 | $ 413,351 | $ 625,809 |

| Interest Expense | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 |

| $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 | |

| Taxable Income | $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 |

| Income Tax Expense | $ 18,700 | $ 47,900 | $ 87,600 | $ 142,000 | $ 216,400 |

| $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 | |

| 10% | 20% | 27% | 32% | 37% | |

Balance Sheet

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : Everything you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Bank

| Cash | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

| Other Current Assets | $ 41,600 | $ 55,800 | $ 74,800 | $ 90,200 | $ 121,000 |

| Total Current Assets | $ 146,942 | $ 244,052 | $ 415,681 | $ 687,631 | $ 990,278 |

| Fixed Assets | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Accum Depreciation | $ 5,200 | $ 10,400 | $ 15,600 | $ 20,800 | $ 25,000 |

| Net fixed assets | $ 19,800 | $ 14,600 | $ 9,400 | $ 4,200 | $ 0 |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

| Current Liabilities | $ 23,300 | $ 26,100 | $ 29,800 | $ 32,800 | $ 38,300 |

| Debt outstanding | $ 108,862 | $ 108,862 | $ 108,862 | $ 108,862 | $ 0 |

| $ 132,162 | $ 134,962 | $ 138,662 | $ 141,662 | $ 38,300 | |

| Share Capital | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Retained earnings | $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 |

| $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 | |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

Cash Flow Statement

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include cash flow from:

- Investments

Below is a sample of a projected cash flow statement for a startup bank business.

Sample Cash Flow Statement for a Startup Bank

| Net Income (Loss) | $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 |

| Change in Working Capital | $ (18,300) | $ (11,400) | $ (15,300) | $ (12,400) | $ (25,300) |

| Plus Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| Net Cash Flow from Operations | $ 21,480 | $ 82,910 | $ 152,629 | $ 256,551 | $ 380,709 |

| Fixed Assets | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Net Cash Flow from Investments | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Equity | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Debt financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow from Financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow | $ 105,342 | $ 82,910 | $ 152,629 | $ 256,551 | $ 271,847 |

| Cash at Beginning of Period | $ 0 | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 |

| Cash at End of Period | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and grow your bank company. It not only outlines your business vision but also provides a step-by-step process of how you will accomplish it.

Now that you know how to write a business plan for your bank, you can get started on putting together your own.

Finish Your Business Plan in 1 Day!

Wish there was a faster, easier way to finish your business plan?

With our Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Other Helpful Articles

Commercial Bank Business Plan

Investment Bank Business Plan

Digital Bank Business Plan

We earn commissions if you shop through the links below. Read more

Back to All Business Ideas

How to Start a Bank: Planning, Funding, and Execution

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on June 20, 2022

Investment range

$13,385,150 - $28,710,200

Revenue potential

$7.2 million - $72 million p.a.

Time to build

12 – 18 months

Profit potential

$720,000 - $7.2 million p.a.

Industry trend

Here are the most important factors to consider when starting a bank:

- Licensing — You will need many licenses and approvals to start a bank. The primary one is the Banking License . Next, you will need to apply for regulatory approval from a central bank. In addition, banks must comply with AML and KYC regulations to prevent financial crimes.

- ATMs and Branches — If your bank plans to open branches or install ATMs, depending on local laws, additional permissions may be required for each location.

- Capital — Regulators will require that you maintain certain levels of capital to cover potential losses. These requirements can be quite high and are meant to ensure the bank’s stability and solvency.

- Insurance — In many jurisdictions, banks are required to insure deposits up to a certain amount. This insurance protects depositors in the event of a bank failure.

- Location — Find a location that’s in a busy commercial area or business district.

- Security — Invest in high-quality physical security such as alarm systems, surveillance cameras, secure vaults, and secure doors. In addition, consider robust cybersecurity measures to protect sensitive data such as encryption, storage solutions, and strict access controls.

- Register your business — A limited liability company (LLC) is the best legal structure for new businesses because it is fast and simple. Form your business immediately using ZenBusiness LLC formation service or hire one of the best LLC services on the market.

- Legal business aspects — Register for taxes, open a business bank account, and get an EIN .

Interactive Checklist at your fingertips—begin your bank today!

You May Also Wonder:

How profitable are banks?

Banks are very profitable, considering that the U.S. banking industry is worth more than $860 billion. The key is to provide a variety of banking services and offer great customer service.

How do I build relationships with customers and attract deposits to my bank?

You’ll have to spend some time marketing to get the word out. Then, when customers come in, you’ll want them to receive personal service.

How do I develop a business plan for my bank?

A business plan is a detailed document that requires considerable time to develop. It includes various sections such as an executive summary, company overview, descriptions of your products and services, market analysis, competitor analysis, sales and marketing plan, management summary, operations plan, and financial projections.

How do I create a risk management plan for my bank?

A risk management plan for a bank is very complex. Your best bet is to hire an experienced banking consultant to help you. It will be worth the cost.

What is the difference between a commercial bank and a community bank?

Commercial banks generally operate nationally and are subject to federal multi-state banking regulations. Community banks only operate in one state or locality.

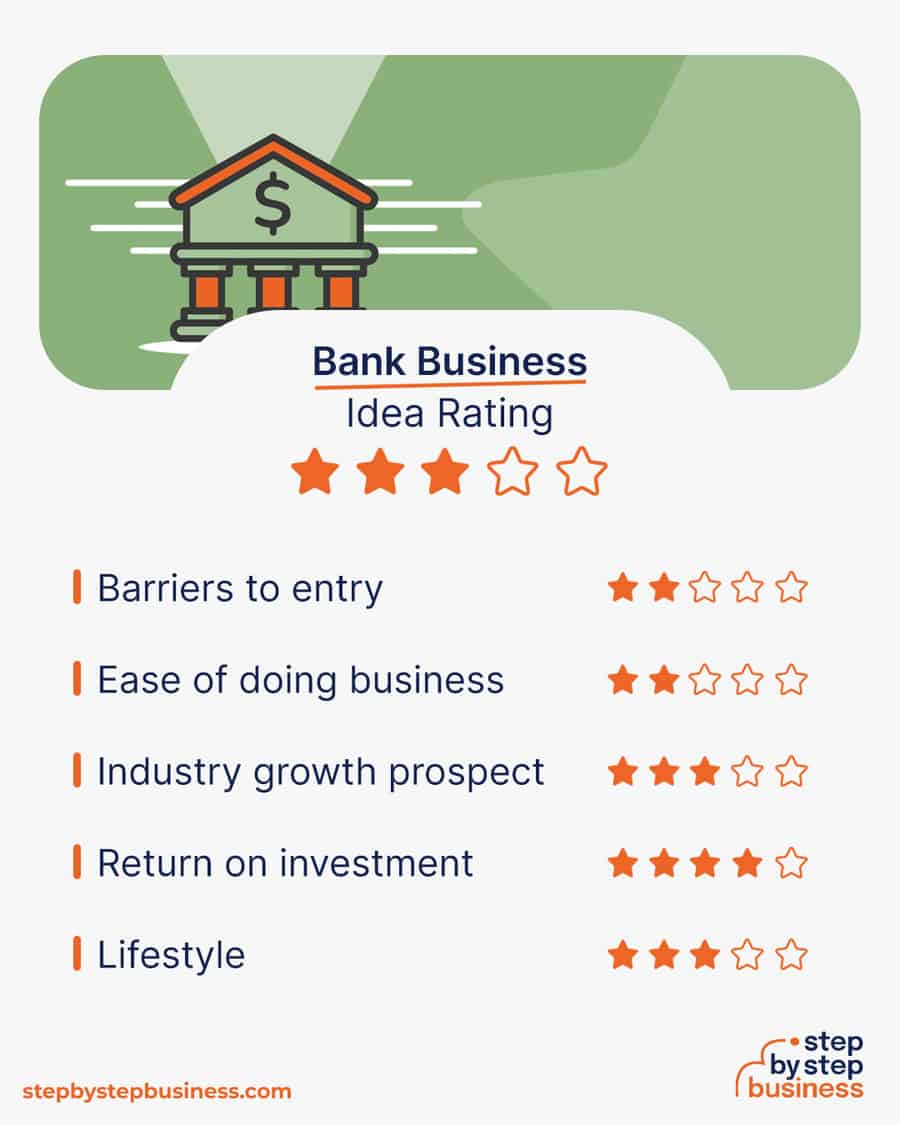

Step 1: Decide if the Business Is Right for You

Pros and cons.

Starting a bank has pros and cons to consider before deciding if it’s right for you.

- Provide value — Crucial financial services for your community

- Large market — Most people rely on banks

- Good money — Banks are big money makers

- Large investment — Millions in starting capital required

- Highly regulated — Banking is the most regulated industry in the US

Bank Industry Trends

Industry size and growth.

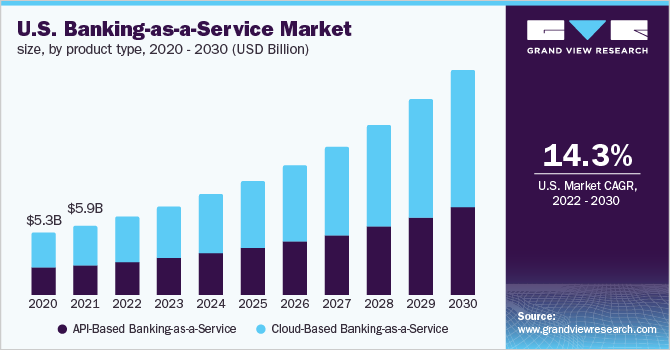

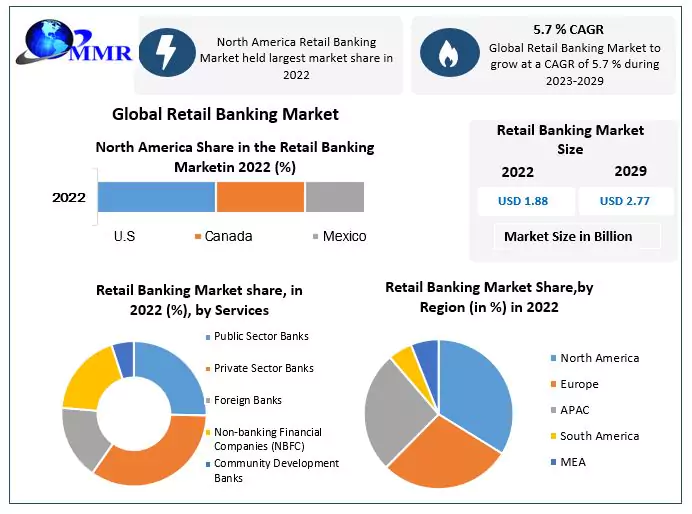

- Industry size and past growth — The US commercial banking industry was worth $1.4 trillion in 2023 after expanding 37.3% since 2022. On average, the industry has grown 5.6% over the last five years.(( https://www.ibisworld.com/industry-statistics/market-size/commercial-banking-united-states/ ))

- Growth forecast — The US commercial banking industry is projected to grow more than 2% yearly by 2029.(( https://www.mordorintelligence.com/industry-reports/us-commercial-banking-market ))

- Number of businesses — In 2023, 4,867 commercial banking businesses were operating in the US.(( https://www.ibisworld.com/industry-statistics/number-of-businesses/commercial-banking-united-states/ ))

- Number of people employed — In 2023, the US commercial banking industry employed 2,595,852 people.(( https://www.ibisworld.com/industry-statistics/employment/commercial-banking-united-states/ ))

Trends and Challenges

- Digital banking is the way of the future, with major banks competing to have the best apps, websites, and digital services, like instant payments.

- Technologies such as Robotic Process Automation and machine learning are helping banks replace manual workflows with cost-efficient, lightning-fast operations.

- For small banks, keeping up with technology to compete with major banks can be expensive.

- Regulations on banks — already the country’s most regulated industry — are continuing to tighten, creating new expenses and operational challenges.

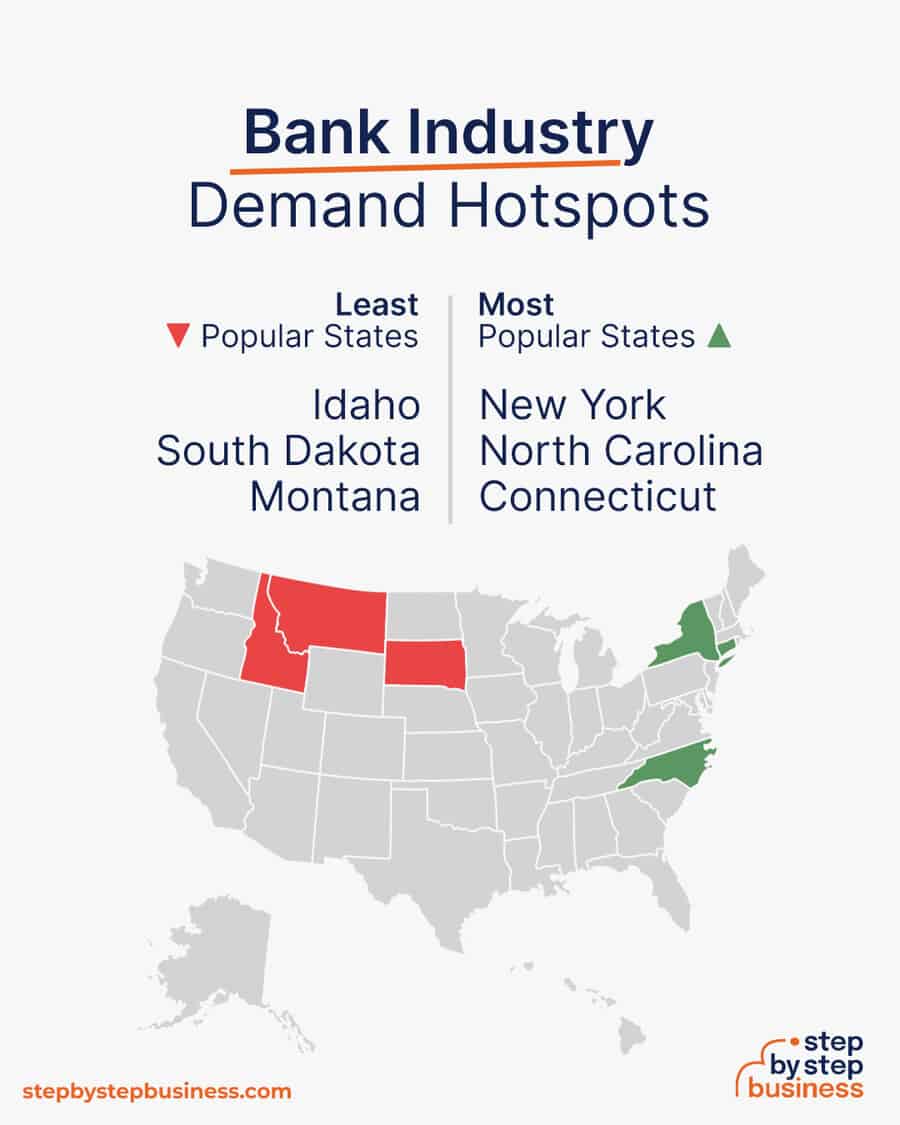

Demand Hotspots

- Most popular states — The most popular states for bank managers are New York, California, and Washington.

- Least popular states — The least popular states for bank managers are Nebraska, Wyoming, and North Dakota.(( https://www.zippia.com/bank-manager-jobs/best-states/ ))

What Kind of People Work in Banks?

- Gender — 51.1% of bank managers are female, while 48.9% are male.

- Average level of education — The average bank manager has a bachelor’s degree.

- Average age — The average bank manager in the US is 45.8 years old.(( https://www.zippia.com/bank-manager-jobs/demographics/ ))

How Much Does It Cost to Start a Bank Business?

Startup costs for a bank range from $13 million to $28 million, with the biggest expense being the startup capital required to meet federal regulations. If you start a digital rather than a physical bank, you could save up to $4 million.

You will need to apply for licenses and insurance with the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) , which is often a laborious process.

You’ll need a handful of items to successfully launch your bank business, including:

- Computer system

- Printers, money counters, other office equipment

- Security system

- Furnishings

| Start-up Costs | Ballpark Range | Average |

|---|---|---|

| Setting up a business name and corporation | $150–$200 | $175 |

| Business licenses and permits | $10,000–$20,000 | $15,000 |

| Insurance | $25,000–$50,000 | $37,500 |

| Website and app development | $100,000–$150,000 | $125,000 |

| Land plus bank construction | $1,000,000–$4,000,000 | $2,500,000 |

| Computer system | $30,000–$50,000 | $40,000 |

| Starting capital to meet regulations | $12,000,000–$24,000,000 | $18,000,000 |

| Labor and operating budget | $200,000–$400,000 | $300,000 |

| Bank furnishings and equipment | $20,000–$40,000 | $30,000 |

| Total | $13,385,150–$28,710,200 | $21,047,675 |

How Much Can You Earn From a Bank Business?

Banks make money from fees and from the interest on loans that they make. The profit margin of a bank is typically about 10%.

In your first year or two, you might get 10,000 customers and make $100,000 in fees per month and $500,000 in interest, bringing in $7,200,000 in annual revenue. This would mean $720,000 in profit, assuming that 10% margin. As you build your customer base, those numbers might increase tenfold. With annual revenue of $72,000,000, you’d make an outstanding profit of $7.2 million.

What Barriers to Entry Are There?

There are a few barriers to entry for a bank. Your biggest challenges will be:

- A large amount of initial capital

- Understanding the complex administrative processes

- Navigating the regulatory environment

Related Business Ideas

From Capital to Cash Flow: Starting a Money Lending Business

From Advice to Assets: Starting a Financial Coaching Business

The Essentials of Starting a Credit Repair Business

Step 2: hone your idea.

Now that you know what’s involved in starting a bank, it’s a good idea to hone your concept in preparation to enter a competitive market.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

Why? Identify an Opportunity

Research banks in your area to examine their products and services, price points, and customer reviews. You’re looking for a market gap to fill. For instance, maybe the local market is missing a community bank that offers free checking accounts or an online bank that offers money market accounts.

You might consider targeting a niche market by specializing in a certain aspect of your industry, such as savings accounts and mortgage loans, or business accounts and loans.

This could jumpstart your word-of-mouth marketing and attract clients right away.

What? Determine Your Financial Products and Services

Banks offer a variety of products and services, including:

- Checking accounts

- Savings accounts

- Money market accounts

- Mortgage loans and other loans

- Credit cards

- Wealth management services

How Much Should You Charge for Bank Services?

Account fees can range from $5 to $15 per month. Banks also charge fees for overdrafts, ATMs, and other services. Loan rates will be dictated by the current market environment. The profit margin for banks is generally about 10%.

Once you know your costs, you can use our profit margin calculator to determine your markup and final price points. Remember, the prices you use at launch should be subject to change if warranted by the market.

Who? Identify Your Target Market

Your target market will be basically anyone. You should spread out your marketing to include TikTok, Instagram, Facebook, and LinkedIn.

Where? Choose Your Bank Location

Selecting the right location for your bank is crucial for its success. Look for a location in a high-traffic area, preferably in a commercial district or near other financial institutions. You can find commercial space to rent in your area on sites such as Craigslist , Crexi , and Instant Offices .

Consider the accessibility and convenience for clients, with easy access to parking and public transportation. Additionally, you should analyze the demographics of the surrounding area to ensure there is a demand for banking services.

By choosing a strategic location, you can position your bank to attract a wide range of customers and establish a strong presence in the financial industry.

Step 3: Brainstorm a Bank Name

Here are some ideas for brainstorming your business name:

- Short, unique, and catchy names tend to stand out

- Names that are easy to say and spell tend to do better

- Name should be relevant to your product or service offerings

- Ask around — family, friends, colleagues, social media — for suggestions

- Including keywords, such as “bank” or “community bank,” boosts SEO

- Name should allow for expansion, for example, “Peak Performance Bank” over “Student Loan Bank”

- A location-based name can help establish a strong connection with your local community and help with the SEO but might hinder future expansion

Discover over 290 unique bank business name ideas here . If you want your business name to include specific keywords, you can also use our bank business name generator. Just type in a few keywords, hit Generate, and you’ll have dozens of suggestions at your fingertips.

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Find a Domain

Powered by GoDaddy.com

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that sets your business apart. However, once you start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Step 4: Create a Bank Business Plan

Here are the key components of a business plan:

- Executive summary — A concise summary highlighting the key points of the business plan, including its mission, goals, and financial projections

- Business overview — An overview of the business, detailing its mission, vision, values, and the problem it aims to solve or the need it fulfills

- Product and services — A detailed description of the products and services offered by the business, emphasizing their unique selling points and value proposition

- Market analysis — A comprehensive analysis of the target market, including demographics, trends, and potential opportunities and challenges

- Competitive analysis — An assessment of the competitive landscape, identifying key competitors, their strengths and weaknesses, and the business’s competitive advantage

- Sales and marketing — A strategy outlining how the business plans to promote and sell its products or services, including pricing, distribution, and promotional activities

- Management team — A brief introduction to the key members of the management team, highlighting their relevant skills and experience

- Operations plan — An outline of the day-to-day operations of the business, covering processes, facilities, technology, and any other critical operational aspects

- Financial plan — A detailed financial forecast, including income statements, balance sheets, and cash flow projections, demonstrating the business’s financial viability and potential for profitability

- Appendix — Supplementary materials such as charts, graphs, and additional information that support and enhance the main components of the business plan

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

Step 5: Register Your Business

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Choose Where to Register Your Company

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people register their business in the state where they live, but if you’re planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to banks.

If you’re willing to move, you could really maximize your business! Keep in mind that it’s relatively easy to transfer your business to another state.

Choose Your Business Structure

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your bank will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Banks are typically corporations — they cannot be formed as LLCs by law.

Here are your options:

- C Corporation — Under this structure, the business is a distinct legal entity and the owner or owners are not personally liable for its debts. Owners take profits through shareholder dividends, rather than directly. The corporation pays taxes, and owners pay taxes on their dividends, which is sometimes referred to as double taxation.

- S Corporation — An S Corporation refers to the tax classification of the business but is not a business entity. It can be either a corporation or an LLC , which just needs to elect to be an S Corp for tax status. Here, income is passed through directly to shareholders, who pay taxes on their share of business income on their personal tax returns.

Step 6: Register for Taxes

The final step before you’re able to pay taxes is getting an Employer Identification Number or EIN. You can file for your EIN online, or by mail/fax. Visit the IRS website to learn more.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist , and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you’re completing them correctly.

Step 7: Fund Your Business

Securing financing is your next step and there are plenty of ways to raise capital:

- Bank loans — This is the most common method but getting approved requires a rock-solid business plan and a strong credit history.

- SBA-guaranteed loans — The Small Business Administration can act as a guarantor, helping gain that elusive bank approval via an SBA-guaranteed loan .

- Government grants — A handful of financial assistance programs help fund entrepreneurs. Visit Grants.gov to learn which might work for you.

- Venture capital — Venture capital investors take an ownership stake in exchange for funds, so keep in mind that you’d be sacrificing some control over your business. This is generally only available for businesses with high growth potential.

- Angel investors — Reach out to your entire network in search of people interested in investing in early-stage startups in exchange for a stake. Established angel investors are always looking for good opportunities.

- Friends and family — Reach out to friends and family to provide a business loan or investment in your concept. It’s a good idea to have legal advice when doing so because SEC regulations apply.

- Personal — Self-fund your business via your savings or the sale of property or other assets.

Your best bet to finance a bank is to seek out angel investors or venture capital. You’ll have to have an extremely detailed business plan and pitch when seeking the considerable amount of money that you need.

Step 8: Apply for Bank Business Licenses and Permits

Starting a bank business requires obtaining a number of licenses and permits from local, state, and federal governments. You will need to apply for licenses and insurance with the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) .

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration ( OSHA ), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package . They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Step 9: Open a Business Bank Account

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account .

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN, articles of incorporation, and other legal documents and open your new account.

Step 10: Get Business Insurance

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

- General liability — The most comprehensive type of insurance, acting as a catch-all for many business elements that require coverage. If you get just one kind of insurance, this is it. It even protects against bodily injury and property damage.

- Business property — Provides coverage for your equipment and supplies.

- Equipment breakdown insurance — Covers the cost of replacing or repairing equipment that has broken due to mechanical issues.

- Worker’s compensation — Provides compensation to employees injured on the job.

- Property — Covers your physical space, whether it is a cart, storefront, or office.

- Commercial auto — Protection for your company-owned vehicle.

- Professional liability — Protects against claims from clients who say they suffered a loss due to an error or omission in your work.

- Business owner’s policy (BOP) — This is an insurance plan that acts as an all-in-one insurance policy, a combination of the above insurance types.

You will also need FDIC insurance, and then you can use “member FDIC” in your marketing.

Step 11: Prepare to Launch

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Essential Software and Tools

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You may want to use industry-specific software, such as Salesforce , FIS , or Alogent , to manage your operations, insurance, compliance, accounts, and financial processing.

- Popular web-based accounting programs for smaller businesses include Quickbooks , FreshBooks , and Xero .

- If you’re unfamiliar with basic accounting, you may want to hire a professional, especially as you begin. The consequences of filing incorrect tax documents can be harsh, so accuracy is crucial.

Develop Your Website

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using website builders . This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech savvy, you can hire a web designer or developer to create a custom website for your bank.

However, people are unlikely to find your website unless you follow Search Engine Optimization ( SEO ) practices. These are steps that help pages rank higher in the results of top search engines like Google.

Here are some powerful marketing strategies for your future bank:

- Local SEO — Regularly update your Google My Business and Yelp profiles to strengthen your local search presence.

- Social media financial education — Utilize platforms like LinkedIn to share financial insights and advice, establishing the bank as a thought leader.

- Digital advertising — Run targeted advertising campaigns for specific financial products and services to reach the right audience.

- Financial literacy campaigns — Distribute newsletters regularly with financial wellness tips and updates on banking products.

- Educational blog — Create content that provides guidance on financial trends, investment strategies, and saving tips.

- Webinars and live Q&As — Host online sessions that address customer financial concerns and recent market changes, enhancing engagement.

- Local sponsorships — Increase your community presence by sponsoring local events and sports teams.

- Financial workshops — Offer free financial planning workshops that cater to various life stages to educate and attract customers.

- Partnerships with local businesses — Collaborate with local businesses to offer banking benefits and host financial seminars.

- Personalized banking services — Provide tailored banking solutions based on customer data to enhance customer satisfaction.

- Rewards program — Develop a rewards program that incentivizes customers to use different banking services.

- Introductory offers — Launch promotions such as new account signup bonuses or reduced rates on loans for a limited time to attract new customers.

Focus on USPs

Unique selling propositions, or USPs, are the characteristics of a product or service that set it apart from the competition. Today, customers are inundated with buying options, so you’ll have a real advantage if they are able to quickly grasp how your bank meets their needs or wishes. It’s wise to do all you can to ensure your USPs stand out on your website and in your marketing and promotional materials, stimulating buyer desire.

Global pizza chain Domino’s is renowned for its USP: “Hot pizza in 30 minutes or less, guaranteed.” Signature USPs for your bank business could be:

- A welcoming community bank for all your financial needs

- Free checking accounts and the best loan rates in town

- Digital banking made easy

You may not like to network or use personal connections for business gain but your personal and professional networks likely offer considerable untapped business potential. Maybe that Facebook friend you met in college is now running a bank, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been working in banks for years and can offer invaluable insight and industry connections.

The possibilities are endless, so it’s a good idea to review your personal and professional networks and reach out to those with possible links to or interest in banks. You’ll probably generate new customers or find companies with which you could establish a partnership.

Step 12: Build Your Team

If you’re starting out small from a home office, you may not need any employees. But as your business grows, you will likely need workers to fill various roles. Potential positions for a bank business include:

- Bank tellers — handling bank transactions

- Personal bankers — opening accounts, taking loan applications

- Mortgage originators — taking mortgage loan applications

- Bank manager — scheduling, managing branch operations

- Operations manager — managing back-office functions

- Compliance officer — handling regulatory compliance

At some point, you may need to hire all of these positions or simply a few, depending on the size and needs of your business. You might also hire multiple workers for a single role or a single worker for multiple roles, again depending on need.

Free-of-charge methods to recruit employees include posting ads on popular platforms such as LinkedIn, Facebook, or Jobs.com. You might also consider a premium recruitment option, such as advertising on Indeed , Glassdoor , or ZipRecruiter . Further, if you have the resources, you could consider hiring a recruitment agency to help you find talent.

Step 13: Run a Bank — Start Making Money!

Starting a bank takes time and money, and it’s a complicated business to run, but once you get it going, you can make a lot of money and serve your community. If you’re willing to do what it takes, you could even build your community bank into a national powerhouse!

Now that you understand what’s involved in the business, it’s time to find investors, get your bank up and running and start financing people’s dreams.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Decide if the Business Is Right for You

- Hone Your Idea

- Brainstorm a Bank Name

- Create a Bank Business Plan

- Register Your Business

- Register for Taxes

- Fund Your Business

- Apply for Bank Business Licenses and Permits

- Open a Business Bank Account

- Get Business Insurance

- Prepare to Launch

- Build Your Team

- Run a Bank — Start Making Money!

Subscribe to Our Newsletter

Featured resources.

10 Unique Security Business Opportunities

David Lepeska

Published on November 4, 2022

The security services industry in the US is estimated to be worth $50 billion and expected to grow steadily in the next five years. Demand forsecuri ...

12 Retirement Business Ideas for a Fulfilling Second Career

Carolyn Young

Published on July 21, 2022

If you’re like many retirees these days, you’re not quite ready to slow down. You want to be productive and of real use. If you’re considering ...

No thanks, I don't want to stay up to date on industry trends and news.

How to Start a Bank: Complete Guide to Launch (2024)

It’s no surprise that one of the most profitable businesses around is banking. The United States alone has the world’s largest financial marketplace, and according to a report by SelectUSA, the financial services industry (which includes banks, investment services firms, and insurers) represents 7.4 percent, or $1.5 trillion, of the U.S. gross domestic product. For those who are willing and able to scale the significant barriers to entry, the rewards for opening a bank are great.

Regulations and capital are the two biggest hurdles to jump, and to be clear, starting a bank is not an easy endeavor, particularly for those unfamiliar with the industry. But with a solid, well-devised business plan and strategy, a pile of sweat equity, plentiful stores of patience, and a dash of good fortune, starting your own bank is possible.

Case Study: Bank of America

- Step 1: Know The Banking Industry

Step 2: Write a Business Plan

Step 3: raise capital, step 4: get a bank charter, step 5: apply for fdic approval, step 6: apply for other necessary permits, step 7: get customers.

Study the guide from start to finish, or click any of the links above to jump to the topic you need to know about right now.

Bank of America is a global giant with 66 million customers and operations in 35 countries worldwide. But like most multinational corporations, BoA’s story of success began with a single founder with a vision.

Bank of America actually started life as Bank of Italy (surprisingly enough) when Italian immigrant Amadeo Giannini founded the bank in San Francisco in 1904. Giannini’s objective was to offer banking services to other Italian immigrants and to middle-class Americans who were often denied accounts by the larger financial institutions of that time.

Providing banking for customers who didn’t already have it was the need that Giannini’s new bank met, and he quickly gained customers from all ethnic backgrounds. His clientele mirrored the “melting pot” of early 20th-century America, and so it was appropriate for him to rename his bank Bank of America.

He also had a bold vision that eventually became reality. Through mergers and acquisitions, Giannini’s humble bank became the U.S.’s largest bank and a global financial powerhouse in under a century. If you aspire to build such an impressive bank, start by learning to develop a business mindset.

Your startup bank may never reach BoA’s heights, but its story is proof that a broad, bold vision backed up with excellent customer service and exemplary corporate management can help a new bank transcend humble origins and become a dominant industry player.

You can write your own success story in banking by following these steps.

Step 1: Know the Banking Industry

Most of us are familiar with banking on some level, whether it be through checking and savings accounts, mortgages or loans, credit cards, retirement accounts, or insurance policies. But behind the ATM machine or the drive-thru window are a whole host of complicated transactions that, in aggregate, ensure that the bank not only has money for you to withdraw, but that as a business entity, it is making a profit.

If you haven’t worked in some level of the financial services industry, it’s important to get some industry experience, some specific education in finance, business, or both, and some expert guidance and advice.

How Much Money Do You Need to Start a Bank?

According to MergersCorp , bank startups need between $12 million and $20 million to start operations. Even if you have the money to start your own bank, you should expect it to take a year or more to become licensed and registered.

How Does a Bank Earn Revenue?

Very simply, banks make money by accepting customer deposits and providing financial services to their customers. Some of the financial services that banks offer include:

- Business loans: Loans to promising small business owners, including tech startups, health/wellness businesses, augmented reality technology, mobile apps, and e-learning platform entrepreneurs. Banks earn money based on the annual interest rate.

- Car loans: Many banks and credit unions provide car loans at better rates than dealerships and earn money on the interest.

- Mortgages: Banks make substantial money by lending funds to buy a home or investment property then collecting interest. They may also earn money by packaging loans together and selling them to other investors.

- Investment portfolio management: Experienced bankers may also offer financial investment portfolios for high net-worth individuals. They will normally charge service fees based on the amount of funds they manage for the customer.

- Credit cards: Banks may also offer credit cards to earn interest from the credit card fees. The interest will often be between 15% and 25%, which provides some of the highest returns in the financial services industry.

Banks also typically pay depositors interest on their deposits, ranging from .01% for most bank accounts to 5.15% for a certificate of deposit (CD).

The difference between the higher rates of interest charged to borrowers and the lower rates of interest paid to depositors is known as the interest spread, and this is the major component of bank profits.

Governments often incentivize loans to certain groups, like loans to women-owned businesses .

Is Owning a Bank Profitable?

Yes. Bank startup entrepreneurs will find a bank’s operations to be a very profitable business. According to NYU Stern , banks have nearly 100% gross profits and 30.89% net margins.

That makes a proposed bank nearly three times more profitable than the average business. But a bank’s operations are highly regulated. Read on to get an understanding of the agencies that you’ll have to work with as you learn how to start a bank.

How Much Does a Bank Owner Make?

According to CareerTrend , a president/owner of a small bank of less than 200 employees earns between $96,000 and $194,000 per year. This compensation is normally a combination of a base salary, profit-sharing, sales commissions, and bonuses.

Federal Reserve: Fractional Reserve Banking

The overwhelming majority of banks in the U.S. operate as fractional reserve banks. This means that at any given time, 10% of the bank’s deposits must be available for withdrawal.

This 10% of the deposit revenues is known as the fractional reserve. For instance, for every $100 that a customer deposits, the bank may use $90 to lend out to other customers (including you, for that matter).

Low fractional reserves allow the circulation of money throughout the economy as measured by a factor called the economic multiplier. Fractional reserves increase the monetary supply for borrowers and are seen as instruments to maintain prosperity and a healthy national economy.

In fact, to maintain a healthy economy in response to the coronavirus pandemic, the Federal Reserve took the unprecedented step to reduce the fractional reserve requirement to zero on March 26, 2020.

The concept of fractional reserve means that banks are counting on depositors holding the majority of their funds in their accounts and not withdrawing them all at once.

Most of the time, that is what happens. But when depositors start to withdraw from their accounts in response to a financial crisis or panic, this is known as a bank run , and it can cause the bank to become insolvent and go out of business.

Federal Deposit Insurance Corporation (FDIC)

The Banking Act of 1933 created the Federal Deposit Insurance Corporation ( FDIC ), which is the regulator for the U.S. banking industry, and it guarantees consumers’ checking and savings accounts up to $250,000 in the event of bank insolvency.

The FDIC is also the regulatory agency for all banks in the United States, and their website provides information and the necessary forms that de novo, or newly established, banks must submit.

Once your bank’s application is in place, expect to wait anywhere from one year to 18 months for approval.

Banks spread out their risk of bank runs by accumulating large numbers of depositors. Low or non-existent fractional reserve requirements have fueled the growth of large national or multinational banks.

Since 2000, there have been 569 bank closures with assets of $1.276 trillion according to the FDIC , which insured nearly 70% of the losses .

Most of these were during the Great Recession caused by the subprime mortgage crisis in 2008, but an average of four banks close each year due to lack of capital adequacy, buyouts, and other causes.

Online Banks

Online banks are typically newly established banks that use emerging technologies to provide a bank account that offers unique features like higher interest payments, buckets for finances, or artificial intelligence technology to help manage finances better.

De Novo Banks

During the first five years of a bank’s operations, you may also hear it referred to as de novo banks, from the Latin word for “new.”

In addition to being up against the economy of scale advantages that large banks enjoy, there are a couple of significant barriers to entry that new bank entrepreneurs must scale. These are 1) regulation, and 2) capitalization (more on this below).

Banking is the most regulated business in the United States. According to Independent Banker , an average of 172 de novo banks opened each year before the 2008 financial crisis.

Since that watershed year, the number dwindled to almost nothing. A significant reason for this downturn is the increased regulations that banks must comply with to even open for business.

Can I Start a Bank With No Money?

Bank founders will have to get a substantial amount of money to set up risk management infrastructure, obtain approval, get their banking license, and comply with banking regulations. This business idea requires a large source of capital from either your own personal wealth, venture capitalists, or other business owners.

If you don’t know where you would get $20 million dollars, consider another business idea .

Get Business Ideas in the UpFlip Academy

We’ve interviewed hundreds of business owners and compiled more than 500 business ideas. We’ve turned them into a database that you can sort by startup costs, average revenue profit margins, time to start the business, and market size.

Banking business plans require careful planning to comply with the complex process of working with appropriate authorities that oversee the management of the banking system.

Your business plan is your venture’s founding document and will be the reference point for all business decisions moving forward. For this reason, it’s important to spend time writing the business plan.

Luckily, there are numerous business planning resources including:

- Small Business Association (SBA): Learn about business plans directly from the government agency that was created to help businesses succeed.

- Bank of America: Read the BoA guide to writing a business plan .

- Chron : Review a step-by-step guide to writing a business plan for a bank.

- BMA Banking Systems : Read the comprehensive guide to writing a plan for a de novo bank.

When you apply for FDIC approval and insurance, they will examine your business plan closely to make sure you will meet regulations and follow banking industry best practices.

We’ll discuss the elements of a good banking business plan in the next sections.

Explain How Your Own Bank Will Make Money

We’ve discussed the primary ways banks make money. You’ll need to explain what services your legal entity will offer and how you’ll comply with the regulatory process.

Plus, you’ll need to ensure regulatory authorities that you’ll manage potential customers’ money in a safe and sound manner.

Identify Your Target Market

Bank startup ideas will have a different target market based on the location, business model, and scope of business.

For instance, if you’re targeting a younger generation of customers, you’ll need to have a big online presence and mobile banking capability.

If you’re targeting older customers, perhaps retirees, mobile banking may be less of a consideration, but convenient branch locations with easy access and plentiful parking become critical.

Another consideration is whether you want to target small business firms by offering business banking, or whether you want to focus more, or solely, on consumer banking.

It can be hard to accurately describe your market, but it’s a critical assessment to make. Market research firms can gather data that either confirm or deny your own intuitions and can help prevent you from making poor decisions early on. For these reasons, it’s worth considering hiring one.

You can find a guide to market research for new businesses from Entrepreneur . And Joe Gardner, CEO of VentureDevs , has a complete guide to market research published by Forbes .

Document the Type of Bank

There are a ton of different types of banks, and you’ll have to decide which one you’re going to create. Some of the options are:

- National Bank: These are similar to the legacy banks like Bank of America and Wells Fargo that have a business location in the majority of states.

- State Chartered Bank : These banks are approved to operate in a single state.

- Online Banks : Companies like Ally and Chime create an online platform to provide banking and financial services. Learn about online banks .

- Credit Unions: These banks are member-owned banks that pay dividends to their account holders.

Most banks are a combination of brick-and-mortar branches with an online banking counterpart, but the extent to which each element is promoted depends on the banking habits of your customer base.

Online-only banks save on infrastructure costs, but when starting your online bank, don’t forget to consider the enhanced cybersecurity costs you’ll incur.

And if you think that by opening a bank as an online-only business you’ll escape the regulatory scrutiny that brick-and-mortar banks endure, think again. The same charter and regulatory code that storefront banks operate under also applies to online banks.

In addition to these laws, you’ll also have to comply with other regulations designed specifically for online banking. These regulations were devised by an organization called the Federal Financial Institutions Examination Council (FFIEC) and are listed in this guide to online banking .

Define Your Business Structure

Your bank startup costs will be underwritten by a team of investors. That means a corporation is the prevailing business structure in the banking industry.

You’ll need to register with your state’s corporation commission or board, but beyond this, you’ll need to consider how the initial board of directors is chosen, what their terms of engagement will be, their compensation (if any), and how often they will meet (your state may mandate a minimum number of yearly meetings).

You should hire a law firm to form your corporation because it’s easier to head off any problems as the business is formed than it is to go back and change your founding documents or business protocols once issues arise.

Most of this process will be done through the Secretary of State Office in the state your bank will be based in. You’ll also have to look at how to open your own bank in each state where you’ll be operating.

Choose Your Bank Business Name

Your bank name can reflect your geographic origins, or it can be more abstract, or even the name of one of its founders. An example of the former is Bank of America, and an example of the latter is Chase.

Choosing your bank name is an important consideration that can affect both the present and future of financial institutions.

For example, naming your bank Bank of North Carolina may attract customers in your home state who want to do business with local financial institutions, but it could hinder your expansion if you want to open branches in, say, Florida. Choose wisely.

Check out our guide to choosing a business name . You might also look at Forbes’ guide, or The Balance. Shopify even has a tool that will generate a business name and claim the domain for you.

Once you’ve determined your bank name, run searches on your state corporation’s website and also do a WHOIS domain name search via a service like ICANN . The latter is critically important for online banking because having your bank name and website different can be devastating for business.

ICANN can also tell you if somebody currently owns the domain name you’re after and what they will charge to sell it to your business.

Address Start-Up and Operations Costs

Your plan should outline the source(s) of your capital and how and when your investors will be paid back. Your operations costs must also be carefully outlined, and the FDIC will look at your plan to ensure that operations costs are realistic and not underestimated. When calculating your answer to the question How much does it cost to start a bank? , include these for main costs.

1. Regulatory/Legal Compliance

Almost all established banks have attorneys on staff to assist with legal and regulatory compliance, and even as a de novo bank, you should enlist the services of a lawyer.