FREE Search Engine for SAP users

SAP Transaction FS00: A Step-by-Step Guide for SAP Users

Welcome to our tutorial on SAP transaction FS00, a crucial transaction code used in SAP Financial Accounting (FI) module. In this tutorial, we will provide you with a detailed step-by-step guide on how to effectively use FS00 to manage general ledger (G/L) master data in your SAP system. Whether you are a beginner SAP user or an experienced consultant looking to refresh your knowledge, this tutorial will equip you with the necessary skills to navigate FS00 with ease.

Before we proceed, we would like to introduce you to a valuable resource that can enhance your SAP knowledge and help you become an expert in the SAP MM module. Check out the SAP MM online video training offered by our expert SAP MM consultant, available at roadtoexpert.com . This training program provides comprehensive modules and practical exercises to boost your proficiency in SAP MM, enabling you to excel in your daily tasks and advance your career.

Now, let’s get started with our tutorial on using SAP transaction FS00.

What is SAP Transaction FS00?

SAP Transaction FS00 (G/L Account Centrally) is a vital transaction code used in SAP FI to create and maintain G/L master data. G/L master data represents the foundation of an organization’s financial accounting system and stores information about various general ledger accounts. With FS00, you can create, change, and display G/L accounts, ensuring accurate financial reporting and analysis.

Step 1: Accessing SAP Transaction FS00

To begin using FS00, follow these steps:

- Login to your SAP system using your user ID and password.

- Launch the SAP Easy Access Menu.

- Navigate to the “Accounting” folder and expand it.

- Locate and click on the “Financial Accounting” folder.

- From the sub-menu, select “General Ledger.”

- Next, choose “Master Records” and click on “Centrally” to proceed to the FS00 transaction.

Step 2: Understanding FS00 Transaction Screen

Once you have accessed FS00, you will encounter the FS00 transaction screen, which consists of various fields and tabs. Let’s explore each of them:

- General Data: This section contains the main fields for entering general information about the G/L account, such as account number, account group, and description.

- Company Code Data: Here, you can specify the company code-specific details for the G/L account, such as currency, reconciliation account, and tax categories.

- Control Data: This tab allows you to define control parameters for the G/L account, including field status group, line item display, and interest calculation settings.

- Posting Data: In this tab, you can configure posting-related settings for the G/L account, such as account type, posting key, and field status variants.

- Account Management: The account management tab provides options for managing the G/L account, such as setting the account as a cost element, activating open item management, and maintaining alternative accounts.

- Additional Data: This tab allows you to add supplementary information to the G/L account, such as long text, bank details, and interest calculation methods.

Step 3: Creating a G/L Account with FS00

To create a new G/L account using FS00, follow these steps:

- Account Number: Enter a unique account number for the G/L account.

- Account Group: Select an appropriate account group based on the nature of the G/L account.

- Description: Provide a meaningful description for the G/L account.

- Company Code: Select the relevant company code for the G/L account.

- Currency: Choose the currency in which the G/L account transactions will be recorded.

- Reconciliation Account: If required, specify a reconciliation account for the G/L account.

- Proceed to the “Control Data” tab and configure the necessary control parameters for the G/L account.

- Next, navigate to the “Posting Data” tab and define posting-related settings for the G/L account.

- If applicable, configure account management options in the “Account Management” tab.

- Lastly, provide any additional data, such as long text or bank details, in the “Additional Data” tab.

- Once you have entered all the required information, click on the “Save” button to create the G/L account.

Congratulations! You have successfully created a G/L account using SAP transaction FS00.

Step 4: Modifying and Displaying G/L Accounts

FS00 also allows you to modify and display existing G/L accounts. Here’s how you can perform these actions:

- To modify a G/L account, access FS00 and enter the account number you want to modify. Make the necessary changes in the relevant tabs and click on “Save” to update the account.

- To display a G/L account, access FS00 and enter the account number you want to display. You can then view all the details associated with the account, such as general data, company code data, and control data.

In this tutorial, we have provided you with a comprehensive guide on using SAP transaction FS00 in the SAP FI module. We covered the basics of FS00, explained how to create G/L accounts, and explored the options for modifying and displaying accounts. Remember to continuously practice and expand your knowledge to become proficient in SAP FI.

To further enhance your skills in SAP MM, we highly recommend our SAP MM online video training, designed by our expert SAP MM consultant. This training program offers comprehensive modules and hands-on exercises to help you become an SAP MM expert. Visit roadtoexpert.com to learn more and take your SAP MM skills to new heights.

Online Video Training

Online video training.

Online Video Trainings

Complete tutorials made by the best experts.

Migration Tools

- Programming

- Admin & EIM

- BI & BW

- FICO & BPC

- CRM & Sales

- Introductions

- SAP PRESS Subscription

Primary and Secondary Costs in SAP S/4HANA

The efficiency and speed of the SAP HANA in-memory database allowed the introduction of the Universal Journal single line-item tables ACDOCA (actual) and ACDOCP (plan).

In turn, this allows all postings from the previous financial and controlling components to be combined in single items. The many benefits include the development of real-time accounting.

Plan costs are posted prior to a fiscal period. Actual costs occur in real time during a period and result from transactions, which can be divided into two groups:

- Primary costs: External business events result in primary costs.

- Secondary costs: Business transactions between cost objects are secondary costs.

We’ll look at both types of costs in this blog post.

Primary Costs

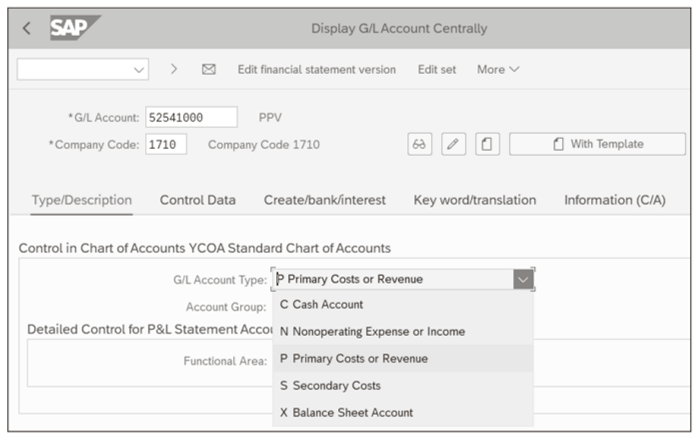

All costs in SAP S/4HANA are identified and controlled by the general ledger account master, which you access with Transaction FS00 or the Manage G/L Account Master Data app. A general ledger account master is displayed in this figure.

In the following sections, we’ll discuss the following general ledger account settings: account type and cost element category. We’ll also discuss cost object assignments as required by certain cost element categories.

General Ledger Account Type

The G/L Account Type is the first setting in the general ledger account master. In controlling, we’re interested in the following three options:

- P Primary Costs or Revenue: Primary costs include, for example, material expenses, salaries, asset depreciation, and energy. You post revenue by selling products and services.

- S Secondary Costs: With these general ledger accounts, you post allocations between cost objects. Examples are the allocation of costs from overhead cost centers to production cost centers; from production orders to customer projects, production orders, or market segments; and from internal projects to cost centers and market segments.

- N Nonoperating Expense or Income: These are profit and loss (P&L) accounts not related to the products and services of the company but belong in the financial statement, such as gains or losses from a foreign exchange market.

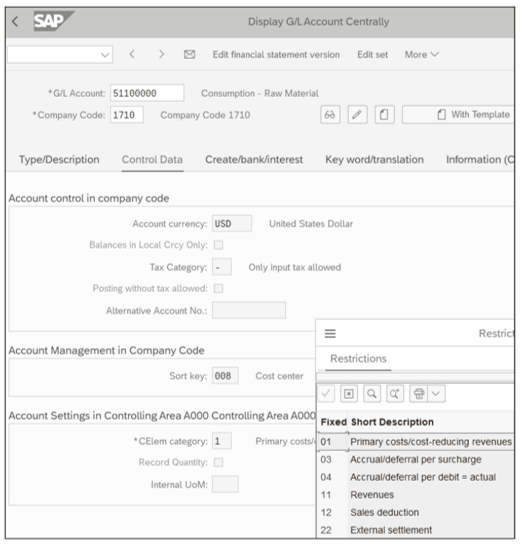

Cost Element Category

The next setting of interest in the general ledger account master is the cost element category. The cost element category determines the processes for which you can use general ledger accounts. You’ll find the CElem category field in the Control Data tab of the general ledger account master, as shown in this figure.

In the CElem category field, following are the possible entries for primary costs or revenues accounts:

- 01 Primary costs/cost-reducing revenues

- 03 Accrual/deferral per surcharge

- 04 Accrual/deferral per debit = actual

- 11 Revenues

- 12 Sales deduction

- 22 External settlement

When you classify a general ledger account with the primary cost or revenue category, it’s relevant for controlling analysis because we’re interested in analyzing and controlling expenses.

Cost Object Assignment

General ledger accounts with a primary cost element category also require a cost object assignment. Let’s follow two typical scenarios in the following sections.

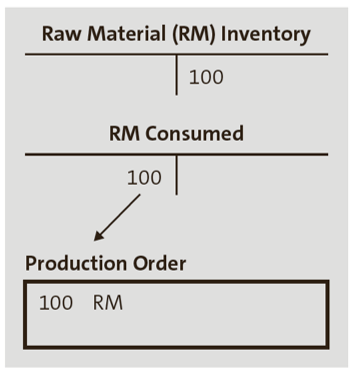

- Goods Issue to Production Order: When goods are issued from inventory, a general ledger balance sheet account is credited, and a P&L consumption (expense) account debited. When the system detects a primary cost element account during a posting to a general ledger account, the P&L line is extended to include controlling information. The production order triggers a reservation for the required components, which is the basis for the material document and subsequent accounting document. The production order is debited automatically because the goods issue is to the production order. The debit value is calculated by multiplying the component standard price by the quantity issued from inventory. The following figure shows an example debit when components with a value of 100 are issued from raw material (RM) inventory to a production order.

Component allocations in routings determine how goods movements are assigned to specific work centers and operations, and these goods issues are displayed along with the activity postings at the work center level.

- Universal Journal Posting: The account posting includes RM inventory (balance sheet) and RM consumed (expense) accounts. Cost object assignment in the Universal Journal allows you to analyze all expense postings with standard SAP S/4HANA and compatibility reports, as well as SAP Fiori apps.

- Vendor Invoice Posting: Primary expenses are assigned cost objects during payment of external vendor invoices. Subcontracting may be required for specialized activities or if the workload exceeds the internal work center capacity. An external services expense account is debited, and the goods receipt/invoice receipt (GR/IR) clearing account credited. The production cost center or production order is assigned a corresponding debit in the Universal Journal. You assign the cost object when you create the purchase order with Transaction ME21N and a corresponding line-item category.

Secondary Costs

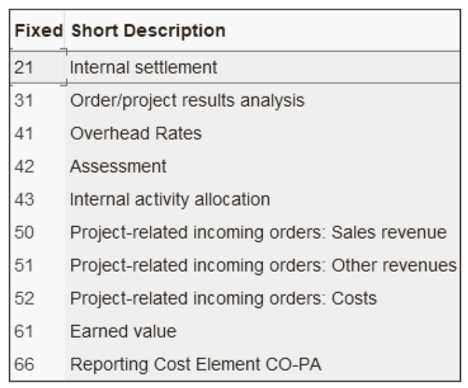

Now that we’ve looked at primary expenses, let’s examine secondary postings. The possible cost element categories when you choose secondary costs as the general ledger account type are shown in this figure.

With these general ledger accounts, you post allocations between cost objects. For example, with cost element category 42 , you assess costs from overhead cost centers to production cost centers.

Costs are allocated from overhead cost centers to production cost centers during assessment and then onto production orders during activity confirmation with cost element category 43 . Let’s examine assessments and activity confirmations in detail in the following sections.

Overhead cost centers collect overhead costs that can’t be directly assigned to a production cost center. Assessments move costs from overhead cost centers to production cost centers.

A building may contain several production facilities with corresponding production cost centers. The building lease primary costs are assigned to an overhead cost center. The lease costs are then allocated to production cost centers during assessments using universal allocation.

Universal allocation is done via the Manage Allocations app and Run Allocations app in SAP Fiori. You use the Manage Allocations app to define the assessment cycle that acts as the framework for the allocation, as well as the cycle segments that define the senders and receivers.

You use the Run Allocations app to create a run and then trigger the allocation cycles. The Allocation Results app allows you to display the results of the allocation in a list form and to access the Allocation Flow app.

You can identify resulting debits to the production cost centers and credits to overhead cost centers with secondary cost element category 42 accounts.

Activity Confirmation

In addition to allocating costs from overhead cost centers to production cost centers with assessments, you allocate costs from production cost centers to production orders during activity confirmations.

When production order activities are confirmed, the production order or product cost collector is debited, and the production cost center is credited. The resulting debits to the production orders and credits to the production cost centers are identified with secondary cost element category 43 accounts.

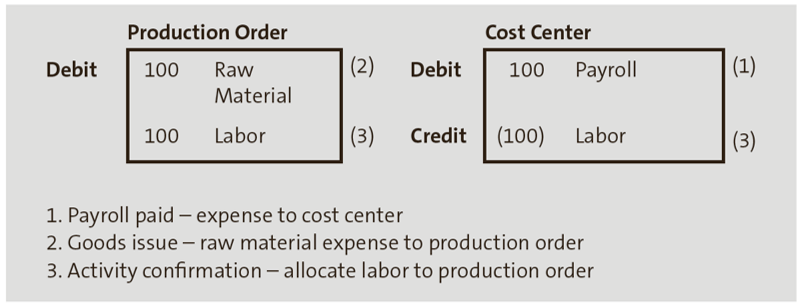

Many products can be manufactured at a work center with activities and facilities paid for by the cost center. Confirmation of labor and overhead activities allocates these costs across many products. The figure below shows an example of labor allocation postings from a production cost center to a production order.

In this example, factory payroll is expensed directly to the production cost center via primary postings and then progressively allocated to each production order with secondary postings during labor activity confirmation. All postings and assignments happen in real time in the Universal Journal.

Overhead Costs: Overhead calculation allocates overhead costs across products from cost centers in a similar way. Overhead costs are distributed with overhead calculation during events.

Editor’s note : This post has been adapted from a section of the book Production Variance Analysis in SAP S/4HANA by John Jordan and Janet Salmon.

Recommendation

To effectively plan production costs, you know that guesswork and projections aren’t enough. Optimize your production processes—and increase profitability—with this guide to production variance analysis in SAP S/4HANA. Start with the planning basics, and then perform costing runs and create cost estimates. See how to post actual costs with the Universal Journal, analyze variance during period-end processing, and assess scrap. Get details on SAP Fiori apps for reporting and the road ahead for variance analysis in this comprehensive resource!

SAP PRESS is the world's leading SAP publisher, with books on ABAP, SAP S/4HANA, SAP CX, intelligent technologies, SAP Business Technology Platform, and more!

Latest Blog Posts

Cash Positioning with SAP S/4HANA Finance

Exploring SAP S/4HANA Advanced Financial Closing (AFC)

The official sap press blog.

As the world’s leading SAP publisher, SAP PRESS’ goal is to create resources that will help you accelerate your SAP journey. The SAP PRESS Blog is designed to provide helpful, actionable information on a variety of SAP topics, from SAP ERP to SAP S/4HANA. Explore ABAP, FICO, SAP HANA, and more!

SAP Blog Topics

- Administration

- Business Intelligence

- Human Resources

Blog curated by

- Legal Notes

- Privacy Policy

- Terms of Use

- Guest Posting

Defining General Ledger (G/L) Accounts and Cost Elements

After completing this lesson, you will be able to define a G/L account

Chart of Account

Each G/L is set up according to a chart of accounts. The chart of accounts contains the definitions of all G/L accounts. The definitions consist of the account number, the account name, and the type of G/L account (e.g. balance sheet, non operating expenses/revenues, primary costs/revenues, secondary costs or cash accounts).

Assignment of Company Codes to Chart of Accounts

A chart of accounts can be used by multiple company codes so that the general ledgers of these company codes have an identical structure.

General Ledger Account and Cost Element

The two segments of the G/L master record from a Financial Accounting perspective are as follows:

The chart of accounts segment contains a description of the account, the account type that classifies how the account can be used in FI and/or CO and, the account group that controls the company code segment fields, and the consolidation account number.

The company code segment contains values specific to how the company code will manage that account.

Account Groups

Accounts with the same account group normally have similar business functions. You can, for example, have an account group for:

Cash accounts

Expense accounts

Revenue accounts

Other balance sheet accounts

The account groups are assigned number ranges. You can control which account numbers are permissible for cash accounts, expense accounts, and so on, through the number ranges.

Account groups also control the appearance of the company code segment of G/L accounts. Account groups control:

The fields that are required for data entry

The fields that are optional for data entry

The fields that are display only.

The fields that do not show up at all in the company code segment

Reconciliation Accounts

Expenditures versus costs.

In the economical theory, there are two approaches for values:

In the first approach, the values in Financial Accounting and Management Accounting are the same:

Controlling provides additional reporting opportunities by separating the FI documents along additional characteristics, such as segments, profit centers, projects, stored in a coding block. The results may be P&L statements and balance sheets per segment, per profit center or per project.

In the second approach (most used in central Europe), Management Accounting is based on cost and revenues. Costs are only those expenditures, which are as follows:

Related to the business of the company

Exactly assigned to periods (source specific)

For example, a gift to a welfare organization is an expenditure, but not a cost, because it is not the business of the company to make gifts.

Expenditures, which do not meet the definition of costs, are only reflected in Financials, and not in Management Accounting. They are called neutral expenditures.

SAP provides the opportunity to realize each of the theories. In SAP S/4HANA revenues, expenditures, and cost are represented by financial accounts and separated by the Account Type of the accounts. Based on the account type, the accounts used in CO are also called cost elements.

Account Types

The controlling area-specific data is only needed for Secondary Costs and Primary Costs or Revenue accounts. In the controlling area-specific data, you assign a Cost Element category. This category determines which account can be used for which business transaction in CO.

Create a Primary Cost Account

Log in to track your progress & complete quizzes

Record account assignment Table in SAP

- CRMC_ACC_MAP Table for Assignment of Account Assignment Group to Account Table Type : TRANSP Package : CRM_LEASING_SRM Module : CRM-LAM-BTX

- ACCRAC Table for Assignment of Acr./Def. G/L Account to Accruals Account Table Type : TRANSP Package : ACCR Module : FI

- BKK610 Table for Account Hierarchy: Assignment of Root Account to Tree Number Table Type : TRANSP Package : FKBR Module : IS-B-BCA-MD

- KOMU Table for Account Assignment Templates for G/L Account Items Table Type : TRANSP Package : FFE Module : FI

- PKOMU Table for Personal Account Assignment Templates for G/L Account Items Table Type : TRANSP Package : FFE Module : FI

- TIVSCTRANSACC Table for Assignment of Clearing Account to Cost Account Table Type : TRANSP Package : RE_SC_BC Module : RE-FX-SC

- TZB27 Table for Assignment of G/L account to account group Table Type : TRANSP Package : FVVD_PAYMENT Module : FS-CML-AC-RPM

- FAGL_RAND_RANGE Table for Totals Record Randomization: Account Assignment Ranges Table Type : TRANSP Package : FAGL_LEDGER_CUST Module : FI-GL

- BKK600 Table for Account Hierarchy: Account Relationships Table Type : TRANSP Package : FKBR Module : IS-B-BCA-MD

- BSACC_HIST_GRP Table for Account Groups for Account History Table Type : TRANSP Package : FIN_BS_DIALOG Module : FI-GL-GL

- BSACC_HIST_GRPT Table for Account Groups for Account History Table Type : TRANSP Package : FIN_BS_DIALOG Module : FI-GL-GL

- CRMD_ACC_PL_ATTR Table for Account Planning account plan attributes Table Type : TRANSP Package : CRM_ACCOUNT_PLANNING Module : CRM-ACP-APL

- ICRC02 Table for Account Groups for G/L Account Reconciliation Table Type : TRANSP Package : FBAS Module : CRM

- ICRC03 Table for Account Groups for G/L Account Reconciliation - Name Table Type : TRANSP Package : FBAS Module : CRM

- ICRC04 Table for Account Groups for G/L Account Reconciliation - User Assgnmt Table Type : TRANSP Package : FBAS Module : CRM

- IDCN_ALGACCGRP Table for Account Level Hierarchy: Account Levels Table Type : TRANSP Package : ID-FI-CN Module : FI-LOC

- IDCN_ALGACCGRPT Table for Account Level Hierarchy: Account Levels (Text) Table Type : TRANSP Package : ID-FI-CN Module : FI-LOC

- IDCN_ALGACCHIER Table for Account Level Hierarchy: Account Level Hierarchy (Top Level) Table Type : TRANSP Package : ID-FI-CN Module : FI-LOC

- IDCN_ZJFSKIPACC Table for Skip G/L Account from P&L Account Closing Posting (China) Table Type : TRANSP Package : ID-FI-CN Module : FI-LOC

- IDCN_ZJFSKIPACCT Table for Skip G/L Account from P&L Account Closing Posting (Text) Table Type : TRANSP Package : ID-FI-CN Module : FI-LOC

- J_3RKPAI Table for Account priorities for account pairs Table Type : TRANSP Package : J3RK Module : FI-LOC

- T033D Table for Account Determination: Account Determination Key Names Table Type : POOL Package : FBAS Module : CRM

- T033J Table for Account Determination: Account Symbol Descriptions Table Type : POOL Package : FBAS Module : CRM

- T033O Table for Account Determination: Account Determination Key Values Table Type : POOL Package : FBAS Module : CRM

- T687 Table for Account Determination: Account Key Table Type : POOL Package : FBD Module : CRM

- T687T Table for Account Determination: Account Key Texts Table Type : POOL Package : FBD Module : CRM

- TACEPSRULE Table for ACE Account Determination: Account Determination Rule Table Type : TRANSP Package : ACE-PS Module : FI-GL-GL-ACE

- TACEPSRULET Table for ACE Account Determination: Account Determination Rule Table Type : TRANSP Package : ACE-PS Module : FI-GL-GL-ACE

- TACEPSSYM Table for ACE Account Determination: Account Symbol Table Type : TRANSP Package : ACE-PS Module : FI-GL-GL-ACE

- TACEPSSYMT Table for ACE Account Determination: Account Symbol Table Type : TRANSP Package : ACE-PS Module : FI-GL-GL-ACE

- TICL832 Table for Entity Table: G/L Account (Chart of Accts and Coll.Account) Table Type : TRANSP Package : ICL_LAE Module : FS-CM

- TIVEXFIREPSYMB Table for Replacement of Account Symbol with FI Account Table Type : TRANSP Package : RE_EX_FI Module : RE-FX-RA

- TJF20 Table for Convert Bank Clearing Account to Interim Account (Bank Rtns) Table Type : TRANSP Package : JSD Module : IS-M

- TJL26 Table for IS-M/SD: Conversion of Clearing Account - Real G/L Account Table Type : TRANSP Package : JSD Module : IS-M

- TKSKA Table for Account classification for account intervals Table Type : POOL Package : KBAS Module : CRM

- TRAC_ACCSYMB Table for Account Determination: Account Symbols Table Type : TRANSP Package : FTR_ACCOUNTING_ADAPTOR Module : FIN-FSCM-TRM-TM-AC

- TZB43 Table for Account Clearing: Checks at Customer Account Level Table Type : TRANSP Package : FVVD_PAYMENT Module : FS-CML-AC-RPM

- WRFT_PREPAY_ACCT Table for Account Determination: Prepayment Clearing Account Table Type : TRANSP Package : WRF_INVOICEVERIFICATION_PREPAY Module : MM-IV-LIV

- /DSD/RP_DRVKTOKD Table for Define Account Group as Account Group for Driver Table Type : TRANSP Package : /DSD/RP Module : LE-DSD-RP

- CRACC Table for Payment Cards: Account Assignments in Card Master Record Table Type : TRANSP Package : FCRD Module : FI-AP-AP-PT

- CRLPOTYTRC Table for Conversion Record for Account Posting Types Table Type : TRANSP Package : ISAUTO_VHU_RL_CUST Module : IS-A-RL

- DKOKS Table for Open Item Account Balance Audit Trail Master Record Table Type : TRANSP Package : FREP Module : CRM

- GLACCREFH Table for G/L Account Master Record: Create with Reference Table Type : TRANSP Package : FBSC Module : CRM

- GLACCREFI Table for G/L Account Master Record: Create with Reference Table Type : TRANSP Package : FBSC Module : CRM

- GLT0 Table for G/L account master record transaction figures Table Type : TRANSP Package : GBAS Module : CRM

- GLT0_BAK Table for G/L Account Master Record Transaction Figures Table Type : TRANSP Package : GBAS Module : CRM

- RLACPOIT Table for Account Posting Record Table Type : TRANSP Package : ISAUTO_VHU_RL Module : IS-A-RL

- SKAT Table for G/L Account Master Record (Chart of Accounts: Description) Table Type : TRANSP Package : FBASCORE Module : CRM-ISA

- FMBGAKONT Table for Assignment of FM Account Assignment to PCO Table Type : TRANSP Package : FMBGA Module : PSM-FM-PO

- FMDECKHK Table for Assignment of FM Account Assignment to Cover Pool Table Type : TRANSP Package : FMOV_CORE Module : FI-FM

- FMDECKHKC Table for Assignment of FM Account Assignment to Cover Pool Table Type : TRANSP Package : FMOV_CORE Module : FI-FM

- FM_CIACC Table Data element for Assignment of FM account assignment to account is binding

- KNTBU Table Data element for Account assignment category: unknown account assignment

- EHSWAE_CHKCOOBJ Table Data element for Object Checked as Account Assignment Object for Assignment

- FM_COACC Table Data element for Assignment of FM-CO account assignment is binding

- KZKON Table Data element for Display or suppress account field/manual account assignment

- SMO3KZKON Table Data element for Display or suppress account field/manual account assignment

- KONAB Table Data element for Derive preliminary account assignment from G/L account

- TPM_ACC_SYMBOL Table Data element for Account Symbol for Account Assignment Reference

- UBC_DT_ACT Table Data element for Value of Account Assignment Field (G/L Account, Project,...)

- BNKKO Table Data element for Bank account/bank clearing account (G/L account)

- UBHKT Table Data element for G/L Account Number for Our Bank Account / Bank Sub-Account

- GU_RECID Table Data element for Record number of the line item record

Record account assignment related terms

Definitions.

SAP is the short form of Systems, Applications & Products in Data Processing. It is one of the largest business process related software. This software focused on business processes on ERP & CRM.

Like most other software, SAP also using database tables to store the data. In SAP thousands of tables are there to store different data. A table contains several fields and some of the fields will be key fields.

Popular Table Searches

Latest table searches.

/support/notes/service/sap_logo.png)

2686674 - Commitment value not updated in report S_ALR_87013019

Purchase Order commitment value is not appearing in the Internal Order Commitment report S_ALR_87013019.

Environment

- FI (Financials)

- CO (Controlling)

- SAP S/4HANA

Commitment, Purchase Order, Internal Order, G/L Account, Balance Sheet Account, FS00, KO02, ME23N, S_ALR_87013019, Record Account Assignment , KBA , CO-OM-OPA-D , Commitments , CO-OM-IS , Information System, iViews , Problem

About this page

Search for additional results.

Visit SAP Support Portal's SAP Notes and KBA Search .

Privacy | Terms of use | Legal Disclosure | Copyright | Trademark

IMAGES

VIDEO

COMMENTS

In transaction FS00, while creating a balance sheet G/L account to be used as an inventory account for Material Management, the checkbox "Apply Acct Assignments Statistically ..." is not available. You have checked the steps outlined in KBA 2274763 .

Search for additional results. Visit SAP Support Portal's SAP Notes and KBA Search. How to maintain the Record Account Assignment flag for a Balance Sheet Account in MDG-F. An the attribute Record Account Assignment in the standard data model 0G is missing in UI.

Step 3: Creating a G/L Account with FS00. To create a new G/L account using FS00, follow these steps: Start by filling in the necessary fields in the "General Data" section: Account Number: Enter a unique account number for the G/L account. Account Group: Select an appropriate account group based on the nature of the G/L account.

Step 1) Enter Transaction Code FS00 in SAP Command Field. Step 2) In the next screen. Enter the G/L Account you want to block or delete. Enter the Company Code. For Blocking. Step 3) In the next step , Press the Block button. Step 4) In the next screen, you have the blocking options for the G/L Accounts. For Deleting.

FS00, FSP0, FSS0, G/L account master data, SKA1, SKB1, KATYP, OB1A , KBA , FI-GL-GL-N , Master Data , How To . About this page This is a preview of a SAP Knowledge Base Article. Click more to access the full version on SAP for Me (Login required). Search for additional results. Visit ...

On the Balance Sheet Accounts view, make sure the account is defined as a balance sheet account for acquisition and production costs. In the SAP Easy Access Menu, choose Accounting Financial Accounting General Ledger Master Records G/L Accounts Individual Processing Centrally (transaction FS00).

Universal Journal Posting: The account posting includes RM inventory (balance sheet) and RM consumed (expense) accounts. Cost object assignment in the Universal Journal allows you to analyze all expense postings with standard SAP S/4HANA and compatibility reports, as well as SAP Fiori apps.

To create the asset go to Navigation: SAP Easy Access -> SAP Menu -> Accounting -> Financial accounting -> Fixed Asset -> Asset -> Create -> Asset. Alternatively: Transaction code AS01. 1) Fill out the fields Asset Class and Company Code with ZSAO (Press Enter) 2) Fill out field Description, as detailed in the image below: 3) If you double ...

Search for additional results. Visit SAP Support Portal's SAP Notes and KBA Search. The account assignment and accounting note fields are missing from the information (C/A) tab either information (CoCd) on FS00-Chart of Accounts Centrally.

General Ledger Account and Cost Element. The two segments of the G/L master record from a Financial Accounting perspective are as follows: The chart of accounts segment contains a description of the account, the account type that classifies how the account can be used in FI and/or CO and, the account group that controls the company code segment ...

FS00, "Apply Acct Assignments Statistically in Fixed Asset Acct/Material Acct" , KBA , FI-GL-GL-N , Master Data , Problem About this page This is a preview of a SAP Knowledge Base Article.

EKKN. account assignment in Purchasing Document. MM - Purchasing. Transparent Table. 20. BSAS. account ing: Secondary Index for G/L account s (Cleared Items) FI - Financial Accounting. Transparent Table.

A table contains several fields and some of the fields will be key fields. List of Record account assignment tables in SAP. CRMC_ACC_MAP for Assignment of Account Assignment Group to Account. ACCRAC for Assignment of Acr./Def. G/L Account to Accruals Account. BKK610 for Account Hierarchy: Assignment of Root Account to Tree Number.

Commitment, Purchase Order, Internal Order, G/L Account, Balance Sheet Account, FS00, KO02, ME23N, S_ALR_87013019, Record Account Assignment , KBA , CO-OM-OPA-D ...