Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

24.1 What Is Money?

Learning objectives.

- Define money and discuss its three basic functions.

- Distinguish between commodity money and fiat money, giving examples of each.

- Define what is meant by the money supply and tell what is included in the Federal Reserve System’s two definitions of it (M1 and M2).

If cigarettes and mackerel can be used as money, then just what is money? Money is anything that serves as a medium of exchange. A medium of exchange is anything that is widely accepted as a means of payment. In Romania under Communist Party rule in the 1980s, for example, Kent cigarettes served as a medium of exchange; the fact that they could be exchanged for other goods and services made them money.

Money, ultimately, is defined by people and what they do. When people use something as a medium of exchange, it becomes money. If people were to begin accepting basketballs as payment for most goods and services, basketballs would be money. We will learn in this chapter that changes in the way people use money have created new types of money and changed the way money is measured in recent decades.

The Functions of Money

Money serves three basic functions. By definition, it is a medium of exchange. It also serves as a unit of account and as a store of value—as the “mack” did in Lompoc.

A Medium of Exchange

The exchange of goods and services in markets is among the most universal activities of human life. To facilitate these exchanges, people settle on something that will serve as a medium of exchange—they select something to be money.

We can understand the significance of a medium of exchange by considering its absence. Barter occurs when goods are exchanged directly for other goods. Because no one item serves as a medium of exchange in a barter economy, potential buyers must find things that individual sellers will accept. A buyer might find a seller who will trade a pair of shoes for two chickens. Another seller might be willing to provide a haircut in exchange for a garden hose. Suppose you were visiting a grocery store in a barter economy. You would need to load up a truckful of items the grocer might accept in exchange for groceries. That would be an uncertain affair; you could not know when you headed for the store which items the grocer might agree to trade. Indeed, the complexity—and cost—of a visit to a grocery store in a barter economy would be so great that there probably would not be any grocery stores! A moment’s contemplation of the difficulty of life in a barter economy will demonstrate why human societies invariably select something—sometimes more than one thing—to serve as a medium of exchange, just as prisoners in federal penitentiaries accepted mackerel.

A Unit of Account

Ask someone in the United States what he or she paid for something, and that person will respond by quoting a price stated in dollars: “I paid $75 for this radio,” or “I paid $15 for this pizza.” People do not say, “I paid five pizzas for this radio.” That statement might, of course, be literally true in the sense of the opportunity cost of the transaction, but we do not report prices that way for two reasons. One is that people do not arrive at places like Radio Shack with five pizzas and expect to purchase a radio. The other is that the information would not be very useful. Other people may not think of values in pizza terms, so they might not know what we meant. Instead, we report the value of things in terms of money.

Money serves as a unit of account , which is a consistent means of measuring the value of things. We use money in this fashion because it is also a medium of exchange. When we report the value of a good or service in units of money, we are reporting what another person is likely to have to pay to obtain that good or service.

A Store of Value

The third function of money is to serve as a store of value , that is, an item that holds value over time. Consider a $20 bill that you accidentally left in a coat pocket a year ago. When you find it, you will be pleased. That is because you know the bill still has value. Value has, in effect, been “stored” in that little piece of paper.

Money, of course, is not the only thing that stores value. Houses, office buildings, land, works of art, and many other commodities serve as a means of storing wealth and value. Money differs from these other stores of value by being readily exchangeable for other commodities. Its role as a medium of exchange makes it a convenient store of value.

Because money acts as a store of value, it can be used as a standard for future payments. When you borrow money, for example, you typically sign a contract pledging to make a series of future payments to settle the debt. These payments will be made using money, because money acts as a store of value.

Money is not a risk-free store of value, however. We saw in the chapter that introduced the concept of inflation that inflation reduces the value of money. In periods of rapid inflation, people may not want to rely on money as a store of value, and they may turn to commodities such as land or gold instead.

Types of Money

Although money can take an extraordinary variety of forms, there are really only two types of money: money that has intrinsic value and money that does not have intrinsic value.

Commodity money is money that has value apart from its use as money. Mackerel in federal prisons is an example of commodity money. Mackerel could be used to buy services from other prisoners; they could also be eaten.

Gold and silver are the most widely used forms of commodity money. Gold and silver can be used as jewelry and for some industrial and medicinal purposes, so they have value apart from their use as money. The first known use of gold and silver coins was in the Greek city-state of Lydia in the beginning of the seventh century B.C. The coins were fashioned from electrum, a natural mixture of gold and silver.

One disadvantage of commodity money is that its quantity can fluctuate erratically. Gold, for example, was one form of money in the United States in the 19th century. Gold discoveries in California and later in Alaska sent the quantity of money soaring. Some of this nation’s worst bouts of inflation were set off by increases in the quantity of gold in circulation during the 19th century. A much greater problem exists with commodity money that can be produced. In the southern part of colonial America, for example, tobacco served as money. There was a continuing problem of farmers increasing the quantity of money by growing more tobacco. The problem was sufficiently serious that vigilante squads were organized. They roamed the countryside burning tobacco fields in an effort to keep the quantity of tobacco, hence money, under control. (Remarkably, these squads sought to control the money supply by burning tobacco grown by other farmers.)

Another problem is that commodity money may vary in quality. Given that variability, there is a tendency for lower-quality commodities to drive higher-quality commodities out of circulation. Horses, for example, served as money in colonial New England. It was common for loan obligations to be stated in terms of a quantity of horses to be paid back. Given such obligations, there was a tendency to use lower-quality horses to pay back debts; higher-quality horses were kept out of circulation for other uses. Laws were passed forbidding the use of lame horses in the payment of debts. This is an example of Gresham’s law: the tendency for a lower-quality commodity (bad money) to drive a higher-quality commodity (good money) out of circulation. Unless a means can be found to control the quality of commodity money, the tendency for that quality to decline can threaten its acceptability as a medium of exchange.

But something need not have intrinsic value to serve as money. Fiat money is money that some authority, generally a government, has ordered to be accepted as a medium of exchange. The currency —paper money and coins—used in the United States today is fiat money; it has no value other than its use as money. You will notice that statement printed on each bill: “This note is legal tender for all debts, public and private.”

Checkable deposits , which are balances in checking accounts, and traveler’s checks are other forms of money that have no intrinsic value. They can be converted to currency, but generally they are not; they simply serve as a medium of exchange. If you want to buy something, you can often pay with a check or a debit card. A check is a written order to a bank to transfer ownership of a checkable deposit. A debit card is the electronic equivalent of a check. Suppose, for example, that you have $100 in your checking account and you write a check to your campus bookstore for $30 or instruct the clerk to swipe your debit card and “charge” it $30. In either case, $30 will be transferred from your checking account to the bookstore’s checking account. Notice that it is the checkable deposit, not the check or debit card, that is money . The check or debit card just tells a bank to transfer money, in this case checkable deposits, from one account to another.

What makes something money is really found in its acceptability, not in whether or not it has intrinsic value or whether or not a government has declared it as such. For example, fiat money tends to be accepted so long as too much of it is not printed too quickly. When that happens, as it did in Russia in the 1990s, people tend to look for other items to serve as money. In the case of Russia, the U.S. dollar became a popular form of money, even though the Russian government still declared the ruble to be its fiat money.

The term money , as used by economists and throughout this book, has the very specific definition given in the text. People can hold assets in a variety of forms, from works of art to stock certificates to currency or checking account balances. Even though individuals may be very wealthy, only when they are holding their assets in a form that serves as a medium of exchange do they, according to the precise meaning of the term, have “money.” To qualify as “money,” something must be widely accepted as a medium of exchange.

Measuring Money

The total quantity of money in the economy at any one time is called the money supply . Economists measure the money supply because it affects economic activity. What should be included in the money supply? We want to include as part of the money supply those things that serve as media of exchange. However, the items that provide this function have varied over time.

Before 1980, the basic money supply was measured as the sum of currency in circulation, traveler’s checks, and checkable deposits. Currency serves the medium-of-exchange function very nicely but denies people any interest earnings. (Checking accounts did not earn interest before 1980.)

Over the last few decades, especially as a result of high interest rates and high inflation in the late 1970s, people sought and found ways of holding their financial assets in ways that earn interest and that can easily be converted to money. For example, it is now possible to transfer money from your savings account to your checking account using an automated teller machine (ATM), and then to withdraw cash from your checking account. Thus, many types of savings accounts are easily converted into currency.

Economists refer to the ease with which an asset can be converted into currency as the asset’s liquidity . Currency itself is perfectly liquid; you can always change two $5 bills for a $10 bill. Checkable deposits are almost perfectly liquid; you can easily cash a check or visit an ATM. An office building, however, is highly illiquid. It can be converted to money only by selling it, a time-consuming and costly process.

As financial assets other than checkable deposits have become more liquid, economists have had to develop broader measures of money that would correspond to economic activity. In the United States, the final arbiter of what is and what is not measured as money is the Federal Reserve System. Because it is difficult to determine what (and what not) to measure as money, the Fed reports several different measures of money, including M1 and M2.

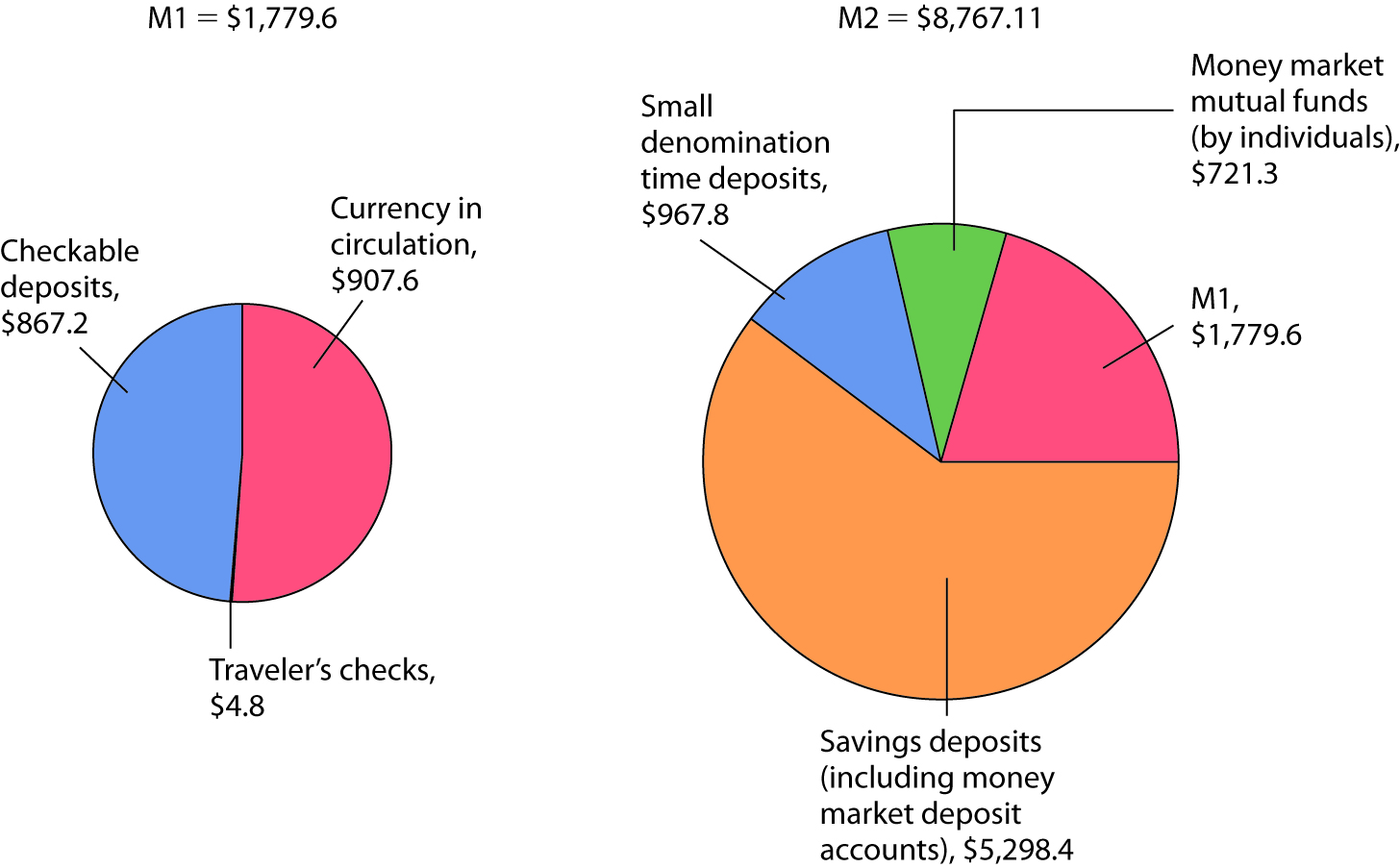

M1 is the narrowest of the Fed’s money supply definitions. It includes currency in circulation, checkable deposits, and traveler’s checks. M2 is a broader measure of the money supply than M1. It includes M1 and other deposits such as small savings accounts (less than $100,000), as well as accounts such as money market mutual funds (MMMFs) that place limits on the number or the amounts of the checks that can be written in a certain period.

M2 is sometimes called the broadly defined money supply, while M1 is the narrowly defined money supply. The assets in M1 may be regarded as perfectly liquid; the assets in M2 are highly liquid, but somewhat less liquid than the assets in M1. Even broader measures of the money supply include large time-deposits, money market mutual funds held by institutions, and other assets that are somewhat less liquid than those in M2. Figure 24.1 “The Two Ms: October 2010” shows the composition of M1 and M2 in October 2010.

Figure 24.1 The Two Ms: October 2010

M1, the narrowest definition of the money supply, includes assets that are perfectly liquid. M2 provides a broader measure of the money supply and includes somewhat less liquid assets. Amounts represent money supply data in billions of dollars for October 2010, seasonally adjusted.

Source : Federal Reserve Statistical Release H.6, Tables 3 and 4 (December 2, 2010). Amounts are in billions of dollars for October 2010, seasonally adjusted.

Credit cards are not money. A credit card identifies you as a person who has a special arrangement with the card issuer in which the issuer will lend you money and transfer the proceeds to another party whenever you want. Thus, if you present a MasterCard to a jeweler as payment for a $500 ring, the firm that issued you the card will lend you the $500 and send that money, less a service charge, to the jeweler. You, of course, will be required to repay the loan later. But a card that says you have such a relationship is not money, just as your debit card is not money.

With all the operational definitions of money available, which one should we use? Economists generally answer that question by asking another: Which measure of money is most closely related to real GDP and the price level? As that changes, so must the definition of money.

In 1980, the Fed decided that changes in the ways people were managing their money made M1 useless for policy choices. Indeed, the Fed now pays little attention to M2 either. It has largely given up tracking a particular measure of the money supply. The choice of what to measure as money remains the subject of continuing research and considerable debate.

Key Takeaways

- Money is anything that serves as a medium of exchange. Other functions of money are to serve as a unit of account and as a store of value.

- Money may or may not have intrinsic value. Commodity money has intrinsic value because it has other uses besides being a medium of exchange. Fiat money serves only as a medium of exchange, because its use as such is authorized by the government; it has no intrinsic value.

- The Fed reports several different measures of money, including M1 and M2.

Which of the following are money in the United States today and which are not? Explain your reasoning in terms of the functions of money.

- A Van Gogh painting

Case in Point: Fiat-less Money

Figure 24.2

Michael Mandiberg – 1 million iraqi dinar – CC BY-SA 2.0.

“We don’t have a currency of our own,” proclaimed Nerchivan Barzani, the Kurdish regional government’s prime minister in a news interview in 2003. But, even without official recognition by the government, the so-called “Swiss” dinar certainly seemed to function as a fiat money. Here is how the Kurdish area of northern Iraq, during the period between the Gulf War in 1991 and the fall of Saddam Hussein in 2003, came to have its own currency, despite the pronouncement of its prime minister to the contrary.

After the Gulf War, the northern, mostly Kurdish area of Iraq was separated from the rest of Iraq though the enforcement of the no-fly-zone. Because of United Nations sanctions that barred the Saddam Hussein regime in the south from continuing to import currency from Switzerland, the central bank of Iraq announced it would replace the “Swiss” dinars, so named because they had been printed in Switzerland, with locally printed currency, which became known as “Saddam” dinars. Iraqi citizens in southern Iraq were given three weeks to exchange their old dinars for the new ones. In the northern part of Iraq, citizens could not exchange their notes and so they simply continued to use the old ones.

And so it was that the “Swiss” dinar for a period of about 10 years, even without government backing or any law establishing it as legal tender, served as northern Iraq’s fiat money. Economists use the word “ fiat ,” which in Latin means “let it be done,” to describe money that has no intrinsic value. Such forms of money usually get their value because a government or authority has declared them to be legal tender, but, as this story shows, it does not really require much “fiat” for a convenient, in-and-of-itself worthless, medium of exchange to evolve.

What happened to both the “Swiss” and “Saddam” dinars? After the Coalition Provisional Authority (CPA) assumed control of all of Iraq, Paul Bremer, then head of the CPA, announced that a new Iraqi dinar would be exchanged for both of the existing currencies over a three-month period ending in January 2004 at a rate that implied that one “Swiss” dinar was valued at 150 “Saddam” dinars. Because Saddam Hussein’s regime had printed many more “Saddam” dinars over the 10-year period, while no “Swiss” dinars had been printed, and because the cheap printing of the “Saddam” dinars made them easy to counterfeit, over the decade the “Swiss” dinars became relatively more valuable and the exchange rate that Bremer offered about equalized the purchasing power of the two currencies. For example, it took about 133 times as many “Saddam” dinars as “Swiss” dinars to buy a man’s suit in Iraq at the time. The new notes, sometimes called “Bremer” dinars, were printed in Britain and elsewhere and flown into Iraq on 22 flights using Boeing 747s and other large aircraft. In both the northern and southern parts of Iraq, citizens turned in their old dinars for the new ones, suggesting at least more confidence at that moment in the “Bremer” dinar than in either the “Saddam” or “Swiss” dinars.

Sources : Mervyn A. King, “The Institutions of Monetary Policy” (lecture, American Economics Association Annual Meeting, San Diego, January 4, 2004), available at http://www.bankofengland.co.uk/speeches/speech208.pdf . Hal R. Varian, “Paper Currency Can Have Value without Government Backing, but Such Backing Adds Substantially to Its Value,” New York Times , January 15, 2004, p. C2.

Answer to Try It! Problem

- Gold is not money because it is not used as a medium of exchange. In addition, it does not serve as a unit of account. It may, however, serve as a store of value.

- A Van Gogh painting is not money. It serves as a store of value. It is highly illiquid but could eventually be converted to money. It is neither a medium of exchange nor a unit of account.

- A dime is money and serves all three functions of money. It is, of course, perfectly liquid.

Principles of Economics Copyright © 2016 by University of Minnesota is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License , except where otherwise noted.

Lesson 9: Money and Inflation

- Teacher Resources

- Lesson Plans

- Economics for Leaders

- Lesson 9: Money and Inflation…

Download EFL Lesson 9 Guide and Slides

Virtual Lesson Instructions and Slides

Introduction

In this lesson students learn that anything that performs the functions of money can be money (even macaroni!). As they use their macaroni to bid on items during an auction, they learn that the value of money depends on the quantity of money relative to the quantity of goods and services they can buy with that money. Historical and contemporary examples as well as video clips help students understand the role that banks and the Federal Reserve play in expanding and contracting the money supply.

MINI ACTIVITY

- Inflation Auction

At the end of this lesson students will be able to:

- Identify the three functions of money.

- Explain how banks create money through fractional reserve banking.

- Give examples of how the Federal Reserve uses their tools to increase or decrease the money supply.

- Explain the cause of inflation.

- Provide examples of the costs of inflation

Economic Concepts

| Money | Inflation | Government Spending |

| Discount Rate | Federal Funds Rate | Federal Reserve System |

| Open Market Operations | Monetary Policy | Interest Rate |

National Content Standards Addressed

Standard 11: role of money.

Money makes it easier to trade, borrow, save, invest, and compare the value of goods and services.

- Money is anything widely accepted as final payment for goods and services.

- Money encourages specialization by decreasing the costs of exchange.

- The basic money supply in the United States consists of currency, coins, and checking account deposits.

- In many economies, when banks make loans, the money supply increases; when loans are paid off, the money supply decreases.

Standard 12: Role of Interest Rates

Interest rates, adjusted for inflation, rise and fall to balance the amount saved with the amount borrowed, which affects the allocation of scarce resources between present and future uses.

- An interest rate is the price of money that is borrowed or saved.

- Like other prices, interest rates are determined by the forces of supply and demand.

- The real interest rate is the nominal or current market interest rate minus the expected rate of inflation.

Standard 19: Unemployment and Inflation

Unemployment imposes costs on individuals and nations. Unexpected inflation imposes costs on many people and benefits some others because it arbitrarily redistributes purchasing power. Inflation can reduce the rate of growth of national living standards because individuals and organizations use resources to protect themselves against the uncertainty of future prices.

- Inflation is an increase in most prices; deflation is a decrease in most prices.

- Inflation reduces the value of money

- When people’s incomes increase more slowly than the inflation rate, their purchasing power declines.

- The costs of inflation are different for different groups of people. Unexpected inflation hurts savers and people on fixed incomes; it helps people who have borrowed money at a fixed rate of interest.

- Inflation imposes costs on people beyond its effects on wealth distribution because people devote resources to protect themselves from expected inflation.

Standard 20: Monetary and Fiscal Policy

Federal government budgetary policy and the Federal Reserve System’s monetary policy influence the overall levels of employment, output, and prices.

- Monetary policies are decision by the Federal Reserve System that lead to changes in the supply of money and the availability of credit. Changes in the money supply can influence overall levels of spending, employment, and prices in the economy by inducing changes in interest rates charged for credit and by affecting the levels of personal and business investment spending.

Download full lesson guide for procedures and teaching tips.

- Voluntary trade creates wealth.

- Institutions that facilitate trade help to increase wealth and raise standards of living.

2. Money enhances voluntary trade by reducing transaction costs.

- Money is anything generally accepted in exchange for goods and services.

- Money is a store of value

- Money is a standard of value.

- Money is a medium of exchange.

3. The interest rate is the opportunity cost of holding money, because instead of holding money, people could hold interest-earning assets (such as Certificates of Deposit or bonds) instead.

4. Interest rates are determined by the interaction of lenders who supply funds, and borrowers, who demand funds.

- Savers supply funds to be loaned and are paid interest for waiting to consume at a later date.

- Demanders of these funds are the borrowers, who pay interest in order to have the right to spend now instead of waiting for future income. This spending might be on consumption or on investment goods (such as plant and equipment).

- Interest rates vary with the type of market. Rates change within a market in response to changes in supply and demand for loanable funds.

5. The money supply is a measure of the total amount of money in an economy.

- The money supply changes through activities of the commercial banking system.

- The Federal Reserve uses open market operations to alter the amount of currency and bank reserves, generally signaling its intentions to do so through changes in its target value for the Federal Funds rate and changes in the Discount rate.

- The Federal Fund rate is the rate of interest at which U.S. banks lend to one another their excess reserves held on deposit by Federal Reserve banks.

- The Discount rate is the rate at which member banks may borrow short term funds directly from a Federal Reserve Bank.

- Other policy vehicles available to the Fed include: reserve requirements, margin requirements on stock loans, credit controls on lending quality, and changes in eligible “collateral” for direct loans to member banks and other commercial institutions (e.g., investment banks).

6. Inflation is a general increase in the level of prices throughout the economy.

- The most commonly used measure of inflation is the Consumer Price Index, (or CPI). The GDP Deflator is another important measure of inflation. Changes in these price indices indicate changes in the purchasing power of the U.S. dollar.

- Inflation encourages more debt and faster spending as buyers and sellers try to avoid rising prices.

- Inflation creates uncertainty and makes future planning more difficult.

- Unanticipated inflation erodes the purchasing power of nominal assets, including money, bonds, and savings accounts. Individuals with fixed incomes also lose.

- The extremely high cost of using money during hyperinflations forces people to resort to barter, which is an inefficient means of transacting.

- A high average rate of inflation is always accompanied by much uncertainty about the future inflation rate, which makes many contracts more risky. Greater levels of risk increase the value of the “option to wait,” which delays many consumption and investment decisions, and thereby slows economic growth.

7. Inflation is a monetary phenomenon, and almost always occurs because increases in the stock of money exceed growth in output of goods and services.

- A frequent problem in developing nations is that governments without stable or consistent tax collections often resort to printing money to finance government spending.

- Intended to halt rising prices, price controls instead disguise inflation and disrupt the allocation of goods and services.

Ideas To Take Away From This Lesson

- Money is an innovation that significantly improved the operation of markets.

- Banks facilitate the operation of markets by expanding the quantity of money in circulation.

- Inflation is a consequence of the money supply growing faster than production.

- The Fed manages price and interest rate levels by changing the money supply.

- Inflation creates disruptions and losses in the overall economy as buyers and sellers act to avoid its effects.

Debbie Henney, FTE Director of Curriculum Receives Bessie B Moore Service Award

Foundation for Teaching Economics is proud to announce that Debbie Henney, director of curriculum for the Foundation for Teaching…

FTE Pays Tribute to Jerry Hume

It is with deep sadness that we announce the loss of William J. Hume, known as Jerry Hume, former Chairman…

Why We Should Be Teaching Students Economic Literacy

Ted Tucker, Executive Director, Foundation for Teaching Economics October 26, 2022 More high schools are offering courses on personal finance…

Money and Banking

(7 reviews)

Robert E. Wright, NYU

Copyright Year: 2012

ISBN 13: 9780982043080

Publisher: Saylor Foundation

Language: English

Formats Available

Conditions of use.

Learn more about reviews.

Reviewed by Nabila Rahman Biju, Assistant Professor of Economics, Berea College on 11/14/23

I really liked the fact that the first few chapters started with very basic ideas which makes it easier for the beginners to start in this field. And I like the think-boxes. read more

Comprehensiveness rating: 5 see less

I really liked the fact that the first few chapters started with very basic ideas which makes it easier for the beginners to start in this field. And I like the think-boxes.

Content Accuracy rating: 4

The discussion of moral hazard and the so called 'evil practice' is a good way to introduce students about the financial system's drawbacks. They should realize that this current system is not the best we could do so far. Rather, it the accumulation of historical accidents and there is plenty of room for improvements in this current system. So yes, I think the content was pretty unbiased.

Relevance/Longevity rating: 5

With all the detailed examples, I found it to be quite relevant. I am teaching Money and Banking class currently, and I can find most of my important topics in this book as well. So, yes, I will say this book is relevant.

Clarity rating: 5

The language of the book is really reader-friendly and as I mentioned before, I felt a non-Econ or non-Business background student also can easily understand.

Consistency rating: 4

The content and topics of each consequent chapters flow well.

Modularity rating: 5

It's already way too divided into sub-topics at least in my opinion. No need to break it down further.

Organization/Structure/Flow rating: 3

Although it is not an e-book and only a pdf, still, putting in a list of contents could be done. I strongly recommend to have a list of contents with hyperlinks linking to each chapter as it really helps. Especially when a person is re-reading, its really annoying to keep scrolling.

Interface rating: 2

Would be nice to have hyperlinks.

Grammatical Errors rating: 5

Good writing

Cultural Relevance rating: 4

I would expect more discussion of other countries also the ancient times. But it's still very relevant.

I liked it quite a bit. Only adding a list of content is the only thing I would ask for. Thanks!

Reviewed by Ulmaskhon Kalandarova, Instructor, Colorado State University on 1/2/21

Although the book covers majority of concepts in money and banking, but unfortunately it seems that all data is outdated and sometime the fundamental legislative laws like Dodd-Frank act not even mentioned. Also, more discussion of bank regulating... read more

Comprehensiveness rating: 3 see less

Although the book covers majority of concepts in money and banking, but unfortunately it seems that all data is outdated and sometime the fundamental legislative laws like Dodd-Frank act not even mentioned. Also, more discussion of bank regulating system is recommended - it is very brief in chapter-11. The revised and more comprehensive version of this book is recommended. For example, this book could compare its' contents with Cecetti's Money and Banking book, which is widely used in teaching this course.

Fundamental concepts seem to be discussed very well, but the demonstration data seems to be a bit loose.

Relevance/Longevity rating: 4

The text is written in clear prose. I did not have any difficulty with its understanding.

Consistency rating: 5

Text is consistent with terminology, however the modern terminology could be also included - like bitcoins, hi tech , mobile banking issues

Modularity rating: 3

Modularity needs to be revised and added more parts for practice, brief summaries, real-life examples.

Structure is outdated - need to include at least some practice problems and explanation of their solutions for some of them in the text. Also, real life examples section would be a plus. Also, brief summary of chapter's main points could improve this book.

Interface rating: 3

I think the book should be revised due to very outdated display features - it seems very old and comparing for example to Cecetti's book in money and banking - I would not choose this book for teaching - because it does not have many different informative, practice, learn sections as other books have.

I didn't find any grammatical errors in the text.

Cultural Relevance rating: 5

I would recommend to add more data from developing nations banking system for informative and comparison/analysis purposes. This could give a brief explanation of different factors that effect developing countries banking systems, and their special characteristics.

Reviewed by Peter Mikek, Associate Professor, Wabash College on 12/22/19

This is a great book for any student that is exposed to questions of money and banking for the first time.The book is certainly comprehensive in covering most of the money and banking topics, reaching a bit into macroeconomics and international... read more

This is a great book for any student that is exposed to questions of money and banking for the first time.The book is certainly comprehensive in covering most of the money and banking topics, reaching a bit into macroeconomics and international finance. The 26 chapters provide overview and numerous examples of standard Money and Banking courses/textbooks and, very likely, include more material than can be thoroughly covered in a semester course. The three chapters devoted totally to banking are complemented with standard coverage of monetary policy and well placed within macroeconomic framework. It is delightful that the focus on banks within financial sector is maintained through most of the text. The text includes a chapter on financial crisis, international finance, and several chapters reviewing and scaffolding a broader context for money and banking. I was puzzled by the fact that I could not locate the chapter of Financial Derivatives. However, I suspect that this was probably some error preparing the online PDF file. While the work is very broad in its scope the text in each sections is super focused and relatively short. While I am a fan of concise textbooks, I found it occasionally too limited (for example there is a chapter with only 6 pages of text that includes several unnecessary excursions into methodology and history).

Overall, I find the book very accurate and unbiased. In some sense the text strikes me as not completely polished but still great text. The remaining typos are not crucial for understanding and can be easily identified.Let me give you some examples: in an example of a balance sheet ,the author claim that liabilities are "things owNed," they place transaction deposits on one T account among bank's assets, in a scheme of a transmission mechanism they have an arrow turned the wrong way (EMP, net worth down), "nominal rates on risky securities had in fact soared in 1930-1933" should actually talk about the real rates, etc. Again, these are small remaining errors and a reader will be able to fix them easily as they go. I am convinced that the next iteration of the text will get rid of the remaining typos.

This is definitely one of the very strong attributes of this interesting text. The examples are definitely up-to-date as it includes examples from the recent financial crises and developments in international finance. But not only that, the author uses rich historical background artfully to place the more recent examples in historical context. This contributes to richer text and better understanding of several provided examples. I believe that the text will need relatively little in terms of updating it.

Clarity rating: 4

This is a fantastically clear presentation of ideas and concepts. The authors use Stop and Think boxes to expand upon the basic ideas with examples, Key Takeaways boxes to reiterate the most important points, Exercise boxes to provide hands-on opportunities. Each section starts with clearly spelled learning objectives. Super concise text leaves the reader with clear message. But maybe the most enjoyable feature of the text is vivacious, playful, and rich language. I am REALLY impressed with the rich vocabulary and engaging, occasionally truly erudite, nicely varied language ("if not insane, at least inane,” “Asymmetric information (that horrible three-headed hound from Hades),” “if you wrap your car around a tree,” etc.). The authors try to engage the average reader also with a number of colloquial expressions that are less to my taste ("those smakers," "kinda funny that," "darn high") but I guess that is just my taste.

The authors are consistent across the chapters, they use standard field specific vocabulary. I think they score high on this point.

This is another strong quality of the text. While some parts are absolutely essential in every Money and Banking text, such as time value of money or chapter on banking and one on monetary policy, there are parts that can easily be added or dropped based on preferences of the instructor. Chapters devoted to exchange rates or international monetary arrangements can easily be postponed to later courses. Similarly, students that already had a decent intermediate macroeconomics will not need chapters focused on macro. So, the text both allows for various arrangements of the building blocks in a variety of ways.

Organization/Structure/Flow rating: 5

The textbook follows a standard order in presentation of the material. Not only the sequencing but also parsing the material into logical units was done with the due care. This is actually essential for good learning success and they did if perfectly. Additionally, I already mentioned that each section has clearly spelled learning objective and Key Takeaways that contribute to transparent structure of the text. Finally, progression from one topic to the next is seamless and easy to follow.

Interface rating: 5

Navigation is easy and clear, the figures, excercises, Stop And Think boxes are clearly marked. The text consistently uses several different colors to indicate parts of the text or to emphasize this or that (such as tables). The interface is not only easy to use, it is also nicely appealing for the reader.

I found no issues with the grammar. Furthermore, I wish to emphasize again that the use charming and vivacious language.

I found the book to follow the usual standards regarding the cultural sensitivity and non-offensive language. Despite the fact that the book is devoted to functioning of a financial system in developed capitalist economy the text includes ample examples from across the globe - in particular in chapters on international finance. German reunification, Chinese high foreign reserves and exchange rate system, Argentine currency crises are just three of numerous examples that cross the cultural and geographical borders with ease and clarity.

This is an absolutely delightful text that uses fresh, clear, and playful language in the field that can be perceived as rather dry. The book will be best suited for beginners with first encounters with money and banking. For others, a skillful instructor can easy point out on what they should focus (and where are few remaining typos). The text is comprehensive and set in a way that will serve broad set of instructor's preferences; from those that wish to focus on international finance to those that wish to include some review of macroeconomics. One of the best attributes of the book is the fact that the author never loses its focus on banks and/or monetary policy. Overall, I find the text great.

Reviewed by Partha Gangopadhyay, Professor, St. Cloud State University on 6/10/19

The text provides a comprehensive coverage of Money and Banking topics. If anything, there is too much material in the book's 26 chapters for one course. Most colleges do not have more than one Money and Banking course. The book has enough... read more

The text provides a comprehensive coverage of Money and Banking topics. If anything, there is too much material in the book's 26 chapters for one course. Most colleges do not have more than one Money and Banking course. The book has enough material for at least two such courses. I did not see an index or a glossary of terms.

Content Accuracy rating: 5

I have not detected any error in the text. I checked out some of the hyperlinks to outside resources. The links seem to work just fine. I would like to see the sources of the tables and figures listed below the tables/figures in the book.

Relevance/Longevity rating: 2

The text needs to be revised and updated. The tables and figures in the book provide information up to 2007-2008. This applies to many of the tables/figures in chapters 9, 10, 11, 15, 16, 18, 19, 20, and 21. There is a brief discussion of banking regulation in chapter 11. However, I did not see even a mention of the Gramm-Leach-Bliley Act of 1999, or the Dodd-Frank Act of 2010, or the Basle 111 capital requirements. The discussion in the books seems to end with the Riegle-Neal Act of 1995, and the Basle 11 requirements. Also, the suggested readings at the end of the chapters need to include more current articles and other resources. The fundamental concepts of money and banking have not materially changed over time. The book does a good job of explaining these concepts. However, the banking laws and data and statistics have changed over time. These need to be updated. The book was written in 2012. It is time for a newer edition. The updates can be easily implemented.

The book is written in clear and concise language. Beginning students should not have any difficulty in reading and understanding the concepts. Students will also be able to personally relate to many of the examples and anecdotes that are spread throughout the book.

The writing style is consistent throughout the book. I also like the consistent layout of the chapters. Each chapter and section begin with a set of learning objectives, and ends with 'Key Takeaways', and a list of suggested readings. I also like the 'Stop and Think' boxes in each chapter.

I may be able to cover 10 or 11 chapters from the book in a sixteen-week semester. As I mentioned elsewhere, there is enough material in the book for at least two 'Money and Banking' courses. It will be easy to pick 10-12 chapters from the book to cover in a 'Money and Banking' class. The text is not overly self-referential, and most chapters can stand on their own. The text can be easily divided into smaller sub-units that can be incorporated in different courses.

The text and the individual chapters are logically organized. The order of the chapters is clear, and the concepts are presented in a coherent and logical manner.

Interface rating: 4

I did not detect any issues with interface. I suggest numbering the equations in chapters 4-7, 9, 14, 15, 17, 18, 20, and 21. Also, the sources of the various tables/figures should be listed below the tables or figures. Several exercises are included in chapters 4-7, 9, 15, 17, 18, and 21. I am assuming that the solutions to these exercises will be made available to the instructors in supplementary materials in the book's website. However, I suggest that the answers to at least some of these exercises should be provided in an Appendix at the end of the book. It will also be helpful if a section of conceptual questions and/or numerical exercises is added at the end of each chapter. I also suggest adding a section in chapter 4 (and in other chapters) showing how to calculate the time value of money (and bond prices) using a financial calculator.

I have not seen any grammatical errors in the book.

I did not notice any cultural insensitivity in the book.

The book is comprehensive in the coverage of Money and Banking topics. However, the book is very outdated. A new edition of the book with up-to-date discussion of the banking regulatory framework, and well as current data and statistics is needed at this point. The concepts are easy to understand, and the book is well-written.

Reviewed by Laura Carolevschi, Assistant Professor, Winona State University on 6/20/17

In its 26 chapters, the textbook covers a wide array of money and banking topics, as well as macroeconomics topics with monetary policy applications. The treatment of the subjects is clear, easy to follow and relevant with applied examples. No... read more

In its 26 chapters, the textbook covers a wide array of money and banking topics, as well as macroeconomics topics with monetary policy applications. The treatment of the subjects is clear, easy to follow and relevant with applied examples. No index or glossary was provided with the version that was reviewed.

The content is accurate, error-free and unbiased, at least in the sections I chose to review.

The theories discussed in the textbook are up-to-date, and will stand the test of time for a while. However, some of the data will need to be updated. I'm reviewing this book in 2017, and many of the graphs have data until 2007-2008.

The author uses a story-telling format that is easy to read and accessible to both beginners and advanced learners. The book has many examples that students might be able to relate to due to personal experience.

All chapters are using the same format. The terminology and concepts are used consistently throughout the text.

While the textbook covers a variety of topics, it is easily divisible into smaller sections. Each chapter is divided into several topics, and each sub-chapter is clearly organized around a single topic, while still easily integrating within the larger subject matter of each chapter. During a regular semester I am usually unable to cover an entire textbook, and I select some chapters to cover first, with a couple of chapters as "maybe", if we still have time at the end of the semester. This textbook can be easily organized in such a way.

The topics in the text are presented in a logical and clear fashion. The organization/structure/flow are consistent throughout the text. All chapters are organized in the same format, making the text easy to read and follow.

The text is free of any interface issues. Most images/tables/graphs were clear and easy to read. However, I encountered a couple of images that were unclear - on page 258, I could only read the names of the countries, but not the text in each box even after zooming in; the table on page 304 seems to not be visible in its entirety. Another thing that would make the book easier to navigate would be a table of contents with hyperlinks to each chapter. The .pdf version that I'm reviewing does not have it.

I could not find any grammar errors. (However, I found some typos - in a few instances, it seems that the space between the words is missing, likethis.)

The treatments of topics in this textbook is respectful of different cultures.

The book provides a comprehensive yet approachable coverage of several monetary policy issues. The format of the book make it versatile to several uses - as a standalone text in money and banking classes, or as supplementary reading in introductory or intermediary macroeconomics classes.

Reviewed by Wendy Usrey, Faculty Instructor, Colorado State University on 12/5/16

This book is fantastic in terms of the breadth of finance, money and banking topics. I have found that most money and banking texts have some of the topics I want to cover in my classes, but I have seen very few that contain all of the material I... read more

This book is fantastic in terms of the breadth of finance, money and banking topics. I have found that most money and banking texts have some of the topics I want to cover in my classes, but I have seen very few that contain all of the material I am looking for in one, easily digestible textbook. With 26 chapters covering everything from how money and banking applies to our everyday lives, to the theory of rational expectations and its implications for monetary policy, this book is so comprehensive I can easily see myself using it in several different finance classes as well as in various economics courses.

I have not seen any errors in terms of content or examples/problems in the text. However, some of the hyperlinks to outside resources are no longer working.

1. I was very excited to see all of the hyperlinks to external content (new stories, other texts, etc), but as mentioned above, quite a few of the hyperlinks are no longer working. Depending on the link this could be a relatively easy fix, but some of these sources may no longer exist and may need to be removed. While not particularly difficult, if the text refers to the content referenced by the link, portions of the text will need to be rewritten if the links are removed. I also noted a few places where the text is already in need of some updating, for example, the book does a good job of explaining the 2007-2008 Financial Crisis, along with concepts such as the “Lender of Last Resort” and monetary policy, but does not contain any discussion on quantitative easing. This was a very critical and important (as well as controversial) component of the Federal Reserve's response the Financial Crisis, so it should have been included in the text or added in an update.

Overall the text is written in a very accessible manner without sacrificing academic rigor. Concepts are explained fully but in such a way that students from a variety of backgrounds should be able to understand the content. As another reviewer mentioned, a glossary or index at the end of the text would be very useful for helping to navigate the text and find definitions of key terms quickly.

Terminology, writing style and framework remain consistent throughout the text.

Despite the amount of material, this text is very well organized. The content is broken up into manageable chunks with very clear learning objectives stated at the beginning and key takeaways at the end of each section. This format makes a big difference in terms of helping the reader stay oriented so they do not get lost in the world of financial jargon and concepts. I particularly liked how each chapter was organized with so many additional resources and references. I particularly like the clear chapter objectives, followed by learning objectives for each sub-section. The "suggested reading" at the end of each chapter, as well as the "stop and think" boxes make the text very approachable for students and give the instructor a lot of great ideas for incorporating outside content and examples into the class.

The order in which the topics are presented is also very good with progression between concepts fluid and intuitive, but hyperlinks referring to other parts of the text make it very easy for an instructor to teach the topics in an order that suits their individual class structure without the worry of having students end up "lost in the text."

The interface of the book is very easy to navigate. Content displays as expected and does not seem to be affected by the format (I reviewed both the web interface as well as the downloaded PDF version). One thing that would make navigation easier would be to add hyperlinks from the table of contents to the chapters in the downloadable PDF version. This feature is available when viewing on the web, but did not appear as an option once I downloaded the PDF.

No grammar or spelling errors were found during my review.

As expected from an academic text, there are no insensitive or offensive references in the text. Additionally, the information is easy to understand regardless of cultural background and can easily be used in diverse classes with little to no adaptation.

Overall I think this is a solid, well written text that contains a lot of relevant and useful information. The world of finance can be intimidating and the author does a wonderful job of helping make the subject matter approachable and interesting, particularly with the use of humor and clever chapter titles. I intend to use this text in several of my own classes that range from introductory up to intermediate level classes.

Reviewed by Mahmoud Al-Odeh, Assistant Professor, Bemidji State University on 6/10/15

This is a good textbook that covers a wide range of topics in the economic analysis theory and application. The book consists of 24 chapters that cover current topics related such as Interest Rates, Inflation, Rate of Return, Future and Current... read more

This is a good textbook that covers a wide range of topics in the economic analysis theory and application. The book consists of 24 chapters that cover current topics related such as Interest Rates, Inflation, Rate of Return, Future and Current Value of Money, Money Supply Process, Monetary Policy Tools and Foreign Exchange. The book also disscussed Balance Sheet and a T-account and provided strategies for Bank Management. The chapters include a good examples to be used in the classroom to explain the topic. The exercises at the end of each topic are extremely helpful and can be used as homework assignments.

I have reviewed several examples given in the book and I found that the book is accurate and contains no errors.

The content and the topics in the book is very good for introductory and intermediate economy classes. The examples provided are current and up-to-date. As any textbook, it is recommended changing and updating the content at least once every five years to include more relevant examples and case studies.

The book is written in a way that students can easily understand the content without difficulties. I also like the funny style (e.g. “grandma, bless her soul,” examples) and the creativity in writing the exercises. This creativity in writing will keep students more engaged with the book content. The examples are clear and short to the point.

The textbook is consistent in terminology and framework. The terms use in each chapter are consistent across the chapters. It is recommended to include a section (e.g. appendix) for key terms & definitions.

The chapters are organized and divided into subsections/subtopics with objectives that support the overall chapters’ objectives. These objectives that are listed at the beginning of each topic are very helpful to assess students’ knowledge. The examples provided in each chapter can be used by instructors to explain the topic in each chapter and to measure the achievements of specific objectives. Some of the features that I like in this textbook are: “key takeaways” sections summarize important points in the topic/chapter; “Suggested Reading” sections provide resources and links to be used for more information; “Stop and Think Box” sections provide discussion topics that make students think about the big picture of the chapter; and “exercises” sections can be used to assess students’ knowledge regarding specific chapter/topic objectives.

Excellent. The logical organization of the chapters made the topics presented more appealing and interesting to students. The book organized using components such as: topics objectives, explanations, examples, key takeaways, Stop and Think Box, and exercises. All these components made the structure of the book easy to follow.

Very good. I found no issues. For future improvements, it would be helpful if special techniques or applications used for writing equations. For example, the equation on page 63 “FV = PV(1 + i) n” it should be PV = FV/(1 + i) ^ n as it is summarized in “key takeaways” on page 66. Also, it is recommended separating the examples giving from the discussion or the explanation. It could be the explanation and discussion first and then section with “example X.X” heading to show an example.

No grammar issues found.

The text is not culturally insensitive or offensive in any way. The examples and topics provided are applicable in any country and for any cultural environment.

This is a good textbook that covers theory and application of the economic analysis. The book structure and the writing style made the topics easy to understand by students. It is highly recommended to be used for introductory and intermediate economy classes. The examples and exercises provided are excellent to be used as in-class activities and homework assignments.

Table of Contents

- Chapter 1: Money, Banking, and Your World

- Chapter 2: The Financial System

- Chapter 3: Money

- Chapter 4: Interest Rates

- Chapter 5: The Economics of Interest-Rate Fluctuations

- Chapter 6: The Economics of Interest-Rate Spreads and Yield Curves

- Chapter 7: Rational Expectations, Efficient Markets, and the Valuation of Corporate Equities

- Chapter 8: Financial Structure, Transaction Costs, and Asymmetric Information

- Chapter 9: Bank Management

- Chapter 10: Innovation and Structure in Banking and Finance

- Chapter 11: The Economics of Financial Regulation

- Chapter 12: Financial Derivatives

- Chapter 13: Financial Crises: Causes and Consequences

- Chapter 14: Central Bank Form and Function

- Chapter 15: The Money Supply Process and the Money Multipliers

- Chapter 16: Monetary Policy Tools

- Chapter 17: Monetary Policy Targets and Goals

- Chapter 18: Foreign Exchange

- Chapter 19: International Monetary Regimes

- Chapter 20: Money Demand

- Chapter 21: IS-LM

- Chapter 22: IS-LM in Action

- Chapter 23: Aggregate Supply and Demand and the Growth Diamond

- Chapter 24: Monetary Policy Transmission Mechanisms

- Chapter 25: Inflation and Money

- Chapter 26: Rational Expectations Redux: Monetary Policy Implications

Ancillary Material

About the book.

The financial crisis of 2007-8 has already revolutionized institutions, markets, and regulation. Wright's Money and Banking V 2.0 captures those revolutionary changes and packages them in a way that engages undergraduates enrolled in Money and Banking and Financial Institutions and Markets courses.

Minimal mathematics, accessible language, and a student-oriented tone ease readers into complex subjects like money, interest rates, banking, asymmetric information, financial crises and regulation, monetary policy, monetary theory, and other standard topics. Numerous short cases, called "Stop and Think" boxes, promote internalization over memorization. Exercise drills ensure basic skills competency where appropriate. Short, snappy sections that begin with a framing question enhance readability and encourage assignment completion.

The 2.0 version of this text boasts substantive revisions (additions, deletions, rearrangements) of almost every chapter based on the suggestions of many Money and Banking instructors.

Some specific highlights are: Chapter 11 now contains enhanced descriptions of recent regulatory changes, including Dodd-Frank, Chapter 12 is an entirely new chapter on derivatives covering forwards, futures, options, and swaps that also including comprehensive treatment of the causes and consequences of financial crises, and Chapter 14 has updated discussions of the Federal Reserve's monetary policy tools, including paying interest on reserves, and the structure and leadership of the European Central Bank.

Recent financial turmoil has increased student interest in the financial system but simultaneously threatens to create false impressions and negative attitudes. This up-to-date text by a dynamic, young author encourages students to critique the financial system without rejecting its many positive attributes. Peruse the book online now to see for yourself if this book fits the needs of your course and students.

This textbook has been used in classes at: Augustana College, Central Michigan University, Florida State University, Lyndon State College, Princeton University, Rutgers University, University of Southern Maine, Western Oregon University., Westminster College.

About the Contributors

Robert E. Wright was born in 1969 in Rochester, New York, to two self-proclaimed factory rats.

"I recall little of my earliest days except the Great Inflation and oil embargo, which stretched the family budget past the breaking point. The recession in the early 1980s also injured my family’s material welfare and was seared into my brain. My only vivid, noneconomic memories are of the Planet of the Apes films (all five of them!) and the 1972 Olympics massacre in Munich; my very young mind conflated the two because of the aural similarity of the words gorilla and guerilla.

After taking degrees in history from Buffalo State College (B.A., 1990) and the University of Buffalo (M.A., 1994; Ph.D., 1997), I began teaching a variety of courses in business, economics, evolutionary psychology, finance, history, and sociology at Temple University, the University of Virginia, sundry liberal arts colleges, New York University’s Stern School of Business, and, since 2009, Augustana College (the one in South Dakota, not the one in Illinois), where I am additionally the director of the Thomas Willing Institute for the Study of Financial Markets, Institutions, and Regulations. I’ve also been an active researcher, editing, authoring, and coauthoring books about the development of the U.S. financial system (Origins of Commercial Banking, Hamilton Unbound, Wealth of Nations Rediscovered, The First Wall Street, Financial Founding Fathers, One Nation Under Debt), construction economics (Broken Buildings, Busted Budgets), life insurance (Mutually Beneficial), publishing (Knowledge for Generations), bailouts (Bailouts), public policy (Fubarnomics), and investments (The Wall Street Journal Guide to the 50 Economics Indicators That Really Matter). Due to my unique historical perspective on public policies and the financial system, I’ve also become something of a media maven, showing up on NPR and other talk radio stations, as well as various television programs, and getting quoted in major newspapers like the Wall Street Journal, New York Times, Chicago Tribune, and the Los Angeles Times. I publish op-eds and make regular public speaking appearances nationally and, increasingly, internationally. I am also active in the Museum of American Finance and sit on the editorial board of its magazine, Financial History.

I wrote this textbook because I strongly believe in the merits of financial literacy for all. Our financial system struggles sometimes in part because so many people remain feckless financially. My hope is that people who read this book carefully, dutifully complete the exercises, and attend class regularly will be able to follow the financial news and even critique it when necessary. I also hope they will make informed choices in their own financial lives."

Contribute to this Page

- Search Search Please fill out this field.

What Is Monetary Theory?

Understanding monetary theory, types of monetary theories.

- Modern Monetary Theory (MMT)

The Bottom Line

Monetary theory: overview and examples of the economic theory.

Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle.

:max_bytes(150000):strip_icc():format(webp)/daniel_liberto-5bfc2715c9e77c0051432901.jpg)

Ammar Mas-Oo-Di / EyeEm / Getty Images

Monetary theory is based on the idea that a change in money supply is a key driver of economic activity. It argues that central banks, which control the levers of monetary policy, can exert much power over economic growth rates by tinkering with the amount of currency and other liquid instruments circulating in a country's economy.

Key Takeaways

- Monetary theory posits that a change in money supply is a key driver of economic activity.

- A simple formula, the equation of exchange, governs monetary theory: MV = PQ.

- The Federal Reserve (Fed) has three main levers to control the money supply: the reserve ratio, discount rate, and open market operations.

- Money creation has become a hot topic under the “Modern Monetary Theory (MMT)" banner.

According to monetary theory, if a nation's supply of money increases, economic activity will rise, too, and vice versa. A simple formula governs monetary theory: MV = PQ.

M represents the money supply, V is the velocity (number of times per year the average dollar is spent), P is the price of goods and services, and Q is the number of goods and services. Assuming constant V, when M is increased, either P, Q, or both P and Q rise.

General price levels tend to rise more than the production of goods and services when the economy is closer to full employment . When there is slack in the economy, Q will increase at a faster rate than P under monetary theory.

In many developing economies, monetary theory is controlled by the central government, which may also be conducting most of the monetary policy decisions. In the U.S., the Federal Reserve Board (FRB) sets monetary policy without government intervention.

The FRB operates on a monetary theory that focuses on maintaining stable prices (low inflation), promoting full employment, and moderating long-term interest rates so the country can achieve steady growth in gross domestic product (GDP) .

The idea is that markets function best when the economy follows a smooth course, with stable prices and adequate access to capital for corporations and individuals.

In the U.S., it is the job of the FRB to control the money supply. The Federal Reserve (Fed) has three main levers:

- Reserve ratio : The percentage of reserves a bank is required to hold against deposits. A decrease in the ratio enables banks to lend more, thereby increasing the supply of money.

- Discount rate : The interest rate the Fed charges commercial banks that need to borrow additional reserves. A drop in the discount rate will encourage banks to borrow more from the Fed and therefore lend more to its customers.

- Open market operations (OMO) : OMO consists of buying and selling government securities. Buying securities from large banks increases the supply of money while selling securities contracts the money supply in the economy.

Monetary Theory vs. Modern Monetary Theory (MMT)

The core tenets of monetary theory have attracted plenty of support under the “ Modern Monetary Theory (MMT) " banner.

The likes of Alexandria Ocasio-Cortez and Bernie Sanders have been championing money creation, describing it as a useful economic tool, while disputing claims that it leads to currency devaluation, inflation, and economic chaos.

MMT posits that governments, unlike regular households, should not tighten their purse strings to tackle an underperforming economy. Instead, it encourages them to spend freely, running up a deficit to fix a nation’s problems.

The idea is that countries such as the U.S. are the sole issuers of their own currencies, giving them full autonomy to increase the money supply or reduce the effect of expansionary monetary policy through taxation.

Because there is no limit to how much money can be printed, the theory argues that there is no way that countries can default on their debts.

Criticisms of Monetary Theory

Not everyone agrees that boosting the amount of money in circulation is wise. Some economists warn that such behavior can lead to a lack of discipline and, if not managed properly, cause inflation to spike, eroding the value of savings, triggering uncertainty, and discouraging firms from investing, among other things.

The premise that taxation can fix these problems has also come under fire. Taking more money from paychecks is a deeply unpopular policy, particularly when prices are rising, meaning that many politicians are hesitant to pursue such measures.

Critics also point out that higher taxation will end up triggering a further increase in unemployment , destroying the economy even more.

Japan is often cited as an example. The country has run fiscal deficits for decades now, with mixed results. Critics regularly point out that continual deficit spending there has forced more people out of work and done little to boost GDP growth.

What Is the Difference Between Keynesian Economics and Monetary Theory?

Keynesian economics focuses on fiscal policy to control the economy; that is, how the government spends its money and determines taxes. Monetary theory believes that the money supply should be used rather than fiscal policy to control the economy.

What Is a Drawback of Monetarism?

As monetarism takes into account the money supply to control the economy, one of its drawbacks is that it does not factor in aspects of "money," such as stocks and bonds, which can alter how people react to changes in the money supply.

What Is the Monetary Base?

The monetary base is the amount of money/cash circulating in an economy, which consists of two parts: currency in circulation and bank deposits.

Monetary theory works on the principle that changes in the money supply can impact economic activity. Central banks, such as the Federal Reserve, can use tools to control inflation and either promote growth or slow down the economy, depending on what is needed.

Critics call for caution when utilizing the money supply to impact the economy, stating that it causes inflation spikes, which would devalue savings, creating uncertainty in the economy.

Federal Reserve Bank of St.Louis. " Market Liquidity and the Quantity Theory of Money ."

Federal Reserve Bank of New York. " Monetary Policy Implementation ."

Feinman, Joshua N. " Reserve Requirements: History, Current Practice, and Potential Reform ." Federal Reserve Bulletin , June 1993, pp. 570.

Sumner, Scott. "Understanding Modern Monetary Theory: Part 1 ." The Library of Economics and Liberty , February 2021.

:max_bytes(150000):strip_icc():format(webp)/InvestinginJunkBoxes-56ade3bf3df78cf772b83f0f.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

What is Money?

Functions of money, properties that money must meet, related readings.

A unit of measure that is generally accepted and recognized as a medium of exchange in the economy

Money refers to any verifiable record that is accepted as a medium of exchange for payment of goods and services and repayment of debts in a specific country. Throughout history, governments adopted different forms of money, such as gold, silver, coins, and banknotes.

The value of money is not necessarily derived from the materials used in its production, but from the willingness of consumers to agree to a displayed value and agree to use this value in future transactions. For money to be accepted as a form of payment in a country, the government must declare the currency as a legal tender for use in financial transactions.

- Money is defined as a unit of measure that is generally accepted and recognized as a medium of exchange in the economy.

- For a commodity or currency to be recognized as money, it must be fungible, stable, recognizable, portable, and durable.

- Different countries around the world use their own monetary systems, which are regulated by a central monetary authority.

The following are the main functions of money:

1. Medium of exchange

The primary function of money is to be a medium of exchange. It means that money serves as an intermediary instrument in the acquisition of goods and services . The basic assumption of designating money as a medium of exchange is that one cannot acquire a good or service without providing the other party with something of material importance in exchange.

2. Store of value

For money to serve as a store of value, it should be reliably saved for future use and be used as a medium of exchange when it is retrieved. As a store of value, money can be used to store value obtained through current production processes or trade activities for use at a future date.

Traders can store the value of the goods to trade them at a future time and/or different location. Therefore, money makes it possible to save for the future, and participate in transactions in different geographical locations.

3. Measure of value

Money is employed as a measure of value in the market to determine the actual value of specific goods and/or services. A unit of account is required when formulating legal agreements that involve debt. Therefore, money acts as a standard measure of trade, and it is used as a basis for making trading quotations and bargaining for better prices in transactions.

4. Standard of deferred payment

A standard of deferred payment is considered one of the accepted methods of settling debts. For example, Person A can lend Person B an amount equivalent to $10,000 for one year, with an agreement to repay the loaned amount after the expiry of one year. The stored value in the sum loaned to Person B is transferred from Person A in exchange for an agreed amount of stored value at a future date.

Person B can then use the loaned funds to purchase other goods and services in exchange for repayment at a future date. It, in essence, means that Person A loaned the use of the goods and services that Person B purchased, even though he did not originally own the goods and services.

For a currency or commodity to be recognized as money, it must meet the following properties:

1. Fungibility

Fungibility refers to the property of a commodity whose individual units should be interchangeable with each other, and the units should be distinguishable from each other. If individual units of the same commodity come in different quantities, it means that the commodity will not be consistent when used in future transactions.

For example, diamonds are not perfectly fungible because of their varying sizes, colors, grades, and cuts. Nevertheless, the U.S. dollar is perfectly fungible, and $10 is interchangeable with two $5s or ten $1s.

2. Durability

Money should be durable enough to withstand repeated usage and retain its usefulness for use in future transactions. The commodity or currency should remain functional, without requiring frequent maintenance or repair over its lifetime. If the commodity is not durable, it will degrade quickly with repeated use, and it will not be useful for future transactions.

3. Portability

Money should be divisible into small quantities so that consumers can carry different quantities of the commodity with ease. It should be convenient for consumers to carry smaller quantities of the commodity when purchasing goods and services from retail stores. If the commodity is immovable or indivisible, consumers will have to incur additional costs to physically transport the commodity.

4. Recognizable

The commodity used as money should be easily identifiable so that users agree on its authenticity and quantity. It makes transactions easier because both parties in the transaction agree to the terms of exchange without incurring additional costs of paying to verify the authenticity of the goods by all parties in the exchange.

When the commodity is non-recognizable, the parties in the transaction will incur transaction costs to verify its authenticity and distinguish between real money and counterfeit money.

5. Stability

The value placed on the commodity against other goods that it trades with should be relatively stable. The commodity’s value should either be consistent or gradually increasing over time. A commodity whose value fluctuates frequently is unsuitable since it will create value disparities when used as a measure of value and a medium of exchange. An unstable commodity will require frequent re-evaluation to determine its actual value in successive transactions.

CFI is the official provider of the Commercial Banking & Credit Analyst (CBCA)™ certification program, designed to transform anyone into a world-class financial analyst.

In order to help you become a world-class financial analyst and advance your career to your fullest potential, these additional resources will be very helpful:

- Capital Markets

- Digital Wallet

- How the Government Makes Money

- Virtual Currency

- See all economics resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Faculty Resources

Assignments.