How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry.

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

Are you an agency specialized in UX, digital marketing, or growth? Join our Partner Program

Learn / Guides / Data analysis for marketers

Back to guides

How to use data analysis methods and techniques to create customer-centric marketing campaigns

Putting on your creativity cap to strategize a new marketing campaign is exciting—but what makes your hard work really feel worth it is when it resonates with your audience and performs well.

While some marketers might be lucky enough to find a winning formula on the first try, you need to use data analysis methods to guide your campaign strategy.

Last updated

Reading time.

Putting customers at the center of your decision-making through data analysis helps you create relevant campaigns that connect with your audience and hit KPI goals. This guide reviews five data analysis methods marketers need to make informed decisions .

The types of data analysis a marketer uses depend on what you want to learn and which data type you have. Marketers use quantitative data—like website traffic totals—and qualitative data—like customer interview transcripts—in data analysis. There are also times when you should combine quant and qual data.

Five data analysis methods marketers use include

Descriptive analytics to summarize quantitative data

Inferential analysis to create and test customer hypotheses

Regression analysis to compare the relationship between variables

Content analysis to quantify text-based insights

Predictive analysis to anticipate trends and learn about customer behavior

5 popular data analysis methods for marketers

Marketers use data analytics to review performance, prioritize campaign updates, and understand customers. As you’ll see in the data analysis techniques below, the method you choose depends on what you learn and the data you collect.

The types of data marketers most commonly use are:

Now that you know the different types of information marketers collect, use the methods below in your data analysis process to get the best results, prioritize product updates, and inform your business decisions.

1. Descriptive analysis

When you want to measure what happened in the past, use descriptive analytics . This data analysis method summarizes quantitative data results, like how many likes a social media post got or your newsletter sign-up rate . Popular descriptive analysis methods include average, median, mode, and simply comparing survey response rates of a multiple-choice question.

How marketers use descriptive analysis:

Benchmark organic traffic each month to understand the impact of content marketing

Compare campaign engagement and conversion results to quarterly goals

Use surveys to measure how prevalent a goal or problem is in your customer base

Benefits and challenges of descriptive analytics:

Many people have some experience with straightforward analysis methods like calculating an average or ranking percentage response, which makes this method quick to implement

Data collection becomes easy through existing web analytics or short surveys

Quantitative data is objective, which means there’s no room for differing interpretations

There are limitations to descriptive analytics:

The process measures an outcome but doesn’t describe why customers chose the response or behaved a certain way

You may lack context about a problem if you only look at one particular data point

You need enough data points to have statistical significance if you want to apply decisions to your entire audience confidently

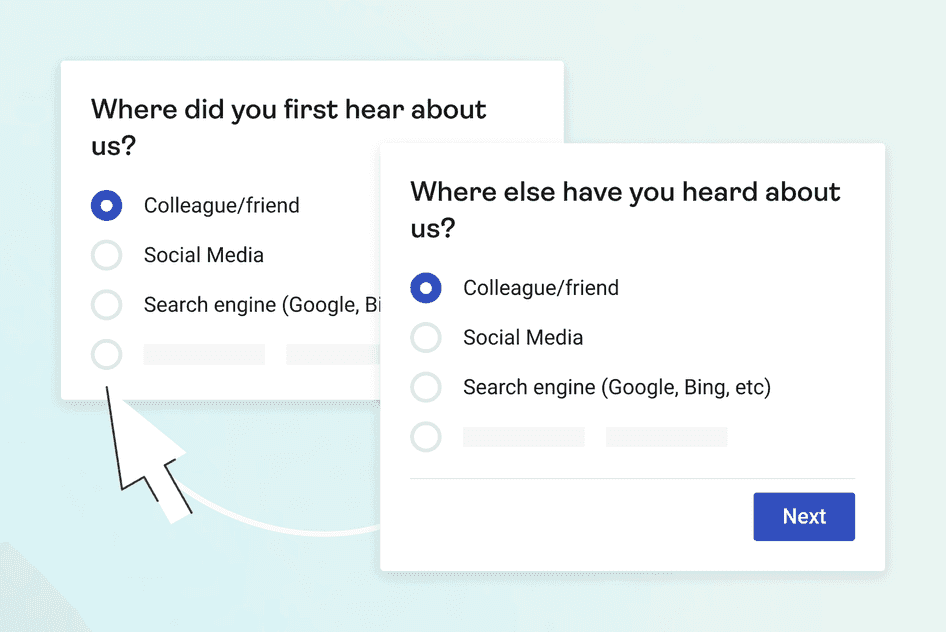

❓ Pro tip: use premade survey questions to easily collect customer feedback.

Asking your audience questions with multiple-choice surveys is a great way to collect quantitative data—assuming you ask the right questions. Your research questions need to be specific enough to get relevant data but not so detailed that you accidentally lead customers to the answer you want to hear.

Use premade survey questions and leverage Hotjar AI to generate survey questions based on your goals to collect the right data.

Here are some survey questions marketers can use:

Where did you first hear about us?

Where else did you hear about us?

What do you use our product/service for?

Which industry does your company belong to?

How relevant is the content you found on our website?

What was your first impression of our product?

Browse 30+ ready-to-use survey templates .

Traffic attribution surveys reveal every channel customers hear about you through, instead of only seeing the referral source of your website analytics

2. Inferential analysis

Sometimes, you have a hunch but want to back up your ideas with data. Inferential analysis lets you hypothesize about your customers’ preferences and motivations by using a mix of multiple quantitative or qualitative data points . You create an inference by stacking insights observed at the same time.

For example, an Engagement Zone heatmap combines interaction data on a website page—like clicks and scrolling—to highlight the elements visitors engage with the most. If your heatmap reveals that a particular image or headline draws visitors in, you can use it in a future campaign to test if it drives engagement across other channels.

How marketers use inferential analysis:

Ask multiple questions in a customer interview and combine common themes to create a product narrative

Research customer preferences or priorities between item categories with surveys

Compare on-page customer feedback from different referral sources to learn about your audience coming from each traffic source

Benefits and challenges of inferential analysis:

Comparing customer responses across multiple questions or touchpoints gives you a fuller understanding of user behavior

Weighing customer responses based on specific conditions—like customer segments with the highest average order value—helps you prioritize which feedback and suggestions to implement

Creating hypotheses from actual customer interactions provides campaign ideas you may not have thought about before

There are drawbacks to inferential analysis:

Your hypothesis-building can be subjective, so look for multiple customer responses or data points that validate an assumption instead of relying on a single insight

You need to collect and manage multiple data sets, which can be time-consuming

An inference is an informed guess, so you still need to test your hypothesis with A/B testing

📹 Pro tip: follow up your A/B testing analysis with recordings.

Let’s say your A/B testing reveals that one campaign landing page far outperforms the other. Do you know why? Dig into why particular copy or design was so compelling using recordings —video playbacks of how visitors behaved on your site. Then, you can apply what you learned to future campaigns.

Hotjar Recordings lets you see what customers see

3. Regression analysis

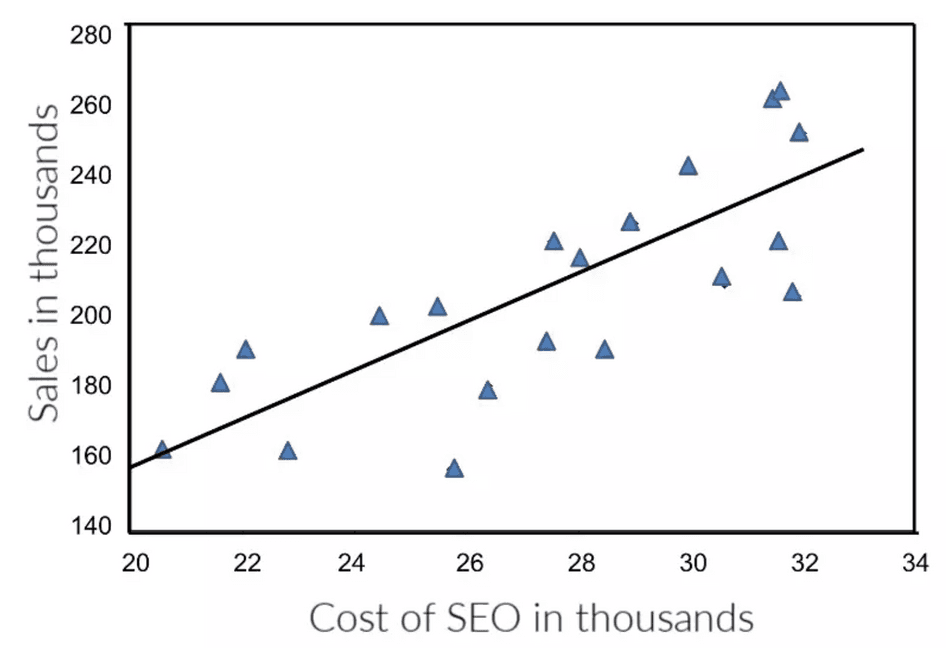

Regression analysis is a powerful statistical analysis method that measures the relationship between data points, like comparing whether increased marketing spending is related to more revenue . The basic process of regression analysis involves plotting your two variables on a chart and then seeing how far those points stray from the regression line. There's a correlation if the data sits close to the line.

Since regression analysis includes multiple variables and some equations, it’s common to use a spreadsheet add-in or a tool like Tableau or The R Project .

Linear regression analysis can help answer the question, ‘Does more SEO investment lead to more sales?’ Image via PracticalEcommerce

How marketers use regression analysis:

Discover which blogs shared on what social media channels resulted in the highest website traffic to update your social sharing strategy

Compare email engagement metrics to website sales to measure the potential impact of the channel

Learn which customer segment is happiest with your company and product through a survey to refine your targeting and messaging

Regression analysis benefits and challenges:

Measure how variables relate to one another to prove marketing impact

Evaluate what to do more of—for example, if you find a correlation between an investment or campaign and increased sales

Analyze large data sets using regression analysis tools and spreadsheets

There are downsides to regression analysis:

The process is a bit more complicated than simply checking your Google Analytics dashboard, so you’ll need a specialized tool or spreadsheet

Correlation isn’t causation, and you might not account for all potential variables that affect an outcome

A few outliers can easily skew results

4. Content analysis

Content analysis turns qualitative insights into quantifiable results to help you make conclusions about customer perspectives, perceptions, and motivations . For example, you can count how many open-ended survey question responses mentioned particular themes to rank their importance to your audience.

Pull content analysis data from open-ended surveys, recordings of real website interactions, interviews, reviews, testimonials, social comments, and brand mentions. You could even run a content analysis on competitor reviews to find what their customers dislike to position your brand against it.

How marketers use content analysis:

Compare repeating themes across customer interviews

Map the most common customer journey steps by watching recordings to learn how customers navigate your brand’s website before purchasing

Review testimonials to discover what stands out to customers to use in future campaigns

Benefits and challenges of content analysis:

You can pull from a wide range of data sources depending on what you already have access to and the time you have to research

Quantifying responses turns subjective responses into objective numbers

It’s easier to share customer response summaries with stakeholders than sharing multiple clips or large qualitative data sets

There are obstacles with content analysis:

Manual text analysis is slow, but there are tools like Lexalytics that help

There’s still some subjectivity involved since you decide how to group responses

Reducing long responses to simple ideas can leave valuable insights behind

🗂️ Pro tip: keep your insights organized with Hotjar.

Content analysis is time consuming (but impactful!) at the best of times, but you’ll quickly get confused without organization. Hotjar Highlights lets you save and share specific insights, like a high click rate on an image (from a heatmap) or a recording snippet from your newsletter page, to stay organized and collaborate with your team.

5. Predictive analysis

Predictive analytics anticipates future trends or analyzes customer behaviors with big data sets, predictive models, artificial intelligence (AI), and machine learning tools. In other words, it’s a bit advanced. However, marketers can unlock powerful insights, like when L’Oréal and Synthesio used AI to forecast beauty trends.

If you don’t want to work with a specialized agency or consultant, there are predictive analytics tools that help marketers without advanced data analysis skills pull insights from customer data.

How marketers use predictive analytics:

Uncover new customer segments based on small differentiating behaviors and psychographics

Find related products to recommend to customers based on past purchases for personalized experiences

Anticipate trends in your industry to create innovative campaigns

Benefits and challenges of predictive analytics:

You can review vast amounts of quantitative data faster than previously possible with technology like machine learning and AI

Nuanced customer insights and trend data give you a competitive advantage

Easily analyze customer behavior at scale, as opposed to manually reviewing a few interview transcripts

There are drawbacks to predictive analytics:

The output is only as good as the raw data input, so incomplete or inaccurate data within a large dataset can skew results

Collecting the volume and variety of data you need for predictive analytics can be time consuming

You’ll likely need to use a specialized tool or work with a data analyst

🚦 Pro tip: monitor customer behavior with Hotjar Trends.

Hotjar Trends lets you visualize your customer behavior metrics so you can spot trends easily.

For example, you can compare how customer segments interact with your pricing page to spot frustration or confusion that signals your marketing funnel needs an extra step. While trends don’t predict the future, continuous tracking gives you an early signal of wins or challenges.

Hotjar makes data visualization easy, with pie charts, line graphs, or bar graphs that give you a high-level understanding of user behavior

Combine data analysis with empathy to create effective campaigns

When you’re knee-deep in spreadsheets and up to your eyes in statistics, it’s easy to view customers as just numbers on the screen. Leading with empathy and curiosity will give you a new perspective on data analysis methods.

If you have a question, ask your customers in a survey. If you want to understand their motivations, chat with them in an interview. If you want to see how they move through your website’s marketing funnel, watch a recording of their behavior.

Your best strategies and campaigns come from a blend of data and humanity. Simply begin with a question or hypothesis and start investigating and analyzing.

Use customer-centric insights to drive your marketing campaigns

Hotjar’s tools give you a direct line to customers to learn about their goals, challenges, and preferences, so you create successful campaigns.

FAQs about data analysis methods for marketers

Why should marketers use data analytics.

Marketers use data analysis to review performance and understand customers, so they can create relevant campaigns.

What types of data do marketers use?

Marketers use numbers-based quantitative data, text-based qualitative data, or a combination of both for data analysis.

Which data analysis methods can marketers use?

Five data analysis methods marketers use are

Descriptive analytics

Inferential analysis

Regression analysis

Content analysis

Predictive analysis

Data analysis process

Previous chapter

Data analysis tools

Next chapter

How to do Market Analysis in 6 Easy Steps

Free Website Traffic Checker

Discover your competitors' strengths and leverage them to achieve your own success

Knowing how to do market analysis is pivotal for many roles, benefiting any organization, regardless of its size, scope, or sector.

Regular market analysis levels up your individual ability to spot potential opportunities, stay on top of current trends, and gives you insights into the competitive landscape .

This article will cover why you need to analyze a market frequently and shows you how to do a basic market analysis in 6 straightforward steps.

What is a market analysis?

Market analysis is the process of gathering data about a target market . It examines the competitive landscape, consumers, and conditions that impact the marketplace.

The benefits of market analysis

Here are eight reasons why a regular market analysis is beneficial:

- Understand the competitive landscape

- Spot trends in your market

- Uncover opportunities for growth or diversification

- Reduce either risk or cost for launching new products or services

- Develop a deeper understanding of a target audience

- Enhance marketing efforts or discover ways to change

- Analyze business performance within a market

- Identify new segments of a market to target

Why you should conduct a market analysis

Aside from the benefits we’ve already listed, reviewing and redoing your market analysis regularly is important . Here’s why.

- Markets shift

- Consumer behaviors change

- New players enter existing markets

- Disruptive technologies and enhancements to rival offerings can shift the landscape

- External events impact market conditions that drive changes

If you already know how to do market analysis, ask yourself how frequently you undertake the task: is it annually or quarterly? And consider the time it takes and the tools you used to obtain your information.

With this in mind, we’ll walk you through the most effective market analysis methods. Showing you the steps to take, with market analysis examples, to bring these steps to life.

How to conduct a market analysis

These six steps break down how to analyze a market into easy-to-follow, digestible stages.

Before you start: Use a framework to record your findings. There are plenty of visualization tools, but a basic excel sheet will be fine if you want to keep it simple. Why? Because when you return to review this analysis and repeat this exercise, you’ll want to have everything recorded in a single place. It will save you time and make any future comparisons easier.

Step 1 – Market segmentation

What: Whether you want to enter a new market , launch a new product, or simply assess opportunities for an existing business, this first step in the market analysis process is crucial yet often overlooked.

Why: Market segmentation helps you identify the core segments of a market to target. By identifying the portion of a market your products will be suitable for, you can accurately define the market size and better understand your potential customers’ specific needs and preferences.

How: There are multiple ways you can segment a market, and the right approach will depend on your product, its customers, and its target profiles.

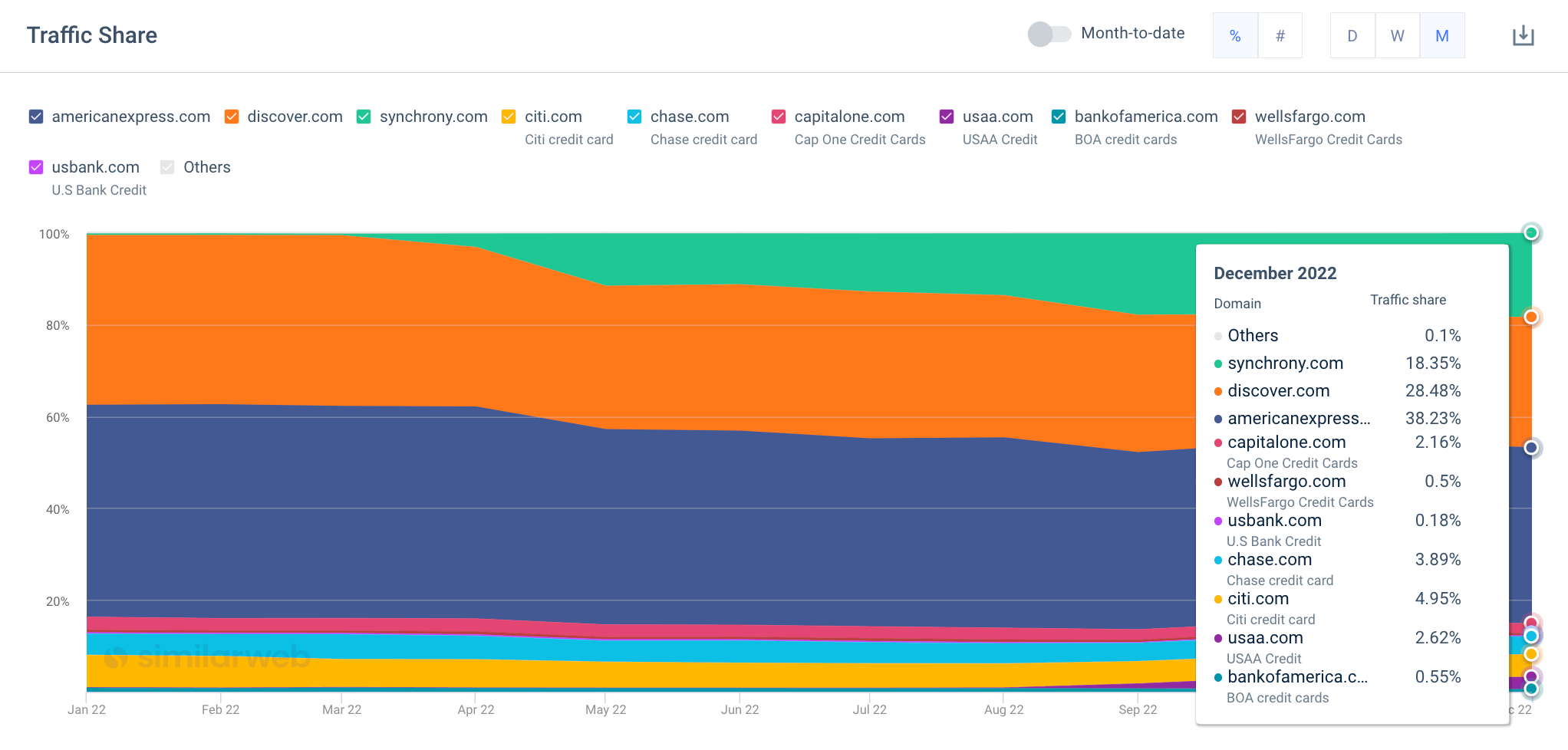

Here, we can see how a segment is built using Similarweb’s website segment feature. I specifically want to view the credit card sector in the US, a market made up of pure players (think Amex or Visa ) and individual players with credit card lines as one of their segments (think Wells Fargo or USAA ). By splitting up a market like this, I can analyze the areas of business I care about more for my market analysis.

So, instead of viewing data that encompasses the other lines of business the likes of Wells Fargo and the USAA handle, such as loans, I get to hone in on their credit card segments only.

This is just one example of market segmentation. You can also segment a market based on consumer needs, ideal consumer profiles, regions, and other demographic data.

Step 2 – Market sizing

What: Market sizing determines your target market’s potential volume or sales revenue. It’s an essential component of market analysis that uses either secondary or primary research to explore the actual size of the market you are in or wish to enter.

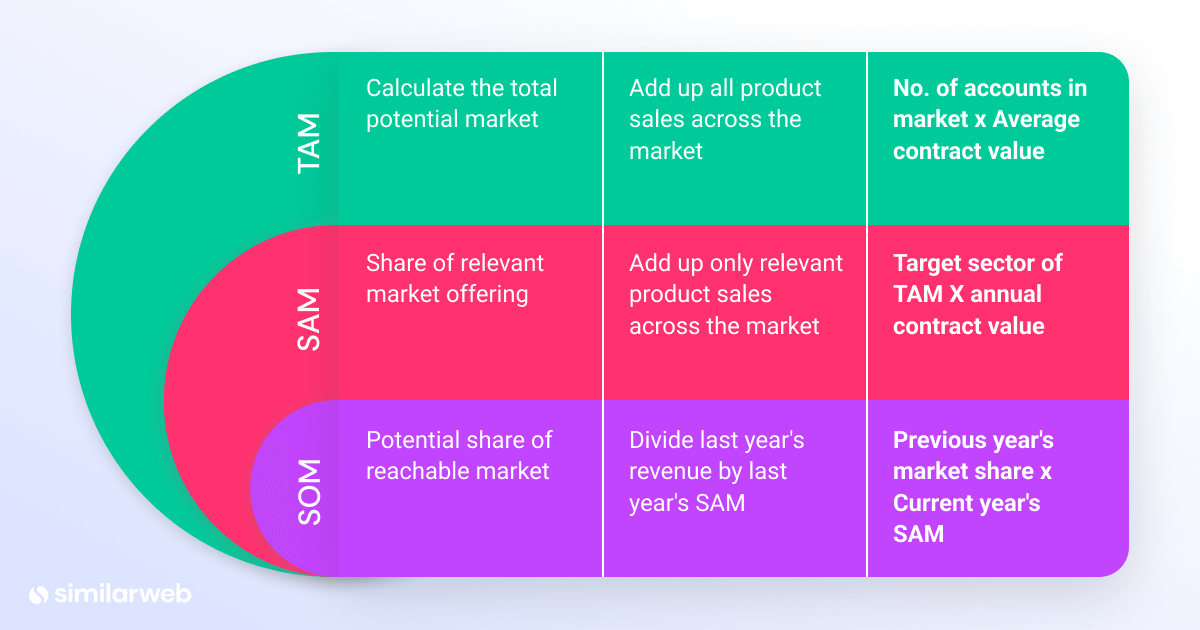

Total Addressable Market (TAM) – This gives you the complete value of the overall market and the first step in the market sizing process . Let’s say we want to analyze the US credit card market, the TAM would account for the whole of this market. Service Addressable Market (SAM) looks at potential audience volumes for a product or service in a target region. Sticking with the credit card sector example, this could be the total value of the credit card business that specifically targets the ‘poor credit rating’ segment of this market. Share of Market (SOM) – Also known as ‘service addressable market,’ it represents the proportion of your SAM that you are likely to achieve. SOM is always lower than SAM, taking a range of estimates based on the previous year’s performance or current market share + project growth to arrive at this figure.

Why: Market sizing helps businesses understand the size of their opportunity. By understanding the size and scope of a market, companies can better assess the potential profitability of the market. Tracking market share over time can also show who wins or loses at any given time.

Power-up Your Market Analysis with Similarweb Today

Market analysis example: market sizing

Using a metric known as traffic share , we can estimate the potential market size by showing the total reachable audience you have or could have with a product or service.

Using Similarweb Industry Analysis , I can see a real-time snapshot of my market’s performance. With it, I can see the total number of people in a market (unique visitors) and establish how much of that share I have or will target this year.

When sizing a market, it’s easy to fall into the habit of analyzing the market quarterly or annually. But often, the best insights are dynamic in nature. They appear to show shifts, sometimes unexpectedly or can indicate growth and changing behaviors as the year progresses. This is why we place a high emphasis on continuing a market analysis throughout the year.

Here, we’re looking at traffic share changes over time using Similarweb’s market trends. You can see the impact of Snychrony’s growth (in green) as they gain traction, along with USAA (purple). At the start of the year, these two players had no impact on the market. By the end of 2022, they’re showing gains and would be two key competitors to track when you reach step 4 of the market analysis process.

Those analyzing a market annually would miss out on key insights that show the rise of these two emerging players. At the end of the year, they’ve already grabbed a chunk of the market and, if they continue on the same trajectory, will continue to do so in 2023.

With the right tools, you get a dynamic view of the market data you need, allowing you to change tactics when markets shift.

Step 3 – Market trends

What: Reviewing current trends is key to any good market analysis. As we all know, trends can rise and fall at a moment’s notice. This is why this activity, in particular, is one you should routinely perform.

Why: Keeping a finger on the pulse can help you adapt and flex, at the right time, in the right way. Market trends give you insights into the current market situation and potential opportunities and challenges. Doing so can help you identify areas for growth, spot potential risks, and plan effective strategies. Market trends can also provide valuable information about customer preferences, competition, and economic and technological developments. By monitoring these trends, businesses can stay ahead of the curve and make informed decisions that will benefit their bottom line.

You may have heard about ChatGPT in the press ; this is an example of a highly-disruptive technology that has the potential to completely shift an entire market; many, in fact. It managed to gain over 1 million users within its first week on the market. And it’s a great example of why regular market trends analysis should occur.

How: There are lots of ways new market trends can surface. Consumer behavior , economic trends, technological advancements, and the competitive landscape can impact how markets behave. Legal and regulatory changes can also influence trends and changes too.

Staying up to date with industry news and legislation changes is useful. But it takes time, and it’s not always the most effective way to know when consumer sentiment changes.

Market research surveys are one way to understand customer attitudes and needs and how they shift over time. However, it’s not the most effective way to inform your market analysis. Particularly when you want real-time market intel.

Market analysis example: trend detection

Similarweb analyzes billions of data signals daily to deliver game-changing insights about any market, region, or individual company. So, as we look at how to do market analysis, I wanted to share a practical example of how clients use Similarweb to spot trends in a market.

Wonderbly , a global business, provides personalized books, serving over 6 million customers. To grow its business, it conducts regular market analysis. As part of this process, they analyzed seasonal trending keywords within Similarweb. Let’s look at what it found out and how it impacted the business.

Wonderbly was able to spot an emerging category (anniversaries and weddings) that was not currently catered for within its own product set. In addition to being able to capitalize on seasonal trends in its market, it achieved a 69% revenue in books purchased by a more mature demographic and a completely new audience for its business.

Read more: Wonderbly’s market analysis success story .

Step 4 – Competitive analysis

What: A competitive analysis involves collecting and reviewing data about key industry players, rivals, or emerging stars in your market. It unpacks and tracks their activities and successes, letting you see what’s working, how they go to market and the various marketing strategies they use to attract and retain customers.

Why: Regardless of your size or scope, understanding the competitive landscape is key. Your target audience knows your competitors and will likely size up the pros and cons of buying from thesm before considering whether to do business with you. A robust competitive analysis can help you refine your own offerings, make informed pricing decisions, show where you can beat out your rivals, and identify areas for improvement or diversification.

How: A tried and trusted tool for this process is the well-known SWOT analysis . It lets you map and view what and how each competitor takes its products to market. Considering things like pricing, positioning, marketing, services, and more. A competitive matrix is another tool used to visualize data about rivals in a market.

To do it, download our free competitive analysis framework . Then, pick five competitors in your market to track. Complete each section, and analyze the results to discover your biggest opportunities.

Step 5 – Develop strategies

What: Use the results of your market analysis to make data-driven decisions .

Why: When you read a post about how to do market analysis, the chances are you’ve got a goal in mind. Perhaps you want to explore a new market before deciding if it’s ripe for entry. You may want to introduce a new product or service or acquire an existing company. Whatever your goal is, ensure you put the insights and data you’ve obtained to good use.

How: Create a list of potential opportunities, then build strategies around each. Here, you might evaluate potential ideas based on project costs or timeframes. Once you’ve clearly mapped out each opportunity, and understand the potential impact it will have, along with associated costs and timeframes, you can think strategically about which ideas to move forward with from both a short and long-term perspective.

Pro Tip: Use a framework to record, capture, and review the data you’ve collected about market segmentation, size, trends, and key competitors. You can draw inspiration from our downloadable competitive analysis frameworks. However, what’s key is that you systematically record your findings and review them regularly.

Step 6 – Monitor the market

What: Keep track of your market and its key players; monitor changes over time.

Why: We know markets shift, whether they’re impacted by consumer behaviors, external factors, or something else. So, it’s important to monitor changes over time.

How: We may be a little biased, but Similarweb gives you a real-time bird-eye view of your market. Letting you dive into the details and unpick changes and tactics whenever you need. With it, you can track key growth metrics, marketing channels, emerging players, trending topics , and much more.

Using the Industry Analysis tab in Similarweb Research Intelligence , I can identify the market leaders and rising stars quickly. Here, I immediately see a company to track, Synchrony . As an emerging player showing exponential growth (2700%), I’ll take my market analysis a step further by investigating their successes later.

Similarweb shows me key insights, such as website traffic , the marketing channels it’s getting traffic from, audience demographics , geography , organic search insights, and more. As part of any good market analysis, the ability to spot rising players and unpack their successes can be crucial, particularly when they’re showing such growth.

Analyzing a market: Conclusions

Learning how to do market analysis is the first step. Aside from analyzing the results and making key strategic decisions, the ability to track changes over time is key. Similarweb makes it easy to segment, size, and analyze a market fast. With it, you can spot opportunities, benchmark your performance, and monitor shifts and changes as they happen, not a month or quarter later.

What are the 4 types of market analysis?

The four types of market analysis are market segmentation, market sizing, market trends, and competitive analysis.

What are the five components of market analysis?

The five components of market analysis are: customer segmentation , customer needs and trends, competitors, market size and trend, and pricing.

What makes a good market analysis?

A good market analysis should include accurate, up-to-date data, clear objectives, and a thorough market and customer needs analysis.

Is market analysis the same as a SWOT analysis?

No, market analysis and SWOT analysis are not the same. While a SWOT analysis evaluates an organization’s strengths, weaknesses, opportunities, and threats, a market analysis focuses on the external environment, such as customer needs, market trends, and competitors.

by Liz March

Digital Research Specialist

Liz March has 15 years of experience in content creation. She enjoys the outdoors, F1, and reading, and is pursuing a BSc in Environmental Science.

Related Posts

Importance of Market Research: 9 Reasons Why It’s Crucial for Your Business

Audience Segmentation: Definition, Importance & Types

Geographic Segmentation: Definition, Pros & Cons, Examples, and More

Demographic Segmentation: The Key To Transforming Your Marketing Strategy

Unlocking Consumer Behavior: What Makes Your Customers Tick?

Customer Segmentation: Expert Tips on Understanding Your Audience

Wondering what similarweb can do for your business.

Give it a try or talk to our insights team — don’t worry, it’s free!

- Technical Support

- Technical Papers

- Knowledge Base

- Question Library

Call our friendly, no-pressure support team.

Data Analytics in Marketing Research: Definition, Types, Process, and More

Data Analytics is a critical function affecting all aspects of the business. This article covers broad data analytic topics for those new to the area of data analytics. At Sawtooth Software, we focus on marketing research and primary data collection through survey research, so this article specifically calls out the use of data analytics in marketing sciences.

Before diving deep into the breadth of data analytics, let’s summarize key takeaways you will gain from this guide:

|

|

|

|---|---|

| What is Data Analytics? | Definition and significance of transforming raw data into actionable insights. |

| Data Analytics vs. Data Science | Understanding the differences and complementary roles of data analytics and data science. |

| Types of Data Analysis | Overview of descriptive, diagnostic, predictive, and prescriptive analytics with practical examples. |

With that introduction, let’s dive deeper into the field of Data Analytics .

Table of Contents

What Is Data Analytics?

At its core, Data Analytics involves the computational analysis of data or statistics. Data can involve numeric values, text, graphics, video or audio files. The value of data analytics lies in its ability to transform vast amounts of raw, often unstructured data into actionable insights. These insights can then guide decision-making, optimize operations, and unveil opportunities for innovation.

Consider a retail business that leverages data analytics to understand customer purchasing patterns, preferences, and behaviors. By analyzing sales data, customer feedback, social media trends, along with primary survey data, the business can tailor its product offerings, improve customer service, predict future trends, and optimize products and pricing for new or existing products. This practical application underscores the transformative power of data analytics in driving business strategy and growth.

Data Analytics vs. Data Science

While often used interchangeably, Data Analytics and Data Science involve nuanced differences, with complementary roles within an organization. Data Analytics focuses on processing and performing statistical analysis on existing datasets. In contrast, Data Science typically involves heavier programming, developing algorithms, and model-building to derive additional insights to solve complex problems and predict future outcomes. Data scientists often leverage machine learning and AI (Artificial Intelligence) in building algorithms, models, and applications.

The impact of both fields on Decision-Making is important. Data analytics provides a more immediate, focused insight primarily aimed at enhancing operational efficiency and answering specific questions. Data Science, on the other hand, dives deeper into predictive analysis, machine learning, and AI to forecast future trends and behaviors.

Marketing Research Consulting

Need help with your research study? Contact our expert consulting team for help with survey design, fielding, and interpreting survey results.

Contact Our Consulting Team

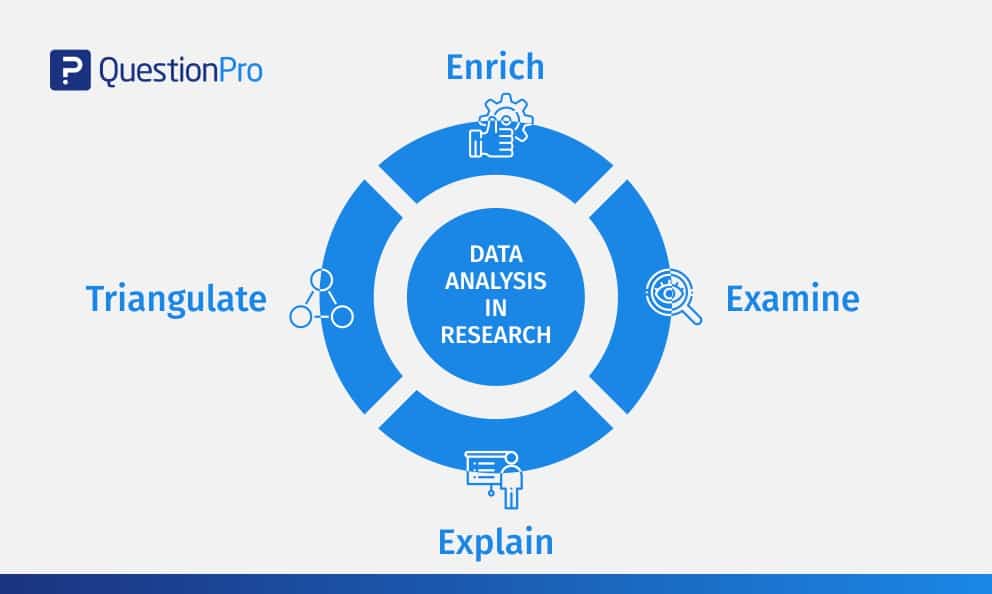

Types of Data Analysis

Data Analysis can be broadly categorized into four main types, each serving a unique purpose in the data analytics landscape. Understanding these types helps you to apply the right analytical approach to your data to derive meaningful conclusions and strategies.

Descriptive Analytics

This type of analytics focuses on the “what” and is the most basic and commonly used. For market research surveys, descriptive analytics summarizes responses to demographic, psychographic, attitudinal, brand usage data, and the like. For historical data, it aims to provide a clear picture of what has happened in the past by summarizing such things as sales data, operations data, advertising data, and website click traffic. Descriptive analytics answers the "What happened?" question by analyzing key performance indicators (KPIs) and metrics. For example, a business might use descriptive analytics to understand its sales trends, customer engagement levels, or production efficiencies over the past year.

Diagnostic Analytics

Moving beyond the “what” to understand the “why,” diagnostic analytics involves a deeper dive into data to examine patterns of association or correlation, with the hope to uncover root causes of attitudes, preference, events or trends. It employs techniques such as correlation analysis, t-tests, chi-square tests, key drivers analysis, and tree-based analysis (such as CART or random forests). For customer satisfaction research key drivers analysis tries to explain how overall customer satisfaction or loyalty can be improved by improving the features or elements of the product or service delivery. An organization might also leverage diagnostic analytics to identify why certain groups of respondents are more likely to be price sensitive or why customer churn increased in a specific period.

Predictive Analytics

This forward-looking analysis leverages data and models that can predict future outcomes. Conjoint analysis is a widely used predictive analytics approach for studying how changes to product features and prices affect demand. MaxDiff (best-worst scaling) is often used to assess which product claims will likely increase new product trial, or which side effects would most discourage patients from undergoing a cancer treatment therapy. Machine learning algorithms such as random forests can score a database to predict which customers are most likely to be receptive to an offer. As another example, a financial institution might use predictive analytics to assess the risk of loan default based on a customer's credit history, transaction data, and market conditions.

Prescriptive Analytics

An advanced form of analytics, prescriptive analytics, goes a step further by recommending actions you can take to affect desired outcomes. It not only predicts what will happen but also suggests various courses of action and the potential implications of each. This type of analytics is particularly valuable in complex decision-making environments. For example, a conjoint analysis market simulator leveraging optimization search routines can determine the right mix of product features and price to reach a particularly valuable market segment .

Each of these types of data analysis plays a critical role in an organization's data-driven decision-making process, enabling businesses to understand their past performance, diagnose issues, create successful products and services, predict future trends, and make informed choices that align with their strategic objectives.

Data Analytics Real-World Example

Consider the case of a data analyst working for an e-commerce platform. By analyzing customer purchase history, the analyst identifies a trend of increased sales in eco-friendly products ( descriptive analytics , the “what”). A survey is designed and conducted to dig deeper into which customers are preferring eco-friendly products, why they prefer them, and for which usage occasions ( diagnostic analytics , the “why”). Within another market research survey, a conjoint analysis or MaxDiff study is included for determining the right product claims, product features, and pricing, targeted to which market segments to develop new products for sales growth ( predictive and prescriptive analytics ).

The role of a data analyst is dynamic and impactful, bridging the gap between data and strategic decision-making. It's a role that requires not only technical skills but also curiosity, creativity, and a keen understanding of the business landscape.

The Data Analysis Process

Breaking down a data analytics process into systematic steps can demystify the journey, making it more approachable and manageable. The Data Analysis Process is a structured approach that guides data analysts from the initial phase of understanding the business problem to the final stage of delivering actionable insights.

Step 1: Defining the Question

The first and perhaps most critical step in the data analysis process is defining the question . This involves understanding the business objectives, the decisions that need to be supported by the data, and the specific questions that the analysis aims to answer. A well-defined question not only provides direction for the analysis but also ensures that the outcomes are relevant and actionable.

Step 2: Collecting Clean Data

Data collection is the next step, where data analysts gather the necessary data from various sources. This could include internal databases, secondary sources of data, customer surveys, and more. Ensuring the cleanliness of the data is paramount at this stage; hence, data cleaning and preprocessing become essential tasks. This involves removing inaccuracies, inconsistencies, handling missing values, and trimming outliers to ensure the data is reliable and accurate for analysis. For market research surveys, this also involves identifying unreliable respondents, fraudulent respondents, and records completed by survey bots.

Step 3: Data Analysis and Interpretation

With clean data in hand, analysts proceed to the heart of the process: data analysis and interpretation . This involves applying statistical methods and analytical models to the data to identify patterns, trends, and correlations. The choice of techniques varies depending on the data and the questions at hand, ranging from simple descriptive statistics to complex predictive models.

Step 4: Data Visualization and Sharing Findings

Data visualization plays a crucial role in this phase, as it transforms complex data sets into visual representations that are easier to understand and interpret. Tools like charts, graphs, and dashboards are used to illustrate the findings compellingly and intuitively.

Finally, sharing the findings with stakeholders is an integral part of the data analysis process. This involves not just presenting the data, but also providing insights, recommendations, and potential implications in a clear and persuasive manner. Effective communication is key here, as the ultimate goal is to inform decision-making and drive action based on the data insights.

For product optimization and pricing research, market simulators from conjoint analysis can be even more useful to a decision-maker than charts and graphs. They allow the manager to test thousands of potential product formulations and prices, to find the right products to best reach target market segments.

Example Scenario

Imagine a data analyst working for a healthcare provider, tasked with reducing patient wait times. By following the data analysis process, the analyst:

- Defines the question: What factors contribute to increased wait times?

- Collects and cleans data from patient records, appointment systems, and feedback surveys.

- Analyzes the data to identify patterns, such as peak times for appointments and common delays in the patient check-in process.

- Visualizes the findings using graphs that highlight peak congestion times and the factors causing delays.

- Shares the insights with the healthcare management team, recommending adjustments to appointment scheduling and check-in processes to reduce wait times.

This systematic approach not only provides actionable insights but also showcases the power of data analytics in solving real-world problems.

Understanding the data analysis process is foundational for anyone looking to delve into data analytics, providing a roadmap for transforming data into insights that can drive informed decision-making.

Tools and Techniques

The field of Data Analytics is supported by a variety of tools and techniques designed to extract, analyze, and interpret data. Market research surveys are often a key source of data. The choice of the right analytics tools and the application of specific analytical techniques can significantly impact the quality of the insights generated. In this section, we will explore some of the key data analytics techniques and highlight commonly used tools, especially for primary survey research, providing tips on how to choose the right ones for specific projects.

Key Data Analytics Techniques

Statistical Testing: When summarizing data using means (for continuous data) or percent of observations falling into different categories (for categorical or nominal data), we often want to know whether the differences we’re observing between groups of respondents, branches of a company, or time periods are statistically meaningful (that they were unlikely to occur by chance).

Correlation Analysis : A statistical approach that examines whether there is a positive, negative, or no correlation between two continuous variables. The square of the correlation coefficient indicates the percent of variance in one variable that is explained by the other.

Regression Analysis : A statistical method used to examine the relationship between dependent (outcome) and independent (predictor) variables. There are regression techniques for predicting continuous variables (ordinary least squares) as well as for categorical outcomes (logistic regression). Regression analysis is particularly useful for identifying relationships between variables, making predictions, and forecasting.

Tree-Based Analysis : These techniques are used for finding which variables tend to predict or explain some outcome, such as purchase of a product, or diagnosis with a disease. Common examples are Classification and Regression Trees (CART) and Random Forests, a combination of multiple trees that can be ensembled for a more accurate consensus prediction.

Time-Series Analysis : Focused on analyzing data points collected or recorded at specific time intervals. This technique is crucial for trend analysis, seasonal pattern identification, and forecasting.

Cluster Analysis : A family of methods used to group a set of objects (such as respondents) in such a way that objects in the same group (called a cluster) are more similar to each other than to those in other groups. It’s extensively used in market segmentation and targeting strategies. Common approaches include k-means clustering, latent class clustering, and ensemble approaches that leverage multiple techniques to achieve a more robust consensus solution.

Conjoint Analysis and MaxDiff: Discrete choice methods often used in market research and economics for assessing the importance of features, measuring price sensitivity , and predicting demand for products or services.

Quick and Intuitive Conjoint Analysis Software

Need to launch a conjoint analysis study? Get access to our free conjoint analysis tool. In just a few minutes, you can create full conjoint analysis exercises with just a few clicks of our easy-to-use interface.

Conjoint Analysis Software Tool or Request a Product Tour

Commonly Used Data Analytics Tools

Excel : A versatile tool for basic data analysis, familiar to most professionals, capable of handling various data analysis functions including pivot tables, basic statistical functions, and data visualization.

SQL : Essential for data extraction, especially from relational databases. SQL allows analysts to query specific data from large databases efficiently.

Python/R : Both are powerful programming languages favored in data analytics for their libraries and packages that support data manipulation, statistical analysis, and machine learning.

Tableau/Power BI : These tools are leaders in data visualization, providing robust platforms for creating dynamic and interactive dashboards and reports.

Sawtooth Software : Provides tools, support services, and consulting services for designing and fielding market research surveys, as well as conducting conjoint analysis, MaxDiff, and cluster analysis.

Free Survey Maker Tool

Get access to our free and intuitive survey maker. In just a few minutes, you can create powerful surveys with its easy-to-use interface.

Try our Free Survey Maker or Request a Product Tour

Choosing the Right Tools and Techniques

Selecting the appropriate tools and techniques depends on several factors:

Project Requirements : The nature of the data and the specific questions you are trying to answer will guide your choice. For instance, Python might be preferred for its machine learning capabilities, while Tableau is chosen for sophisticated visualizations.

Data Size and Complexity : Large datasets and complex analyses might require more advanced tools like Python or R, whereas Excel (limited to around 1 million rows and 16 thousand columns) could suffice for smaller, simpler datasets.

Skill Set : The proficiency of the data analyst in using these tools also plays a significant role. It’s essential to balance the choice of tool with the analyst's comfort level and expertise.

Budget and Resources : Some tools require significant investment, both in terms of licenses and training. Open-source options like Python and R offer powerful functionalities at no cost.

Example Application

Consider a retail company looking to optimize its inventory levels based on historical sales data. The data analyst might use:

- SQL to extract sales data from the company's database.

- Python for conducting time-series analysis to identify sales trends and predict future demand.

- Tableau to create visualizations that illustrate these trends and forecasts, facilitating strategic discussions on inventory management.

Through the strategic application of these tools and techniques, data analysts can uncover valuable insights that drive informed decision-making and strategic planning within organizations.

The exploration of tools and techniques underscores the versatility and power of data analytics. Whether through statistical analysis, predictive modeling, or insightful visualizations, these tools empower analysts to turn data into strategic assets.

Importance and Uses of Data Analytics