License for Use of "Physicians' Current Procedural Terminology", (CPT) Fourth Edition

End User/Point and Click Agreement: CPT codes, descriptions and other data only are copyright 2009 American Medical Association (AMA). All Rights Reserved (or such other date of publication of CPT). CPT is a trademark of the AMA.

You, your employees and agents are authorized to use CPT only as contained in the following authorized materials including but not limited to CGS fee schedules, general communications, Medicare Bulletin , and related materials internally within your organization within the United States for the sole use by yourself, employees, and agents. Use is limited to use in Medicare, Medicaid, or other programs administered by the Centers for Medicare & Medicaid Services (CMS). You agree to take all necessary steps to insure that your employees and agents abide by the terms of this agreement.

This product includes CPT which is commercial technical data and/or computer data bases and/or commercial computer software and/or commercial computer software documentation, as applicable which were developed exclusively at private expense by the American Medical Association, 515 North State Street, Chicago, Illinois, 60610. U.S. Government rights to use, modify, reproduce, release, perform, display, or disclose these technical data and/or computer data bases and/or computer software and/or computer software documentation are subject to the limited rights restrictions of DFARS 252.227-7015(b)(2)(June 1995) and/or subject to the restrictions of DFARS 227.7202-1(a)(June 1995) and DFARS 227.7202-3(a)June 1995), as applicable for U.S. Department of Defense procurements and the limited rights restrictions of FAR 52.227-14 (June 1987) and/or subject to the restricted rights provisions of FAR 52.227-14 (June 1987) and FAR 52.227-19 (June 1987), as applicable, and any applicable agency FAR Supplements, for non-Department Federal procurements.

AMA Disclaimer of Warranties and Liabilities.

CPT is provided "as is" without warranty of any kind, either expressed or implied, including but not limited to, the implied warranties of merchantability and fitness for a particular purpose. AMA warrants that due to the nature of CPT, it does not manipulate or process dates, therefore there is no Year 2000 issue with CPT. AMA disclaims responsibility for any errors in CPT that may arise as a result of CPT being used in conjunction with any software and/or hardware system that is not Year 2000 compliant. No fee schedules, basic unit, relative values or related listings are included in CPT. The AMA does not directly or indirectly practice medicine or dispense medical services. The responsibility for the content of this file/product is with CGS or the CMS and no endorsement by the AMA is intended or implied. The AMA disclaims responsibility for any consequences or liability attributable to or related to any use, non-use, or interpretation of information contained or not contained in this file/product. This Agreement will terminate upon notice if you violate its terms. The AMA is a third party beneficiary to this Agreement.

CMS Disclaimer

The scope of this license is determined by the AMA, the copyright holder. Any questions pertaining to the license or use of the CPT must be addressed to the AMA. End Users do not act for or on behalf of the CMS. CMS DISCLAIMS RESPONSIBILITY FOR ANY LIABILITY ATTRIBUTABLE TO END USER USE OF THE CPT. CMS WILL NOT BE LIABLE FOR ANY CLAIMS ATTRIBUTABLE TO ANY ERRORS, OMISSIONS, OR OTHER INACCURACIES IN THE INFORMATION OR MATERIAL CONTAINED ON THIS PAGE. In no event shall CMS be liable for direct, indirect, special, incidental, or consequential damages arising out of the use of such information or material.

This license will terminate upon notice to you if you violate the terms of this license. The AMA is a third party beneficiary to this license.

POINT AND CLICK LICENSE FOR USE OF "CURRENT DENTAL TERMINOLOGY", ("CDT")

End User License Agreement

These materials contain Current Dental Terminology, Fourth Edition (CDT), copyright © 2002, 2004 American Dental Association (ADA). All rights reserved. CDT is a trademark of the ADA.

THE LICENSE GRANTED HEREIN IS EXPRESSLY CONDITIONED UPON YOUR ACCEPTANCE OF ALL TERMS AND CONDITIONS CONTAINED IN THIS AGREEMENT. BY CLICKING BELOW ON THE BUTTON LABELED "I ACCEPT", YOU HEREBY ACKNOWLEDGE THAT YOU HAVE READ, UNDERSTOOD AND AGREED TO ALL TERMS AND CONDITIONS SET FORTH IN THIS AGREEMENT.

IF YOU DO NOT AGREE WITH ALL TERMS AND CONDITIONS SET FORTH HEREIN, CLICK BELOW ON THE BUTTON LABELED "I DO NOT ACCEPT" AND EXIT FROM THIS COMPUTER SCREEN.

IF YOU ARE ACTING ON BEHALF OF AN ORGANIZATION, YOU REPRESENT THAT YOU ARE AUTHORIZED TO ACT ON BEHALF OF SUCH ORGANIZATION AND THAT YOUR ACCEPTANCE OF THE TERMS OF THIS AGREEMENT CREATES A LEGALLY ENFORCEABLE OBLIGATION OF THE ORGANIZATION. AS USED HEREIN, "YOU" AND "YOUR" REFER TO YOU AND ANY ORGANIZATION ON BEHALF OF WHICH YOU ARE ACTING.

- Subject to the terms and conditions contained in this Agreement, you, your employees, and agents are authorized to use CDT-4 only as contained in the following authorized materials and solely for internal use by yourself, employees and agents within your organization within the United States and its territories. Use of CDT-4 is limited to use in programs administered by Centers for Medicare & Medicaid Services (CMS). You agree to take all necessary steps to ensure that your employees and agents abide by the terms of this agreement. You acknowledge that the ADA holds all copyright, trademark and other rights in CDT-4. You shall not remove, alter, or obscure any ADA copyright notices or other proprietary rights notices included in the materials.

- Applicable Federal Acquisition Regulation Clauses (FARS)\Department of Defense Federal Acquisition Regulation Supplement (DFARS) Restrictions Apply to Government use. Please click here to see all U.S. Government Rights Provisions .

- ADA DISCLAIMER OF WARRANTIES AND LIABILITIES. CDT-4 is provided "as is" without warranty of any kind, either expressed or implied, including but not limited to, the implied warranties of merchantability and fitness for a particular purpose. No fee schedules, basic unit, relative values or related listings are included in CDT-4. The ADA does not directly or indirectly practice medicine or dispense dental services. The sole responsibility for the software, including any CDT-4 and other content contained therein, is with (insert name of applicable entity) or the CMS; and no endorsement by the ADA is intended or implied. The ADA expressly disclaims responsibility for any consequences or liability attributable to or related to any use, non-use, or interpretation of information contained or not contained in this file/product. This Agreement will terminate upon notice to you if you violate the terms of this Agreement. The ADA is a third-party beneficiary to this Agreement.

- CMS DISCLAIMER. The scope of this license is determined by the ADA, the copyright holder. Any questions pertaining to the license or use of the CDT-4 should be addressed to the ADA. End users do not act for or on behalf of the CMS. CMS DISCLAIMS RESPONSIBILITY FOR ANY LIABILITY ATTRIBUTABLE TO END USER USE OF THE CDT-4. CMS WILL NOT BE LIABLE FOR ANY CLAIMS ATTRIBUTABLE TO ANY ERRORS, OMISSIONS, OR OTHER INACCURACIES IN THE INFORMATION OR MATERIAL COVERED BY THIS LICENSE. In no event shall CMS be liable for direct, indirect, special, incidental, or consequential damages arising out of the use of such information or material.

The license granted herein is expressly conditioned upon your acceptance of all terms and conditions contained in this agreement. If the foregoing terms and conditions are acceptable to you, please indicate your agreement by clicking below on the button labeled "I ACCEPT". If you do not agree to the terms and conditions, you may not access or use the software. Instead, you must click below on the button labeled "I DO NOT ACCEPT" and exit from this computer screen.

| | | |

| 866.290.4036 ( 888.270.9481) 866.276.9558 |

| | | ">Email | Font Size: | To view instructions, hover over each field. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Check the Medicare Box.

Patient's Medicare number.  Insured's name if Medicare is not primary. Leave blank if Medicare is primary. May have "SAME" when insured is the patient. These are situational if Medicare is not primary. For Electronic claims “SAME” is not acceptable. Patient's name - last name, first name, middle initial - must be as it appears on the Medicare Card. Date of birth - 8 digits - MM DD YYYY entered into spaces and appropriate box checked for sex.

Enter the patient's mailing address and telephone number. On the first line enter the street address; the second line, the city and state; the third line, the ZIP code and phone number. Telephone number field not available in this format. Check the appropriate box for patient's relationship to insured when item 4 is completed.

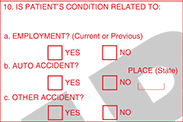

Enter the insured's address and telephone number. When the address is the same as the patient's, enter the word SAME. Complete this item only when items 4, 6, and 11 are completed.  Leave blank. Patient status field is not available in this format.  Enter the last name, first name, and middle initial of the enrollee in a Medigap policy if it is different from that shown in item 2. Otherwise, enter the word SAME. If no Medigap benefits are assigned, leave blank. This field may be used in the future for supplemental insurance plans.  Items 10a - 10cCheck "YES" or "NO" to indicate whether employment, auto liability, or other accident involvement applies to one or more of the services described in item 24. Enter the State postal code. Any item checked "YES" indicates there may be other insurance primary to Medicare. Identify primary insurance information in item 11. If Medicare is primary, enter the word "NONE". If Medicare is secondary, enter the insured's policy or group number and proceed to items 11a through 11c. This field is required on a paper claim. Policy number and or group number of the Medigap insured preceded by "MEDIGAP", "MG", or "MGAP." Enter the insured's birth date and sex, if different from item 23.

ANSI 5010 - This segment has been deleted. Enter employer's name, if applicable. If there is a change in the insured's status, e.g., retired, enter either a 6-digit (MM | DD | YY) or 8-digit (MM | DD | CCYY) retirement date preceded by the word, "RETIRED." Form version 02/12: provide this information to the right of the vertical dotted line. This field is not available in this format. Leave blank if item 9d is completed . Otherwise, enter the claims processing address of the Medigap insurer. Use an abbreviated street address, two-letter postal code, and ZIP code copied from the Medigap insured's Medigap identification card.

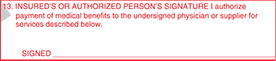

Enter the 9-digit PAYERID number of the primary insurer. If no PAYERID number exists, then enter the complete primary payer’s program or plan name. If the primary payer’s EOB does not contain the claims processing address, record the primary payer’s claims processing address directly on the EOB. This is required if there is insurance primary to Medicare that is indicated in item 11. Enter the Coordination of Benefits Agreement (COBA) Medigap-based Identifier(ID) . Patient’s Medicaid number - If patient is not enrolled in Medicaid, leave blank. Not Needed - Medicaid automatically crosses over. Leave blank - this is not required by Medicare.  The patient or authorized representative must sign and enter either a 6-digit date (MM | DD | YY), 8-digit date (MM | DD | CCYY), or an alpha-numeric date (e.g., January 1, 1998) unless the signature is on file. In lieu of signing the claim, the patient may sign a statement to be retained in the provider, physician, or supplier file in accordance with Chapter 1, “General Billing Requirements.” If the patient is physically or mentally unable to sign, a representative specified in chapter 1, may sign on the patient’s behalf. In this event, the statement’s signature line must indicate the patient’s name followed by “by” the representative’s name, address, relationship to the patient, and the reason the patient cannot sign. The authorization is effective indefinitely unless the patient or the patient’s representative revokes this arrangement. NOTE: This can be “Signature on File” and/or a computer generated signature. The patient’s signature authorizes release of medical information necessary to process the claim. It also authorizes payment of benefits to the provider of service or supplier when the provider of service or supplier accepts assignment on the claim. Signature by Mark (X) - When an illiterate or physically handicapped enrollee signs by mark, a witness must enter his/her name and address next to the mark. Note: The signature date field is not available in this format  Enter either a patient’s or authorized person’s signature and date or enter “Signature on File” (SOF). Enter the date of the current illness, injury or pregnancy. For Chiropractic services, enter the date of the initiation of the course of treatment.

*Use if different information given at the claim level Leave blank. Not required by Medicare. If the patient is employed and is unable to work in his/her current occupation, enter an 8-digit (MM | DD | CCYY) or 6-digit (MM | DD | YY) date when patient is unable to work. An entry in this field may indicate employment related insurance coverage.

Enter the name of the referring or ordering physician if the service or item was ordered or referred by a physician. All physicians who order services or refer Medicare beneficiaries must report this data. Similarly, if Medicare policy requires you to report a supervising physician, enter this information in item 17. When a claim involves multiple referring, ordering, or supervising physicians, use a separate CMS-1500 claim form for each ordering, referring, or supervising physician. Enter one of the following qualifiers as appropriate to identify the role that this physician (or non-physician practitioner) is performing: Qualifier Provider Role DN Referring Provider DK Ordering Provider DQ Supervising Provider Enter the qualifier to the left of the dotted vertical line on item 17.

This block is not used after May 23, 2008. This is not used after May 23, 2008. Enter either an 8-digit (MM | DD | CCYY) or a 6-digit (MM | DD | YY) date when a medical service is furnished as a result of, or subsequent to, a related hospitalization.

Enter the NPI of the referring, ordering, or supervising physician or non-physician practitioner listed in item 17. All physicians and non-physician practitioners who order services or refer Medicare beneficiaries must report this data. Enter applicable dates (either an 8-digit (MM | DD | CCYY) or a 6-digit (MM | DD | YY) date), dosage, global surgery period, or other narrative information. All information listed in Item 19 and its electronic equivalent is situational.

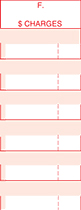

Enter the acquisition price under “$ Charges” if the “Yes” box is checked. A “Yes” check indicates that an entity other than the entity billing for the service performed the diagnostic test. A “No” check indicates that no anti-markup tests are included on the claim. When Yes is annotated, Item 32a shall be completed. When submitting a PS1 segment, the facility information must also be in either loop 2310D or 2420C. The “ICD Indicator” identifies the ICD code set being reported. Enter the applicable ICD indicator according to the following: Indicator Code Set 9 ICD-9-CM diagnosis 0 ICD-10-CM diagnosis Enter the indicator as a single digit between the vertical, dotted lines.

Note: Up to eight diagnosis codes may be entered in priority order on electronic claims. Do not use decimal points. ANSI 5010 - In addition: Up to 12 diagnoses may be entered. Leave blank or enter one of the following items as applicable:

Enter the date of service - 6 digits (MMDDYY) or 8-digit (MMDDYYYY) date for each procedure or service.

Enter the appropriate two-digit place of service (POS) code to identify where the item is used or the service is performed. Enter the procedure code and up to four applicable modifiers.

This is a required field. Enter the diagnosis code reference letter (as appropriate, per form version) as shown in item 21 to relate the date of service and the procedures performed to the primary diagnosis.  Enter the charge for each listed service. Note: Nonparticipating providers may not exceed the limiting charge fee for each service. Enter the number of days or units. For anesthesia, convert hours into minutes, if necessary, and enter the total minutes required for the procedure. This field should be blank on all claims received after May 23, 2008. Exception: Providers who have terminated their Medicare provider numbers and were never assigned an NPI. The 1C qualifier must be in this field and there must be a comment in block 19 that this is a submission from a terminated provider.

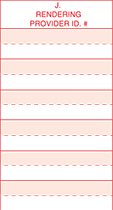

This is only used when the exception is met and there are comments in the narrative field that the submission is from a terminated provider.  Enter the rendering provider’s NPI in the unshaded portion.

Enter the Federal Tax ID (Employer Identification Number or Social Security Number) of the provider and check the appropriate box.

Enter the patient's account number. Check the appropriate box to indicate whether the provider accepts assignment of Medicare benefits. Enter the total charges for the services. Enter the total amount that the patient paid for covered services only. Enter the signature of provider of service or supplier, or his/her representative, and either the 6-digit date (MM | DD | YY), 8-digit date (MM | DD | CCYY), or alpha-numeric date (e.g., January 1, 1998) the form was signed.  Enter the name and complete address including the ZIP code of the facility where the services were rendered. If the supplier is a certified mammography screening center, enter the six-digit FDA approved certification number.

Enter the provider’s billing name, address, ZIP code and telephone number.

Enter the NPI of the service facility. This is a conditional field. There should be nothing in this field unless there is a purchased test as listed in Item 20. The NPI of the provider from whom the test was purchased will be listed if this is the case.

Effective May 23, 2008 this field is not to be reported. Enter the NPI of the billing provider or group.

Item 33b is not generally reported. However, for some Medicare policies you may be instructed to use this item; direction as to how to use this item will be in the instructions you received regarding the specific policy, if applicable.  Stay Connected People With Medicare

EDI UB-04 Claims Processing Procedures (Part 4)Edi ub-04 claims procedures (security health plan). EDI UB-04 Claims processing procedures: EDI UB-04 Claims completion for inpatient and outpatient services billed by hospitals, skilled nursing facilities, home health agencies and other institutional providers ( Continuation). 51. Health plan ID – Providers’ current Medicare Provider Number. 52. Release of information certification indicator – This field indicates whether the provider has on file a signed statement from the beneficiary permitting the provider to release data to other organizations in order to adjudicate the claim. (Required) 53. Assignment of benefit certification indicator – This field shows whether the provider has a signed form authorizing the third-party insurer to pay the provider directly for the service. 54. Prior payments – payers and patient – The amount the hospital has received toward payment of this bill prior to the billing date for the payer indicated in field 50 on lines a., b., and c. for outpatient claims and all other third-party payers. (Required) 55. Estimated amount due – An estimate by the hospital of the amount due from the indicated payer in field 50 on lines a., b., and c., or from the patient (estimated responsibility less any prior payments). 56. NPI – National Provider Identifier (Type 2 for organization required). 57. Other Provider ID – This field is not used for provider reporting. For National use only. 58. Insured’s name – Name of the patient or insured individual in whose name the insurance is issued as qualified by the payer organization listed in field 50 on lines a., b., and c. (Required) 59. Patient’s relationship to insured – This field contains the code that indicates the relationship of the patient to the insured individuals identified in field 58 on lines a., b., and c. (Required) when Medicare is the secondary or tertiary payer. 60. Certificate/Social Security Number/health insurance claim/identification number – The insured’s identification number assigned by the payer organization. This field allows 19 alphanumeric characters in three lines. (Required) 61. Insured group name – The group or plan through which the health insurance coverage is provided to the insured. (Required) 62. Insurance group number – The identification number, control number or code that is assigned by the insurance company or claims administrator to identify the group under which the individual is covered. 63. Treatment authorization codes – A number or other indicator that designates that the treatment covered by this bill has been authorized by the payer indicated in field 50 on lines a., b., and c. (Required) 64. Document control number – Not required. 65. Employer name of the insured – Name of the employer that provides health care coverage for the insured individual identified in field 58 on lines a., b., and c. This field allows for 24 alphanumeric characters on each of three lines. (Required) UB-04 Claims Processing Procedures (Part 1) UB-04 Claims Processing Procedures (Part 2) UB-04 Claims Processing Procedures (Part 3) Leave a Reply Cancel replyYour email address will not be published. Post Navigation

What is Assignment of Benefits in Medical Billing? An assignment of benefits is the act of signing documentation authorizing a health insurance company to pay a physician directly. In other words, the insurance company can pay claims without the direct involvement of the patient in the process. There are other situations where AOBs can be helpful, but we’ll focus on their use in relation to medical benefits. If there isn’t an assignment of benefits agreement in place, the patient would be responsible for paying the other party directly from their own pocket, then filing a claim with their insurance provider to receive reimbursement. This could be time-consuming and costly, especially if the patient has no idea how to file a claim. The document is typically signed by patients when they undergo medical procedures. The purpose of this form is to assign the responsibility of payment for any future medical bills that may arise after the procedure. It’s important to note that not all procedures require an AOB. An assignment of benefits agreement might be utilized to pay a medical practitioner the patient didn’t choose, like an anesthesiologist. The patient may have picked a surgeon, but an anesthesiologist assigned on the day of the procedure might issue a separate bill. They’re, in essence, signing that anyone involved in their treatment can receive direct payment from the insurance carrier. It doesn’t have to go through the patient. This document can also eliminate service fees surrounding processing. As a result, the patient can focus on medical treatment and recovery without being bogged down with the complexities of paying medical bills. The overall intent of an assignment of benefits agreement is to make the process more manageable for the patient, as they don’t need to haggle directly with their insurer. List of Providers and ServicesWhen the patient signs an AOB agreement, they give a third party right to obtain payment for services the provider performed, and medical billing services are a prime example of where they may sign an AOB agreement.

Services of professionals other than a primary care physician, which includes:

Information Commonly Requested on Assignment of Benefits Form:

How AOBs Affect the Medical PractitionerA medical provider or their administrative staff may feel overwhelmed by the sheer number of forms patients must fill out prior to treatment. Demanding more paperwork from patients may be seen as an added burden on the managerial staff, as well as the patient. However, getting a signed AOB is vital in preserving the interests of everyone involved. In addition to receiving direct payment from the insurance company without needing to go through the patient, a signed assignment of benefits form will help medical providers appeal denied and underpaid claims. They can ask that payments be made directly to them rather than through the patient. This makes the process more manageable for both the doctors and the patient. Things to Bear in MindThe patient gives their rights and benefits to third parties under their current health plan. Depending on the wording in the AOB, their insurer may not be allowed to contact them directly about their claims. In addition, the patient may be unable to negotiate settlements or approve payments on their behalf and enable third parties to endorse checks on behalf of the patient. Finally, when the patient signs an AOB, the insurer may sue the third parties involved in the dispute. Looking for a qualified medical billing service?By taking just 1 minute to provide some basic information about your practice, you can get up to 5 pre-screened companies competing for your business. Related Posts What Is Cosmetic Dermatology? Your Guide to Treatments, Costs, and MoreWhat is a clia number in medical billing, healthcare revenue cycle management explained, leave a reply. Your email address will not be published. Required fields are marked * Save my name, email, and website in this browser for the next time I comment. An official website of the United States government Here’s how you know The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site. The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.  U.S. Dept. of Health & Human Services Pub 100-04 Medicare Claims Processing: Crossover of Assignment of Benefits Indicator (CLM08) From Paper Claim InputGuidance announcing that system changes are being made to the manner in which the shared system sets the CLM08 value in the Coordination of Benefits (COB) flat file. Language is being modified in the Internet Only Manual Form CMS-1500 submission requirements related to box 13 which clarifies the COB ramifications of completing or not completing box 13 of the Form CMS-1500. Download the Guidance Document Issued by: Centers for Medicare & Medicaid Services (CMS) Issue Date: November 02, 2007 HHS is committed to making its websites and documents accessible to the widest possible audience, including individuals with disabilities. We are in the process of retroactively making some documents accessible. If you need assistance accessing an accessible version of this document, please reach out to the [email protected] . DISCLAIMER: The contents of this database lack the force and effect of law, except as authorized by law (including Medicare Advantage Rate Announcements and Advance Notices) or as specifically incorporated into a contract. The Department may not cite, use, or rely on any guidance that is not posted on the guidance repository, except to establish historical facts. Create an Account  Not Registered Yet?Allow us to better serve you by enabling a faster line of communication, receive notifications when information you care about is updated and customize your support interests. Assignment of Benefits Set to No - Signature on File PreferenceAnswer ID 159 Access: Everyone

The Assignment of Benefits indicates whether or not to print Signature on File. If Signature on File does not appear on a printed claim, then the insurance payment would be mailed to the patient. The only difference for eClaims is that it is indicated by a Y or N. To check setup for Signature on File:

If these areas were already setup correctly but the Assignment of Benefits was set to N (no) it might have been changed just on that one claim.

Printed copies of this document are considered uncontrolled.Was this answer helpful. Still have questions? Answer Options  Related Answers

Search NAICRecommended. Back to Newsroom Consumer Insight Sept. 13, 2023 Assignment of Benefits: Consumer BewareYou've just survived a severe storm, or a tornado and you've experienced some extensive damage to your home that requires repairs, including the roof. Your contractor is now asking for your permission to speak with your insurance company using an Assignment of Benefits. Before you sign, read the fine print. Otherwise, you may inadvertently sign over your benefits and any extra money you’re owed as part of your claim settlement. The National Association of Insurance Commissioners (NAIC) offers information to help you better understand insurance, your risk and what to do in the event you need repairs after significant storm damage. Be cautious about signing an Assignment of Benefits. An Assignment of Benefits, or an AOB, is an agreement signed by a policyholder that allows a third party—such as a water extraction company, a roofer or a plumber—to act on behalf of the insured and seek direct payment from the insurance company. An AOB can be a useful tool for getting repairs done, as it allows the repair company to deal directly with your insurance company when negotiating repairs and issuing payment directly to the repair company. However, an AOB is a legal contract, so you need to understand what rights you are signing away and you need to be sure the repair company is trustworthy.

Be on alert for fraud. Home repair fraud is common after a natural disaster. Contractors often come into disaster-struck regions looking to make quick money by taking advantage of victims.

Immediately after the disaster, have an accurate account of the damage for your insurance company when you file a claim.

Most insurance companies have a time requirement for reporting a claim, so contact your agent or company as soon as possible. Your state insurance department can help you find contact information for your insurance company, if you cannot find it.

After you report damage to your insurance company, they will send a claims adjuster to assess the damage at no cost to you . An adjuster from your insurance company will walk through and around your home to inspect damaged items and temporary repairs you may have made.

Once the adjuster has completed an assessment, they will provide documentation of the loss to your insurer to determine your claims settlement. When it comes to getting paid, you may receive more than one check. If the damage is severe or you are displaced from your home, the first check may be an emergency advance. Other payments may be for the contents of your home, other personal property, and structural damages. Please note that if there is a mortgage on your home, the payment for structural damage may be payable to you and your mortgage lender. Lenders may put that money into an escrow account and pay for repairs as the work is completed. More information. States have rules governing how insurance companies handle claims. If you think that your insurer is not responding in a timely manner or completing a reasonable investigation of your claim, contact your state insurance department . About the National Association of Insurance Commissioners As part of our state-based system of insurance regulation in the United States, the National Association of Insurance Commissioners (NAIC) provides expertise, data, and analysis for insurance commissioners to effectively regulate the industry and protect consumers. The U.S. standard-setting organization is governed by the chief insurance regulators from the 50 states, the District of Columbia and five U.S. territories. Through the NAIC, state insurance regulators establish standards and best practices, conduct peer reviews, and coordinate regulatory oversight. NAIC staff supports these efforts and represents the collective views of state regulators domestically and internationally. You are using an outdated browser. Please upgrade your browser to improve your experience. More on Loop 2320 OI/Item 13The signature in this item authorizes payment of mandated Medigap benefits to the participating physician or supplier if you included necessary Medigap information in item 9 and its subdivisions. The patient or their authorized representative signs this item or the signature must be on file as a separate Medigap authorization. The Medigap assignment on file in the participating provider of service or supplier’s office must specify the insurer. It may state that the authorization applies to all occasions of service until it’s revoked. We’ll now review the claim information in this section of Lesson 4 relevant to Medicare Secondary Payer (MSP). Authorized SignatureYou can use a Signature on File or a computer generated signature. Electronic claims include an Assignment of Benefits Indicator or a Release of Information Code in Loop 2320. Enter Other PayerIn addition to NY Medicaid, you may enter additional payers who are responsible for this claim. Remember that all elements marked with an asterisk ( * ) are required when entering a Payer. Not all claims will have Other Payer information. Note: A maximum of 10 Other Payer records may be entered per claim. Other Payer InformationOther Payer Name: Select the name of the desired payer from the provided list. If the Other Payer you are looking for is not listed, contact your Administrator to add the Payer to the Support File of valid Payers. Required for all Other Payers. Payer Sequence Number: Select the value that represents the order in which payment was received from other payers. Payers may be entered in any sequence and displayed in any sequence. Required for all Other Payers. Payer Type: A code identifying the type of Payer. Enter or select a value from the list of available codes. Other Payer Paid Amount: This field is required when this payer has adjudicated the claim. If the Other Payer denied the claim, enter 0. If the Other Payer has not adjudicated the claim, leave blank. If a value is entered, the Date Claim Paid must be entered as well. Other Payer Claim Control Number: Enter the claim control number of the other payer. Date Claim Paid: Date on which the Other Payer Paid Amount was received. This date may not be greater than the current date. The format is: MM/DD/YYYY and may either be entered in the field or selected from the calendar available by pressing the button to the right of the field. Other SubscriberLast Name/First Name: If entering an Other Payer, you must enter the First and Last Name of the Subscriber for the Payer. The Subscriber may or may not be the Client. Primary ID: The Other Insured Identifier as assigned by the Payer. This is required when entering the Subscriber for the Other Payer. Address Line 1/2: The street address of the Subscriber, if known. City: Enter city name of the Subscriber. State: State in which the Subscriber lives. Select value from the list of available valid state abbreviations, defaults to 'NY'. Zip Code: Enter the postal Code associated with the Subscriber's address. Country: Country in which the Subscriber lives. Select value from the list of available countries, defaults to 'US'. Other Subscriber InformationRelationship: Code indicating the relationship between the Client/Patient and the Subscriber for this Payer. Enter or select a value from the list of available codes. A relationship is required if a Subscriber is entered. Group Number: Enter the Subscriber’s group number for the other payer when applicable. Group Name: The Group Name associated with the Group Number above. Claim AdjustmentsIf the other payer reported claim adjustments at the claim level, enter the adjustment information here. Otherwise, this information will be blank. Claim adjustment group codes and reason codes are from the remittance of the other payer. Claim Adjustment Group: Enter the Group Code as received from the other payer. A maximum of 5 Claim Adjustment Groups are allowed per claim and the values are to be entered. Reason Code: Enter the Claim Adjustment Reason Code as received from the other payer. The Claim Adjustment Group/Reason Code combination may not be entered more than once. If an Adjustment Amount or Adjustment Quantity is entered, a Reason Code is required. Adjustment Amount: Enter the Adjustment Amount as received from the other payer. Adjustment Quantity: Enter the Quantity Adjusted as received from the other payer. Other Insurance Coverage InformationAssignment of Benefits?: The Benefits Assignment Certification Indicator. 'Yes' indicates insured or authorized person authorizes benefits to be assigned to the provider while 'No' indicates that no authorization has been given. This value will default to 'Yes' and is required if an Other Payer Name is selected. Patient Signature Source: Enter or select the Patient Signature Source Code, indicating how the patient or subscriber authorization signatures were obtained and how they are being retained by the provider. An entry is required if an Other Payer Name is selected. Release of Information?: Indicates whether the provider has a signed statement by the patient authorizing the release of medical data to other organizations. This value is required if an Other Payer Name is selected. Remaining Patient Liability: This is the amount the provider believes is due and owing after the Other Payer’s adjudication. Non-Covered Charge Amount: Enter the dollar value of the claim in this field if the other payer was not billed, and documentation is on file that the other payer would not have paid the claim. Once all the information for the Payer has been added, another payer may be added by clicking the Next Payer>> control at the top or bottom of the tab. This will return you to the top of the page with all the values cleared out and a new Payer Number listed at the top of the page. Clicking View All Other Payers will display the Other Payers Summary page. Click = 4 && typeof(BSPSPopupOnMouseOver) == 'function') BSPSPopupOnMouseOver(event);" class="BSSCPopup" onclick="BSSCPopup('../Tab_Controls.htm');return false;">here for the controls located at the bottom of the page or continue to the Service Line(s) tab.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

IMAGES

COMMENTS

Shared systems and contractors are requested to initiate system changes to appropriately set the correct indicator in CLM08 based on the presence of or lack of a signature in box 13 of the Form CMS-1500. In addition, the Form CMS-1500 claim completion instructions are being revised in order to inform providers regarding how the presence or lack ...

OI03 - Benefits assignment: Item 14. Enter the date of the current illness, injury or pregnancy. For Chiropractic services, enter the date of the initiation of the course of treatment. ... Enter the indicator as a single digit between the vertical, dotted lines. Do not report both ICD-9-CM and ICD-10-CM codes on the same claim form. If there ...

Assignment of benefit certification indicator - This field shows whether the provider has a signed form authorizing the third-party insurer to pay the provider directly for the service. 54. Prior payments - payers and patient - The amount the hospital has received toward payment of this bill prior to the billing date for the payer ...

Indicator's must equal one of the following values: 12,13,14,15,16,41,42,43 or 47 if 2000B SBR01 = "T" or "S" ... Assignment of Benefits Indicator. QI06. Release of information code. 14. Date of current illness, injury or pregnancy. 2300. DTP01. Accident qualifier = 439. DTP03. Accident date.

Assignment of benefits is not authorization to submit claims. It is important to note that the beneficiary signature requirements for submission of claims are separate and distinct from assignment of benefits requirements except where the beneficiary died before signing the request for payment for a service furnished by a supplier and the supplier accepts assignment for that service.

2300 CLM10 175 Benefits assignments Certification indicator Benefits Assignment Indicator is required. Y = Yes; N = No 2320 O103 345 Benefits Assignment Indicator is required. Y = Yes; N = No 14 Date of current: illness, injury, pregnancy 2300 DTP03 (439) 194 Accident date Required if Related Cause code (CLM11-1, -2 or -3) = Auto Accident

B. New Provider Accepts Assignment Indicator Under NCPDP version 5.1, Medicare did not reflect the provider assignment indicator independently on the COB/crossover claim. The NCPDP D.0 has added a provider accept assignment indicator field as element 361-2D in the Transmission Insurance Segment. As

An Assignment of Benefits Based Rejection is due to the Assignment of Benefits Indicator missing or invalid on the claim. This field indicates whether or not the insured has authorized the plan to remit payment to the provider. To resolve this please follow these steps: Once this is completed, a corrected claim will need to be submitted.

These updates will allow payments to be issued to the provider when the "Provider Accept Assignment Code" indicator in the CLM07 (Loop 2300) states "C" (Non-Assigned) and the "Benefit Assignment Certification" indicator in the CLM08 (Loop 2300) states "Y" (Yes), indicating that the insured/member authorizes benefits to be ...

To setup Benefits Assignment Certification Indicator. SelectClientsfrom theViewmenu, or click theClients iconon the Therapy or View Listbar. Select aClient. Select theInsurancetab. Select theInsurance policy. Select one of the values listed in the drop down box forBenefits Assignment Certification Indicator. Applies to 4010, 5010 Possible ...

An assignment of benefits is the act of signing documentation authorizing a health insurance company to pay a physician directly. In other words, the insurance company can pay claims without the direct involvement of the patient in the process. There are other situations where AOBs can be helpful, but we'll focus on their use in relation to ...

B. New Provider Accepts Assignment Indicator . Under NCPDP version 5.1, Medicare did not reflect the provider assignment indicator independently on the COB/crossover claim. The NCPDP D.0 has added a provider accept assignment indicator field as element 361-2D in the Transmission Insurance Segment. As indicated below, Medicare will always

Pub 100-04 Medicare Claims Processing: Crossover of Assignment of Benefits Indicator (CLM08) From Paper Claim Input. Guidance announcing that system changes are being made to the manner in which the shared system sets the CLM08 value in the Coordination of Benefits (COB) flat file. Language is being modified in the Internet Only Manual Form CMS ...

The assignment of benefits indicator. A 'Y' value indicates insured or authorized person authorizes benefits to be assigned to the provider; an 'N' value indicates benefits have not been assigned to the provider. If Y has been entered in the Registration - Patient- Insurance <Assignment> field for the secondary insurance, then 'Y' is used.

4. A patient's signature is not required for: A claim submitted for diagnostic tests or test interpretations performed in a facility that has no contact with the patient. Document the signature space "Patient not physically present for services." Medicaid patients. Deceased patients when the physician accepts assignment.

If any of these boxes were unchecked, or the calculation method was Patient Responsible for All, resubmit the claim after making the changes, and the Assignment of Benefits indicator should now be set to Yes.. If these areas were already setup correctly but the Assignment of Benefits was set to N (no) it might have been changed just on that one claim.

Benefits Assignment Indicator is required. Y = Yes; N = No authorized 2320personʹs Benefits signature Certification: O103 345 Benefits assignments indicator Assignment Indicator is required. Y =Yes; N No 2300 DTP03 (439) 194 Accident date Required if Related Cause code (CLM11‐1, ‐2 or ‐3) = Auto

The second reimbursement method a physician/supplier has is choosing to not accept assignment of benefits. Under this method, a non-participating provider is the only provider that can file a claim as non-assigned. When the provider does not accept assignment, the Medicare payment will be made directly to the beneficiary.

An Assignment of Benefits, or an AOB, is an agreement signed by a policyholder that allows a third party—such as a water extraction company, a roofer or a plumber—to act on behalf of the insured and seek direct payment from the insurance company. An AOB can be a useful tool for getting repairs done, as it allows the repair company to deal ...

The Medigap assignment on file in the participating provider of service or supplier's office must specify the insurer. It may state that the authorization applies to all occasions of service until it's revoked. ... Electronic claims include an Assignment of Benefits Indicator or a Release of Information Code in Loop 2320. Page 1 of 1.

The Benefits Assignment Certification Indicator. 'Yes' indicates insured or authorized person authorizes benefits to be assigned to the provider while 'No' indicates that no authorization has been given. This value will default to 'Yes' and is required if an Other Payer Name is selected. Patient ...

An Assignment of Benefits (AOB) is an agreement that transfers insurance claims rights or benefits to a third party, such as a contractor. They file a claim for their services, and direct the insurance to pay them directly — without your involvement. Once an AOB contract is signed, the contractor takes control and can submit whatever they'd ...

Box 53a, 53b, 53c - Assignment of Benefits Certification Indicator June 16, 2023 15:04; Box Description. This field shows whether the provider has a signed form authorizing the third-party insurer to pay the provider directly for the service. The form contents will either be Y or N. ... To update the benefits assignment, update the patient's ...