Kuznet’s Inverted U-Hypothesis on Income Inequality | Economics

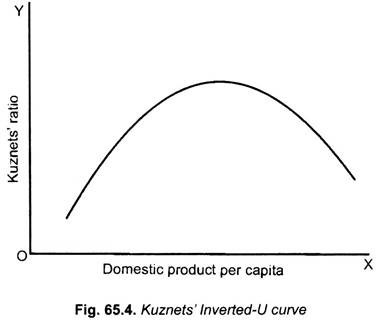

Simon Kuznets put forward the hypothesis that relationship between per capita national income and the degree of inequality in income distribution may be of the form of inverted-U. Due to limitations of data he used an inequality measure of the ratio of income share of the richest 20 per cent of the population to the bottom 60 per cent of the population known as Kuznets’ ratio.

According to the Kuznets’ Inverted U-hypothesis, as per capita national income of a country increases, in the initial stages of growth, inequality in income distribution rises and after reaching the highest degree in the intermediate level the income inequality falls. This is shown in Fig. 65.4 where as a country develops and its per capita income rises, the degree of income inequality initially rises and after reaching the maximum level, it falls as GDP per capita increases further.

As time series data of the transition of the poor underdeveloped countries from underdeveloped stage to the developed stage was not available, he used the data of cross section of countries including both developed and developing countries. In his 1955 study he calculated the Kuznets’ ratios and found that the developing countries tend to have a higher degree of inequality whereas the rich developed countries tend to have a lower degree of inequality.

The Kuznets Curve

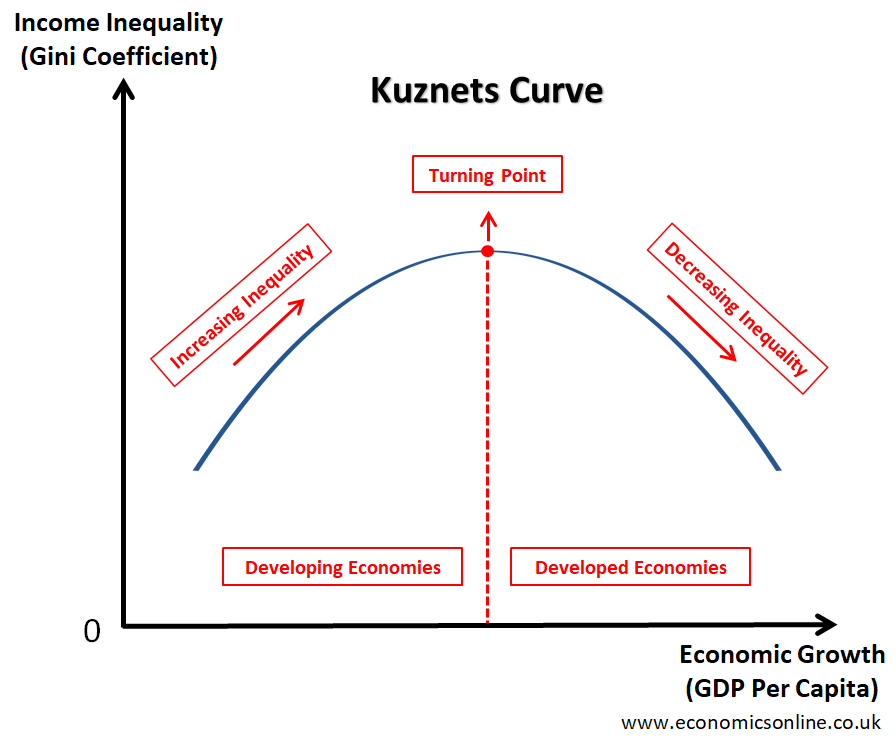

The Kuznets curve is a graphical representation of the relationship between economic growth and income inequality.

It is a hypothetical inverted U-shaped curve that illustrates that with increasing GDP per capita (economic growth), countries initially experience increasing income inequality, but later on, the income inequality decreases.

The Kuznets curve is named after its creator, Simon Kuznets, an American economist who first introduced the concept in 1950s and 1960s. Kuznets was a Nobel laureate in economics and made significant contributions to the fields of economic growth and income inequality.

Graph of the Kuznets Curve

The following diagram shows the graph of a typical inverted U-shaped Kuznets curve.

The horizontal axis (x-axis) represents economic growth in terms of gross domestic product (GDP) per capita. The vertical axis (y-axis) represents the level of income inequality, which is measured using the Gini coefficient . Let’s explain the Kuznets curve in four parts:

1. The Starting Point

The starting point of the Kuznets curve shows low income inequality in a country with low GDP per capita. This is because poor economies with a dominant agricultural sector often have a more equal distribution of income among individuals.

2. The Upward Slope

The upward sloping part of the Kuznets curve illustrates that as economies experience economic growth and progress from agricultural economies to industrialised ones, income inequality starts to increase.

This is because, with greater economic activity, new investment opportunities increase for those who already have the capital to invest. This means that those who already have wealth have the opportunity to increase it. There is also an influx of inexpensive rural labour to the cities (urbanisation), which keeps wages down for the working class because of an increase in labour supply (higher urban population ). This widens the gap between the rich and the poor, leading to an increase in income inequality.

So, the initial increase in income inequality can be attributed to factors such as the concentration of wealth in the hands of a few individuals or groups, the unequal distribution of resources, and urbanisation.

3. The Turning Point

The turning point shown on the Kuznets curve graph represents maximum income inequality. This turning point occurs at a certain level of per capita income and is usually referred to as the "Kuznets threshold," where income inequality reaches its peak. This turning point can occur at different levels of economic growth in different countries.

4. The Downward Slope

After the turning point, the downward sloping part of the Kuznets curve illustrates that income inequality decreases with a further increase in GDP per capita. This happens when deindustrialisation occurs along with an increase in the service sector. Income inequality begins to decline as the benefits of economic growth gradually trickle down to lower-income groups. This can be due to factors such as increased access to education, progressive taxation, and social welfare programmes run by governments.

Hence, the downward sloping part of the Kuznets curve illustrates that income inequality eventually starts diminishing as economies continue to progress, leading to a more equitable distribution of income.

Empirical Evidence

Many studies have examined the validity of the Kuznets curve across different countries and time periods. While findings are not universally consistent, empirical evidence supports the general idea that economic inequality, especially in European countries, tends to rise during the early stages of economic growth and then decline.

The Significance of the Kuznets Curve

The Kuznets curve is an important tool that offers policymakers valuable insights into the relationship between economic growth and income inequality. By understanding this curve, governments can design policies to achieve an important macroeconomic objective of low income inequality. Such policies may include investments in education and skills to enhance human capital, progressive taxation, social welfare programmes, and labour market regulation.

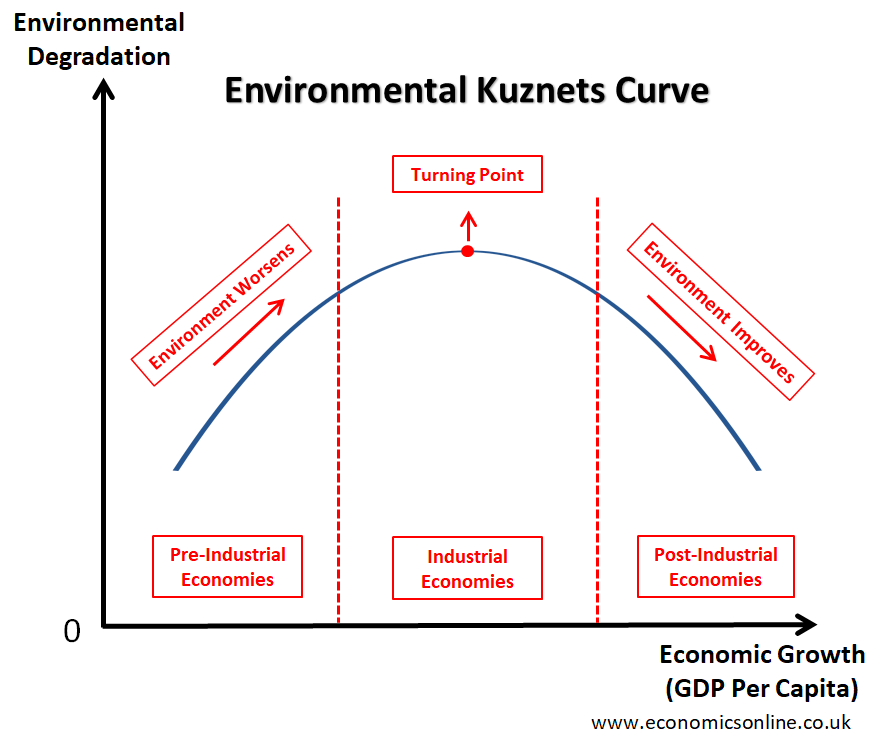

Environmental Kuznets Curve

The Environmental Kuznets Curve (EKC) shows the relationship between environmental degradation and economic growth. The graph of EKC is also an inverted U-curve and is shown below.

The horizontal axis (x-axis) represents economic growth in terms of gross domestic product (GDP) per capita. The vertical axis (y-axis) represents the level of environmental degradation or pollution (environmental damage).

Initially, as countries experience rapid industrialization and economic growth, environmental pollution tends to worsen. However, as countries develop and become more aware of environmental concerns, environmental degradation decreases because of deindustrialisation (decrease in manufacturing), green environmental policies, sustainable development, environmental protection, renewable energy sourcing, environmental regulations, and environmentally friendly technologies.

Hence, environmental degradation starts to decline eventually in post-industrial developed economies with a dominant service sector.

Mixed Empirical Evidence

Empirical results about the relationships illustrated by the Kuznets curve are mixed. For example, the Kuznets curve does not explain the rise in income inequality in some developed economies, such as the UK.

Oversimplification

The Kuznets’ hypothesis assumes a simple and linear relationship between economic growth and income inequality. However, the real world is complex, and the said relationship can be influenced by many other economic, social, and political factors.

The Kuznets curve suggests that income inequality will eventually decrease over time as a result of economic growth. However, it does not account for the potential time lag between economic growth and the realisation of decreased income inequality. In certain cases, income inequalities can persist for extended periods despite economic growth.

Economic Landscape

The Kuznets curve was developed during a time when industrialisation was the main form of economic growth and development. However, the economic landscape has changed now, and income inequalities can be influenced by factors such as automation, globalisation, and the gig economy, which were not covered by the Kuznets curve.

The Kuznets curve suggests that with economic growth, income distribution becomes more uneven, and then after a certain income level, income becomes more evenly distributed. The environmental Kuznets curve illustrates the EKC hypothesis, which is a relationship between environmental degradation and economic growth. Both Kuznets curves have similar shapes. The Kuznets curve has offered valuable insights into the dynamics of income inequality and economic development. Despite its limitations, the Kuznets curve provides a framework for policymakers to address income disparities. Furthermore, the emerging concept of the environmental Kuznets curve reinforces the need for sustainable development while protecting environmental quality.

How Can a SaaS Model Be Useful for Your Business?

Supply and Demand Curves Explained

Essential Economics Terms: Kuznets Curve

Controversial Trickle-Down Theory of Economic Development

Jason Kerwin/Wikimedia Commons/ CC BY-SA 2.5

- U.S. Economy

- Supply & Demand

- Archaeology

- Ph.D., Business Administration, Richard Ivey School of Business

- M.A., Economics, University of Rochester

- B.A., Economics and Political Science, University of Western Ontario

The Kuznets curve is a hypothetical curve that graphs economic inequality against income per capita over the course of economic development (which was presumed to correlate with time). This curve is meant to illustrate economist Simon Kuznets’ (1901-1985) hypothesis about the behavior and relationship of these two variables as an economy develops from a primarily rural agricultural society to an industrialized urban economy.

Kuznets’ Hypothesis

In the 1950s and 1960s, Simon Kuznets hypothesized that as an economy develops, market forces first increase then decrease the overall economic inequality of the society, which is illustrated by the inverted U-shape of the Kuznets curve. For instance, the hypothesis holds that in the early development of an economy, new investment opportunities increase for those who already have the capital to invest. These new investment opportunities mean that those who already hold the wealth have the opportunity to increase that wealth. Conversely, the influx of inexpensive rural labor to the cities keeps wages down for the working class thus widening the income gap and escalating economic inequality.

The Kuznets curve implies that as a society industrializes, the center of the economy shifts from rural areas to the cities as rural laborers, such as farmers, begin to migrate seeking better-paying jobs. This migration, however, results in a large rural-urban income gap and rural populations decrease as urban populations increase. But according to Kuznets’ hypothesis, that same economic inequality is expected to decrease when a certain level of average income is reached and the processes associated with industrialization, such as democratization and the development of a welfare state, take hold. It is at this point in economic development that society is meant to benefit from trickle-down effect and an increase in per-capita income that effectively decreases economic inequality.

The inverted U-shape of Kuznets curve illustrates the basic elements of the Kuznets’ hypothesis with income per capita graphed on the horizontal x-axis and economic inequality on the vertical y-axis. The graph shows income inequality following the curve, first increasing before decreasing after hitting a peak as per-capita income increases over the course of economic development.

Kuznets’ curve has not survived without its share of critics. In fact, Kuznets himself emphasized the “fragility of [his] data” among other caveats in his paper. The primary argument of critics of Kuznets’ hypothesis and its resulting graphical representation is based on the countries used in Kuznets’ data set. Critics say that the Kuznets curve does not reflect an average progression of economic development for an individual country, but rather it is a representation of historical differences in economic development and inequality between countries in the dataset. The middle-income countries used in the data set are used as evidence for this claim as Kuznets primarily used countries in Latin America, which have had histories of high levels of economic inequality as compared to their counterparts in terms of similar economic development. The critics hold that when controlling for this variable, the inverted U-shape of the Kuznets curve begins to diminish. Other criticisms have come to light over time as more economists have developed hypotheses with more dimensions and more countries had undergone rapid economic growth that did not necessarily follow Kuznets’ hypothesized pattern.

Today, the environmental Kuznets curve (EKC)—a variation on the Kuznets curve—has become standard in environmental policy and technical literature.

- Marginal Revenue and the Demand Curve

- Understanding Indifference Curves and How to Plot Them

- The Long-Run Supply Curve

- 10 Supply and Demand Practice Questions

- Understanding How the Supply Curve Works

- Understanding Term Spreads or Interest Rate Spreads

- How to Read Shifts in the Supply Curve

- The Demand Curve Explained

- Shifting the Demand Curve

- The Beveridge Curve

- The Lorenz Curve

- The Phillips Curve

- Budget Line and Indifference Curve Practice Problems

- How Slope and Elasticity of a Demand Curve Are Related

- What is a Cost Function?

- The Effects of a Black Market on Supply and Demand

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

Study Notes

What is the Kuznets Inequality Curve?

Last updated 11 Oct 2023

- Share on Facebook

- Share on Twitter

- Share by Email

The Kuznets curve, named after economist Simon Kuznets, is a graphical representation of the relationship between economic development and income inequality. It suggests that as an economy develops from a low-income agrarian society to a higher-income industrial and then post-industrial society, income inequality follows a specific pattern. The Kuznets curve is often depicted as an inverted U-shaped curve. Here's a simplified explanation of the Kuznets curve:

- Low-Income Stage (Agrarian Economy): At the initial stage of economic development, when a society is primarily agrarian, income inequality tends to be relatively low. In agrarian economies, most people are engaged in similar occupations, and there are limited opportunities for significant income disparities.

- High-Income Stage (Industrialization): As the economy develops and transitions into an industrial phase, income inequality may increase. Industrialization often leads to the growth of cities and the emergence of new industries. This can result in wage disparities between skilled and unskilled workers, as well as between urban and rural areas. Income inequality rises during this phase.

- Turning Point: The Kuznets curve suggests that there is a "turning point" at which income inequality reaches its peak. This turning point is often associated with a shift from industrialization to a more advanced, post-industrial economy.

- High-Income Stage (Post-Industrial or High-Income Economy): After reaching the turning point, as the economy becomes more post-industrial, income inequality is expected to decline. In post-industrial societies, there may be more emphasis on service industries, education, and technology, which can lead to a more even distribution of income.

The Kuznets curve is often used to describe historical trends in industrialized Western economies during the 20th century. According to this hypothesis, as these countries transitioned from primarily agrarian to industrial economies, income inequality increased, peaking around the mid-20th century, and then began to decrease.

It's important to note that the Kuznets curve is a simplification of the complex relationship between economic development and income inequality. It is not a universal law, and its applicability varies among different countries and regions. The turning point and the exact shape of the curve can differ depending on various factors, including government policies, labor market conditions, and social institutions.

Moreover, some economists argue that in today's globalized world, the Kuznets curve may not be as relevant, as the relationship between economic development and income inequality is influenced by a wide range of factors, including technological change, globalization, and policy choices. Nonetheless, the Kuznets curve remains a useful concept for understanding the historical evolution of income inequality in certain contexts.

- Simon Kuznets

- Kuznets (Inequality) Curve

You might also like

Economics of inequality (revision video).

Topic Videos

Economic Growth - Rising Inequality and Rapid Growth

Rostow's five stages of economic growth model.

The Modern Kuznets Curve - A Second Wave of Inequality

26th March 2016

Inequality - Incomes of richest 1% in the USA surge

22nd February 2023

2.5.4 Impact of Economic Growth (Edexcel A-Level Economics Teaching PowerPoint)

Teaching PowerPoints

4.2.2 Inequality (Edexcel)

4.2.2 inequality (edexcel a-level economics teaching powerpoint), our subjects.

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

- IAS Preparation

- UPSC Preparation Strategy

Kuznets Curve

A Kuznets curve is a graphical representation of market forces and income as and when an economy develops. The Kuznets curve was first developed by economists Simon Kuznets in the 1950s and 1960s.

Kuznets curve is an important topic in the economics segment of the IAS Exam .

|

|

Explanation of the Kuznets curve

The Kuznets curve shows that when a nation undergoes industrialization, the centre of the nation’s economy will shift towards urban centres. As internal migration by farmers looking for better-paying jobs in urban hubs causes a significant rural-urban inequality gap, the rural population will decrease and the urban population will increase.

When a certain level of average income is set and the process of industrialisation is in full swing, inequality is expected to decrease. Kuznets believed that inequality would follow an inverted “U” shape as it rises and falls with an increase in income per capita

Kuznets curve diagrams show an inverted U curve, although variables along the axes are often mixed and matched, with inequality or the Gini coefficient on the Y-axis and economic development, time or per-capita incomes on the X-axis.

Kuznets Curve: UPSC Exam Notes – Download PDF Here

The Kuznets ratio is a measurement of the ratio of income going to the highest-earning households (usually defined by the upper 20%) to income going to the lowest-earning households, which is commonly measured by either the lowest 20% or lowest 40% of income. Comparing 20% to 20%, a completely even distribution is expressed as 1; 20% to 40% changes this value to 0.5.

Find the strategy and syllabus for UPSC Economics in the given article

Kuznets had two similar explanations for this historical phenomenon:

- Workers migrated from agriculture to industry

- Rural workers moved to urban jobs.

In both explanations, inequality will decrease after 50% of the shift force switches over to the higher paying sector

Criticism of the Kuznets Curve

It has been noted that the U-shape of the Kuznets curve does not represent progress in the development of individual nations but the historical differences between them. The reason being most of the data in the Kuznets curve were gathered from Latin America, a middle-income region with a history of inequality. When this variable is taken into account then the U-shape of the curve disappears.

The economic rise of East Asia has been used to criticize the validity of the Kuznets curve theory. The rapid economic rise of Japan, South Korea, China, Singapore – known as the Four Asian Tigers – between 1965 and 1990, was called the East Asian Miracle. Manufacturing and export grew quickly and powerfully. Yet simultaneously, life expectancy was found to increase and population levels living in absolute poverty decreased.

This development contradicts Kuznets curve theory because the economic development of the East Asian economy distributed the benefits of economic growth among the populace when the theory stated that rapid capital accumulation would lead to an increase in inequality.

The Economics Questions for UPSC Mains GS 3 are important for the IAS exam preparation.

Candidates can check out the relevant links given below to prepare for the Economics Optional for UPSC exam-

FAQ about Kuznets Curve

What was simon kuznets known for, what are kuznets cycles.

Aspirants can find complete information regarding the Government Exams through the linked article. More exam-related preparation materials will be found through the links given below:

Related Links

| IAS General Studies Notes Links | |

Leave a Comment Cancel reply

Your Mobile number and Email id will not be published. Required fields are marked *

Request OTP on Voice Call

Post My Comment

IAS 2024 - Your dream can come true!

Download the ultimate guide to upsc cse preparation, register with byju's & download free pdfs, register with byju's & watch live videos.

Kuznets Inverted-U Hypothesis

- Post author: Viren Rehal

- Post published: September 19, 2022

- Post category: Basic Ideas and Theories / Development Economics

- Post comments: 0 Comments

Simon Kuznets observed a relationship between inequality and development which came to be known as the Kuznets Inverted-U hypothesis. He postulated that inequality in income distribution will rise during the early stages of development. With further development, inequality will increase to a maximum and eventually start decreasing in the later stages of growth and development.

As observed by Kuznets in some cases, when measures of income inequality such as the Gini coefficient are expressed as a function of per capita income, an inverted U-shaped curve can be observed. Hence, it is generally referred to as Kuznets’ Inverted-U curve.

Gini-Coefficient and Per-capita Income

Corrado Gini proposed the Gini coefficient in an attempt to measure income inequality. The Gini coefficient ranges from 0 to 1. A value of 0 on the Gini coefficient implies perfect equality, whereas, a value of 1 means perfect inequality. Hence, the higher the value of the Gini coefficient, the higher the level of income inequality. To learn more about the calculation of the Gini coefficient, see here .

As seen in the diagram, the value of the Gini coefficient increases in the early stages of development. This means that income inequality rises initially. However, with further growth and development of the economy, the Gini coefficient reaches a maximum and starts declining. This implies that income inequality eventually falls in the later stages of development.

Econometrics Tutorials

- VECM Video Tutorial Series

- 3SLS Model: Video Tutorial Series

- 2SLS Model: Video Tutorial Series

- Bundle: 2SLS and 3SLS Models

- ARIMA and SARIMA Models

- Logit and Probit Models

Causes of inverted-U shape

- Structural changes : In the earlier stages, development is most likely to be concentrated in the industrial sector as the economy moves from a traditional to a modern industrial economy. The industrial sector is generally characterised by higher productivity and wages, but lower employment opportunities. This leads to a further increase in income inequality in the earlier stages and the Gini coefficient increases. To learn more about structural changes and related theories, go here .

- Migration : there will be an increase in demand for labour in the modern industrial sector with continuous development. Rural labour will start migrating to urban industrial centres, which are generally characterized by higher wages and inequality. As the modern sector grows with development, an inverted U-shape will emerge as the economy moves from the traditional to the modern economy. Because political institutions such as labour unions are created, it will increase the incomes of lower-wage workers. Therefore, this will contribute to bridging the income gap and help in reducing the inequalities as the economy develops.

- Returns to education : initially, returns to education will see a huge rise as demand for skilled labour rises with development. Skilled labour is associated with higher wages leading to increasing inequality. Hence, the Gini coefficient will increase in the beginning. However, the supply of educated labour will keep growing and the proportion of unskilled labour will fall with further development. Hence, inequalities in income will start falling with a rise in the proportion of the skilled labour force leading to an inverted U-shape.

- Firstly, the empirical evidence in support of the Inverted-U hypothesis is mixed. It has been observed that income inequalities rise in developed countries such as the USA and Japan. Hence, the Kuznets Inverted-U fails to explain this phenomenon.

- Kuznets himself advocated that his hypothesis was based on insufficient data. It was based on very short time period data.

- The role of political and social reforms has been completely ignored in the hypothesis. Development and per capita income are not the only determinants of inequality. Policies by the government or the introduction of other reforms can have a huge impact on inequality irrespective of the per capita income.

adaptation to the Environmental Kuznets curve

The Kuznets curve has been adapted to explain changes in environmental degradation with development and growth. It deals with environmental degradation instead of income inequality in a similar manner to the original hypothesis.

The Environmental Kuznets curve states that pollution or environmental degradation increases in the earlier stages of development, reaches a maximum and starts decreasing with further growth and development.

The level of environmental degradation increases when the economy develops in the earlier stages. This happens because the economy shifts from traditional agriculture to an industrial economy. Industries are characterised by higher pollution levels and environmental degradation.

However, environmental degradation will eventually start declining with development. As the becomes highly industrialized and then shifts to a service-based economy, it will lead to the development of more efficient and green technology. With environment-friendly technology being developed, the level of pollution and degradation will go down.

- Pollution is not just a function of income, it depends on several other factors. The relationship between development and environmental degradation is not so straightforward and simplistic.

- Growth generally brings even higher pollution through higher resource use. The eventual fall in pollution as proposed by this hypothesis may not arrive.

- Developed countries have been observed to have the highest CO2 emissions which contradict the hypothesis.

- It requires political or government intervention to reduce environmental degradation. It does not happen on its own. Given the option to continue as they are, the industries will not care about the environment or pollution.

- The hypothesis does not consider the irreversibility of environmental damage.

augmented Kuznets’ curve

One of the major criticisms of the Kuznets’ curve was the empirical evidence of rising inequality levels in developed countries. The majority of the developing countries were found to be on the downward trend of the Kuznets curve. However, inequality was observed to be increasing in high-income economies such as the USA.

It was postulated that the original Kuznets curve holds until the economies are producing consumer goods. Whereas, with a shift toward the production of capital goods in highly developed countries, inequality starts to rise again. These capital goods can be categorised as advanced technology goods that are monopolistic in nature and are produced by advanced industrial economies. These economies are found on the upward-sloping part of the Augmented Kuznets curve.

Visualizing Data with Python

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.

Related Posts

- Fei and Ranis’ Model of Structural Change

- Low-level Equilibrium Trap: Nelson

- Lewis Model of Structural Change

- Vicious Circle of Poverty

Three Core Values of Development

You might also like, gender development index: gdi, inclusive development: meaning and features, leave a reply cancel reply.

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.

Our systems are now restored following recent technical disruption, and we’re working hard to catch up on publishing. We apologise for the inconvenience caused. Find out more: https://www.cambridge.org/universitypress/about-us/news-and-blogs/cambridge-university-press-publishing-update-following-technical-disruption

We use cookies to distinguish you from other users and to provide you with a better experience on our websites. Close this message to accept cookies or find out how to manage your cookie settings .

Login Alert

- > Inequality and Industrial Change

- > Toward a New Kuznets Hypothesis: Theory and Evidence on Growth and Inequality

Book contents

- Frontmatter

- Contributors

- Permissions

- Acknowledgments

- PART I INTRODUCTION TO THEORY AND METHOD

- PART II INEQUALITY, UNEMPLOYMENT, AND INDUSTRIAL CHANGE

- PART III INEQUALITY AND DEVELOPMENT

- 7 Toward a New Kuznets Hypothesis: Theory and Evidence on Growth and Inequality

- 8 Measuring the Evolution of Inequality in the Global Economy

- 9 Economic Regionalization, Inequality, and Financial Crises

- 10 Inequality and State Violence: A Short Report

- 11 Grading the Performance of Latin American Regimes, 1970–1995

- 12 The Evolution of Industrial Earnings Inequality in Mexico and Brazil

- 13 The Legacy of the HCI: An Empirical Analysis of Korean Industrial Policy

- 14 Inequality and Economic Development: Concluding Reflections

- PART IV METHODS AND TECHNIQUES

- Data Appendix

- References and Selected Bibliography

7 - Toward a New Kuznets Hypothesis: Theory and Evidence on Growth and Inequality

Published online by Cambridge University Press: 05 June 2012

Simon Kuznets proposed a broad hypothesis on the process of development: that economic progress is accompanied by increasing inequality in the early stages of industrialization, which then tends to decline as industrialization deepens. Recent empirical tests of the Kuznets hypothesis have raised questions about this conjecture, yet most of these studies are based on limited and deficient data. Here we examine the dynamics of inequality across the Organization for Economic Cooperation and Development (OECD) using methods that allow the construction of long and dense time series of inequality. We find that an augmented Kuznets curve for developed countries, where inequality increases with income growth for the highest-income countries, is consistent with this data set. Thus, we offer a macroeconomic alternative to the skill-biased technological change hypothesis, which has been dominant in the literature as an explanation for increasing inequality.

For the study of the economic growth of nations, it is imperative that we become more familiar with findings in those related social disciplines that can help us understand population growth patterns, the nature and forces in technological change, the factors that determine the characteristics and trends in political institutions. … Effective work in [the field of economic growth, inequality, and technology] necessarily calls for a shift from market economics to political and social economy.

Access options

Save book to kindle.

To save this book to your Kindle, first ensure [email protected] is added to your Approved Personal Document E-mail List under your Personal Document Settings on the Manage Your Content and Devices page of your Amazon account. Then enter the ‘name’ part of your Kindle email address below. Find out more about saving to your Kindle .

Note you can select to save to either the @free.kindle.com or @kindle.com variations. ‘@free.kindle.com’ emails are free but can only be saved to your device when it is connected to wi-fi. ‘@kindle.com’ emails can be delivered even when you are not connected to wi-fi, but note that service fees apply.

Find out more about the Kindle Personal Document Service .

- Toward a New Kuznets Hypothesis: Theory and Evidence on Growth and Inequality

- By Pedro Conceição , Institut Superior Tecnico, Lisbon, James K. Galbraith , University of Texas

- Edited by James K. Galbraith , University of Texas, Austin , Maureen Berner , University of North Carolina, Chapel Hill

- Book: Inequality and Industrial Change

- Online publication: 05 June 2012

- Chapter DOI: https://doi.org/10.1017/CBO9781139175210.008

Save book to Dropbox

To save content items to your account, please confirm that you agree to abide by our usage policies. If this is the first time you use this feature, you will be asked to authorise Cambridge Core to connect with your account. Find out more about saving content to Dropbox .

Save book to Google Drive

To save content items to your account, please confirm that you agree to abide by our usage policies. If this is the first time you use this feature, you will be asked to authorise Cambridge Core to connect with your account. Find out more about saving content to Google Drive .

A Kuznets curve for intergenerational mobility

Daniel gerszon mahler, roy van der weide, christoph lakner, ambar narayan, rakesh gupta.

In the 1950s, Simon Kuznets hypothesized that an inverted U-shaped relationship exists between inequality and development. As countries developed, inequality would increase until a certain tipping point, after which it would start to fall again. Although this hypothesis is highly contested , the inverted U-curve is featured in most introductory textbooks on development economics.

A new working paper presenting the Global Database on Intergenerational Mobility makes it possible for the first time to study the relationship between economic development and intergenerational mobility across a wide cross-section of countries that includes both the world’s poorest and richest countries. Intergenerational mobility is related to but different from inequality. Where inequality in Kuznets’ theory describes the dispersion of incomes, intergenerational mobility is related to the dispersion of opportunities. We distinguish between two different concepts of intergenerational mobility, which we refer to as absolute and relative. Absolute mobility measures whether children are doing better than their parents, while relative mobility measures how strong the connection is between parents’ outcomes and children’s outcomes.

To achieve a truly global coverage of 153 countries representing 97 percent of the world’s population, the Global Database on Intergenerational Mobility focuses on intergenerational mobility in education. Our measure of absolute mobility in education is the share of individuals who have attained more years of schooling than their parents. The measure of relative mobility in education presented here is (one minus) the correlation between a cohort’s years of schooling and their parents’ years of schooling. Higher the correlation, the more parents’ education is predictive of their children’s education success, and lower the relative mobility. Plotting these measures of intergenerational mobility against GDP per capita around the time when children entered school allows for testing Kuznets’ hypothesis in the domain of socio-economic mobility.

The results are strikingly clear.

|

| |

|

Share of adults with more years of schooling than their parents |

One minus the correlation between the years of schooling of adults and their parents |

|

|

|

|

| |

An inverted U-shaped relationship exists between absolute mobility and development while the relationship between relative mobility and development shows a regular U-shape. The slope changes sign at around $10,000 for absolute mobility and around $5,000 for relative mobility (in 2011 USD PPP). Both of these thresholds correspond to income levels of middle-income countries. This predicts that countries with very different levels of national income may achieve similar levels of intergenerational mobility. For example, the Dominican Republic and Japan are estimated to have the same level of absolute mobility (around 0.55). Similarly, Liberia and Israel are estimated to have the same level of relative mobility (around 0.6).

Before commenting on a possible rationale for these patterns, one methodological sidestep is necessary. A challenge with measuring intergenerational mobility in education is that education in bounded both from the bottom and the top. This may matter for both measures.

In terms of absolute mobility, if parents have a university degree, it is difficult to outperform them. As a country gets wealthier, more people complete tertiary education, and it becomes harder for children to outperform their parents. This would imply a mechanical decline in absolute mobility at high levels of development. One pragmatic way of getting around this is to categorize children of parents with tertiary education as upwards mobile if they match their parent’s tertiary education. In the paper we show that even with this adjustment, absolute mobility continues to decline at very high levels of GDP per capita.

The boundedness of education attainment might also matter for relative mobility. This is particularly pertinent for low levels of development, where a large fraction of the population has zero years of schooling. As we will argue below, in these cases, it is not altogether clear how to think about relative mobility. A completely different measure of relative mobility which is less impacted by what happens in the bottom of the distribution is the probability that a child born in the top quartile falls out of the top quartile. The U-curve is also present with this measure.

So what can explain these patterns?

With regards to the inverted U-shape between absolute mobility and development, the intuition may be reminiscent of Kuznets’ original intuition. At low levels of development, a country is stuck in poverty and though the threshold for surpassing parents’ education is low, so is the capacity to educate children. As countries start to grow, individuals start doing better than their parents. Sooner or later, growth rates start to level off, and a smaller fraction improves upon the past generation. Though the capacity to educate children is high so is the threshold for surpassing parents’ education levels.

A candidate explanation for the observed pattern for relative mobility is the following. In the world’s poorest countries, a large majority of parents have no education. When there is little variation in parental education, it will be a poor predictor of individual socioeconomic status (i.e. it matters less what household one is born into when the large majority of parents are equally deprived), indicating a high level of relative mobility.

As countries develop and increase their levels of human capital, parental education levels will start to diverge. When these gaps become sufficiently large and are not adequately compensated for through public interventions, it will matter for an individual’s educational success whether s/he is born into a poor or better-off family (which in turn is correlated with parental education). Hence, in countries where the variation in social class is significant while the infrastructure needed to equalize opportunities may not yet be affordable, relative mobility is expected to be low.

When countries increase their national incomes further, they are likely to develop the fiscal space necessary to fund the type of public interventions that will give children born into disadvantaged backgrounds the opportunities to fulfill their potential (i.e. public interventions will partly compensate for inequalities in private investments). As the public interventions grow in size and effectiveness, relative mobility is expected to increase. This pattern is far from inevitable, though. To ensure that opportunities become more equal when countries develop, it is imperative that some of the extra fiscal space is indeed directed to public policies that expand opportunities for the worst off.

For more analysis on intergenerational mobility, see the new working paper .

We gratefully acknowledge financial support from the UK government through the Data and Evidence for Tackling Extreme Poverty (DEEP) Research Programme.

- Inequality and Shared Prosperity

Get updates from Let's Talk Development

Thank you for choosing to be part of the Let's Talk Development community!

Your subscription is now active. The latest blog posts and blog-related announcements will be delivered directly to your email inbox. You may unsubscribe at any time.

Senior Economist, Development Data Group, World Bank

Senior Economist, Development Research Group, World Bank

Program Manager, Development Data Group, World Bank

Lead Economist, Poverty Global Practice, World Bank

Consultant, Development Research Group, World Bank

Join the Conversation

- Share on mail

- comments added

Historical environmental Kuznets curve for the USA and the UK: cyclical environmental Kuznets curve evidence

- Published: 17 September 2024

Cite this article

- Tolga Omay ORCID: orcid.org/0000-0003-0263-2258 1 ,

- Julide Yildirim ORCID: orcid.org/0000-0002-4739-6028 2 &

- Nazmiye Balta-Ozkan ORCID: orcid.org/0000-0002-2848-5535 3

Human activities, including population growth, industrialization, and urbanization, have increasingly impacted the environment. Despite the benefits of economic growth to individual welfare, its negative environmental consequences necessitate a thorough assessment. The environmental Kuznets curve (EKC), positing an inverted U-shaped relationship between income per capita and environmental degradation, has been extensively studied since its proposition by Grossman and Krueger (Environmental impacts of a North American free trade agreement, National Bureau of Economic Research working paper, 1991. https://doi.org/10.3386/w3914 ). However, empirical evidence on the validity and shape of the EKC varies due to methodological differences, country-specific dynamics, and other factors. Examining the historical growth paths of individual countries helps explain the mixed findings in empirical EKC research. Long-term data allow researchers to determine the EKC's shape and turning points, aiding policymakers in devising appropriate environmental policies for each economic growth cycle within the framework of global environmental governance. Accordingly, this study contributes to the literature by taking a historical perspective on the EKC, focusing specifically on the United States and the United Kingdom. Drawing on data spanning from 1850, we employ advanced econometric techniques, including fractional frequency flexible Fourier form Dickey–Fuller-type unit root tests and structural breaks unit root tests, to overcome limitations of traditional linearized EKC estimations. Moreover, the classical polynomial regression approach is employed to model the long-term cycles based on the scatterplot inspection of per capita carbon dioxide (CO 2 ) and per capita GNP series. Contrary to conventional expectations, our empirical findings do not support the existence of a clear inverted U-shaped EKC relationship between CO 2 emissions and economic growth for either country. Instead, our analysis reveals the presence of multiple regimes, indicating a cyclical pattern where economic growth affects environmental quality with varying severity over time. Furthermore, we demonstrate proper modeling techniques for the EKC, highlighting the importance of identification and misspecification tests. Our study identifies cyclical EKC patterns for both the UK and the USA, with the UK exhibiting two cycles and the USA exhibiting three, shaped by varying economic, social, and technological contexts. By revealing the nuances of the economic growth-environmental degradation nexus for these early developer countries, our study provides valuable insights for policymakers seeking to devise evidence-based and environmentally sustainable growth policies within the framework of global environmental governance. These findings underscore the importance of considering historical context and structural changes when analyzing the EKC, providing valuable insights for policymakers aiming to design adaptive and sustainable economic growth strategies.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author upon reasonable request.

The technical details of these tests are given in supplementary material as technical annex.

We use the genetic algorithm in our estimation process of the smooth transition trend since it is shown to be the best performing algorithm in estimating LST types of equations. For details, see Omay et al. ( 2018 ).

Please see https://www.bankofengland.co.uk/statistics/research-datasets for detailed information about the historical sources of the data.

http://www.nber.org/data/abc/ .

http://cdiac.ornl.gov/ .

https://www.nber.org/cycles.html .

Please see Mittlefehldt ( 2018 ) for a review of development of renewable technologies in the USA since the energy crises of the 1970s.

https://www.carbonbrief.org/analysis-uk-carbon-emissions-in-2017-fell-to-levels-last-seen-in-1890 .

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/272061/5761.pdf (Accessed on 20/02/2021).

https://www.iea.org/articles/global-co2-emissions-in-2019 .

Alford, B. W. E. (1981). New industries for old? British Industry between the wars. In R. Floud & D. McCloskey (Eds.), The economic history of Britain since 1700 (pp. 308–331). Cambridge University Press.

Google Scholar

Apergis, N., & Ozturk, I. (2015). Testing environmental Kuznets curve hypothesis in Asian countries. Ecological Indicators, 52 , 16–22. https://doi.org/10.1016/j.ecolind.2014.11.026

Article Google Scholar

Arapostathis, S., Carlsson-Hyslop, A., Pearson, P. J. G., Thornton, J., Gradillas, M., Laczay, S., & Wallis, S. (2013). Governing transitions: Cases and Insights from two periods in the history of the UK gas industry. Energy Policy, 52 , 25–44. https://doi.org/10.1016/j.enpol.2012.08.016

Ashby, L., & Anderson, M. (1977). Studies in the politics of environmental protection: The Historical Roots of the British Clean Air Act, 1956: II. The appeal to public opinion over domestic smoke, 1880–1892. Interdisciplinary Science Reviews, 2 , 9–26.

Article CAS Google Scholar

Balaguer, J., & Cantavella, M. (2016). Estimating the environmental kuznets curve for spain by considering fuel oil prices (1874–2011). Ecological Indicators, 60 , 853–859. https://doi.org/10.1016/j.ecolind.2015.08.006

Ball, M., & Wood, A. (1996). Trend growth in post-1850 British economic history: The Kalman filter and historical judgment. Journal of the Royal Statistical Society: Series D (The Statistician), 45 (2), 143–152.

Bell, M. L., Davis, D. L., & Fletcher, T. (2004). A Retrospective assessment of mortality from the london smog episode of 1952: The role of influenza and pollution. Environmental Health Perspectives, 112 , 6–8. https://doi.org/10.1289/ehp.6539

Berry, H., Kaul, A., & Lee, N. (2021). Follow the smoke: The pollution haven effect on global sourcing. Strategic Management Journal, 42 (13), 2420–2450.

Bhanumati, P., de Haan, M., & Tebrake, J. W. (2022). Greenhouse emissions rise to record, erasing drop during pandemic. IMF Blogs.

Brimblecombe, P. (1977). London air pollution, 1500–1900. Atmospheric Environment, 11 , 1157–1162.

Broadberry, S., & Howlett, P. (2005). The United Kingdom during World War I: Business as usual? In S. Broadberry, & M. Harrison (Ed.), The economics of world war I. (pp. 206–234) Cambridge University Press. https://doi.org/10.1017/CBO9780511497339.008

Campbell, B. C. (1999). Understanding economic change in the gilded age. OAH Magazine of History, 13 , 16–20. https://doi.org/10.1093/maghis/13.4.16

Climate Change Committee. (2020). The sixth carbon budget: The UK’s path to net zero.

Cheng, S. C., Wu, T. P., Lee, K. C., & Chang, T. (2014). Flexible fourier unit root test of unemployment for PIIGS countries. Economic Modelling, 36 , 142–148. https://doi.org/10.1016/j.econmod.2013.09.021

Churchill, S. A., Inekwe, J., Ivanovski, K., & Smyth, R. (2018). The environmental Kuznets curve in the OECD: 1870–2014. Energy Economics, 75 , 389–399. https://doi.org/10.1016/j.eneco.2018.09.004

Congregado, E., Feria-Gallardo, J., Golpe, A. A., & Iglesias, J. (2016). The environmental Kuznets curve and CO 2 emissions in the USA: Is the relationship between GDP and CO 2 emissions time varying? Evidence across economic sectors. Environmental Science and Pollution Research, 23 , 18407–18420. https://doi.org/10.1007/s11356-016-6982-9

Coombs, B. (2013). British tank production and the war economy, 1934–1945 . Bloomsburry Academic.

Destek, M. A., & Sinha, A. (2020). Renewable, Non-renewable energy consumption, economic growth, trade openness and ecological footprint: Evidence from organisation for economic co-operation and development countries. Journal of Cleaner Production . https://doi.org/10.1016/j.jclepro.2019.118537

Dinda, S. (2004). Environmental Kuznets curve hypothesis: A survey. Ecological Economics, 49 , 431–455. https://doi.org/10.1016/j.ecolecon.2004.02.011

Dogan, E., & Turkekul, B. (2016). CO 2 emissions, real output, energy consumption, trade, urbanization and financial development: Testing the EKC hypothesis for the USA. Environmental Science and Pollution Research, 23 , 1203–1213. https://doi.org/10.1007/s11356-015-5323-8

Doms, M., & Dunne, T. (1995). Energy intensity, electricity consumption, and advanced manufacturing-technology usage. Technological Forecasting and Social Change, 49 , 297–310. https://doi.org/10.1016/0040-1625(95)00055-F

Enders, W., & Lee, J. (2012). A unit root test using a fourier series to approximate smooth breaks. Oxford Bulletin of Economics and Statistics, 74 , 574–599. https://doi.org/10.1111/j.1468-0084.2011.00662.x

Enders, W., & Li, J. (2015). Trend-cycle decomposition allowing for multiple smooth structural changes in the trend of US real GDP. Journal of Macroeconomics, 44 , 71–81. https://doi.org/10.1016/j.jmacro.2015.02.002

Esteve, V., & Tamarit, C. (2012a). Is there an environmental Kuznets curve for spain? Fresh evidence from old data. Economic Modelling, 29 , 2696–2703. https://doi.org/10.1016/j.econmod.2012.08.016

Esteve, V., & Tamarit, C. (2012b). Threshold cointegration and nonlinear adjustment between CO 2 and income: The environmental Kuznets curve in Spain, 1857–2007. Energy Economics, 34 , 2148–2156. https://doi.org/10.1016/j.eneco.2012.03.001

Fosten, J., Morley, B., & Taylor, T. (2012). Dynamic misspecification in the environmental Kuznets curve: Evidence from CO 2 and SO 2 emissions in the United Kingdom. Ecological Economics, 76 , 25–33. https://doi.org/10.1016/j.ecolecon.2012.01.023

Fouquet, R., & Pearson, P. J. G. (1998). A Thousand years of energy use in The United Kingdom. Energy Journal, 19 , 1–41. https://doi.org/10.5547/ISSN0195-6574-EJ-Vol19-No4-1

Gordon, R. J. (1986). The American business cycle: Continuity and change . University of Chicago Press.

Book Google Scholar

Grid, N. (2020). Energy.

Grossman, G., & Krueger, A. (1991). Environmental ımpacts of a North American free trade agreement, national bureau of economic research working paper. https://doi.org/10.3386/w3914

Hanif, I. (2017). Economics-energy-environment nexus in Latin America and the Caribbean. Energy, 141 , 170–178. https://doi.org/10.1016/j.energy.2017.09.054

Harrison, M. (1998). The economics of World War II: An overview. In M. Harrison (Ed.), The economics of world war II: six great powers in ınternational comparison. (pp. 1–42) Cambridge University Press. https://doi.org/10.1017/CBO9780511497339.002

Harrison, S., & Weder, M. (2009). Technological change and the roaring twenties: A neoclassical perspective. Journal of Macroeconomics, 31 , 363–375. https://doi.org/10.1016/j.jmacro.2009.05.003

He, J., & Richard, P. (2009). Environmental Kuznets curve for CO 2 in Canada. Ecological Economics, 11 (3), 1–11.

Holtz-Ekain, D., & Selden, T. M. (1995). Stoking the fires? CO 2 emissions and economic growth. Journal of Public Economics, 57 , 85–101. https://doi.org/10.1016/0047-2727(94)01449-X

Humphrey, W. S., & Stanislaw, J. (1979). Economic growth and energy consumption in the UK, 1700–1975. Energy Policy, 7 , 29–42.

Huntington, H. G. (2005). US carbon emissions, technological progress and economic growth since 1870. International Journal of Global Energy Issues, 23 , 292–306. https://doi.org/10.1504/IJGEI.2005.006948

Jayanthakumaran, K., Verma, R., & Liu, Y. (2012). CO 2 emissions, energy consumption, trade and income: A comparative analysis of China and India. Energy Policy, 42 , 450–460. https://doi.org/10.1016/j.enpol.2011.12.010

Kander, A., & Lindmark, M. (2004). Energy consumption pollutant emissions and growth in the long run: Sweden through 200 years. European Review of Economic History, 8 , 297–335. https://doi.org/10.1017/S1361491604001224

Kasman, A., & Duman, Y. S. (2015). CO 2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: A panel data analysis. Economic Modelling, 44 , 97–103. https://doi.org/10.1016/j.econmod.2014.10.022

Klausen, J. (1998). War and welfare: Europe and the United States, 1945 to the Present . Martin’s Press.

Lanne, M., & Liski, M. (2004). Trends and breaks in per-capita carbon dioxide emissions, 1870–2028. Energy Journal, 25 (4), 41–65. https://doi.org/10.5547/ISSN0195-6574-EJ-Vol25-No4-3

Larson, E. D. (2012). Can US carbon emissions keep falling? Climate Central, 2 .

Leybourne, S., Newbold, P., & Vougas, D. (1998). Unit roots and smooth transitions. Journal of Time Series Analysis, 19 , 83–97. https://doi.org/10.1111/1467-9892.00078

Lindmark, M. (2002). An EKC-pattern in historical perspective: Carbon dioxide emissions, technology, fuel prices and growth in Sweden 1870–1997. Ecological Economics, 42 , 333–347. https://doi.org/10.1016/S0921-8009(02)00108-8

Lindmark, M., & Acar, S. (2014). The environmental Kuznets curve and the pasteur effect: Environmental costs in Sweden 1850–2000. European Review of Economic History, 18 , 306–323. https://doi.org/10.1093/ereh/heu011

Lipford, J. W., & Yandle, B. (2010). Environmental Kuznets curves, carbon emissions, and public choice. Environment and Development Economics, 15 (4), 417–438.

Liu, Z., Ciais, P., Deng, Z., Lei, R., Davis, S. J., Feng, S., & Schellnhuber, H. J. (2020). Near-real-time monitoring of global CO 2 emissions reveals the effects of the COVID-19 pandemic. Nature Communications, 11 (1), 5172. https://doi.org/10.1038/s41467-020-18922-7

Mikayilov, J. I., Hasanov, F. J., & Galeotti, M. (2018). Decoupling of CO 2 emissions and GDP: A time-varying cointegration approach. Ecological Indicators, 95 , 615–628. https://doi.org/10.1016/j.ecolind.2018.07.051

Mittlefehldt, S. (2018). From appropriate technology to the clean energy economy: Renewable energy and environmental politics since the 1970s. Journal of Environmental Studies and Sciences, 8 , 212–219. https://doi.org/10.1007/s13412-018-0471-z

Moomaw, W. R., & Unruh, G. C. (1997). Are environmental Kuznets curves misleading us? The case of CO 2 emissions. Environment and Development Economics, 2 , 451–463. https://doi.org/10.1017/S1355770X97000247

Morley, J. C., Nelson, C. R., & Zivot, E. (2003). Why are the beveridge-nelson and unobserved-components decompositions of GDP so different? Review of Economics and Statistics, 85 , 235–243.

Moutinho, V., Madaleno, M., & Elheddad, M. (2020). Determinants of the environmental kuznets curve considering economic activity sector diversification in the OPEC countries. Journal of Cleaner Production . https://doi.org/10.1016/j.jclepro.2020.122642

Mulatu, A. (2017). The structure of UK outbound FDI and environmental regulation. Environmental and Resource Economics, 68 , 65–96. https://doi.org/10.1007/s10640-017-0145-4

Nasir, M. A., Huynh, T. L. D., & Tram, H. T. X. (2019). Role of financial development, economic growth and foreign direct investment in driving climate change: A case of emerging ASEAN. Journal of Environmental Management, 242 , 131–141.

Nelson, H. T., von Hippel, D., Peterson, T., & Garagulagian, R. (2016). The great recession or progressive energy policies? Explaining the decline in US greenhouse gas emissions forecasts. Journal of Environmental Planning and Management, 59 , 480–500. https://doi.org/10.1080/09640568.2015.1017042

Omay, T. (2015). Fractional frequency flexible fourier form to approximate smooth breaks in unit root testing. Economic Letters, 134 , 123–126. https://doi.org/10.1016/j.econlet.2015.07.010

Omay, T., Emirmahmutoglu, F., & Hasanov, M. (2018). Structural break, nonlinearity and asymmetry: A re-examination of PPP proposition. Applied Economics, 50 , 1289–1308. https://doi.org/10.1080/00036846.2017.1361005

Omay, T., Gupta, R., & Bonaccolto, G. (2017). The US real GNP is trend-stationary after all. Applied Economics Letters, 24 , 510–514. https://doi.org/10.1080/13504851.2016.1205719

Ray, R. L., Singh, V. P., Singh, S. K., Acharya, B. S., & He, Y. (2022). What is the impact of COVID-19 pandemic on global carbon emissions? Science of the Total Environment, 816 , 151503. https://doi.org/10.1016/j.scitotenv.2021.151503

Sanyé-Mengual, E., Secchi, M., Corrado, S., Beylot, A., & Sala, S. (2019). Assessing the decoupling of economic growth from environmental impacts in the european union: A consumption-based approach. Journal of Cleaner Production, 236 , 117535. https://doi.org/10.1016/j.jclepro.2019.07.010

Schenk, C. R. (2005). Britain in the world economy. In P. Addison & H. Jones (Eds.), A companion to contemporary Britain 1939–2000 (pp. 463–481). Blackwell.

Şentürk, H., Omay, T., Yildirim, J., & Köse, N. (2020). Environmental Kuznets curve: Non-linear panel regression analysis. Environmental Modeling and Assessment, 25 , 633–651. https://doi.org/10.1007/s10666-020-09702-0

Sephton, P., & Mann, J. (2016). Compelling evidence of an environmental Kuznets curve in the United Kingdom. Environmental and Resource Economics, 64 , 301–315. https://doi.org/10.1007/s10640-014-9871-z

Shahbaz, M., Khraief, N., & Mahalik, M. K. (2020). Investigating the environmental Kuznets’s curve for Sweden: Evidence from multivariate adaptive regression splines (MARS). Empirical Economics, 59 , 1883–1902. https://doi.org/10.1007/s00181-019-01698-1

Shahbaz, M., Omay, T., & Roubaud, D. (2018). Sharp and smooth breaks in unit root. The Journal of Energy and Development, 44 , 5–40.

Shahbaz, M., Shafiullah, M., Papavassiliou, V. G., & Hammoudeh, S. (2017). The CO 2 –growth nexus revisited: A nonparametric analysis for the G7 economies over nearly two centuries. Energy Economics, 65 , 183–193. https://doi.org/10.1016/j.eneco.2017.05.007

Song, Y., Zhang, M., & Zhou, M. (2019). Study on the decoupling relationship between CO 2 emissions and economic development based on two-dimensional decoupling theory: A case between china and the United States. Ecological Indicators, 102 , 230–236. https://doi.org/10.1016/j.ecolind.2019.02.044

Stradling, D., & Thorsheim, P. (1999). The smoke of great cities: British and American efforts to control air pollution, 1860–1914. Environmental History, 4 (1), 6–31.

Tol, R. S. J., Pacala, S. W., & Socolow, R. H. (2009). Understanding long-term energy use and carbon dioxide emissions in the USA. Journal of Policy Modelling, 31 , 425–445. https://doi.org/10.1016/j.jpolmod.2008.12.002

Unruh, G. C., & Moomaw, W. R. (1998). An alternative analysis of apparent EKC-type transitions. Ecological Economics, 25 (2), 221–229. https://doi.org/10.1016/S0921-8009(97)00182-1

Wei, C. (2024). Historical trend and drivers of China’s CO 2 emissions from 2000 to 2020. Environment, Development and Sustainability, 26 (1), 2225–2244. https://doi.org/10.1007/s10668-022-02811-8

Wrigley, E. A. (2013). Energy and the English industria revolution. Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences, 371 , 1–272. https://doi.org/10.5860/choice.48-4603

Yang, J., Hao, Y., & Feng, C. (2021). A race between economic growth and carbon emissions: What play important roles towards global low-carbon development? Energy Economics, 100 , 105327. https://doi.org/10.1016/j.eneco.2021.105327

Yilanci, V., Gorus, M. S., & Andreoni, V. (2023). Reinvestigation of the validity of the EKC hypothesis extended with energy: A time-varying analysis for the United Kingdom. Journal of Cleaner Production, 428 , 139284.

Download references

This work was not supported by any institution.

Author information

Authors and affiliations.

Department of Economics, Atılım University, Ankara, Turkey

Department of Economics, TED University, Ankara, Turkey

Julide Yildirim

School of Water, Energy and Environment, Cranfield University, Cranfield, Bedfordshire, MK43 0AL, UK

Nazmiye Balta-Ozkan

You can also search for this author in PubMed Google Scholar

Contributions

Tolga Omay, Julide Yildirim, Nazmiye Balta-Ozkan equally contribute to conceptualization, methodology, writing-review & editing, validation, and formal analysis. Data curation, and writing-original draft.

Corresponding author

Correspondence to Tolga Omay .

Ethics declarations

Conflict of interests.

The authors declare no competing interests.

Ethical approval

Not applicable.

Consent for publication

Additional information, publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Omay, T., Yildirim, J. & Balta-Ozkan, N. Historical environmental Kuznets curve for the USA and the UK: cyclical environmental Kuznets curve evidence. Environ Dev Sustain (2024). https://doi.org/10.1007/s10668-024-05320-y

Download citation

Received : 01 February 2022

Accepted : 17 August 2024

Published : 17 September 2024

DOI : https://doi.org/10.1007/s10668-024-05320-y

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Cyclical environmental Kuznets curve

- Environmental degradation

- Economic growth

- Fourier filter

- Smooth structural breaks unit root test

JEL Classification

- Find a journal

- Publish with us

- Track your research

COMMENTS

Simon Kuznets put forward the hypothesis that relationship between per capita national income and the degree of inequality in income distribution may be of the form of inverted-U. Due to limitations of data he used an inequality measure of the ratio of income share of the richest 20 per cent of the population to the bottom 60 per cent of the population known as Kuznets' ratio. According to the ...

The Kuznets curve is a graphical representation of the relationship between economic growth and income inequality. It is a hypothetical inverted U-shaped curve that illustrates that with increasing GDP per capita (economic growth), countries initially experience increasing income inequality, but later on, the income inequality decreases. Origin.

Kuznets curve diagrams show an inverted U curve, ... economist Robert Fogel noted Kuznets's own reservations about the "fragility of the data" which underpinned the hypothesis. Fogel notes that most of Kuznets's paper was devoted to explicating the conflicting factors at play. Fogel emphasized Kuznets's opinion that "even if the data turned out ...

Updated on April 10, 2019. The Kuznets curve is a hypothetical curve that graphs economic inequality against income per capita over the course of economic development (which was presumed to correlate with time). This curve is meant to illustrate economist Simon Kuznets' (1901-1985) hypothesis about the behavior and relationship of these two ...

The Kuznets curve, named after economist Simon Kuznets, is a graphical representation of the relationship between economic development and income inequality. It suggests that as an economy develops from a low-income agrarian society to a higher-income industrial and then post-industrial society, income inequality follows a specific pattern. The Kuznets curve is often depicted as an inverted U ...

the Kuznets curve—the inverse-U shaped pattern of inequality. In a seminal paper, Kuznets (1955) argued that as countries developed, income inequality first increased, peaked, and then decreased, and documented this using both cross-country and time-series data. The empirical validity of this "Kuznets curve" has been intensively inves-

The Kuznets inverted U-shaped hypothesis, also known as the Kuznets curve, is a theory in economics proposed by Simon Kuznets. It suggests a relationship bet...

The explanation that Kuznets himself gave to the inverted-U curve hypothesis was based on the sectoral shifts away from traditional agriculture that characterizes long-run economic growth. In effect, the model he had in mind was very much along the lines of the classical surplus labor model as formulated in the modern literature by Lewis (1954 ...

This paper provides a historical analysis of the changing significance of the most influential statement ever made on inequality and development—Simon Kuznets's "inverted U-curve hypothesis." The shifting interpretations and appropriations of the hypothesis over time—from its status as a speculative supposition in 1955, to its rise and fall as a reified socioeconomic law, to its ...

Abstract. In the over half a century since its inception, the inverted U-curve hypothesis cautiously articulated by Simon Kuznets in 1954 has gone through a spectacular rise and fall, having first skyrocketed to universal acclaim as an indubitable socioeconomic law, then having endured a period of substantial criticism before eventually giving ...

KEY WORDS: Kuznets's U-curve; income inequality; development; comparative theory; social scientific knowledge. Simon Kuznets's "inverted U-curve hypothesis" is one of the most en-during and remarkable arguments in the history of the social sciences. First made public in his 1954 Presidential Address to the American Economic

The Kuznets ratio is a measurement of the ratio of income going to the highest-earning households (usually defined by the upper 20%) to income going to the lowest-earning households, which is commonly measured by either the lowest 20% or lowest 40% of income. Comparing 20% to 20%, a completely even distribution is expressed as 1; 20% to 40% ...

known as the "Kuznets curve," "the inverted-U" or simply the Kuznets Hypothesis (KH). 2. A similar prediction of an initial rise in inequality, but an eventual turning point, emerged from another influential development model by Arthur Lewis (1954). The subsequent literature formalized and developed the insights from the Kuznets-Lewis ...

Kuznets' inverted-U hypothesis implies that economic growth worsens income inequality first and improves it later at a higher stage of economic development. In addition to economic growth, other factors such as population growth, resource endowment, price instability, openness, currency devaluation, etc. have been identified as determinants of ...

Twenty years later, Robinson (1976) confirmed Kuznets's theory by constructing a mathematical model that represents it. Based on the Kuznets model, he divided the economy into two sectors, the agricultural sector, and the non-agricultural sector. 1 Eq. (4) gives the shape of the curve, which will be Inverted-U with A < 0.Robinson explains how we get the Kuznets curve through this equation ...

Simon Kuznets observed a relationship between inequality and development which came to be known as the Kuznets Inverted-U hypothesis. He postulated that inequality in income distribution will rise during the early stages of development. With further development, inequality will increase to a maximum and eventually start decreasing in the later ...

The Kuznets-proposition, which is often referred to as the "inverted U" hypothesis, has been rationalized mainly in terms of models of dualistic development.2 The hypothesis has received enormous attention in the lit- erature on economic development and income distribution, and has been subjected to numerous.

Recent empirical tests of the Kuznets hypothesis have raised questions about this conjecture, yet most of these studies are based on limited and deficient data. ... Note you can select to save to either the @free.kindle.com or @kindle.com variations. '@free.kindle.com' emails are free but can only be saved to your device when it is ...

The Kuznets hypothesis of inverted U-curve dependence of the income inequality on the absolute value of the average income is still an unresolved issue despite the growing number of theoretical ...

Now that we know the Kuznets hypothesis, we must comprehend the measurements of economic development and economic inequality used for it. Firstly, the economy's production of goods and services is established; that is, the gross domestic product (GDP) for a period in per capita terms so that this production measure takes the country's population into account—the result being the GDP per ...

Kuznets's Inverted-U Hypothesis: Comment. In a recent article appearing in this journal, Ram [5] presents evidence from the United States contradicting the Kuznets inverted-U hypothesis associated with income inequality, which states that inequality would initially increase with economic development but then would fall eventu- ally [3; 4]. Ram ...

In the 1950s, Simon Kuznets hypothesized that an inverted U-shaped relationship exists between inequality and development. As countries developed, inequality would increase until a certain tipping point, after which it would start to fall again. Although this hypothesis is highly contested, the inverted U-curve is featured in most introductory ...

Note that developed countries are debtors, developing countries are creditors. Fig. 4. Ecological deficit/reserve map. Full size image. ... Kuznets's Inverted U hypothesis has been tested in many studies. There is little evidence for a common inverted U-shaped pathway that countries follow as their income rises. For all countries, the goal ...

Human activities, including population growth, industrialization, and urbanization, have increasingly impacted the environment. Despite the benefits of economic growth to individual welfare, its negative environmental consequences necessitate a thorough assessment. The environmental Kuznets curve (EKC), positing an inverted U-shaped relationship between income per capita and environmental ...