Essay on Inflation

Students are often asked to write an essay on Inflation in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Inflation

Understanding inflation.

Inflation is when prices of goods and services rise over time. This means you need more money to buy the same things. It’s like a slow-motion robbery!

Causes of Inflation

Inflation is often due to increased production costs or increased demand for goods and services. When people want more of something, and it’s scarce, prices go up.

Impact of Inflation

Inflation affects everyone. If your income doesn’t increase as fast as inflation, you’ll have less buying power. But, if you’re a business owner, you might be able to raise prices and make more money.

Controlling Inflation

Governments try to control inflation by adjusting interest rates, taxes, and government spending. It’s a tricky balancing act to keep inflation low but not too low.

250 Words Essay on Inflation

Inflation, a crucial economic concept, refers to the rate at which the general level of prices for goods and services is rising, subsequently eroding purchasing power. It’s an indicator of the economic health of a nation, with moderate inflation signifying a growing economy.

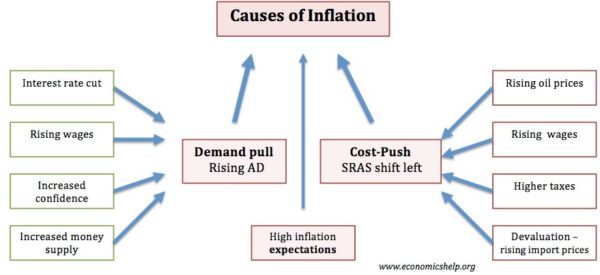

The Causes of Inflation

Inflation generally occurs due to two primary factors: demand-pull and cost-push inflation. Demand-pull inflation transpires when demand for goods and services surpasses their supply. On the other hand, cost-push inflation arises when the costs of production escalate, causing producers to increase prices to maintain profit margins.

Effects of Inflation

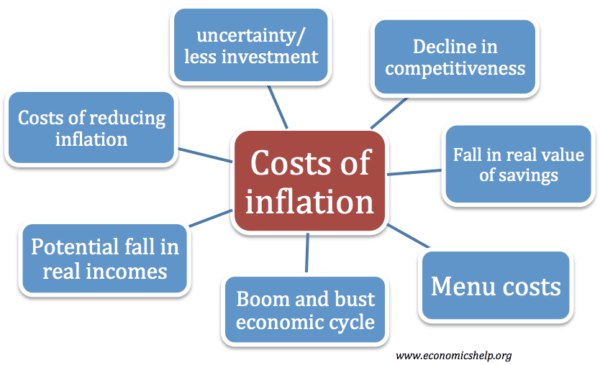

Inflation impacts various aspects of the economy. It erodes the purchasing power of money, causing consumers to spend more for the same goods or services. Inflation can also create uncertainty in the economy, affecting investment and saving decisions. However, moderate inflation can stimulate spending and investment, driving economic growth.

Managing Inflation

Central banks attempt to control inflation through monetary policy. By adjusting interest rates, they influence the level of spending and investment in the economy. Higher interest rates typically reduce spending, curbing inflation. Conversely, lower interest rates stimulate spending, potentially leading to inflation.

Inflation is a complex and multifaceted subject. Understanding its causes, effects, and the measures to control it is essential for both macroeconomic stability and individual financial well-being. As future leaders, it’s crucial for us as students to grasp these concepts to make informed decisions in our professional and personal lives.

500 Words Essay on Inflation

Introduction to inflation.

Inflation is primarily caused by an increase in the money supply that outpaces economic growth. Ever since the end of the gold standard, governments have had the ability to create money at will. If a nation’s money supply grows too rapidly compared to its production of goods and services, prices will increase, leading to inflation.

Additionally, inflation can be spurred by demand-pull conditions, where demand for goods and services exceeds their supply. Cost-push inflation, on the other hand, occurs when the costs of production increase, causing producers to raise prices to maintain their profit margins.

Impacts of Inflation

Moreover, inflation can harm savers if the inflation rate surpasses the interest rate on their savings. It also favors borrowers, as the real value of their debt diminishes over time. This redistribution of wealth from savers to borrowers can lead to social and economic inequalities.

Central banks use monetary policy to control inflation. They adjust the money supply by setting interest rates and through open market operations. By raising interest rates, central banks can decrease the money supply, making borrowing more expensive and slowing economic activity, thereby reducing inflation.

Inflation is an intricate part of our economic systems. It is a double-edged sword that can stimulate economic growth when mild, but can also lead to economic instability when it becomes too high. Understanding inflation is crucial for policymakers, investors, and consumers alike as it influences our decisions and shapes our economic reality. By effectively managing inflation, governments can promote economic stability and growth, thereby improving the standard of living for their citizens.

If you’re looking for more, here are essays on other interesting topics:

Apart from these, you can look at all the essays by clicking here .

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Presentations made painless

- Get Premium

100 Inflation Essay Topic Ideas & Examples

Inside This Article

Inflation is a key economic indicator that affects the purchasing power of consumers and the overall health of an economy. As such, it is a popular topic for essays and research papers in economics, finance, and related fields. If you are looking for inspiration for your next inflation essay, look no further. Here are 100 inflation essay topic ideas and examples to help you get started:

- The causes and effects of inflation

- The relationship between inflation and unemployment

- The impact of inflation on interest rates

- The role of the Federal Reserve in controlling inflation

- The differences between demand-pull and cost-push inflation

- The effects of hyperinflation on a country's economy

- The impact of inflation on fixed income earners

- The relationship between inflation and the stock market

- The effects of inflation on real estate prices

- The impact of inflation on international trade

- The role of inflation expectations in shaping economic behavior

- The effects of inflation on poverty and income inequality

- The impact of inflation on retirement savings

- The relationship between inflation and economic growth

- The effects of inflation on consumer spending

- The role of inflation in shaping monetary policy decisions

- The impact of inflation on business investment

- The effects of inflation on government finances

- The relationship between inflation and currency exchange rates

- The impact of inflation on the cost of living

- The effects of inflation on social welfare programs

- The role of inflation in causing economic recessions

- The impact of inflation on international competitiveness

- The effects of inflation on the environment

- The relationship between inflation and financial stability

- The role of inflation in shaping government policy decisions

- The impact of inflation on entrepreneurship and innovation

- The effects of inflation on consumer confidence

- The relationship between inflation and technological advancement

- The impact of inflation on the healthcare industry

- The effects of inflation on the education sector

- The role of inflation in shaping consumer behavior

- The impact of inflation on the agricultural sector

- The relationship between inflation and social mobility

- The effects of inflation on urban development

- The role of inflation in shaping labor market dynamics

- The impact of inflation on small businesses

- The effects of inflation on the tourism industry

- The relationship between inflation and government regulations

- The impact of inflation on infrastructure development

- The role of inflation in shaping energy policy

- The effects of inflation on the manufacturing sector

- The relationship between inflation and the digital economy

- The impact of inflation on the gig economy

- The effects of inflation on the sharing economy

- The role of inflation in shaping consumer preferences

- The impact of inflation on the automotive industry

- The relationship between inflation and the housing market

- The effects of inflation on the retail sector

- The impact of inflation on the hospitality industry

- The role of inflation in shaping supply chain dynamics

- The effects of inflation on the fashion industry

- The relationship between inflation and the art market

- The impact of inflation on the entertainment industry

- The effects of inflation on the music industry

- The role of inflation in shaping the sports industry

- The relationship between inflation and the gaming industry

- The impact of inflation on the film industry

- The effects of inflation on the publishing industry

- The role of inflation in shaping the food and beverage industry

- The impact of inflation on the beauty and personal care industry

- The effects of inflation on the health and wellness industry

- The relationship between inflation and the pharmaceutical industry

- The impact of inflation on the technology industry

- The effects of inflation on the telecommunications industry

- The role of inflation in shaping the media industry

- The relationship between inflation and the advertising industry

- The impact of inflation on the e-commerce industry

- The effects of inflation on the transportation industry

- The role of inflation in shaping the logistics industry

- The impact of inflation on the energy industry

- The effects of inflation on the renewable energy industry

- The relationship between inflation and the oil and gas industry

- The impact of inflation on the mining industry

- The effects of inflation on the construction industry

- The role of inflation in shaping the real estate industry

- The relationship between inflation and the property market

- The impact of inflation on the architecture and design industry

- The effects of inflation on the engineering industry

- The role of inflation in shaping the manufacturing industry

- The effects of inflation on the aerospace industry

- The relationship between inflation and the defense industry

- The impact of inflation on the security industry

- The effects of inflation on the law enforcement industry

- The role of inflation in shaping the healthcare industry

- The impact of inflation on the medical devices industry

- The effects of inflation on the biotechnology industry

- The role of inflation in shaping the life sciences industry

- The impact of inflation on the education industry

- The effects of inflation on the e-learning industry

- The relationship between inflation and the edtech industry

- The impact of inflation on the publishing industry

- The effects of inflation on the media and entertainment industry

- The role of inflation in shaping the sports and recreation industry

- The relationship between inflation and the leisure and travel industry

- The impact of inflation on the tourism and hospitality industry

- The effects of inflation on the food and beverage industry

- The role of inflation in shaping the retail and consumer goods industry

These are just a few examples of the many possible topics you could explore in an inflation essay. Whether you are interested in the macroeconomic implications of inflation or its effects on specific industries, there is no shortage of interesting and important questions to investigate. So pick a topic that interests you, do some research, and start writing!

Want to research companies faster?

Instantly access industry insights

Let PitchGrade do this for me

Leverage powerful AI research capabilities

We will create your text and designs for you. Sit back and relax while we do the work.

Explore More Content

- Privacy Policy

- Terms of Service

© 2024 Pitchgrade

Economic essays on inflation

- Definition – Inflation – Inflation is a sustained rise in the cost of living and average price level.

- Causes Inflation – Inflation is caused by excess demand in the economy, a rise in costs of production, rapid growth in the money supply.

- Costs of Inflation – Inflation causes decline in value of savings, uncertainty, confusion and can lead to lower investment.

- Problems measuring inflation – why it can be hard to measure inflation with changing goods.

- Different types of inflation – cost-push inflation, demand-pull inflation, wage-price spiral,

- How to solve inflation . Policies to reduce inflation, including monetary policy, fiscal policy and supply-side policies.

- Trade off between inflation and unemployment . Is there a trade-off between the two, as Phillips Curve suggests?

- The relationship between inflation and the exchange rate – Why high inflation can lead to a depreciation in the exchange rate.

- What should the inflation target be? – Why do government typically target inflation of 2%

- Deflation – why falling prices can lead to negative economic growth.

- Monetarist Theory – Monetarist theory of inflation emphasises the role of the money supply.

- Criticisms of Monetarism – A look at whether the monetarist theory holds up to real-world scenarios.

- Money Supply – What the money supply is.

- Can we have economic growth without inflation?

- Predicting inflation

- Link between inflation and interest rates

- Should low inflation be the primary macroeconomic objective?

See also notes on Unemployment

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

What Causes Inflation?

- Walter Frick

Why your money is worth less than it used to be.

What causes inflation? There is no one answer, but like so much of macroeconomics it comes down to a mix of output, money, and expectations. Supply shocks can lower an economy’s potential output, driving up prices. An increase in the money supply can stoke demand, driving up prices. And the expectation of inflation can become a self-fulfilling cycle as workers and companies demand higher wages and set higher prices.

Since the financial crisis of 2008 and the Great Recession, investors and executives have grown accustomed to a world of low interest rates and low inflation. No longer. In 2021, inflation began rising sharply in many parts of the world, and in 2022 the U.S. saw its worst inflation in decades.

- Walter Frick is a contributing editor at Harvard Business Review , where he was formerly a senior editor and deputy editor of HBR.org. He is the founder of Nonrival , a newsletter where readers make crowdsourced predictions about economics and business. He has been an executive editor at Quartz as well as a Knight Visiting Fellow at Harvard’s Nieman Foundation for Journalism and an Assembly Fellow at Harvard’s Berkman Klein Center for Internet & Society. He has also written for The Atlantic , MIT Technology Review , The Boston Globe , and the BBC, among other publications.

Partner Center

Home — Essay Samples — Economics — Political Economy — Inflation

Essays on Inflation

Inflation essay topics and outline examples, essay title 1: understanding inflation: causes, effects, and economic policy responses.

Thesis Statement: This essay provides a comprehensive analysis of inflation, exploring its root causes, the economic and societal effects it generates, and the various policy measures employed by governments and central banks to manage and mitigate inflationary pressures.

- Introduction

- Defining Inflation: Concept and Measurement

- Causes of Inflation: Demand-Pull, Cost-Push, and Monetary Factors

- Effects of Inflation on Individuals, Businesses, and the Economy

- Inflationary Policies: Central Bank Actions and Government Interventions

- Case Studies: Historical Inflationary Periods and Their Consequences

- Challenges in Inflation Management: Balancing Growth and Price Stability

Essay Title 2: Inflation and Its Impact on Consumer Purchasing Power: A Closer Look at the Cost of Living

Thesis Statement: This essay focuses on the effects of inflation on consumer purchasing power, analyzing how rising prices affect the cost of living, household budgets, and the strategies individuals employ to cope with inflation-induced challenges.

- Inflation's Impact on Prices: Understanding the Cost of Living Index

- Consumer Behavior and Inflation: Adjustments in Spending Patterns

- Income Inequality and Inflation: Examining Disparities in Financial Resilience

- Financial Planning Strategies: Savings, Investments, and Inflation Hedges

- Government Interventions: Indexation, Wage Controls, and Social Programs

- The Global Perspective: Inflation in Different Economies and Regions

Essay Title 3: Hyperinflation and Economic Crises: Case Studies and Lessons from History

Thesis Statement: This essay explores hyperinflation as an extreme form of inflation, examines historical case studies of hyperinflationary crises, and draws lessons on the devastating economic and social consequences that result from unchecked inflationary pressures.

- Defining Hyperinflation: Thresholds and Characteristics

- Case Study 1: Weimar Republic (Germany) and the Hyperinflation of 1923

- Case Study 2: Zimbabwe's Hyperinflationary Collapse in the Late 2000s

- Impact on Society: Currency Devaluation, Poverty, and Social Unrest

- Responses and Recovery: Stabilizing Currencies and Rebuilding Economies

- Preventative Measures: Policies to Avoid Hyperinflationary Crises

Report on Inflation and Its Causes

The rise of inflation rate in the us, made-to-order essay as fast as you need it.

Each essay is customized to cater to your unique preferences

+ experts online

Iflation and Its Causes

Methods to control inflation, the grade inflation, inflation: a deceitful solution to debt, let us write you an essay from scratch.

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

How to Control Inflation in Pakistan

Main factors of inflation in singapore, effects of inflation on commercial banks’ lending: a case of kenya commercial bank limited, food inflation in the republic of india, get a personalized essay in under 3 hours.

Expert-written essays crafted with your exact needs in mind

The Issue of Unemployment and Inflation in Colombia

The theory and policy of macroeconomics on inflation rate, socio-economic conditions in 'what is poverty' by jo goodwin parker, non-accelerating inflation rate of unemployment (nairu), targeting zero inflation and increase of government spending as a way of curbing recession, howa spiraling inflation has impacted the venezuelan economy, how venezuela has been affected by inflation, effects of inflation on kenya commercial banks lending, exploring theories of inflation in economics, about fuel prices: factors, impacts, and solutions, analyzing the inflation reduction act, the oscillating tides of the american economy, exploring the implications of the inflation reduction act, inflation reduction act in the frame of macroeconomic challenges, the impact of inflation reduction act on the international economic stage, relevant topics.

- Unemployment

- Penny Debate

- American Dream

- Real Estate

- Supply and Demand

- Minimum Wage

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

Facing down a surprising U.S. inflation surge

Kennedy School experts in public finance and economic policy weigh in on the causes and responses to the highest American consumer price jump in three decades.

Inflation in the United States has jumped to the highest level in 30 years, reaching 6.2% in October as measured by the Consumer Price Index. The COVID-19 pandemic has fueled consumer demand for goods and services at a time when supply lines are constrained and many industries have been affected by staff shortages. The inflation surge has generated intense political debate on the causes and the appropriate response.

We asked several economists and public finance experts at Harvard Kennedy School—all of whom have held senior federal government economics roles—to offer brief perspectives on how they view the underlying issues and the key policy choices facing the Biden administration and Congress.

- Linda Bilmes - Inflation's impact at the state and local level

- Karen Dynan - Weighing the uncertainties

- Jeffrey Frankel - Inflation Do's and Don'ts

- Jason Furman - Supply and demand challenges

- Lawrence H. Summers - Biden team needs to signal its concern about inflation

Inflation risks also lie ahead for state and local governments

On the revenue side, income and sales tax receipts will largely keep pace with inflation, so moderate inflation is unlikely to have a major impact. However, if inflation leads to sharply higher interest rates that lead to a stock market sell-off, then states that are highly dependent on capital gains taxes (such as California and New Jersey) may suffer. Another area of vulnerability could be property taxes, especially states where increases in assessed values or in property taxes are capped, as with California’s Prop. 13. These prevent rising house prices feeding through into state revenues, and are also the major revenue source for local governments.

On the expense side, the biggest risk is rising wages, which consume the largest share of state budgets. We could see public sector unions pushing for a return of “CPI-plus” language in new labor agreements. This would automatically bake in the cost of higher inflation to local expenditures. In addition, high inflation could significantly weaken state pension plans, many of which assume that future wage increases will be only 2%. Most of the current generation of local pension managers have little experience with inflation. They need to begin adjusting their portfolios now to prevent erosion of their asset bases.

Linda Bilmes is the Daniel Patrick Moynihan Lecturer in Public Policy and previously served as Assistant Secretary of Commerce.

What's certain is just how many uncertainties lie ahead

What is not clear is how quickly these issues will resolve. The size and persistence of demand/supply imbalances has repeatedly surprised us, in part because virus caseloads have stayed unexpectedly high. We have only a limited understanding of why so many would-be workers are staying out of the labor force, making it hard to predict how many will return and how quickly. We are not sure how much inflation expectations have risen (a critical determinant of whether higher inflation sticks) because of measurement difficulties.

This uncertainty makes it difficult for monetary policymakers to know when they need to begin raising rates to avoid letting inflation stay at undesirably high levels. Given that they may need to revise their views quickly based on incoming data, it is especially important that they communicate the high degree of uncertainty. Surprising financial markets with an abrupt unexpected change in policy could lead to a rapid decline in asset prices that causes a significant setback in the economic recovery.

Karen Dynan is a professor of the practice of economics and former chief economist of the U.S. Treasury.

Some inflation-fighting do's and don'ts

Let’s start with two don'ts.

- Don’t do what Federal Reserve Chair Arthur Burns and President Richard Nixon did in 1971, in order to help the president’s reelection: They responded to moderate 5% to 6 % inflation with a combination of rapid monetary stimulus and doomed wage-price controls. The lid was blown off the boiling pot a few years later; the inflation rate jumped above 12%.

- Don’t do what Donald Trump did on April 2, 2020 , to help out American oil producers: He persuaded Saudi Arabia that OPEC must cut oil output and raise prices.

- Continue to fight in the Senate for a fully funded social spending bill (“Build Back Better”).

- Let imports into the country more easily. They are a safety valve for an overheated economy. Trump put up a lot of import tariffs , which raise prices to consumers—sometimes directly, as with washing machines, and sometimes indirectly, as with steel and aluminum, which are important inputs into autos and countless other goods. With or without foreign reciprocation, U.S. trade liberalization could bring prices down quickly in many supply-constrained sectors.

- Similarly, facilitating orderly immigration would help alleviate the shortage of workers that employers in some sectors are experiencing.

- Further vaccination would increase the supply of labor, through several possible channels. One channel would be to keep children in school, allowing more parents to go back to work. Another channel is to alleviate worker’s fears of infection in the workplace.

Jeffrey Frankel is the James W. Harpel Professor of Capital Formation and Growth and was a member of the Council of Economic Advisors from 1983-1984 and 1996-1999.

Supply and demand—and the Federal Reserve’s key role

Economists like to explain everything with demand and supply, and the concepts work well here. Demand is likely to remain high, fueled by households with healthy balance sheets, continued fiscal support, and very low interest rates. No one knows how long it will take supply to recover, or even whether it will fully recover, but it could be at least a year. The combination of strong demand and weak supply will likely keep inflation uncomfortably high.

President Biden can do a little about inflation by helping with port capacity and other supply-chain measures. Even better would be dropping President Trump’s tariffs on China. But these steps would only be small. The main agency charged with controlling inflation is the Federal Reserve. They are right to continue to be focused on the millions of people without jobs but should recalibrate towards incorporating more concern for inflation into their policy stance, including setting a default of more rate increases in 2022, something it can call off if inflation and/or employment is well below what we are currently expecting.

Jason Furman is the Aetna Professor of the Practice of Economic Policy and previously was chair of the Council of Economic Advisors under President Obama.

Biden team needs to signal its determination to address inflation

Simultaneously, the Administration should signal that a concern about inflation will inform its policies generally. Measures already taken to reduce port bottlenecks may have limited effect but are a clear positive step. Buying inexpensively should take priority over buying American. Tariff reduction is the most important supply-side policy the administration could undertake to combat inflation. Raising fossil fuel supplies, such as the recent deployment of the Strategic Petroleum Reserve, is crucial. And financial regulators need to step up and be attentive to the pockets of speculative excess that are increasingly evident in financial markets.

Excessive inflation and a sense that it was not being controlled helped elect Richard Nixon and Ronald Reagan, and risks bringing Donald Trump back to power. While an overheating economy is a relatively good problem to have compared to a pandemic or a financial crisis, it will metastasize and threaten prosperity and public trust unless clearly acknowledged and addressed.

Lawrence H. Summers is Charles W. Eliot University Professor , Weil Director of the Mossavar-Rahmani Center for Business and Government, and president emeritus of Harvard University. His government positions included Secretary of the Treasury in the Clinton Administration and Director of the National Economic Council under President Obama. Portions of this essay were excerpted from a Washington Post column .

Banner image by AP Photo/Noah Berger; inline image by Xinhua via Getty Images; faculty portraits by Martha Stewart

More from HKS

Helping homeowners during the covid-19 pandemic: lessons from the great recession, democratizing the federal regulatory process: a blueprint to strengthen equity, dignity, and civic engagement through executive branch action, economic inequality and insecurity: policies for an inclusive economy.

Get smart & reliable public policy insights right in your inbox.

Essay on Inflation: Meaning, Measurement and Causes

Let us make in-depth study of the meaning, measurement and causes of inflation.

Meaning of Inflation:

By inflation we mean a general rise in prices. To be more correct, inflation is a persistent rise in general price level rather than a once-for-all rise in it.

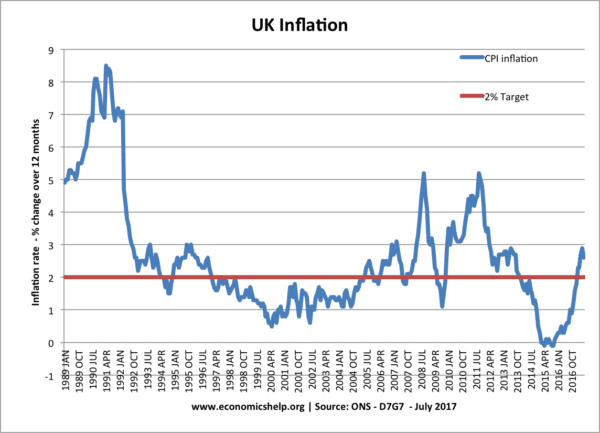

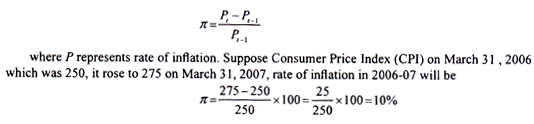

Rate of inflation is either measured by the percentage change in wholesale price index number (WPI) over a period or by percentage change in consumer price index number (CPI).

Opinion surveys conducted in India and the United States reveal that inflation is the most important concern of the people as it affects their standard of living adversely A high rate of inflation erodes the real incomes of the people. A high rate of inflation makes the life of the poor people miserable. It is therefore described as anti-poor, inflation redistributes income and wealth in favour of the rich.

ADVERTISEMENTS:

Thus, it makes the rich richer and the poor poorer. Above all, a high rate inflation adversely effects output and encourages investment in unproductive channels such as purchase of gold, silver, jewellery and real estate. Therefore, it adversely affects long-run economic growth, especially in developing countries like India. Inflation has therefore been described ‘as enemy number one’.

Measurement of Rate of Inflation:

Inflation has been one of the important problems facing the economies of the world. Precisely stated, inflation is the rate of change of general price level during a period of time. And the general price level in a period is the result of inflation in the past. Through rate of inflation economists measures the cost of living in an economy. Let us explain how rate of inflation is measured. Suppose P i X represents the price level on 31st March 2006 and P represents the price level on 31st March 2007. Then the rate of inflation in year 2006-07 will be equal to

Thus, rate of inflation during 2006-07 will be 10 per cent. This is called point-to-point inflation rate. There are 52 weeks in a year, average of price indexes of 52 weeks of a year (say 2005-06) can be calculated to compare the average of price indexes of 52 weeks of year 2006-07 and find the inflation rate on the basis of average weekly price levels of a year. In both these ways rate of inflation in different years is measured and compared.

It is evident from above that price level in a period is measured by a price index. There are several commodities in an economy which are produced and consumed by the people. It is through construction of a weighted price index that economists aggregate money prices of several commodities which are assigned different weights.

In India the wholesale price Index (WPI) of all commodities with base year 1993-94 price level at the end of fiscal year is used to measure rate of inflation and is widely reported in the media. Since the wholesale price index does not truly indicate the cost of living, separate Consumer Price Index (CPI) for agricultural labourers and Consumer Price Index (CPI) for industrial workers (with base 1982 = 100) at the end of fiscal year are constructed to measure rate of inflation.

In constructing the Consumer Price Index (CPI) the price of a basket of goods which a typical consumer, industrial worker or agricultural labourer as the case may be are taken into account.

What Causes Inflation?

1. keynes’s view:.

Classical economists thought that it was the quantity of money in the economy that determined the general price level in the economy. According to them, rate of inflation depends on the growth of money supply in the economy. Keynes criticized the ‘ Quantity Theory of Money’ and showed that expansion in money supply did not always lead to inflation or rise in price level.

Keynes who before the Second World War explained that involuntary unemployment and depression were due to the deficiency of aggregate demand, during the war period when price rose very high he explained that inflation was due to excessive aggregate demand. Thus, Keynes put forward what is now called demand-pull theory of inflation.

Demand – Pull Inflation

Thus, according to Keynes, inflation is caused by a situation whereby the pressure of aggregate demand for goods and services exceeds the available supply of output (both begging counted at the prices ruling at the beginning of a period). In such a situation, rise in price level is the natural consequence.

Now, this imbalance between aggregate demand and supply may be the result of more than one force at work. As we know aggregate demand is the sum of consumers’ spending on consumer goods and services, government spending on consumer goods and services and net investment being planned by the entrepreneurs.

But excess of aggregate demand over aggregate supply does not explain persistent rise in prices, year after year. An important factor which feeds inflation is wage-price spiral. Wage-price spiral operates as follows: A rise in prices reduces the real consumption of the wage earners. They will, therefore, press for higher money wages to compensate them for the higher cost of living. Now, an increase in wages, if granted, will raise the prime cost of production and, therefore, entrepreneurs will raise the prices of their products to recover the increment in cost.

This will add fuel to the inflationary fire. A further rise in prices raises the cost of living still further and the workers ask for still higher wages. In this way, wages and prices chase each other and the process of inflationary rise in prices gathers momentum. If unchecked, this may lead to hyper-inflation which signifies a state of affairs where wages and prices chase each other at a very quick speed.

2. Monetarist View:

The Keynesian explanation of demand-pull inflation is important to note that both the original quantity theorists and the modem monetarists, prominent among whom is Milton Friedman, explain inflation in terms of excess demand for goods and services. But there is an important difference between the monetarist view of demand-pull inflation and the Keynesian view of it. Keynes explained inflation as arising out of real sector forces.

In his model of inflation excess demand comes into being as a result of autonomous increase in expenditure on investment and consumption or increase in government expenditure. That is, the increase in aggregate expenditure or demand occurs independent of any increase in the supply of money.

On the other hand, monetarists explain the emergence of excess demand and the resultant rise in prices on account of the increase in money supply in the economy. To quote Milton Friedman, a Nobel Laureate in economics. “Inflation is always and everywhere a monetary phenomenon…… and can be produced only by a more rapid increase in the quantity of money than in output.”

Friedman holds that when money supply is increased in the economy, then there emerges an excess supply of real money balances with the public over their demand for money. This disturbs the monetary equilibrium. In order to restore the equilibrium the public will reduce the money balances by increasing expenditure on goods and services.

Thus, according to Friedman and other modern quantity theorists, the excess supply of real monetary balances results in the increase in aggregate demand for goods and services. If there is no proportionate increase in output, then extra money supply leads to excess demand for goods and services. This causes inflation or rise in prices. Thus, according to monetarists let by Prof. Milton Friedman, excess creation of money supply is the main factor responsible for inflation.

Cost-Push Inflation:

Even when there is no increase in aggregate demand, prices may still rise. This may happen if the costs, particularly the wage costs, increase. Now, as the level of employment increases, the demand for workers rises progressively so that the bargaining position of the workers is enhanced. To exploit this situation, they may ask for an increase in wage rates which are not justifiable either on grounds of a prior rise in productivity or cost of living.

The employers in a situation of high demand and employment are more agreeable to concede to these wage claims because they hope to pass on these rises in costs to the consumers in the form of rise in prices. Therefore, when inflation is caused by rise in wages or hike in other input costs such as rise in prices of raw materials, rise in prices of petroleum products, it is called cost-push inflation. If this happens we have another inflationary factor at work.

Besides the increase in wages of labour without any increase in its productivity, or rise in costs of other inputs there is another factor responsible for cost-push inflation. This is the increase in the profit margins by the firms working under monopolistic or oligopolistic conditions and as a result charging higher prices from the consumers. In the former case when the cause of cost-push inflation is the rise in wages it is called wage-push inflation and in the latter case when the cause of cost-push inflation is the rise in profit margins, it is called profit-push inflation.

In addition to the rise in wage rate of labour and increase in profit margin, in the seventies the other cost-push factors (also called supply shocks) causing increase in marginal cost of production became more prominent in bringing about rise in prices. During the seventies, rise in prices of raw materials, especially energy inputs such a hike in crude oil prices made by OPEC resulted in rise in prices of petroleum products.

For example, sharp rise in world oil prices during 1973-75 and again in 1979-80 produced significant cost-push factor which caused inflation not only in Indian but all over the world. Now, in June-August 2004 again the world oil prices have greatly risen. As a result, in India prices of petrol, diesel, cooking gas were raised by petroleum companies. This is tending to raise the rate of inflation.

Related Articles:

- Essay on the Causes of Inflation (473 Words)

- Demand Pull Inflation and Cost Push Inflation | Money

- Difference between Demand Inflation and Cost Inflation

- Cost-Push Inflation and Demand-Pull or Mixed Inflation

What is inflation?

Inflation has been top of mind for many over the past few years. But how long will it persist? In June 2022, inflation in the United States jumped to 9.1 percent, reaching the highest level since February 1982. The inflation rate has since slowed in the United States , as well as in Europe , Japan , and the United Kingdom , particularly in the final months of 2023. But even though global inflation is higher than it was before the COVID-19 pandemic, when it hovered around 2 percent, it’s receding to historical levels . In fact, by late 2022, investors were predicting that long-term inflation would settle around a modest 2.5 percent. That’s a far cry from fears that long-term inflation would mimic trends of the 1970s and early 1980s—when inflation exceeded 10 percent.

Get to know and directly engage with senior McKinsey experts on inflation.

Ondrej Burkacky is a senior partner in McKinsey’s Munich office, Axel Karlsson is a senior partner in the Stockholm office, Fernando Perez is a senior partner in the Miami office, Emily Reasor is a senior partner in the Denver office, and Daniel Swan is a senior partner in the Stamford, Connecticut, office.

Inflation refers to a broad rise in the prices of goods and services across the economy over time, eroding purchasing power for both consumers and businesses. Economic theory and practice, observed for many years and across many countries, shows that long-lasting periods of inflation are caused in large part by what’s known as an easy monetary policy . In other words, when a country’s central bank sets the interest rate too low or increases money growth too rapidly, inflation goes up. As a result, your dollar (or whatever currency you use) will not go as far today as it did yesterday. For example: in 1970, the average cup of coffee in the United States cost 25 cents; by 2019, it had climbed to $1.59. So for $5, you would have been able to buy about three cups of coffee in 2019, versus 20 cups in 1970. That’s inflation, and it isn’t limited to price spikes for any single item or service; it refers to increases in prices across a sector, such as retail or automotive—and, ultimately, a country’s economy.

How does inflation affect your daily life? You’ve probably seen high rates of inflation reflected in your bills—from groceries to utilities to even higher mortgage payments. Executives and corporate leaders have had to reckon with the effects of inflation too, figuring out how to protect margins while paying more for raw materials.

But inflation isn’t all bad. In a healthy economy, annual inflation is typically in the range of two percentage points, which is what economists consider a sign of pricing stability. When inflation is in this range, it can have positive effects: it can stimulate spending and thus spur demand and productivity when the economy is slowing down and needs a boost. But when inflation begins to surpass wage growth, it can be a warning sign of a struggling economy.

Looking for direct answers to other complex questions?

Inflation may be declining in many markets, but there’s still uncertainty ahead: without a significant surge in productivity, Western economies may be headed for a period of sustained inflation or major economic reset , as Japan has experienced in the first decades of the 21st century.

What does seem to be changing are leaders’ attitudes. According to the 2023 year-end McKinsey Global Survey on economic conditions , respondents reported less fear about inflation as a risk to global and domestic economic growth . But this sentiment varies significantly by region: European respondents were most concerned about the effects of inflation, whereas respondents in North America offered brighter views.

What causes inflation?

Monetary policy is a critical driver of inflation over the long term. The current high rate of inflation is a result of increased money supply , high raw materials costs , labor mismatches , and supply disruptions —exacerbated by geopolitical conflict .

In general, there are two primary types, or causes, of short-term inflation:

- Demand-pull inflation occurs when the demand for goods and services in the economy exceeds the economy’s ability to produce them. For example, when demand for new cars recovered more quickly than anticipated from its sharp dip at the beginning of the COVID-19 pandemic, an intervening shortage in the supply of semiconductors made it hard for the automotive industry to keep up with this renewed demand. The subsequent shortage of new vehicles resulted in a spike in prices for new and used cars.

- Cost-push inflation occurs when the rising price of input goods and services increases the price of final goods and services. For example, commodity prices spiked sharply during the pandemic as a result of radical shifts in demand, buying patterns, cost to serve, and perceived value across sectors and value chains. To offset inflation and minimize impact on financial performance, industrial companies were forced to increase prices for end consumers.

Learn more about McKinsey’s Growth, Marketing & Sales Practice.

What are some periods in history with high inflation?

Economists frequently compare the current inflationary period with the post–World War II era , when price controls, supply problems, and extraordinary demand in the United States fueled double-digit inflation gains—peaking at 20 percent in 1947—before subsiding at the end of the decade. Consumption patterns today have been similarly distorted, and supply chains have been disrupted by the pandemic.

The period from the mid-1960s through the early 1980s in the United States, sometimes called the “Great Inflation,” saw some of the country’s highest rates of inflation, with a peak of 14.8 percent in 1980. To combat this inflation, the Federal Reserve raised interest rates to nearly 20 percent. Some economists attribute this episode partially to monetary policy mistakes rather than to other causes, such as high oil prices. The Great Inflation signaled the need for public trust in the Federal Reserve’s ability to lessen inflationary pressures.

Inflation isn’t solely a modern-day phenomenon, of course. One very early example of inflation comes from Roman times, from around 200 to 300 CE. Roman leaders were struggling to fund an army big enough to deal with attackers from multiple fronts. To help, they watered down the silver in their coinage, causing the value of money to slowly fall—and inflation to pick up. This led merchants to raise their prices, causing widespread panic. In response, the emperor Diocletian issued what’s now known as the Edict on Maximum Prices, a series of price and wage controls designed to stop the rise of prices and wages (one helpful control was a maximum price for a male lion). But because the edict didn’t address the root cause of inflation—the impure silver coin—it didn’t fix the problem.

How is inflation measured?

Statistical agencies measure inflation first by determining the current value of a “basket” of various goods and services consumed by households, referred to as a price index. To calculate the rate of inflation over time, statisticians compare the value of the index over one period with that of another. Comparing one month with another gives a monthly rate of inflation, and comparing from year to year gives an annual rate of inflation.

In the United States, the Bureau of Labor Statistics publishes its Consumer Price Index (CPI), which measures the cost of items that urban consumers buy out of pocket. The CPI is broken down by region and is reported for the country as a whole. The Personal Consumption Expenditures (PCE) price index —published by the US Bureau of Economic Analysis—takes into account a broader range of consumer spending, including on healthcare. It is also weighted by data acquired through business surveys.

How does inflation affect consumers and companies differently?

Inflation affects consumers most directly, but businesses can also feel the impact:

- Consumers lose purchasing power when the prices of items they buy, such as food, utilities, and gasoline, increase. This can lead to household belt-tightening and growing pessimism about the economy .

- Companies lose purchasing power and risk seeing their margins decline , when prices increase for inputs used in production. These can include raw materials like coal and crude oil , intermediate products such as flour and steel, and finished machinery. In response, companies typically raise the prices of their products or services to offset inflation, meaning consumers absorb these price increases. The challenge for many companies is to strike the right balance between raising prices to cover input cost increases while simultaneously ensuring that they don’t raise prices so much that they suppress demand.

How can organizations respond to high inflation?

During periods of high inflation, companies typically pay more for materials , which decreases their margins. One way for companies to offset losses and maintain margins is by raising prices for consumers. However, if price increases are not executed thoughtfully, companies can damage customer relationships and depress sales —ultimately eroding the profits they were trying to protect.

When done successfully, recovering the cost of inflation for a given product can strengthen relationships and overall margins. There are five steps companies can take to ADAPT (adjust, develop, accelerate, plan, and track) to inflation:

- Adjust discounting and promotions and maximize nonprice levers. This can include lengthening production schedules or adding surcharges and delivery fees for rush or low-volume orders.

- Develop the art and science of price change. Instead of making across-the-board price changes, tailor pricing actions to account for inflation exposure, customer willingness to pay, and product attributes.

- Accelerate decision making tenfold. Establish an “inflation council” that includes dedicated cross-functional, inflation-focused decision makers who can act quickly and nimbly on customer feedback.

- Plan options beyond pricing to reduce costs. Use “value engineering” to reimagine a portfolio and provide cost-reducing alternatives to price increases.

- Track execution relentlessly. Create a central supporting team to address revenue leakage and to manage performance rigorously. Traditional performance metrics can be less reliable when inflation is high .

Beyond pricing, a variety of commercial and technical levers can help companies deal with price increases in an inflationary market , but other sectors may require a more tailored response to pricing.

Learn more about our Financial Services , Industrials & Electronics , Operations , Strategy & Corporate Finance , and Growth, Marketing & Sales Practices.

How can CEOs help protect their organizations against uncertainty during periods of high inflation?

In today’s uncertain environment, in which organizations have a much wider range of stakeholders, leaders must think about performance beyond short-term profitability. CEOs should lead with the complete business cycle and their complete slate of stakeholders in mind.

CEOs need an inflation management playbook , just as central bankers do. Here are some important areas to keep in mind while scripting it:

- Design. Leaders should motivate their organizations to raise the profile of design to a C-suite topic. Design choices for products and services are critical for responding to price volatility, scarcity of components, and higher production and servicing costs.

- Supply chain. The most difficult task for CEOs may be convincing investors to accept supply chain resiliency as the new table stakes. Given geopolitical and economic realities, supply chain resiliency has become a crucial goal for supply chain leaders, alongside cost optimization.

- Procurement. CEOs who empower their procurement organizations can raise the bar on value-creating contributions. Procurement leaders have told us time and again that the current market environment is the toughest they’ve experienced in decades. CEOs are beginning to recognize that purchasing leaders can be strategic partners by expanding their focus beyond cost cutting to value creation.

- Feedback. A CEO can take a lead role in playing back the feedback the organization is hearing. In today’s tight labor market, CEOs should guide their companies to take a new approach to talent, focusing on compensation, cultural factors, and psychological safety .

- Pricing. Forging new pricing relationships with customers will test CEOs in their role as the “ultimate integrator.” Repricing during inflationary times is typically unpleasant for companies and customers alike. With setting new prices, CEOs have the opportunity to forge deeper relationships with customers, by turning to promotions, personalization , and refreshed communications around value.

- Agility. CEOs can strive to achieve a focus based more on strategic action and less on firefighting. Managing the implications of inflation calls for a cross-functional, disciplined, and agile response.

A practical example: How is inflation affecting the US healthcare industry?

Consumer prices for healthcare have rarely risen faster than the rate of inflation—but that’s what’s happening today. The impact of inflation on the broader economy has caused healthcare costs to rise faster than the rate of inflation. Experts also expect continued labor shortages in healthcare—gaps of up to 450,000 registered nurses and 80,000 doctors —even as demand for services continues to rise. This drives up consumer prices and means that higher inflation could persist. McKinsey analysis as of 2022 predicted that the annual US health expenditure is likely to be $370 billion higher by 2027 because of inflation.

This climate of risk could spur healthcare leaders to address productivity, using tech levers to boost productivity while also reducing costs. In order to weather the storm, leaders will need to quickly set high aspirations, align their organizations around them, and execute with speed .

What is deflation?

If inflation is one extreme of the pricing spectrum, deflation is the other. Deflation occurs when the overall level of prices in an economy declines and the purchasing power of currency increases. It can be driven by growth in productivity and the abundance of goods and services, by a decrease in demand, or by a decline in the supply of money and credit.

Generally, moderate deflation positively affects consumers’ pocketbooks, as they can purchase more with less money. However, deflation can be a sign of a weakening economy, leading to recessions and depressions. While inflation reduces purchasing power, it also reduces the value of debt. During a period of deflation, on the other hand, debt becomes more expensive. And for consumers, investments such as stocks, corporate bonds, and real estate become riskier.

A recent period of deflation in the United States was the Great Recession, between 2007 and 2008. In December 2008, more than half of executives surveyed by McKinsey expected deflation in their countries, and 44 percent expected to decrease the size of their workforces.

When taken to their extremes, both inflation and deflation can have significant negative effects on consumers, businesses, and investors.

For more in-depth exploration of these topics, see McKinsey’s Operations Insights collection. Learn more about Operations consulting , and check out operations-related job opportunities if you’re interested in working at McKinsey.

Articles referenced:

- “ Investing in productivity growth ,” March 27, 2024, Jan Mischke , Chris Bradley , Marc Canal, Olivia White , Sven Smit , and Denitsa Georgieva

- “ Economic conditions outlook during turbulent times, December 2023 ,” December 20, 2023

- “ Forward Thinking on why we ignore inflation—from ancient times to the present—at our peril with Stephen King ,” November 1, 2023

- “ Procurement 2023: Ten CPO actions to defy the toughest challenges ,” March 6, 2023, Roman Belotserkovskiy , Carolina Mazuera, Marta Mussacaleca , Marc Sommerer, and Jan Vandaele

- “ Why you can’t tread water when inflation is persistently high ,” February 2, 2023, Marc Goedhart and Rosen Kotsev

- “ Markets versus textbooks: Calculating today’s cost of equity ,” January 24, 2023, Vartika Gupta, David Kohn, Tim Koller , and Werner Rehm

- “ Inflation-weary Americans are increasingly pessimistic about the economy ,” December 13, 2022, Gonzalo Charro, Andre Dua , Kweilin Ellingrud , Ryan Luby, and Sarah Pemberton

- “ Inflation fighter and value creator: Procurement’s best-kept secret ,” October 31, 2022, Roman Belotserkovskiy , Ezra Greenberg , Daphne Luchtenberg, and Marta Mussacaleca

- “ Prime Numbers: Rethink performance metrics when inflation is high ,” October 28, 2022, Vartika Gupta, David Kohn, Tim Koller , and Werner Rehm

- “ The gathering storm: The threat to employee healthcare benefits ,” October 20, 2022, Aditya Gupta , Akshay Kapur , Monisha Machado-Pereira , and Shubham Singhal

- “ Utility procurement: Ready to meet new market challenges ,” October 7, 2022, Roman Belotserkovskiy , Abhay Prasanna, and Anton Stetsenko

- “ The gathering storm: The transformative impact of inflation on the healthcare sector ,” September 19, 2022, Addie Fleron, Aneesh Krishna , and Shubham Singhal

- “ Pricing during inflation: Active management can preserve sustainable value ,” August 19, 2022, Niels Adler and Nicolas Magnette

- “ Navigating inflation: A new playbook for CEOs ,” April 14, 2022, Asutosh Padhi , Sven Smit , Ezra Greenberg , and Roman Belotserkovskiy

- “ How business operations can respond to price increases: A CEO guide ,” March 11, 2022, Andreas Behrendt , Axel Karlsson , Tarek Kasah, and Daniel Swan

- “ Five ways to ADAPT pricing to inflation ,” February 25, 2022, Alex Abdelnour , Eric Bykowsky, Jesse Nading, Emily Reasor , and Ankit Sood

- “ How COVID-19 is reshaping supply chains ,” November 23, 2021, Knut Alicke , Ed Barriball , and Vera Trautwein

- “ Navigating the labor mismatch in US logistics and supply chains ,” December 10, 2021, Dilip Bhattacharjee , Felipe Bustamante, Andrew Curley, and Fernando Perez

- “ Coping with the auto-semiconductor shortage: Strategies for success ,” May 27, 2021, Ondrej Burkacky , Stephanie Lingemann, and Klaus Pototzky

This article was updated in April 2024; it was originally published in August 2022.

Want to know more about inflation?

Related articles.

What is supply chain?

How business operations can respond to price increases: A CEO guide

Five ways to ADAPT pricing to inflation

- Entertainment

- Environment

- Information Science and Technology

- Social Issues

Home Essay Samples Government

Essay Samples on Inflation

How to reduce inflation: the role of monetary policy and measures.

Inflation, the persistent rise in the general price level, poses challenges for individuals, businesses, and economies as a whole. Controlling and reducing inflation is a crucial objective for policymakers seeking to maintain stable economic conditions. There are several ways how to reduce inflation and this...

- Monetary Policy

Unraveling Theories of Inflation in Economics and Its Problem Nature

Inflation is the continual rise in prices, this is also known as a monetary problem. There are different monetary policies in order to keep inflation below a certain level one of these consist of inflation targeting which allows banks to keep a good stability on...

- Economic Problem

How to Reduce Unemployment: What the Government Can Do for People

Unemployment is defined as 'People willing and able to work at the current rate of pay but who are unable to find a job'. There are a number of types of unemployment, including structural, cyclical, seasonal and frictional unemployment. Unemployment is a key measure of...

- Unemployment

Teachers And Professional Athletes Are Paid Differently: Teachers Should Be Paid More

Is it fair that Teachers and Professional Athletes are paid differently? I think the real question should be if they can even be categorized the same. I don't believe the wages of the two can even compare, simply because who is to say one is...

The Political Stance on Raising the Minimum Wage

The lowest wage permitted by law or by a special agreement is a country’s Minimum wage [1]. With a population of 7.6 billion people in the world of whom 2.5 billion live on less than $2 a day [2]. The cost of water in the...

- Minimum Wage

Stressed out with your paper?

Consider using writing assistance:

- 100% unique papers

- 3 hrs deadline option

Minimum Wage: The Slow Increase and Development History

Politicians had been advocating for minimum salary growth often over the previous couple of years and elections. Most Democrats argue for growth at the same time as Republicans generally oppose it. Democrats say we want a boom in the minimal salary to raise human beings...

The Effects of Inflation on a Financial Situation of People

Have you ever thought about how inflation can affect us in a financial sense? This paper will go in-depth and explain the causes of inflation and how it affects consumer behavior, income, investment, and business. In this paper we will go over the methods on...

- Financial Crisis

Understanding Inflation'S Dangers To Philippine Economy

Throughout the most parts of the world, consistent efforts are placed to reduce skyrocketing inflation rates to fall on targeted bands of an economy. Motivated by the convention that inflation bring harmful effects. In the Philippines’ inflation rate soared up to 6.7% for months September...

- Philippines

How Does Inflation Affect the Imbalance of Payments

Inflation rate is a significant variable in economy and affected nation’s balance of payments. It is determined as a stable increase in the overall price level of goods and services in the economy. According to Quah and Vahey (1995), inflation rate is general increase in...

- World Economy

Perception Of Ofw Children On The Inflation In Saudi Arabia

Introduction The economy is a man-made organization with the purpose of satisfying human wants by using limited or scarce resources available and known to a society (Aggarwal & Devi, 2002). It encompasses all of the activities involved in the production and distribution of goods and...

- Saudi Arabia

Effect Of Rupee Depreciation On Indian Economy

Lower value of Currency leads to rattle the economic growth of every small scale to large scale business affecting the population adversely. The terms Inflation, Price Hike, Imports, and taxes can’t remain untouched with the inclusion of Currency Depreciation for any country. Ultimately the financial...

Best topics on Inflation

1. How to Reduce Inflation: the Role of Monetary Policy and Measures

2. Unraveling Theories of Inflation in Economics and Its Problem Nature

3. How to Reduce Unemployment: What the Government Can Do for People

4. Teachers And Professional Athletes Are Paid Differently: Teachers Should Be Paid More

5. The Political Stance on Raising the Minimum Wage

6. Minimum Wage: The Slow Increase and Development History

7. The Effects of Inflation on a Financial Situation of People

8. Understanding Inflation’S Dangers To Philippine Economy

9. How Does Inflation Affect the Imbalance of Payments

10. Perception Of Ofw Children On The Inflation In Saudi Arabia

11. Effect Of Rupee Depreciation On Indian Economy

- Police Brutality

- Gun Control

- Community Policing

- Declaration of Independence

- American Flag

- Gerrymandering

- Presidential Debate

- Fire Safety

- American Government

- Franklin D. Roosevelt

Need writing help?

You can always rely on us no matter what type of paper you need

*No hidden charges

100% Unique Essays

Absolutely Confidential

Money Back Guarantee

By clicking “Send Essay”, you agree to our Terms of service and Privacy statement. We will occasionally send you account related emails

You can also get a UNIQUE essay on this or any other topic

Thank you! We’ll contact you as soon as possible.

Essay Service Examples Economics Inflation

Impact of Inflation on the Economy

- Proper editing and formatting

- Free revision, title page, and bibliography

- Flexible prices and money-back guarantee

Our writers will provide you with an essay sample written from scratch: any topic, any deadline, any instructions.

Cite this paper

Related essay topics.

Get your paper done in as fast as 3 hours, 24/7.

Related articles

Most popular essays

- Unemployment

Today, as thirty and forty years ago, economists debate how much unemployment is voluntary, how...

- Critical Thinking

- Economic Development

Inflation, the general increase in prices over time, is a persistent economic issue that affects...

“Grade Inflation: Causes, Consequences, and Cure,” is an informational article written by a...

When comparing the GDP of 1950s America with 2019 America, even after you account for the...

- Food Shortage

Pulse moong (19.74%), Pulse gram(18.2%), Chicken (17.53%), Eggs (14.28%), Wheat(12.63%),...

Canada belongs to the Commonwealth of nations. Its political system is federalism and...

- Economic System

- Perspective

“Production is the only answer to inflation”, - Chester Bowles. Inflation is the rate at which the...

- Economic Growth

- Economic Problem

This report discussed the path of inflation in the united States of America. The first path of the...

Inflation is the measurement of how much more costly a collection of goods and services has gotten...

Join our 150k of happy users

- Get original paper written according to your instructions

- Save time for what matters most

Fair Use Policy

EduBirdie considers academic integrity to be the essential part of the learning process and does not support any violation of the academic standards. Should you have any questions regarding our Fair Use Policy or become aware of any violations, please do not hesitate to contact us via [email protected].

We are here 24/7 to write your paper in as fast as 3 hours.

Provide your email, and we'll send you this sample!

By providing your email, you agree to our Terms & Conditions and Privacy Policy .

Say goodbye to copy-pasting!

Get custom-crafted papers for you.

Enter your email, and we'll promptly send you the full essay. No need to copy piece by piece. It's in your inbox!

- TeachableMoment

What Is Inflation? What Can Be Done About It?

Students discuss the rising cost of goods and services and consider why this is happening and what people propose to do about it.

To The Teacher

According to a Pew Research poll released in May 2022, seven in ten Americans said inflation was the biggest problem facing the United States today.

But what is inflation? And how worried should we be about it?

This lesson consists of two readings, with discussion questions. The first reading introduces the concept of inflation, explains why many people are concerned about it, and examines the factors that cause prices to rise or fluctuate over time. The second reading looks at policies the government might pursue to address inflation.

Introduction

Ask students:

- What is inflation?

- Why has inflation been in the news?

- Have you yourself been affected by inflation? How?

- If wages are rising (which they currently are in the U.S.), how does that affect the impact of inflation on working people?

Tell students that we’ll be reading about and discussing the issue of inflation today.

Reading One:

How Big of a Problem is Inflation?

According to a Pew Research poll released in May 2022, seven in ten Americans believe inflation is the biggest problem facing the United States today. Likewise, in late May, President Biden stated that “tackling inflation [is] my top economic priority.” Discussion of inflation has become increasingly common in the news and on social media.

But what is inflation and how worried should we be about it?

Inflation is the broad increase in the prices of goods and services in an economy. Typically, commentators discuss inflation in relation to “purchasing power,” which means that as prices increase, you can purchase less for $1 than you could previously.

Even when inflation is low, the prices of everything from food and transportation to insurance and rent tend to rise over time. A hot dog or ice cream cone that cost $1 in the 1980s might, on average, cost $3 a few decades later. In periods of high inflation, price changes can appear more quickly, resulting in a very visible—and sometimes painful—loss of purchasing power. For example, a used car that cost $5,000 before the pandemic might be selling for $8,000 just two years later. A gallon of gasoline, the price of which was averaging around $3 last spring, was running about $5 per gallon on average by June 2022.

The focus on inflation in the media is in part due to the strong emotional reaction that rising prices can evoke: Nobody likes to pay more than they used to pay for goods and services. Politics and policy reporter German Lopez discussed such reactions in a May 12, 2022, article for The New York Times. Lopez wrote:

Inflation stands out from other problems because it is so inescapable. Unlike unemployment, it affects everyone. And people encounter it every day — when they go to the grocery store, drive by a gas station or buy almost anything. Inflation also contributes to a sense of powerlessness. Rising prices feel like something done to people rather than a problem they brought on themselves. Short of cutting their spending, individuals cannot do much about inflation.… “People are so raw at this point, having lived through two years of Covid, that any new thing is going to make them upset and angry,” said George Loewenstein, a behavioral economist at Carnegie Mellon University. “It just feels like it’s one thing after another.”

However, rising prices are not necessarily a cause for alarm. Moderate inflation is considered a normal part of a healthy economy. Typically, people’s wages rise along with prices. Therefore, even if costs are increasing, wages might be rising more quickly, allowing people to get ahead.

Moreover, some of the typical government responses to inflation can themselves result in economic problems that hurt working people. As Lopez further explained: Rising prices are a sign of an economy running too hot — too much spending resulting in too much demand for a limited supply. Policymakers can prevent this by deliberately slowing down the economy; they can raise interest rates (increasing the cost of borrowing money), hike taxes or cut budgets.

The Federal Reserve has increased interest rates. The central bank’s chair, Jerome Powell, said he is aiming for a “soft landing” — essentially, avoiding going too far and causing a recession — but there is no guarantee that he will succeed. In the 1980s, the Fed tanked the economy to put down stubbornly high inflation.

Because typical government responses to inflation can result in unemployment and recession, some economists and advocates caution against overreacting to the current price increases. In recent months, more job opportunities, a low unemployment rate, and rising wages have put people in a better position to pay their bills. For working people, these gains may outweigh higher prices at the grocery store or gas pump.

The U.S. Bureau of Labor Statistics reported that consumer prices increased 6.2 percent from October 2020 to October 2021, the largest 12-month increase since the period ending November 1990. But at the same time, wages for working people rose by 5.8 percent – nearly keeping pace with inflation.

Nevertheless, inflation has become such a widely-discussed issue because many Americans are still struggling to cover the costs of basic expenses such as food, transportation, healthcare, and housing. The question is, what is the best way to strengthen the purchasing power of those who need help the most?

For Discussion

- How much of the material in this reading was new to you, and how much was already familiar? Do you have any questions about what you read?

- According to the reading, what is inflation and why is it a problem for ordinary people?

- What is the government’s typical response to inflation and how does this impact the economy?

- Have you noticed a difference in prices of goods and services in stores? What changes have you seen?

- Have you noticed an increase in the amount of pay that jobs are offering?

- How have these changes impacted you or your family?

Reading Two

Possible Solutions to Inflation

While no one is happy about inflation, there is heated debate among policymakers about what the appropriate response should be. Given that some actions the government may take to control inflation would likely drive up unemployment, the question for people needing jobs is whether the proverbial medicine might be worse than the disease.

Some conservative economists, including Michael Strain of the American Enterprise Institute , have argued that the Federal Reserve should cool down the economy by continuing to raise interest rates. Strain also opposes social spending proposed by the Biden administration, which he writes, would “make our already troubling inflation problem worse.”

Republicans cited inflation as a reason for opposing the Biden administration’s Build Back Better bill – which would have broadened families’ access to preschool and childcare, healthcare, tuition support, and other social benefits. Stephen Moore, a senior fellow at FreedomWorks, writes in The Hill: “More debt, spending and printing of money at this stage of our economic recovery would be the equivalent of pouring gasoline on an inflation forest fire.”

However, economics professor and Roosevelt Institute fellow J.W. Mason argues that cutting public spending will not help most Americans. Mason predicted that inflation, while challenging, is likely to come down over the next year. He argued that “We should not dismiss these problems, but they are not a sign that the pandemic response was too big… Because our success in protecting people during the pandemic has been extraordinary. Peoples’ ability to continue paying their bills today is much greater than at any comparable point in any past economic crisis, despite the higher prices.”

Writing for The Nation in February 2022, author and political science professor James Galbraith argues that “Some price increases should be accepted, and some should be managed, as best we can, with policies that keep things under control and share the burdens.” He writes :

What are those policies? They include large investments in infrastructure, mass transit, housing, and rebuilding cities; action on climate change; and legislation for higher minimum wages and guaranteed jobs. Once again, all of these efforts will tend to push up prices, at first. That’s because they generate incomes that cannot be spent immediately on more consumer goods…. Above all, we should demilitarize and redirect those valuable materials, skills, and personnel to tackle the big investments we need here at home.… That, by the way, is what Germany, Japan, Korea, and China have all done—and exactly why they are the top or rising economic powers while we are the declining one. Second, the U.S. should definancialize. Since the time of Reagan, the American economy has ridden waves of speculation—in real estate, in information technology, in mortgages, and now in real estate once again—each leading to a bust. Here the way out is twofold. First, break up or take over the large banks, restore effective regulation, and create a public banking system that serves a public purpose—as France did following the Second World War... Third, control healthcare costs. How? By enacting Medicare for All, including the power of a government purchaser to negotiate drug prices. Medicare for All is a system of strategic price control aimed at a critical sector; it is potentially the most powerful anti-inflationary tool the government has. Fourth, control rents. Since all locations are unique, rental housing is by nature a form of market power. And while landlords do deserve a fair return, renters also deserve a fair deal. Rent control, managed by community boards, is the way to achieve this and to keep housing costs down. Finally, use selective price controls to stop price gouging. Inflation is always aggravated by bad actors who abuse their market power to profiteer. Against this, the best weapon is the empowered consumer, informed and organized.

Note: “Price gouging” is when companies take advantage of inflation by raising prices unnecessarily, bringing them higher profits.

Being an informed and empowered consumer, as Galbraith suggests, can be a potential means of forming a collective response to inflation. Whether the government encourages this, and the other solutions Galbraith proposes, or whether it focuses on cutting spending and increasing interest rates, will have significant economic consequences for working people in America.

- How much of the material in this reading was new to you, and how much was already familiar? Do you have any questions about what you read?

- Beyond raising interest rates, what are some other policy changes that might relieve the upward pressure on prices? What do you think are some of the costs and benefits of these different responses?

- Some companies are raising prices because the costs of their raw materials are creeping upwards. However, according to several reports, large corporations such as CVS and T.J. Maxx hiked prices unnecessarily in 2021, using inflation as an excuse to charge consumers more while making record profits. What do you think about this? How might consumers respond?

Research assistance provided by Celeste Pepitone-Nahas.

Share this Page

Essay on Inflation

Essay generator.