9 Case Studies That Prove Experiential Retail Is The Future

Table of Contents

What is a pop-up shop? Everything you need to know to try short-term retail > 23 Smart Pop-Up Shop Ideas to Steal From These Successful Brands > 9 Case Studies That Prove Experiential Retail Is The Future

What is experiential retail, and how can experiential retail benefit your business?

Experiential retail is a term used to define a type of retailing that aims to provide customers with a unique and memorable experience. Experiential retail is typically characterized by one or more of the following features: the use of unique and interesting spaces, objects, or experiences; high levels of customer engagement; and the use of technology to enhance customer interactions.

One key aspect of experiential retail is the ability to create an attractive and welcoming environment for staff and customers alike. This can be achieved through a combination of factors, including good design, cleanliness, and lighting . Another important factor is how well the store reflects its brand identity.

Although there are many different types of experiential retail outlets, they all share certain common elements: they are designed to provide a memorable experience for their customers; they are focused on creating an enjoyable atmosphere for staff members as well as the public; they offer an appealing mix of products and services, and they use technology to enhance customer interactions.

Finally, experiential retail is not just about selling products or services. It is also about building strong relationships with customers that go beyond transactions.

Experiential retail is the future. For years we’ve heard about the decline of physical retail and the rise of the internet. However, the desire for retail experiences is on the rise with 52% millennials saying of their spending goes on experience-related purchases. This introduces the concept of ‘retailtainment’.

Enter: retailtainment

Because of this, retailers have evolved their offerings. By focusing on so-called ‘ retailtainment’ and immersive retail experiences, brands are able to provide customers with fun, unique and in-person experiences that elevate shopping to new heights.

With retailtainment, the retail industry is shifting attention from a features-and-benefits approach to a focus on immersive shopping and customer experience . To be successful, retailers must offer consumers a desirable retail experience that in turn drives sales.

What is meant by Retailtainment?

The term “retailtainment” is used to describe the trend of retailers using entertainment to attract customers and encourage them to spend more time – and money – in their stores. This can take the form of in-store events, interactive displays, and even simply providing a comfortable and enjoyable environment for customers to shop in. The goal of retailtainment is to create a unique and memorable shopping experience that will keep customers coming back.

With the rise of online shopping and brick-and-mortar retailers have to work harder than ever to compete. By offering an enjoyable and entertaining shopping experience, retailers can attract customers who are looking for more than just a transaction. Retailtainment can be a powerful tool to build customer loyalty and drive sales.

How does retailtainment fit in today’s retail experiential strategy?

As shoppers’ expectations become more demanding, retailers are turning to retailtainment to create a more engaging and memorable shopping experience. By incorporating elements of entertainment into the retail environment, retailers can create a unique and differentiated customer experience that will help them stand out from the competition.

There are a number of ways that retailtainment can be used to improve the customer experience. For example, retailers can use interactive technology to create an immersive shopping experience that engages shoppers on a personal level. Additionally, retailers can use entertainment to add excitement and energy to their store environment, making it more inviting and enjoyable for shoppers.

Ultimately, retailtainment can play a key role in helping retailers create a customer experience that is unique, differentiated, and memorable.

What is the difference between retailtainment and experiential retail?

Both retailtainment and experiential retail are designed to make the shopping experience more enjoyable and engaging. However, experiential retail goes a step further by creating an emotional connection with customers. This emotional connection can lead to brand loyalty and repeat business.

Thus, while both retailtainment and experiential retail are important trends in the retail industry, experiential retail is more focused on creating a lasting impression and emotional connection with customers.

Here are our 8 favorite examples of Experiential Retail and retailtainment in action:

Marvel: Avengers S.T.A.T.I.O.N provides fans with interactive brand building experience

The Avengers S.T.A.T.I.O.N. is an immersive exhibit that has toured the world since the first Avengers film. It has appeared in key retail areas such as New York Seoul Paris , Beijing, London and Las Vegas, and always pulls in huge crowds. Based on the global box-office film franchise, Marvel’s The Avengers, the store features real life movie props and interactive displays.

There are Marvel-branded items for sale but the goal of the project is not to shift T-shirts and mugs. It is about delivering an in-person experience to fans and bringing the brand to life.

The Avengers S.T.A.T.I.O.N. is a great example of retailtainment and experiential retail in action. Visitors are fully immersed in the fictional world they adore, further cementing their affiliation and love for the Marvel brand.

For a brand as strong and iconic as Marvel, it would be easy to sit back and take popularity for granted. However, through the use of retailtainment they are continuing to delight their customers beyond the screen.

Farfetch: Creating a retail experience of the future

Image via Bloomberg

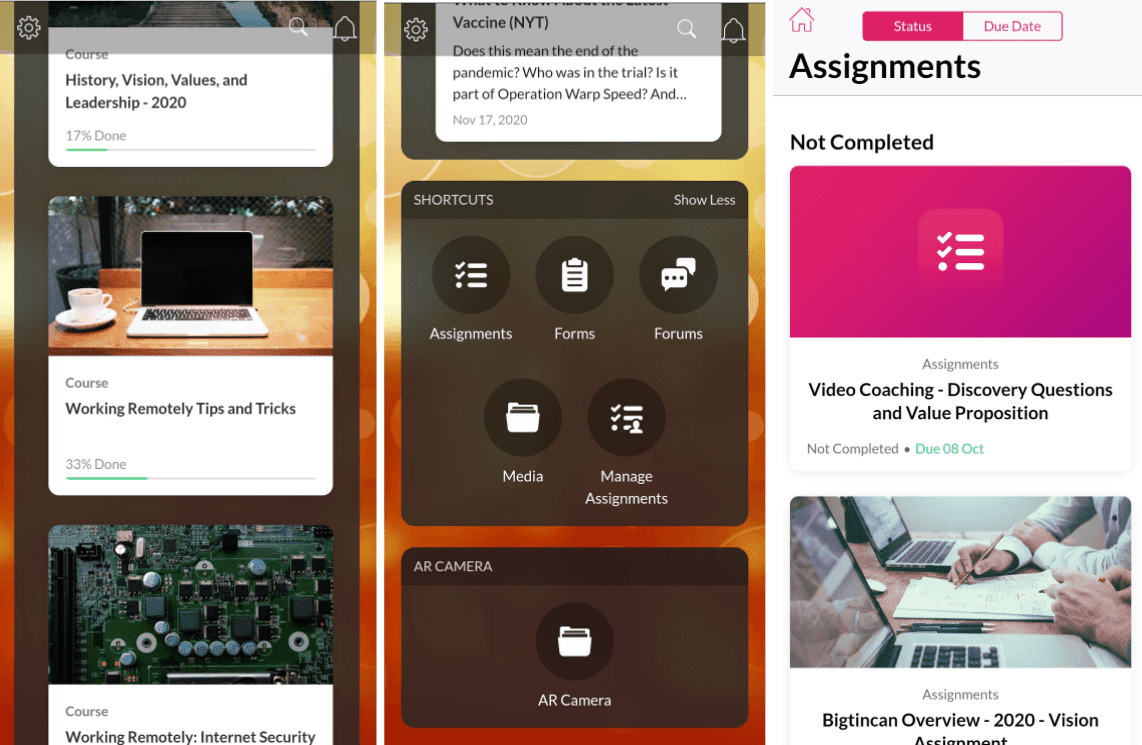

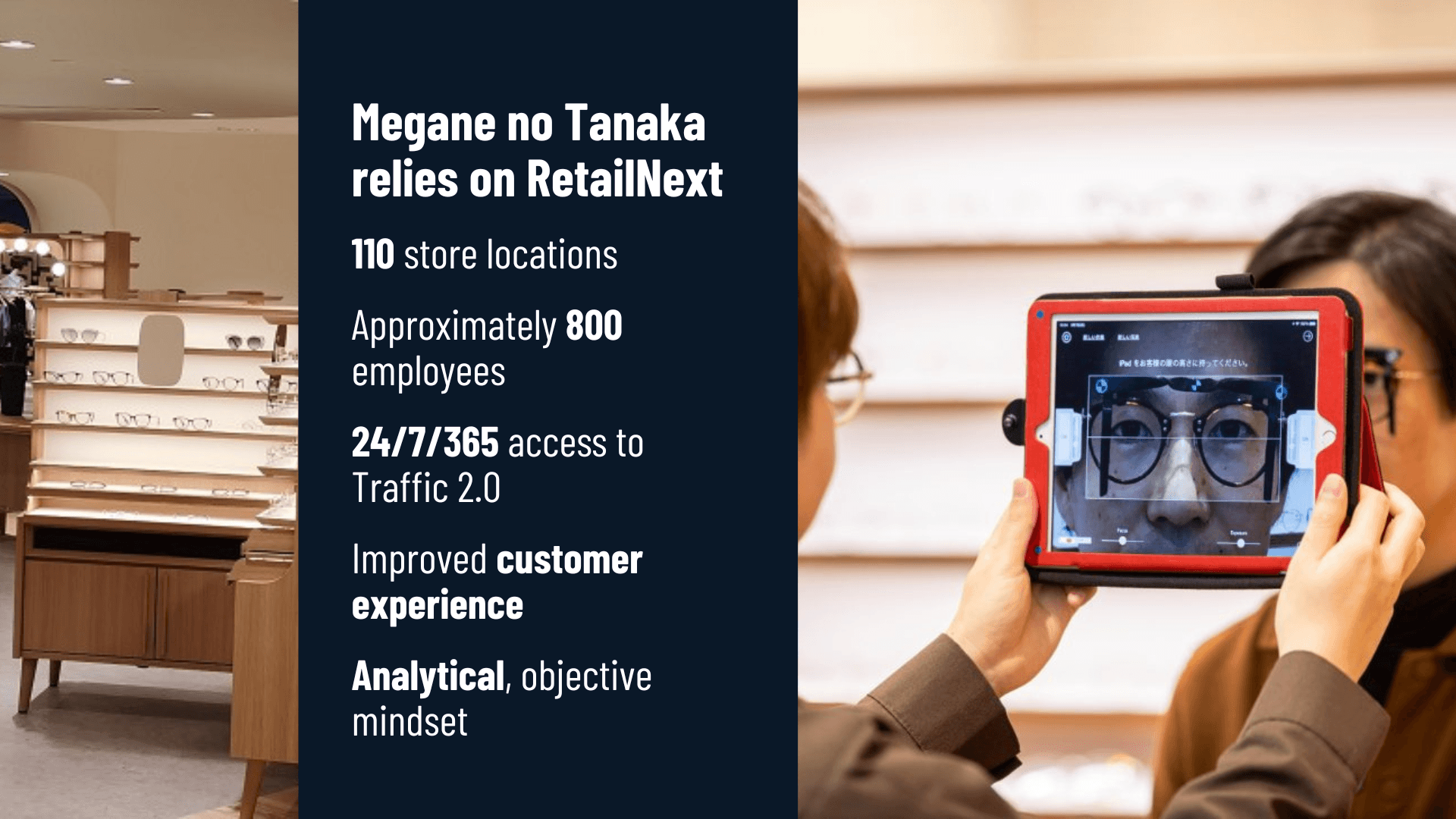

Farfetch is as an e-commerce portal for luxury boutiques. It’s successfully positioned itself as a technology provider for brands; combining technology and fashion to provide unique in-store experiences.

José Neves, CEO of Farfetch, has spoken about his concern that physical retail is diminishing; it accounts for 93 per cent of sales today, but by 2025 is predicted to account for just 80 per cent.

Enter: Farfetch’s Augmented Retail Solution

Neves’ vision for retailtainment includes advancements in technology to make the consumer experience more human. He produced Farfetch’s Store of the Future, an augmented retail solution that “links the online and offline worlds, using data to enhance the retail experience.” In its retail store in London, Farfetch provided connected clothing racks, touch-screen-enhanced mirrors and sign-in stations that pulled data collected online to use in-store.

Farfetch provided customers with a sign-in screen to search their purchase history and wish list, which provided valuable customer insight for the sales assistants. There was also a smart mirror to request different sizes, alternative products or pay without leaving the dressing room.

This innovation led them to be labeled as “ The Retailer of the Future ”, allowing customers to enjoy an effortless in-person experience that harmonizes the best parts of boutique shopping with the speed and convenience of online shopping.

Read More: Excess Inventory Post-Holiday? Open a Pop-Up Shop

Huda Beauty: Cosmic experience in Covent Garden

Huda Beauty , one of the world’s fastest-growing beauty brands, ran an immersive retail experience pop-up store right in the centre of Covent Garden, London, to launch a new product range and reach new customers.

Huda used the location ( sourced by Storefront pop up space rental ) to deliver a sci-fi themed experience in support of their new eye-shadow palette Mercury Retrograde.

The entire exterior of the pop-up resembled a multi-faceted, metallic mass of geometrical shapes. This was echoed inside with various ‘galactic’ elements, all manner of mirrored surfaces and shimmering fixtures and elements.

As part of the event, visitors could sit on the throne Huda used in her launch material, all set up to encourage as much social media activity and engagement as possible.

Huda Beauty caught the eye and wowed its visitors. Introducing a whole swathe of new customers to the Huda Beauty brand.

Read More: 4 Beauty Brands Who Successfully Launched A Pop-Up Store

Vans: A shopping experience to remember

Image via Skateparks

The House of Vans in London lives up to the company motto of being “off the wall”. A location where art, music, BMX, street culture and fashion converge, you can find almost everything you can imagine across the 30,000 square feet building. Amongst a cinema, café, live music venue and art gallery, the bottom floor holds the most unique feature of the building: the concrete ramp, mini ramp and street course.

Nothing better epitomizes the Vans brand than a space where young people can not only shop but spontaneously socialize. The House of Vans is the perfect example of how experiential retail can be used to empower a shopping experience.

Read More: How The Music Industry Is Making The Most of Pop-Up Stores

Ikea: Using social media to power a unique retail experience

Ikea brought 100 Facebook competition winners to one of its warehouses and let them stay the night. They were able to select the mattress, sheets and pillows to fully give them a fully tailored experience. A sleep expert was on hand with tips for getting a good night’s rest, including how to find the perfect mattress for any sleeping style.

This was a clever and unique way to obtain visibility and get fans to focus on what Ikea has to offer and try it out for themselves.

This idea came from understanding their consumer insights on social media. Lois Blenkinsop, Ikea’s U.K. PR and internal communications manager, said: “Social media has opened up a unique platform for us to interact directly with our customers. Listening to what they want is what we do best, and the Big Sleepover is just one example of how we’re using such instant and open feedback to better inform our marketing activity.”

From using social media they were able to apply experiential marketing to their retail strategy and provide their customers with a memorable event that brought the brand a ton of visibility and engagement.

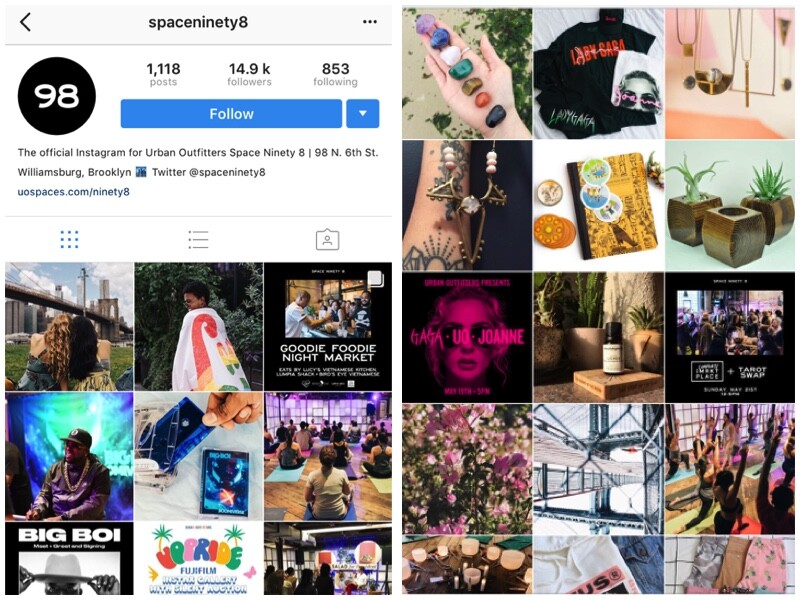

Space Ninety 8: showcasing the art of retailtainment

Image via @Space90

As a spin-off from Urban Outfitters, Space Ninety 8 is a shared retail space that spans 5 floors, hosting retailers, galleries and even a rooftop restaurant and bar.

Scanning their Instagram, you can see the variety of what Space Ninety 8 offers beyond solely retail. Advertised next to yoga classes is an album signing by Big Boi, alongside pictures of art classes and Lady GaGa merchandise. By reflecting the flexible nature of modern life, the brand created a versatile store that emphasizes experience, perfecting the art of retailtainment.

TOMS: creating an immersive experience through VR

Experiences don’t have to be a permanent feature of a store in order to make an impact on customers. In 2015 TOMS’ placed VR headsets into 100 stores, enabling them to virtually transport players to Peru to see the impact of their One for One giving campaign on local people.

As you walk through the village stores with locals smiling and waving at you, it is impossible not to feel warmed by the friendly atmosphere. Not only did this retail experience improve awareness of their social corporate responsibility and promote their giving campaign, it also gave customers an unforgettable and immersive experience they were unlikely to forget.

[Check out Toms’ continued focus on immersive retail experiences here]

How to Provide Retailtainment that Drives Traffic and Sales

These case studies all stress the importance of providing an in-store experience. By exceeding expectations you drive emotional reactions. There are five consistent elements each use in their stores to ensure a remarkable customer shopping experience:

- Interactiveness: All of these retailers ensure that the senses are connected – memories of what we feel, hear, see, smell, and touch, may last a lifetime.

- Originality: These ideas were all authentic and natural, making the customer feel as if they entered a different world.

- Connectedness: Customers must feel that the experience has been created for them.

- Unexpectedness: These unique experiences are critical to ensure your brand is remembered.

- Reliability: The experience is executed through tested methods to achieve consistency and excellence.

The future of experiential retail

As the world of retail continues to evolve, so too must the way brands create memorable experiences for their customers. With the rise of digital and mobile technologies, consumers now have more choices than ever before when it comes to how they shop and what they buy. To stay ahead of the curve, brands must find new and innovative ways to engage with their customers and create unforgettable shopping experiences.

One way to do this is through experiential retail – using physical spaces to create immersive, one-of-a-kind experiences that cannot be replicated online. This could involve anything from in-store events and workshops to augmented reality and virtual reality experiences.

Experiential marketing isn’t about spending millions on fancy gadgets for your retail store. Sure it can help, but it’s mostly about a personalized shopping experience and providing an unparalleled retail experience for your guests and customers. The brands that delight their customers are the brands that drive loyalty and advocacy. Couple this with excellent customer service and you’re on to a winner. These case studies all demonstrate how it is possible to follow similar steps to overcome the challenges eCommerce has brought.

The brands that use their physical stores to focus on the customer experience are the brands that will do the best. The dynamic between physical and online retail has shifted and the impact of the Covid 19 pandemic has only accentuated this.

Planning your own experiential retail project and need some help? Drop us a note and we’ll help you out.

For more on launching temporary retail stores and one-off events, download our Ultimate Pop-Up Guide and make your ideas happen.

- Recent Posts

- Easter: 25 spaces to rent around the world to treat your customers! - May 31, 2022

- 11 retail trends to expect in 2022 - January 26, 2022

- Online children’s fashion resale platform uses pop-up stores to increase visibility and spread its message of sustainability - July 21, 2021

Related posts:

Start typing and press enter to search

The 24 Best eCommerce Retail Case Studies Worth Reading

In the fast-paced world of retail and eCommerce, staying ahead of the game is not just a goal; it’s the lifeline of our industry. For seasoned retail executives, inspiration often comes from the experiences and successes of industry giants who paved the way with their innovative thinking and managed to thrive through thick and thin. That’s why we’re excited to bring you an exclusive collection of the 30 best eCommerce case studies meticulously curated to provide you with a wealth of insights and ideas to fuel your strategies. These case studies are more than just success stories; they are beacons of guidance for retail professionals navigating the ever-changing landscape of our industry.

In this article, we delve deep into the journeys of retail giants who have not only weathered the storms of disruption but have emerged as trailblazers in eCommerce. From adapting to shifting consumer behaviors to mastering the art of online engagement, this compilation offers a treasure trove of wisdom for the modern retail executive.

Table of Contents

- > Case studies for grocery/wholesale eCommerce retailers

- > Case studies for fashion eCommerce retailers

- > Case Studies for home & furniture eCommerce retailers

- > Case Studies for health & beauty eCommerce retailers

- > Case studies for electronics and tools eCommerce retailers

- > Case Studies for toys and leisure eCommerce retailers

Case studies for grocery/wholesale eCommerce retailers

Retail case study #1: tesco .

Industry : Grocery stores

Why worth reading:

- Historical evolution: Understanding Tesco’s rise from a group of market stalls to a retail giant provides valuable lessons on growth and adaptation to market changes.

- Customer service focus: Tesco’s long-term emphasis on customer service, which is consistent across their physical and online platforms, showcases the importance of customer-centric strategies.

- Innovation in eCommerce: The case study covers Tesco’s pioneering of the world’s first virtual grocery store in South Korea, a testament to its innovative approach to digital retailing.

- Crisis management: Insights into how Tesco handled the Horse Meat Scandal, including efforts to tighten its supply chain, contributing to its logistical success.

- Financial integrity: The study discusses the Accounting Scandal, offering a sobering look at financial transparency and the repercussions of financial misreporting.

Read the full Tesco case study here .

Retail case study #2: Walmart

Industry : Discount department and grocery stores

- Data-driven success: The case study provides a wealth of data, showcasing Walmart’s remarkable achievements. With an annual revenue of almost $570 billion, a global presence in 24 countries, and a customer base exceeding 230 million weekly, it’s a testament to the effectiveness of their strategies.

- Marketing strategies: The case study delves deep into Walmart’s marketing strategies. It highlights their focus on catering to low to middle-class demographics, the introduction of the Walmart Rewards loyalty program, and their commitment to environmental sustainability, all of which have contributed to their success.

- eCommerce transformation: As eCommerce continues to reshape the retail landscape, this case study details how Walmart shifted significantly towards omnichannel retail. Readers can learn about their innovative technologies and approaches, such as personalized shopping experiences and augmented reality, that have helped them adapt to changing consumer behavior.

- Supply chain innovation: Walmart’s proficiency in supply chain management is a crucial takeaway for retail executives. Their decentralized distribution center model , in-house deliveries, and data-driven optimization exemplify the importance of efficient logistics in maintaining a competitive edge.

Read the full Walmart case study here .

Retail case study #3: Sainsbury’s

Industry : Grocery stores

- Omnichannel success amidst pandemic challenges: With the fastest growth in online shopping among major retailers, the study illustrates how Sainsbury’s adapted and thrived during unprecedented times.

- Dynamic brand positioning: The analysis delves into Sainsbury’s strategic shift in brand positioning, demonstrating a keen responsiveness to changing consumer preferences. This shift showcases the brand’s agility in aligning with contemporary health-conscious consumer trends, supported by relevant data and market insights.

- Supply chain and quality assurance: The study highlights Sainsbury’s commitment to a stellar supply chain, emphasizing the correlation between high product quality, ethical sourcing, and customer loyalty. With data-backed insights into the extensive distribution network and sourcing standards, retail executives can glean valuable lessons in maintaining a competitive edge through a robust supply chain.

- Innovative technological integration: Sainsbury’s implementation of cutting-edge technologies, such as Amazon’s “Just Walk Out” and Pay@Browse, demonstrates a commitment to providing customers with a seamless and convenient shopping experience.

- Diversification beyond grocery: The case study unveils Sainsbury’s strategic partnerships with companies like Amazon, Carluccio’s, Itsu, Leon, and Wasabi, showcasing the brand’s versatility beyond traditional grocery retail.

Read the full Sainsbury’s case study here .

Retail case study #4: Ocado

- From startup to industry leader: The Ocado case study presents a remarkable journey from a three-employee startup in 2000 to becoming the UK’s largest online grocery platform.

- Omnichannel excellence: The study emphasizes Ocado’s success in implementing an omnichannel approach, particularly its early adoption of smartphone technology for customer engagement.

- Operational efficiency: From automated warehouses with machine learning-driven robots to digital twins for simulating order selection and delivery processes, the data-rich content sheds light on how technology can be leveraged for operational efficiency.

- Navigating challenges through innovation: Ocado’s strategic response to challenges, particularly its shift from primarily a grocery delivery service to a technology-driven company, showcases the power of innovative thinking. The case study details how Ocado tackled complexities associated with grocery deliveries and embraced technology partnerships to stay ahead.

- Strategic partnerships: The study sheds light on Ocado’s strategic partnerships with grocery chains and companies like CitrusAd for advertising opportunities on its platform.

Read the full Ocado case study here .

Retail case study #5: Lidl

Industry : Discount supermarkets

- Longevity and evolution: The article provides a detailed overview of Lidl’s origins and evolution, offering insights into how the brand transformed from a local fruit wholesaler to a global retail powerhouse. Understanding this journey can inspire retail executives to explore innovative strategies in their own companies.

- Global success: Retail executives can draw lessons from Lidl’s international expansion strategy, identifying key factors that contributed to its success and applying similar principles to their global ventures.

- Awards and recognitions: The numerous awards and accomplishments earned by Lidl underscore the effectiveness of its marketing strategy. Marketers and eCommerce professionals can learn from Lidl’s approach to quality, innovation, and customer satisfaction.

- Comprehensive marketing components: The article breaks down Lidl’s marketing strategy into key components, such as pricing strategy, product diversification, and target audience focus. Readers can analyze these components and consider incorporating similar holistic approaches in their businesses to achieve well-rounded success.

- Omnichannel transformation: The discussion on Lidl’s transformation to an omnichannel strategy is particularly relevant in the current digital age. This information can guide executives in adopting and optimizing similar omnichannel strategies to enhance customer experiences and drive sales.

Read the full Lidl case study here .

Retail case study #6: ALDI

Industry : FMCG

- Omnichannel approach: Aldi’s growth is attributed to a robust omnichannel strategy that seamlessly integrates online and offline channels. The case study delves into how Aldi effectively implemented services that can overcome the intricacies of a successful omnichannel approach in today’s dynamic retail landscape.

- Target market positioning: Aldi’s strategic positioning as the most cost-effective retail store for the middle-income group is explored in detail. The case study elucidates how Aldi’s pricing strategy, emphasizing the lowest possible prices and no-frills discounts, resonates with a wide audience.

- Transparency: Aldi’s commitment to transparency in its supply chain is a distinctive feature discussed in the case study. For retail executives, understanding the importance of transparent supply chain practices and their impact on brand perception is crucial in building consumer trust.

- Differentiation: Aldi’s successful “Good Different” brand positioning, which communicates that low prices result from conscientious business practices, is a key focus of the case study. Effective differentiation through brand messaging contributes to customer trust and loyalty, especially when combined with ethical business practices.

- CSR Initiatives: The case study highlights Aldi’s emphasis on social responsibility to meet the expectations of millennial and Gen-Z shoppers. By consistently communicating its CSR efforts, such as sustainable sourcing of products, Aldi creates a positive brand image that resonates with socially conscious consumers and builds brand reputation.

Read the full Aldi case study here .

Retail case study #7: ASDA

Industry : Supermarket chain

- Omnichannel implementation: The case study details how ASDA seamlessly integrates physical and virtual channels, offering customers a diverse shopping experience through in-store, digital checkouts, Click & Collect services, and a dedicated mobile app.

- Market segmentation strategies: The incorporation of partnerships with young British designers and influencer collaborations, coupled with socially progressive messaging, reflects a strategic shift that can inspire marketers looking to revitalize product lines.

- Crisis management and ethical branding: The study highlights ASDA’s strong response to the COVID-19 crisis, with ASDA’s actions showcasing a combination of crisis management and ethical business practices. This section provides valuable insights for executives seeking to align their brand with social responsibility during challenging times.

- Product and format diversification: ASDA’s product categories extend beyond groceries, including clothing, home goods, mobile products, and even insurance. The case study explores how ASDA continues to explore opportunities for cross-promotion and integration.

- Website analysis and improvement recommendations: The detailed analysis of ASDA’s eCommerce website provides actionable insights for professionals in the online retail space. This section is particularly beneficial for eCommerce professionals aiming to enhance user experience and design.

Read the full ASDA case study here .

Case studies for fashion eCommerce retailers

Retail case study #8: Farfetch

Industry : Fashion retail

- Effective SEO strategies: The Farfetch case study offers a detailed analysis of the company’s search engine optimization (SEO) strategies, revealing how it attracted over 4 million monthly visitors. The data presented underscores the importance of patient and dedicated SEO efforts, emphasizing the significance of detailed page structuring, optimized content, and strategic backlinking.

- Paid search advertising wisdom and cost considerations: The study delves into Farfetch’s paid search advertising approach, shedding light on its intelligent optimization tools and the nuances of running localized advertisements. Moreover, it discusses the higher cost of visitor acquisition through paid search compared to organic methods, providing valuable insights for marketers navigating the paid advertising landscape.

- Innovative LinkedIn advertising for talent acquisition: Farfetch’s unique use of LinkedIn advertising to attract talent is a standout feature of the case study and highlights the significance of proactive recruitment efforts and employer branding through social media channels.

- Strategic use of social media platforms: Exploring the brand’s highly consistent organic marketing across various social media channels, with a focus on visual content, highlights Farfetch’s innovative use of Instagram’s IGTV to promote luxury brands. The emphasis on social media engagement numbers serves as a testament to the effectiveness of visual content in the eCommerce and fashion sectors.

- Website design and conversion optimization insights: A significant portion of the case study is dedicated to analyzing Farfetch’s eCommerce website, providing valuable insights for professionals aiming to enhance their online platforms. By identifying strengths and areas for improvement in the website’s design, marketers, and eCommerce professionals can draw actionable insights for their platforms.

Read the full Farfetch case study here .

Retail case study #9: ASOS

Industry : Fashion eCommerce retail

- Mobile shopping success: eCommerce executives can draw inspiration from ASOS’s commitment to enhancing the mobile shopping experience, including features such as notifications for sale items and easy payment methods using smartphone cameras.

- Customer-centric mentality: ASOS emphasizes the importance of engaging customers on a personal level, gathering feedback through surveys, and using data for continuous improvement. This approach has contributed to the brand’s strong base of loyal customers.

- Inclusive marketing: ASOS’s adoption of an ‘all-inclusive approach’ by embracing genderless fashion and featuring ‘real’ people as models reflects an understanding of evolving consumer preferences. Marketers can learn from ASOS’s bold approach to inclusivity, adapting their strategies to align with the latest trends and values embraced by their target audience.

- Investment in technology and innovation: The case study provides data on ASOS’s substantial investment in technology, including visual search, voice search, and artificial intelligence (AI). eCommerce professionals can gain insights into staying at the forefront of innovation by partnering with technology startups.

- Efficient global presence: ASOS’s success in offering a wide range of brands with same and next-day shipping globally is attributed to its strategic investment in technology for warehouse automation. This highlights the importance of operational efficiency through technology, ensuring a seamless customer experience and reduced warehouse costs.

Read the full ASOS case study here .

Retail case study #10: Tommy Hilfiger

Industry : High-end fashion retail

- Worldwide brand awareness: The data presented highlights Tommy Hilfiger’s remarkable journey from a men’s clothing line in 1985 to a global lifestyle brand with 2,000 stores in 100 countries, generating $4.7 billion in revenue in 2021. This strategic evolution, exemplified by awards and recognitions, showcases the brand’s adaptability and enduring relevance in the ever-changing fashion landscape.

- Adaptation and flexibility to changing market trends: The discussion on how the brand navigates changing trends and overcame market saturation, particularly in the US, provides practical insights for professionals seeking to navigate the challenges of evolving consumer preferences.

- Successful omnichannel marketing: Tommy Hilfiger’s success is attributed to a brand-focused, digitally-led approach. The analysis of the brand’s omnichannel marketing strategy serves as a map for effective promotion and engagement across various channels.

- Decision-making and customer engagement: The case study emphasizes the brand’s commitment to data-driven decision-making with insights into customer behavior, leveraging data for effective customer engagement.

Read the full Tommy Hilfiger case study here .

Retail case study #11: Gap

- Overcoming challenges: The case study provides a comprehensive look at Gap Inc.’s financial performance, and growth despite the challenges. These insights can offer valuable takeaways into effective financial management and strategies for sustained success.

- Strong branding: Gap’s journey from a single store to a global fashion retailer reveals the importance of strategic brand positioning. Understanding how Gap targeted different market segments with unique brand identities, can inspire retail executives looking to diversify and expand their brand portfolios.

- Omnichannel adaptation: The case study delves into Gap’s omnichannel strategy, illustrating how the company seamlessly integrates online and offline experiences.

- Unique use of technology: By exploring the technologies Gap employs, such as Optimizely and New Relic, retail executives can learn about cutting-edge tools for A/B testing, personalization, and real-time user experience monitoring. This insight is crucial for staying competitive in the digital retail landscape.

- Inspiring solutions: The case study highlights challenges faced by Gap, including logistical, technological, financial, and human resource challenges.

Read the full Gap case study here .

Retail case study #12: Superdry

- Success story: The case study emphasizes SUPERDRY’s successful transition to an omnichannel retail strategy, with in-depth insights into their adaptation to online platforms and the integration of technologies like the Fynd app.

- Mobile-first and social-first strategies: As mobile internet usage continues to rise, understanding how SUPERDRY leverages videos and social media to engage customers can offer valuable takeaways for optimizing digital strategies.

- Sustainable fashion focus: Executives looking to appeal to environmentally conscious consumers can gain insights into how SUPERDRY navigated the shift towards sustainable practices and became a leader in eco-friendly fashion.

- Data-driven marketing strategies: The case study delves into SUPERDRY’s social media marketing strategies, showcasing how the company uses targeted campaigns, influencers, and seasonal keywords.

- Global market understanding: By exploring SUPERDRY’s experience in the Chinese market and its decision to exit when faced with challenges, the case study offers valuable insights into global market dynamics.

Read the full SUPERDRY case study here .

Retail case study #13: New Look

Industry : Fast-fashion retail

- Strategic pivots for profitability: A decade of revenue contraction led New Look to adopt transformative measures, from restructuring credits to withdrawing from non-profitable markets.

- Omnichannel strategy: Marketers and eCommerce professionals can study New Look’s journey, understanding how the integration of physical stores and online platforms enhances customer experience, reduces costs, and improves profitability.

- Social media mastery: The case study underscores the pivotal role of social media in engaging audiences, showcasing how New Look leverages user-generated content to build brand loyalty and maintain a positive brand perception.

- Effective partnerships for growth: New Look strategically partners with major eCommerce platforms like eBay & Next to expand its brand presence, and tap into new audiences and markets.

Read the full New Look case study here .

Retail case study #14: Zara

- Rapid international expansion through innovative strategies: Zara’s unique approach to continuous innovation and quick adaptation to fashion trends fueled its global success. Marketers can learn how to build brand narratives that resonate across diverse markets, and eCommerce professionals can glean strategies for seamless international expansion.

- Revolutionary eCommerce tactics: The case study provides a deep dive into Zara’s eCommerce strategy, emphasizing the importance of agility and responsiveness. The brand can be a bright example of implementing supply chain strategies for a swift market adapting to rapid fashion cycles.

- Visionary leadership: Amancio Ortega’s low-profile persona and visionary leadership style are explored in the case study, aiding retail executives to learn about leadership strategies that prioritize customer-centric business models.

- Omnichannel marketing and integrated stock management: Zara’s successful integration of automated marketing and stock management systems is a focal point in the case study. With insights into implementing integrated stock management systems to meet the demands of both online and offline channels, Zara can inspire professionals to improve their operations.

- Co-creation with the masses: Zara’s innovative use of customer feedback as a driving force for fashion trends is a key takeaway. Marketers can learn about the power of customer co-creation in shaping brand identity, and eCommerce professionals can implement similar models for product launches and updates.

Read the full Zara case study here .

Case Studies for home & furniture eCommerce retailers

Retail case study #15: john lewis.

Industry : Homeware and clothing retail

- Omnichannel perspective: The data-driven approach, especially in tracking orders and customer behavior, serves as a blueprint for any retail business aiming to enhance its omnichannel experience.

- Strategic growth factors: This case study offers concrete data on the strategies that contributed to the company’s sustained success, inspiring similar endeavors.

- Innovative customer engagement: John Lewis’s take on customer engagement showcases the brand’s agility and responsiveness to evolving consumer needs, supported by data on the effectiveness of these initiatives.

- eCommerce best practices and pitfalls: The analysis of John Lewis’s eCommerce website provides a data-backed evaluation of what works and what could be improved. The critique is grounded in data, making it a valuable resource for those looking to optimize their online platforms.

Read the full John Lewis case study here .

Retail case study #16: Argos

Industry : Homeware catalog retail

- Adaptation to the changing retail landscape: Argos’s journey from a catalog retailer to a retail giant demonstrates its ability to successfully adapt to the evolving retail landscape.

- Omnichannel success story: The case study provides a detailed analysis of Argos’s omnichannel strategy, showcasing how the company effectively integrated online and offline channels to achieve a seamless shopping experience across multiple touchpoints.

- Market share and financial performance: The inclusion of data on Argos’s market share and financial performance offers retail executives concrete metrics to evaluate the success of the marketing strategy. Understanding how Argos maintained a robust market share despite challenges provides actionable insights.

- Technological advancements: The case study delves into the technologies employed by Argos, such as Adobe Marketing Cloud, New Relic, and ForeSee.

- Overcoming obstacles: By examining the challenges faced by Argos, including logistical, technological, financial, and human resources challenges, retail executives can gain a realistic understanding of potential obstacles in implementing omnichannel strategies.

Read the full Argos case study here .

Retail case study #17: IKEA

Industry : Home & furniture retail

- Data-driven evolution: This detailed case study offers a data-rich narrative, illuminating the brand’s evolution into a leader in omnichannel retail.

- Pandemic response: This exploration delves into the integration of eCommerce strategies, online expansions, and the balance between physical and digital customer experiences.

- Advanced mobile apps and AR integration: A deep dive into IKEA’s innovative applications, notably the AR app “IKEA Place,” showcases how the brand leverages technology for a seamless customer experience.

- Democratic design approach: The study meticulously breaks down IKEA’s success factors, emphasizing the brand’s holistic approach through the lens of “Democratic Design.”

- DIY mentality and demographic targeting: A detailed analysis of how IKEA’s affordability is intertwined with a Do-It-Yourself (DIY) mentality. The case study explores how IKEA strategically tapped into a shift in consumer behavior, particularly among younger demographics, influencing not only purchasing patterns but also reshaping industry norms.

Read the full IKEA case study here .

Retail case study #18: Marks & Spencer

Industry : Clothing and home products retail

- Valuable lessons in eCommerce: The Marks & Spencer eCommerce case study offers a profound exploration of the brand’s journey from a latecomer to the online scene to a digital-first retailer.

- Real-world application of effective solutions: By diving into the history of Marks & Spencer, the case study provides tangible examples of how a retail giant faced setbacks and strategically pivoted to revitalize its eCommerce platform.

- Data-driven analysis of eCommerce failures: The case study meticulously analyzes the pitfalls Marks & Spencer encountered during its eCommerce journey, offering a data-driven examination of the repercussions of a poorly executed website relaunch.

- Multichannel customer experience: Marks & Spencer’s shift towards a multichannel customer experience is dissected in the case study, emphasizing the significance of a seamless user journey for increased customer satisfaction and loyalty.

- Embracing technology: Exploring Marks & Spencer’s technological innovations, such as the introduction of an intelligent virtual assistant can enhance the customer shopping journey, foster engagement, and contribute to revenue growth.

Read the full Marks & Spencer case study here .

Retail case study #19: Macy’s

Industry : Clothing and homeware retail

- Resilience and adaptability: The case study showcases Macy’s ability to navigate and triumph over obstacles, especially evident during the COVID-19 pandemic. Despite hardships, Macy’s not only survived but thrived, achieving $24.4 billion in net sales for 2022.

- Omnichannel innovation: Macy’s successful transition to omnichannel retailing is a standout feature. The case study delves into Macy’s implementation of a seamless omnichannel strategy, emphasizing the integration of physical and digital retail channels.

- Private label strategy: The introduction of new private brands and the emphasis on increasing the contribution of private brands to sales by 2025 provides a strategic lesson. Retailers can learn from Macy’s approach to enhancing control over production and distribution by investing in private brands, ultimately aiming for a more significant share of profits.

- Groundbreaking retail media strategy: Macy’s innovative approach to retail media and digital marketing is another compelling aspect. For marketers, this presents a case study on how to leverage proprietary shopper data for effective advertising, including entry into connected TV (CTV).

- Community engagement and social responsibility: The case study explores Macy’s “Mission Every One” initiative, highlighting its commitment to corporate citizenship and societal impact, integrating values into business strategies.

Read the full Macy’s case study here .

Case Studies for health & beauty eCommerce retailers

Retail case study #20: the body shop .

Industry : Beauty, health, and cosmetics

- Activism and ethical values: The Body Shop has pioneered promoting eco-friendly, sustainable, and cruelty-free products. The brand’s mission is to empower women and girls worldwide to be their best, natural selves. This strong ethical foundation has been integral to its identity.

- Recycling, community fair trade, and sustainability: The Body Shop initiated a recycling program early on, which turned into a pioneering strategy. It collaborates with organizations to create sustainable solutions for recycling, such as the Community Trade recycled plastic initiative in partnership with Plastics for Change.

- Product diversity: The Body Shop’s target demographic primarily focuses on women, but it has expanded some product lines to include men. Its products include skincare, hair and body treatments, makeup, and fragrances for both men and women.

- Omnichannel strategy, technology, and eCommerce best practices: The Body Shop has embraced an omnichannel approach that incorporates personalization, customer data and analytics, and loyalty programs. The Body Shop utilizes technology, including ContactPigeon, for omnichannel customer engagement, personalization, and data-driven decision-making.

Read the full The Body Shop case study here .

Retail case study #21: Boots

Industry : Pharmacy retail

- Long-term success: Boots’ rich history serves as a testament to the effectiveness of the brand’s strategies over time, offering valuable insights into building a brand that withstands the test of time.

- Strategic omnichannel approach: The Boots case study provides a deep dive into the marketing strategy that propelled the brand to success, with valuable insights into crafting effective omnichannel growth.

- Impactful loyalty program: Marketers can glean insights into designing loyalty programs that resonate with customers, fostering brand allegiance.

- Corporate Social Responsibility (CSR) as a pillar: The case study sheds light on how Boots addresses critical issues like youth unemployment and climate change, showcasing how a socially responsible approach can positively impact brand perception.

- Adaptive strategies during crises: Boots’ proactive role during the COVID-19 pandemic, offering vaccination services and supporting the National Health Service (NHS), demonstrates the brand’s agility during crises.

Read the full Boots case study here .

Retail case study #22: Sephora

Industry : Cosmetics

- Authentic customer experience-focused mentality: Backed by an impressive array of data, the case study meticulously outlines how Sephora transforms its in-store spaces into digital playgrounds, leveraging mobile technologies, screens, and augmented reality to enhance the customer shopping experience.

- Exceptional omnichannel business plan: The early adoption of an omnichannel strategy has been pivotal to Sephora’s ascendancy. The case study delves into the mobile app’s central role, acting as a comprehensive beauty hub with data-driven insights that drive the success of groundbreaking technologies.

- Omnichannel company culture: The case study illuminates this by detailing how this amalgamation allows a holistic view of the customer journey, blurring the lines between online and in-store interactions. This unique approach positions Sephora as a global leader in turning omnichannel thinking into a robust business strategy.

- Turning data into growth: Sephora’s adept utilization of mobile technologies to harness customer insights is a beacon for retailers in an era where data reigns supreme. The case study dissects how a surge in digital ad-driven sales, showcases the power of data-driven decision-making.

Read the full Sephora case study here .

Case studies for electronics and tools eCommerce retailers

Retail case study #23: screwfix.

Industry : Tools and hardware retail

- Innovative omnichannel approach: The case study highlights how the company strategically implemented online ordering with in-store pickup, creating a seamless shopping experience that contributed to a significant sales growth of 27.9% in just one year.

- Customer-centric strategies: Marketers can gain insights from Screwfix’s emphasis on customer experience. By studying customer feedback and incorporating personalized shopping experiences, Screwfix achieved success in the competitive home improvement sector.

- Supply chain management for rapid growth: The company strategically opened distribution centers to keep up with demand, ensuring efficient inventory management for both online and in-store orders.

- Mobile-first approach for trade professionals: With a customer base primarily consisting of trade professionals, the company’s mobile app allows for easy inventory search, order placement, and quick pickups, catering to the needs of time-sensitive projects.

- Commitment to employee well-being and community: Retail executives and marketers can draw inspiration from Screwfix’s commitment to building a positive workplace culture.

Read the full Screwfix case study here .

Case Studies for toys and leisure eCommerce retailers

Retail case study #24: lego.

Industry : Toys and leisure retail

- Global reach strategies: LEGO’s case study meticulously outlines LEGO’s focused approach, investing in flagship stores and understanding the local market nuances.

- Diversification and licensing brilliance: LEGO’s commitment to diversification through licensing and merchandising emerges as a beacon for marketers. The collaboration with well-established brands, the creation of movie franchises, and themed playsets not only elevate brand visibility but also contribute significantly to sales.

- Social media takeover: The case study unveils LEGO’s unparalleled success on social media platforms, boasting over 13 million Facebook followers and 10.04 billion views on YouTube. LEGO’s adept utilization of Facebook, Instagram, and YouTube showcases the power of social media in engaging customers.

- User-generated content (UGC) as a cornerstone: LEGO’s innovative use of digital platforms to foster a community around user-generated content is a masterclass in customer engagement. This abundance of UGC not only strengthens brand loyalty but also serves as an authentic testament to LEGO’s positive impact on users’ lives.

- Education as a marketing pillar: LEGO’s unwavering commitment to education, exemplified by its partnerships and $24 million commitment to educational aid, positions the brand as more than just a toy. Aligning brand values with social causes and leveraging educational initiatives, builds trust and credibility.

- Cutting-edge mobile strategy: Sephora’s foresight into the mobile revolution is dissected in the case study, presenting a playbook for retailers aiming to capitalize on the mobile landscape.

Read the full LEGO case study here .

Tons of eCommerce retail inspiration, in one place

In the realm of business, success stories are not just tales of triumph but blueprints for aspiring executives to carve their paths to growth. The case studies explored here underscore a common theme: a mindset poised for evolution, a commitment to experimentation, and an embrace of emerging trends and technologies are the catalysts for unparalleled growth.

For any executive eager to script their growth story, these narratives serve as beacons illuminating the way forward. The dynamic world of retail beckons those ready to challenge the status quo, adopting the strategies and technologies that promise scalability. The key lies in constant optimization, mirroring the agility demonstrated by industry leaders.

As you embark on your growth journey, consider the invaluable lessons embedded in these success stories. Now is the time to experiment boldly, adopting new trends and technologies that align with your brand’s ethos. If you seek personalized guidance on navigating the intricate landscape of growth, our omnichannel retail experts at ContactPigeon are here to assist. Book a free consultation call to explore how our customer engagement platform can be the linchpin of your growth strategy. Remember, the path to scaling growth begins with a willingness to innovate, and your unwritten success story awaits its chapter of transformation.

Let’s Help You Scale Up

Loved this article? We also suggest:

Sofia Spanou

Sign up for a demo, this site uses cookies..

We use cookies to optimize our communication and to enhance your customer experience. By clicking on the Agree button, you agree to the collection of cookies. You can also adjust your preferences by clicking on Customize.

Essential (Always Active)

Performance.

- How it works

Retail Marketing

10 Insightful Retail Marketing Case Studies of Top Brands

Tue, 13 Jun 2023 06:35:02 GMT

Speak to our Hyperlocal Expert

Retail marketing case study is an in-depth analysis of a marketing campaign used by a retail brand. It showcases the goals, strategies, and results of the campaign, offering valuable insights for other retailers to learn from.

Discover 10 compelling retail marketing case studies showcasing the power of retail marketing strategies employed by top brands. Dive into the world of retail as we explore how these brands have achieved remarkable results through innovative approaches. From redefining customer experiences to harnessing digital channels, these retail marketing case studies offer valuable insights into successful retail marketing tactics. Join us on this journey as we uncover the secrets behind their accomplishments and gain inspiration for your own retail marketing endeavors.

Retail Marketing: What It Is and Why It Is Important

Retail marketing is the comprehensive range of strategies and activities implemented by businesses to effectively promote and sell their products within retail environments. It encompasses various tactics like advertising, branding, pricing, visual merchandising, and engaging with customers to elevate their shopping experience and drive sales.

Crafting a winning retail brand strategy is crucial for long-term success, as it helps businesses establish a distinctive identity, effectively communicate their value proposition, and stay relevant in the market. By leveraging customer insights and implementing innovative marketing approaches, businesses can create a strong brand presence, build customer loyalty, and ultimately achieve sustainable growth. To learn more about crafting a winning retail brand strategy, you can watch our informative video, “Crafting a Winning Retail Brand Strategy for Long-Term Success.”

10 Insightful Retail Marketing Case Studies

#1 retail marketing case study - kalyan jewellers, - redefining the jeweler retail experience.

Kalyan Jewelers is a renowned jewellery brand that has revolutionized the retail experience through innovative strategies and personalized customer service. With their digital transformation and focus on creating immersive store environments, Kalyan Jewellers has set new standards in the jewellery industry.

- Case Study Overview

Explore the inspiring journey of Kalyan Jewellers as they redefined the jewelry retail landscape, leveraging cutting-edge technology and personalized customer experiences .

- Key Strategies Implemented

a. Digital Transformation - Kalyan Jewelers embraced digital technologies to enhance the customer journey, offering online shopping, virtual try-on features, and personalized recommendations.

b. Store Ambience and Design - By creating immersive and luxurious store environments, Kalyan Jewelers captivated customers with an unforgettable in-store experience.

c. Personalized Customer Service - Kalyan Jewelers focused on building lasting relationships with customers through personalized consultations, customized jewelry designs, and exceptional after-sales support.

- Results and Impact

Discover how Kalyan Jewellers’ innovative approach led to increased footfall, higher customer engagement, enhanced brand loyalty, and a significant boost in sales revenue.

#2 Retail Marketing Case Study - Bridgestone

- driving brand loyalty through retail marketing strategies.

Bridgestone, a leading tire manufacturer, excelled in retail marketing by introducing interactive displays and targeted loyalty programs, enhancing customer engagement and brand loyalty. Their strategies helped them achieve significant growth in sales and establish a strong market presence in the competitive tire industry.

Bridgestone, a prominent tire manufacturer, implemented innovative retail marketing strategies to enhance brand loyalty and customer engagement.

a. Implementation of Interactive Displays Bridgestone enhanced customer engagement by incorporating interactive displays in their retail stores, providing a unique and immersive experience. b. Introduction of Targeted Loyalty Programs Bridgestone implemented loyalty programs to reward and retain customers, encouraging brand loyalty and repeat business. c. Building Strong Customer Relationships through Retail Outlets Bridgestone emphasized building strong relationships with customers by fostering open communication, offering personalized recommendations, and addressing their needs and concerns.

Bridgestone’s retail marketing efforts increased brand loyalty, customer satisfaction, and repeat purchases. The interactive displays enhanced the overall shopping experience, while the targeted loyalty programs incentivized customers to choose Bridgestone for their tire needs. These strategies contributed to Bridgestone’s growth, market presence, and competitive advantage in the tire industry.

#3 Retail Marketing Case Study - Schneider Electric

- innovations in smart energy solutions for retail.

Schneider Electric is at the forefront of providing advanced energy management solutions to the retail sector. Their cutting-edge technologies and expertise empower retailers to optimise energy usage, reduce costs, and create sustainable and efficient operations while delivering an enhanced customer experience.

Learn how Schneider Electric transformed the retail industry by implementing innovative smart energy solutions. Discover the strategies they used to optimise energy consumption and drive efficiency in retail stores.

a. Integrated Energy Management Systems

Schneider Electric seamlessly integrated advanced energy management systems, allowing retailers to monitor and control energy usage in real time for better efficiency.

b. IoT Technology Utilization

By leveraging IoT technology, Schneider Electric connected and managed energy-consuming devices and systems, enabling centralized control, automation, and proactive maintenance.

c. Customized Energy Efficiency Solutions

Schneider Electric developed tailored energy efficiency solutions that met the specific needs of retail businesses, resulting in cost savings and environmental benefits.

Schneider Electric’s smart energy solutions delivered significant energy savings, reduced operational costs, and improved sustainability for retail businesses. The implementation of these solutions also enhanced store performance, customer experience, and environmental responsibility.

#4 Retail Marketing Case Study - Grohe

- experiential showrooms for elevated retail experiences.

Grohe is a prominent provider of premium bathroom and kitchen fittings, known for their innovative designs and superior quality.

This case study examines how Grohe successfully implemented experiential showrooms to enhance the retail experience for customers. By creating immersive environments that showcased their products in real-life settings, Grohe aimed to engage customers on a deeper level and drive brand loyalty.

a. Technology-Driven Experiences Grohe utilized virtual reality and augmented reality to enhance the showroom experience, allowing customers to virtually explore products, customize features, and visualize installations.

b. Personalized Customer Service Grohe provided expert guidance and assistance, ensuring customers received tailored recommendations based on their needs and preferences.

c. Hands-on Product Demonstrations Grohe emphasized interactive product demonstrations, enabling customers to experience the quality and functionality of the fittings firsthand.

Through these strategies, Grohe achieved positive results such as increased customer engagement, improved brand visibility, higher conversion rates, and a strengthened reputation as an industry leader in providing innovative and high-quality bathroom and kitchen fittings.

#5 Retail Marketing Case Study - Mahindra Tractors

- enhancing sales and engagement through retail marketing.

Mahindra Tractors is a leading manufacturer of agricultural machinery, specializing in tractors and farm equipment.

This case study explores how Mahindra Tractors implemented effective retail marketing strategies to boost sales and engagement in the agricultural machinery market.

a. Personalized Experiences

Mahindra Tractors tailored product recommendations, financing options, and customer support to meet individual needs and enhance the buying experience.

b. Digital Marketing

Mahindra Tractors used online ads, social media, SEO, and content marketing to reach and engage their target audience, drive website traffic, and generate leads.

c. After-Sales Support

Mahindra Tractors provided timely assistance, maintenance, and repair services, ensuring customer satisfaction and fostering loyalty.

Through their retail marketing initiatives, Mahindra Tractors achieved increased sales, improved brand visibility, enhanced customer loyalty, and strengthened their position as a trusted brand in the agricultural machinery industry.

#6 Retail Marketing Case Study - VLCC Institute

- revolutionizing the beauty and wellness education industry through retail marketing.

VLCC Institute is a prestigious institution that offers comprehensive courses and training programs in beauty and wellness. With a strong focus on quality education and industry-relevant skills, VLCC Institute has become a leading choice for aspiring beauty professionals.

Discover how VLCC Institute transformed its retail marketing strategies to revolutionize the beauty and wellness education industry. This case study provides insights into their journey, highlighting the key tactics they employed to enhance brand visibility, attract students, and establish themselves as a pioneer in the market.

VLCC Institute implemented several key strategies to redefine its retail marketing approach. These included creating modern and well-equipped training centers that simulated real-world salon and spa environments, implementing targeted hyperlocal marketing campaigns to reach potential students, partnering with industry experts and influencers for endorsements and collaborations, providing personalized counseling and career guidance to prospective students, and offering industry-relevant certifications and placements.

The implementation of these strategies yielded remarkable results for VLCC Institute. They witnessed a significant increase in student enrollments, achieved higher retention rates, expanded their presence across multiple locations, and strengthened their reputation as a trusted institution in the beauty and wellness education sector. VLCC Institute’s retail marketing initiatives played a pivotal role in positioning them as a market leader, driving their growth, and creating valuable career opportunities for their students.

#7 Retail Marketing Case Study - Kohler

- transforming bathrooms and kitchens with retail design excellence.

Kohler is a renowned global brand specializing in innovative kitchen and bathroom fixtures, faucets, and accessories.

This case study examines how Kohler implemented retail design excellence to elevate the customer experience and drive business growth.

Kohler focused on creating immersive showroom experiences, incorporating cutting-edge technology, providing personalized consultations, and showcasing their extensive product range. These strategies aimed to inspire customers, demonstrate product functionality, and differentiate Kohler from competitors.

The implementation of these strategies resulted in increased customer engagement, enhanced brand perception, higher sales conversion rates, and strengthened customer loyalty for Kohler. The company’s commitment to retail design excellence played a significant role in its market leadership and continued success.

#8 Retail Marketing Case Study - ExxonMobil

- innovative retail marketing for fuelling success.

ExxonMobil is a renowned energy company specializing in petroleum and petrochemical products, known for its expertise in exploration, production, refining, and marketing.

Explore how ExxonMobil leveraged innovative retail marketing strategies to achieve success in the fuel industry. Discover how they enhanced customer experiences, optimized convenience, and differentiated their brand in a competitive market.

ExxonMobil implemented a range of strategies, including integrating advanced technologies at fuel stations, introducing loyalty programs and strategic partnerships, providing convenient amenities, and prioritizing sustainability initiatives. These strategies aimed to attract and retain customers, establish a distinct brand identity, and foster long-term loyalty.

The implementation of these strategies led to increased customer engagement, higher fuel sales, improved customer satisfaction, and a reinforced brand reputation. ExxonMobil’s commitment to innovative retail marketing played a vital role in its remarkable success in the competitive fuel industry, solidifying its position as the industry leader.

#9 Retail Marketing Case Study - Greenply

- building a strong retail presence in the wood panel industry.

Greenply is a prominent player in the wood panel industry, specializing in manufacturing and supplying high-quality plywood, veneers, and other wood-based products. With a strong focus on sustainability and innovation, Greenply has earned a reputation for its superior craftsmanship and reliability.

Discover how Greenply strategically built a robust retail presence in the competitive wood panel industry. This case study explores their journey, highlighting the key initiatives they undertook to expand their market reach, enhance customer experiences, and strengthen their brand position.

Greenply implemented a comprehensive set of strategies, including establishing an extensive distribution network, partnering with retailers and contractors, investing in marketing and advertising campaigns, launching customer-centric initiatives, and prioritizing product quality and innovation. These strategies aimed to increase market penetration, build brand loyalty, and drive customer satisfaction.

The implementation of these strategies resulted in significant business growth for Greenply. They witnessed a substantial increase in market share, expanded their customer base, strengthened their brand reputation, and achieved higher customer satisfaction ratings. Greenply’s strategic approach to retail marketing played a pivotal role in its success, positioning them as a leading player in the wood panel industry.

#10 Retail Marketing Case Study - Gulf Oil

- fueling success with effective retail marketing strategies.

Gulf Oil is a prominent global energy company specializing in oil and gas exploration, production, and marketing.

This case study highlights how Gulf Oil successfully implemented retail marketing strategies to thrive in the competitive energy industry.

Gulf Oil executed targeted advertising campaigns, formed strategic partnerships with retail outlets, introduced innovative loyalty programs, and prioritized customer-centric initiatives. These efforts aimed to enhance brand visibility, engage customers, and foster loyalty.

The implementation of these strategies yielded positive outcomes, including increased market share, higher customer retention rates, improved brand perception, and substantial growth in sales and revenue for Gulf Oil.

By leveraging the strategies and lessons learned from these case studies on retail marketing, businesses can position themselves for success and achieve remarkable results in the competitive world of retail.

Discover valuable insights about Indian retail industry 2024 with this enlightening article from the Times of India, offering a wealth of information to expand your understanding.

Frequently Asked Questions (FAQs)

1. what are case studies on retail marketing.

Case studies on retail marketing involve in-depth analysis of real-world business situations, showcasing successful strategies, challenges faced, and resulting outcomes to provide valuable insights for marketing professionals.

2. What are the Problems in Retail Marketing?

Local marketing focuses on promoting products or services to a specific geographical area, such as a town or city.

3. Why is Retail Marketing Important?

Retail marketing holds significance as it enables businesses to attract and retain customers, drive sales, enhance brand recognition, deliver personalized experiences, and adapt to evolving market conditions.

4. What Do We Study in Retail Marketing?

The field of retail marketing encompasses studying consumer behavior, market segmentation, retail store operations, merchandising techniques, pricing strategies, promotional approaches, and customer relationship management.

5. What is the Concept of Retail?

Retail involves the sale of goods or services directly to consumers through physical or digital channels, emphasizing the interaction between businesses and customers. It encompasses aspects like product selection, pricing, distribution, and customer engagement.

In summary, the blog “10 Insightful Retail Marketing Case Studies of Top Brands” explores the successful strategies employed by top brands in the retail industry. These case studies on retail marketing demonstrate the significance of understanding consumer behavior, embracing digital marketing, and creating unique retail experiences. By examining these real-world examples, businesses can gain valuable insights to enhance their own retail marketing efforts. It is essential for brands to continually adapt and innovate in order to stay competitive and succeed in today’s dynamic retail landscape.

Take Advantages of Sekel Tech Retail Marketing Platform

Sekel Tech Retail Marketing Platform has helped its clients achieve remarkable success. For instance, Kalyan Jewellers used the platform to redefine the jewelry retail experience, resulting in increased sales and satisfied customers. Bridgestone also benefited from the platform, using personalized marketing and data analytics to build customer loyalty. These retail marketing case studies demonstrate how the Sekel Tech Retail Marketing Platform empowers retailers to improve their marketing, enhance customer experiences, and achieve business goals. Take advantage of this powerful platform to revolutionize your retail marketing strategies and drive business growth. Learn more about how Sekel Tech can transform your marketing efforts and enhance customer experiences.

Similar Blogs

Loved this content?

Sign up for our newsletter and get the latest tips & updates directly in your inbox.

There’s more where that came from!

Let's Connect

Understand our solution Better!

Leave an Enquiry

Experience new growth possibilities with Microsoft Advertising today >

Watches of Switzerland Group

From Breitling, TAG Heuer, Cartier, and more, consumers know Watches of Switzerland Group have the best in luxury. But the world of luxury watches is competitive, and Watches of Switzerland Group wanted to drive more conversions efficiently during their peak trading season. Already live with Microsoft Shopping campaigns, the team was happy with great results. So, the team knew it was time to level up and take their ad strategy further. The goal was to scale the platform with a focus on ecommerce sales and thus Watches of Switzerland Group expanded into additional campaigns.

The solution

To scale the platform with a focus on ecommerce conversion, the Watches of Switzerland Group's performance agency Kinase:

- Created new Cost Per Sale (CPS) Shopping campaigns to supplement existing shopping campaigns to expand reach on the search engine results page.

- Launched CPS campaigns with five brands that saw immediate uplift in clicks and impressions.

- Accelerated the CPS campaigns to include 24 more brands, thanks to the impressive results.

"Launching CPS campaigns during the peak period drove incremental revenue at a very favorable ROI. This was a welcome boost to our online performance during a very competitive period."

— James Thompson, Group Digital Marketing Manager at The Watches of Switzerland Group

The results

The CPS campaign results were outstanding. Watches of Switzerland Group received an additional 3.2K clicks compared to their base target ROAS (Return on Ad spend) campaigns at an 84% lower Cost Per Click (CPC). Generating over £12K of revenue since October, Watches of Switzerland Group achieved a 16x ROAS on tROAS campaigns. The Watches of Switzerland Group team is continuing to scale by increasing budgets and target CPS to expand the reach. The team is delighted to use this strategy to supplement current Microsoft shopping activity, and, because of the campaign successes, have continued the rollout to cover most of their store’s inventory.

Ready to get started with us?

Stay informed.

Sign up for the Microsoft Advertising Insider newsletter to keep up with the latest insights, product news, tips and tricks, thought leadership, customer case studies, and resources.

Recommended for you

Mediamarktsaturn germany.

How MediaMarkt increased holiday season revenue with Microsoft Advertising.

August 26, 2024

How Chewsy, a tasty vitamin company, achieved healthy returns from an OTT (over the top) video campaign with Microsoft Advertising

August 16, 2024

How InnoGames increased ROAS by more than 2.5x with Audience ads

August 12, 2024

- How to Navigate Omnichannel Retail, Based on Amazon & Wayfair

by Kelly Jacobson | Aug 26, 2024 | Blog

Navigating the Complexity of Omnichannel Retail: Stories of Success and Lessons Learned

According to Forrester , 43% of business leaders see omnichannel retail experiences as a growing need, pushing more digital-era companies to invest in retail locations.

Forrester’s research also predicts that 72% of total US retail sales will occur in brick-and-mortar stores by 2028.

Based on this data, it seems simple: Click-and-mortar is growing, and retail companies need to adapt.

But is the online-to-offline transition so easy?

Take it from these megabrands: There’s a lot to learn.

Amazon: A Case Study for Not Quite

Over the last 20 years, Amazon cemented itself as the go-to destination for online shopping.

Since then, the ecommerce giant rapidly expanded its offline presence to try and establish an omnichannel retail strategy.

( One Door CEO Tom Erskine chatted about it here .)

In 2015, Amazon opened its first physical store, Amazon Book, in Seattle as a “physical extension of Amazon.com”.

In 2017, it acquired upscale grocery store chain Whole Foods , giving the company an instant brick-and-mortar presence across 400 stores.

Amazon further invested in the multibillion-dollar grocery industry with Amazon Go, a first-of-its-kind convenience store chain where customers could scan a QR code when they walked in, pick up a basket, and start shopping.

When they were done, they could walk out.

Amazon Go involved zero customer service interaction, differentiating Amazon from its competition – including, ironically, the grocery company it acquired .

By January 2023, Amazon planned to scale this “Just Walk Out” technology into multiple retail sectors: fashion, big-box grocery, drive-up grocery pickup, and more.

However, this cashierless experience – and synergizing offline-online success – was not the futuristic shopping success Amazon hoped it would be.

In a few short years:

- The company closed all 68 of its bookstores , 4-star shops (a store where all items stocked had to be rated four stars or above on Amazon’s site), and pop-up shops.

- Amazon closed all drive-up grocery locations and its Amazon Style apparel stores after only two years in business.

- It reconfigured its no-checkout shopping experience into scan-and-go smart cart technology , hindering its originality in the retail space.

- Amazon paused all expansion plans, resets, and renovations for new stores.

So, even with its hyper-success in ecommerce, why hasn’t Amazon gotten a handle on omnichannel retail?

The company faced operational, financial, and technological challenges as it tried to scale its physical-store footprint:

- The high cost of implementation. Amazon is an ecommerce leader, but setting up shop proved to be more complicated than creating digital storefronts. The company ran into operational problems, like setting up heavy network infrastructure and deeply complex security technologies to prevent retail theft. It also developed proprietary identity recognition via AI, sensor fusion, and computer vision for its Just Walk Out tech. (However, the “tech” turned out to be manual labor anyway , delivering another blow to Amazon’s reputation as an innovative and ethical retailer). Each delay disrupted business operations and bottom-line revenue.

- The lack of store planning software. Amazon didn’t invest in visual merchandising software for its physical stores. Amazon store associates complained about setting up brand-new shops using manual processes and disjointed planning processes, and Amazon headquarters didn’t have visibility into ground-level problems, like incompliant fixtures and materials. This lack of agile planogram software led to disorganized stores, a poor in-store shopping experience, and damaged and out-of-stock products.

- The assumption of consumer behavior. It’s very hard to translate – or elevate – that breezy online shopping experience in a brick-and-mortar space. When opening its physical stores, Amazon assumed that its customers would prefer high-tech shopping experiences, like Just Walk Out. However, many people said it made them feel like they were stealing , or they didn’t understand the technology – even if it was meant to simplify the shopping experience. They described the physical Amazon grocery stores as “clinical” and said they wouldn’t do big shopping trips there. That’s a stark difference in consumer behavior from online to offline shopping, a concept Amazon didn’t seem to consider.

Years ago, Amazon.com was the catalyst for a conversation about the death of retail, but the reality of Amazon shaking up the brick-and-mortar retail sector has yet to materialize.