The Great Depression

“Regarding the Great Depression, … we did it. We’re very sorry. … We won’t do it again.” —Ben Bernanke, November 8, 2002, in a speech given at “A Conference to Honor Milton Friedman … On the Occasion of His 90th Birthday.”

In 2002, Ben Bernanke , then a member of the Federal Reserve Board of Governors, acknowledged publicly what economists have long believed. The Federal Reserve’s mistakes contributed to the “worst economic disaster in American history” (Bernanke 2002).

Bernanke, like other economic historians, characterized the Great Depression as a disaster because of its length, depth, and consequences. The Depression lasted a decade, beginning in 1929 and ending during World War II. Industrial production plummeted. Unemployment soared. Families suffered. Marriage rates fell. The contraction began in the United States and spread around the globe. The Depression was the longest and deepest downturn in the history of the United States and the modern industrial economy.

The Great Depression began in August 1929, when the economic expansion of the Roaring Twenties came to an end. A series of financial crises punctuated the contraction. These crises included a stock market crash in 1929 , a series of regional banking panics in 1930 and 1931 , and a series of national and international financial crises from 1931 through 1933 . The downturn hit bottom in March 1933, when the commercial banking system collapsed and President Roosevelt declared a national banking holiday . 1 Sweeping reforms of the financial system accompanied the economic recovery, which was interrupted by a double-dip recession in 1937 . Return to full output and employment occurred during the Second World War.

To understand Bernanke’s statement, one needs to know what he meant by “we,” “did it,” and “won’t do it again.”

By “we,” Bernanke meant the leaders of the Federal Reserve System. At the start of the Depression, the Federal Reserve’s decision-making structure was decentralized and often ineffective. Each district had a governor who set policies for his district, although some decisions required approval of the Federal Reserve Board in Washington, DC. The Board lacked the authority and tools to act on its own and struggled to coordinate policies across districts. The governors and the Board understood the need for coordination; frequently corresponded concerning important issues; and established procedures and programs, such as the Open Market Investment Committee, to institutionalize cooperation. When these efforts yielded consensus, monetary policy could be swift and effective. But when the governors disagreed, districts could and sometimes did pursue independent and occasionally contradictory courses of action.

The governors disagreed on many issues, because at the time and for decades thereafter, experts disagreed about the best course of action and even about the correct conceptual framework for determining optimal policy. Information about the economy became available with long and variable lags. Experts within the Federal Reserve, in the business community, and among policymakers in Washington, DC, had different perceptions of events and advocated different solutions to problems. Researchers debated these issues for decades. Consensus emerged gradually. The views in this essay reflect conclusions expressed in the writings of three recent chairmen, Paul Volcke r, Alan Greenspan , and Ben Bernanke .

By “did it,” Bernanke meant that the leaders of the Federal Reserve implemented policies that they thought were in the public interest. Unintentionally, some of their decisions hurt the economy. Other policies that would have helped were not adopted.

An example of the former is the Fed’s decision to raise interest rates in 1928 and 1929. The Fed did this in an attempt to limit speculation in securities markets. This action slowed economic activity in the United States. Because the international gold standard linked interest rates and monetary policies among participating nations, the Fed’s actions triggered recessions in nations around the globe. The Fed repeated this mistake when responding to the international financial crisis in the fall of 1931. This website explores these issues in greater depth in our entries on the stock market crash of 1929 and the financial crises of 1931 through 1933 .

An example of the latter is the Fed’s failure to act as a lender of last resort during the banking panics that began in the fall of 1930 and ended with the banking holiday in the winter of 1933. This website explores this issue in essays on the banking panics of 1930 to 1931 , the banking acts of 1932 , and the banking holiday of 1933 .

One reason that Congress created the Federal Reserve, of course, was to act as a lender of last resort. Why did the Federal Reserve fail in this fundamental task? The Federal Reserve’s leaders disagreed about the best response to banking crises. Some governors subscribed to a doctrine similar to Bagehot’s dictum, which says that during financial panics, central banks should loan funds to solvent financial institutions beset by runs. Other governors subscribed to a doctrine known as real bills. This doctrine indicated that central banks should supply more funds to commercial banks during economic expansions, when individuals and firms demanded additional credit to finance production and commerce, and less during economic contractions, when demand for credit contracted. The real bills doctrine did not definitively describe what to do during banking panics, but many of its adherents considered panics to be symptoms of contractions, when central bank lending should contract. A few governors subscribed to an extreme version of the real bills doctrine labeled “liquidationist.” This doctrine indicated that during financial panics, central banks should stand aside so that troubled financial institutions would fail. This pruning of weak institutions would accelerate the evolution of a healthier economic system. Herbert Hoover’s secretary of treasury, Andrew Mellon, who served on the Federal Reserve Board, advocated this approach. These intellectual tensions and the Federal Reserve’s ineffective decision-making structure made it difficult, and at times impossible, for the Fed’s leaders to take effective action.

Among leaders of the Federal Reserve, differences of opinion also existed about whether to help and how much assistance to extend to financial institutions that did not belong to the Federal Reserve. Some leaders thought aid should only be extended to commercial banks that were members of the Federal Reserve System. Others thought member banks should receive assistance substantial enough to enable them to help their customers, including financial institutions that did not belong to the Federal Reserve, but the advisability and legality of this pass-through assistance was the subject of debate. Only a handful of leaders thought the Federal Reserve (or federal government) should directly aid commercial banks (or other financial institutions) that did not belong to the Federal Reserve. One advocate of widespread direct assistance was Eugene Meyer , governor of the Federal Reserve Board, who was instrumental in the creation of the Reconstruction Finance Corporation .

These differences of opinion contributed to the Federal Reserve’s most serious sin of omission: failure to stem the decline in the supply of money. From the fall of 1930 through the winter of 1933, the money supply fell by nearly 30 percent. The declining supply of funds reduced average prices by an equivalent amount. This deflation increased debt burdens; distorted economic decision-making; reduced consumption; increased unemployment; and forced banks, firms, and individuals into bankruptcy. The deflation stemmed from the collapse of the banking system, as explained in the essay on the banking panics of 1930 and 1931 .

The Federal Reserve could have prevented deflation by preventing the collapse of the banking system or by counteracting the collapse with an expansion of the monetary base, but it failed to do so for several reasons. The economic collapse was unforeseen and unprecedented. Decision makers lacked effective mechanisms for determining what went wrong and lacked the authority to take actions sufficient to cure the economy. Some decision makers misinterpreted signals about the state of the economy, such as the nominal interest rate, because of their adherence to the real bills philosophy. Others deemed defending the gold standard by raising interests and reducing the supply of money and credit to be better for the economy than aiding ailing banks with the opposite actions.

On several occasions, the Federal Reserve did implement policies that modern monetary scholars believe could have stemmed the contraction. In the spring of 1931, the Federal Reserve began to expand the monetary base, but the expansion was insufficient to offset the deflationary effects of the banking crises. In the spring of 1932, after Congress provided the Federal Reserve with the necessary authority, the Federal Reserve expanded the monetary base aggressively. The policy appeared effective initially, but after a few months the Federal Reserve changed course. A series of political and international shocks hit the economy, and the contraction resumed. Overall, the Fed’s efforts to end the deflation and resuscitate the financial system, while well intentioned and based on the best available information, appear to have been too little and too late.

The flaws in the Federal Reserve’s structure became apparent during the initial years of the Great Depression. Congress responded by reforming the Federal Reserve and the entire financial system. Under the Hoover administration, congressional reforms culminated in the Reconstruction Finance Corporation Act and the Banking Act of 1932 . Under the Roosevelt administration, reforms culminated in the Emergency Banking Act of 1933 , the Banking Act of 1933 (commonly called Glass-Steagall) , the Gold Reserve Act of 1934 , and the Banking Act of 1935 . This legislation shifted some of the Federal Reserve’s responsibilities to the Treasury Department and to new federal agencies such as the Reconstruction Finance Corporation and Federal Deposit Insurance Corporation. These agencies dominated monetary and banking policy until the 1950s.

The reforms of the 1930s, ’40s, and ’50s turned the Federal Reserve into a modern central bank. The creation of the modern intellectual framework underlying economic policy took longer and continues today. The Fed’s combination of a well-designed central bank and an effective conceptual framework enabled Bernanke to state confidently that “we won’t do it again.”

- 1 These business cycle dates come from the National Bureau of Economic Research . Additional materials on the Federal Reserve can be found at the website of the Federal Reserve Bank of St. Louis.

Bibliography

Bernanke, Ben. Essays on the Great Depression . Princeton: Princeton University Press, 2000.

Bernanke, Ben, “ On Milton Friedman's Ninetieth Birthday ," Remarks by Governor Ben S. Bernanke at the Conference to Honor Milton Friedman, University of Chicago, Chicago, IL, November 8, 2002.

Chandler, Lester V. American Monetary Policy, 1928 to 1941 . New York: Harper and Row, 1971.

Chandler, Lester V. American’s Greatest Depression, 1929-1941 . New York: Harper Collins, 1970.

Eichengreen, Barry. “The Origins and Nature of the Great Slump Revisited.” Economic History Review 45, no. 2 (May 1992): 213–239.

Friedman, Milton and Anna Schwartz. A Monetary History of the United States: 1867-1960 . Princeton: Princeton University Press, 1963.

Kindleberger, Charles P. The World in Depression, 1929-1939 : Revised and Enlarged Edition. Berkeley: University of California Press, 1986.

Meltzer, Allan. A History of the Federal Reserve: Volume 1, 1913 to 1951 . Chicago: University of Chicago Press, 2003.

Romer, Christina D. “The Nation in Depression.” Journal of Economic Perspectives 7, no. 2 (1993): 19-39.

Temin, Peter. Lessons from the Great Depression (Lionel Robbins Lectures) . Cambridge: MIT Press, 1989.

Written as of November 22, 2013. See disclaimer .

Essays in this Time Period

- Bank Holiday of 1933

- Banking Act of 1933 (Glass-Steagall)

- Banking Act of 1935

- Banking Acts of 1932

- Banking Panics of 1930-31

- Banking Panics of 1931-33

- Stock Market Crash of 1929

- Emergency Banking Act of 1933

- Gold Reserve Act of 1934

- Recession of 1937–38

- Roosevelt's Gold Program

Federal Reserve History

- History & Society

- Science & Tech

- Biographies

- Animals & Nature

- Geography & Travel

- Arts & Culture

- Games & Quizzes

- On This Day

- One Good Fact

- New Articles

- Lifestyles & Social Issues

- Philosophy & Religion

- Politics, Law & Government

- World History

- Health & Medicine

- Browse Biographies

- Birds, Reptiles & Other Vertebrates

- Bugs, Mollusks & Other Invertebrates

- Environment

- Fossils & Geologic Time

- Entertainment & Pop Culture

- Sports & Recreation

- Visual Arts

- Demystified

- Image Galleries

- Infographics

- Top Questions

- Britannica Kids

- Saving Earth

- Space Next 50

- Student Center

- Introduction & Top Questions

Timing and severity

- Stock market crash

- Banking panics and monetary contraction

- The gold standard

- International lending and trade

- Sources of recovery

- Economic impact

- Global concerns

- Political movements and social change

- The documentary impulse

- Federal arts programs

- Popular culture

- Portrayals of hope

What was the Great Depression?

What were the causes of the great depression, how did the great depression affect the american economy, how did the united states and other countries recover from the great depression, when did the great depression end.

Great Depression

Our editors will review what you’ve submitted and determine whether to revise the article.

- Academia - The Great Crash of 1929 and the Great Depression in the Global Context

- EH.net - An Overview of the Great Depression

- The Balance - The Great Depression, What Happened, What Caused It, How It Ended

- Social Sciences LibreTexts - What Happened during the Great Depression?

- Federal Reserve History - The Great Depression

- The Canadian Encyclopedia - Great Depression

- The Library of Economics and Liberty - Great Depression

- Legends of America - President Franklin D. Roosevelt

- Khan Academy - The Great Depression

- Great Depression - Children's Encyclopedia (Ages 8-11)

- Great Depression: In Depth - Student Encyclopedia (Ages 11 and up)

- Table Of Contents

The Great Depression, which began in the United States in 1929 and spread worldwide, was the longest and most severe economic downturn in modern history. It was marked by steep declines in industrial production and in prices (deflation), mass unemployment , banking panics, and sharp increases in rates of poverty and homelessness.

Four factors played roles of varying importance. (1) The stock market crash of 1929 shattered confidence in the American economy, resulting in sharp reductions in spending and investment. (2) Banking panics in the early 1930s caused many banks to fail, decreasing the pool of money available for loans. (3) The gold standard required foreign central banks to raise interest rates to counteract trade imbalances with the United States, depressing spending and investment in those countries. (4) The Smoot-Hawley Tariff Act (1930) imposed steep tariffs on many industrial and agricultural goods, inviting retaliatory measures that ultimately reduced output and caused global trade to contract.

In the United States, where the Depression was generally worst, industrial production between 1929 and 1933 fell by nearly 47 percent, gross domestic product (GDP) declined by 30 percent, and unemployment reached more than 20 percent. Because of banking panics, 20 percent of banks in existence in 1930 had failed by 1933.

Three factors played roles of varying importance. (1) Abandonment of the gold standard and currency devaluation enabled some countries to increase their money supplies, which spurred spending, lending, and investment. (2) Fiscal expansion in the form of increased government spending on jobs and other social welfare programs , notably the New Deal in the United States, arguably stimulated production by increasing aggregate demand. (3) In the United States, greatly increased military spending in the years before the country’s entry into World War II helped to reduce unemployment to below its pre-Depression level by 1942, again increasing aggregate demand.

In most affected countries, the Great Depression was technically over by 1933, meaning that by then their economies had started to recover. Most did not experience full recovery until the late 1930s or early 1940s, however. The United States is generally thought to have fully recovered from the Great Depression by about 1939.

Recent News

Great Depression , worldwide economic downturn that began in 1929 and lasted until about 1939. It was the longest and most severe depression ever experienced by the industrialized Western world, sparking fundamental changes in economic institutions, macroeconomic policy, and economic theory. Although it originated in the United States , the Great Depression caused drastic declines in output, severe unemployment , and acute deflation in almost every country of the world. Its social and cultural effects were no less staggering, especially in the United States, where the Great Depression represented the harshest adversity faced by Americans since the Civil War .

Economic history

The timing and severity of the Great Depression varied substantially across countries. The Depression was particularly long and severe in the United States and Europe ; it was milder in Japan and much of Latin America. Perhaps not surprisingly, the worst depression ever experienced by the world economy stemmed from a multitude of causes. Declines in consumer demand , financial panics , and misguided government policies caused economic output to fall in the United States, while the gold standard , which linked nearly all the countries of the world in a network of fixed currency exchange rates , played a key role in transmitting the American downturn to other countries. The recovery from the Great Depression was spurred largely by the abandonment of the gold standard and the ensuing monetary expansion. The economic impact of the Great Depression was enormous, including both extreme human suffering and profound changes in economic policy .

The Great Depression began in the United States as an ordinary recession in the summer of 1929. The downturn became markedly worse, however, in late 1929 and continued until early 1933. Real output and prices fell precipitously. Between the peak and the trough of the downturn, industrial production in the United States declined 47 percent and real gross domestic product (GDP) fell 30 percent. The wholesale price index declined 33 percent (such declines in the price level are referred to as deflation ). Although there is some debate about the reliability of the statistics, it is widely agreed that the unemployment rate exceeded 20 percent at its highest point. The severity of the Great Depression in the United States becomes especially clear when it is compared with America’s next worst recession, the Great Recession of 2007–09, during which the country’s real GDP declined just 4.3 percent and the unemployment rate peaked at less than 10 percent.

The Depression affected virtually every country of the world. However, the dates and magnitude of the downturn varied substantially across countries. Great Britain struggled with low growth and recession during most of the second half of the 1920s. The country did not slip into severe depression, however, until early 1930, and its peak-to-trough decline in industrial production was roughly one-third that of the United States. France also experienced a relatively short downturn in the early 1930s. The French recovery in 1932 and 1933, however, was short-lived. French industrial production and prices both fell substantially between 1933 and 1936. Germany ’s economy slipped into a downturn early in 1928 and then stabilized before turning down again in the third quarter of 1929. The decline in German industrial production was roughly equal to that in the United States. A number of countries in Latin America fell into depression in late 1928 and early 1929, slightly before the U.S. decline in output. While some less-developed countries experienced severe depressions, others, such as Argentina and Brazil , experienced comparatively mild downturns. Japan also experienced a mild depression, which began relatively late and ended relatively early.

The general price deflation evident in the United States was also present in other countries. Virtually every industrialized country endured declines in wholesale prices of 30 percent or more between 1929 and 1933. Because of the greater flexibility of the Japanese price structure, deflation in Japan was unusually rapid in 1930 and 1931. This rapid deflation may have helped to keep the decline in Japanese production relatively mild. The prices of primary commodities traded in world markets declined even more dramatically during this period. For example, the prices of coffee, cotton, silk, and rubber were reduced by roughly half just between September 1929 and December 1930. As a result, the terms of trade declined precipitously for producers of primary commodities .

The U.S. recovery began in the spring of 1933. Output grew rapidly in the mid-1930s: real GDP rose at an average rate of 9 percent per year between 1933 and 1937. Output had fallen so deeply in the early years of the 1930s, however, that it remained substantially below its long-run trend path throughout this period. In 1937–38 the United States suffered another severe downturn, but after mid-1938 the American economy grew even more rapidly than in the mid-1930s. The country’s output finally returned to its long-run trend path in 1942.

Recovery in the rest of the world varied greatly. The British economy stopped declining soon after Great Britain abandoned the gold standard in September 1931, although genuine recovery did not begin until the end of 1932. The economies of a number of Latin American countries began to strengthen in late 1931 and early 1932. Germany and Japan both began to recover in the fall of 1932. Canada and many smaller European countries started to revive at about the same time as the United States, early in 1933. On the other hand, France, which experienced severe depression later than most countries, did not firmly enter the recovery phase until 1938.

The Great Depression: Causes, Impacts, and Recovery

Introduction.

The Great Depression remains one of the most harrowing periods in American history, a time when the nation’s economic foundations trembled, societal norms were challenged, and government intervention in economy and society reached new heights. The crisis, which lasted from 1929 until the onset of the global conflict of World War II, was not merely an American phenomenon but one that rippled across the globe, yet its most profound effects were felt on the American soil. An investigation into the Great Depression is not only an inquiry into an economic downturn but a chapter in history that illustrates the resilience and adaptability of the American spirit.

This essay endeavors to dissect the multi-faceted nature of the Great Depression, examining its causes, the extensive impact it had on the American populace, and the eventual path to recovery. It paints a picture of the era’s hardship, but also of innovation and courage in the face of adversity. By understanding this dark period in American history, we gain insight into the country’s socio-economic evolution and prepare ourselves with the knowledge to prevent or mitigate similar future crises.

Historical Context

Before the descent into economic darkness, America experienced what is often referred to as the “Roaring Twenties,” a decade marked by remarkable technological advancements, new social freedoms, and a buoyant economy that seemed to defy limitations. Innovations like the assembly line and mass production revolutionized industry, while a surge in consumerism, fueled by easy credit, kept factories humming and the stock market soaring. Jazz music and the Charleston dance craze symbolized a society in the throes of modernity, casting off the restrictive mores of the past.

However, beneath the sheen of prosperity, there were troubling signs. The agricultural sector, still a significant part of the economy, began to struggle due to overproduction and falling prices. Income inequality was at an all-time high, with the richest Americans reaping a disproportionate share of the decade’s economic gains. These economic disparities, coupled with a highly speculative stock market, created an unstable financial situation. It was a speculative bubble that could only expand so far before bursting.

As the 1920s progressed, speculation became rampant, with many investors buying stocks on margin, paying only a fraction of the value and borrowing the rest, with the assumption that the market’s upward trajectory was a constant. This speculative bubble was precarious, and when confidence wavered, it led to a cascading series of events that would trigger the greatest economic depression of the 20th century. The stage was set for a downturn, but few could anticipate the breadth and depth of the crisis that would soon engulf the nation and the world.

Causes of the Great Depression

The descent into the Great Depression, the deepest and longest-lasting economic downturn in the history of the Western industrialized world, was not the result of a singular event, nor can it be attributed to a lone cause. It was a complex confluence of factors that coalesced into a perfect storm of economic calamity. This section explores the multi-dimensional causes that led to the Great Depression.

The Stock Market Crash of 1929

Historians often cite the cataclysmic stock market crash that began on October 24, 1929, known as “Black Thursday,” as the inaugural event of the Great Depression. The speculative bubble that had been building through the 1920s, predicated on unwarranted optimism and leveraged investments, finally burst. Over the course of a few days, the market lost a significant portion of its value. This drastic decline in stock prices eroded wealth, both actual and perceived, leading to a precipitous drop in consumer spending and investment.

Bank Failures and Financial Contagion

In the wake of the stock market crash, a wave of bank failures followed, beginning in 1930 and stretching across the decade. Without the safeguards of modern deposit insurance, panic ensued as customers rushed to withdraw their funds, only to find that banks, heavily invested in the stock market or into loans that could not be repaid, were unable to return their deposits. These banking collapses further exacerbated the already declining levels of consumer confidence and spending.

Decrease in Consumer Purchasing

The uncertainty and fear that gripped the nation had a chilling effect on consumer purchasing. As individuals lost their life savings and fear of unemployment spread, the natural reaction was to cut spending to a minimum. This retreat from consumption led to a reduction in the production of goods, further leading to a surge in unemployment, creating a vicious downward spiral as a result.

The Drought and Dust Bowl

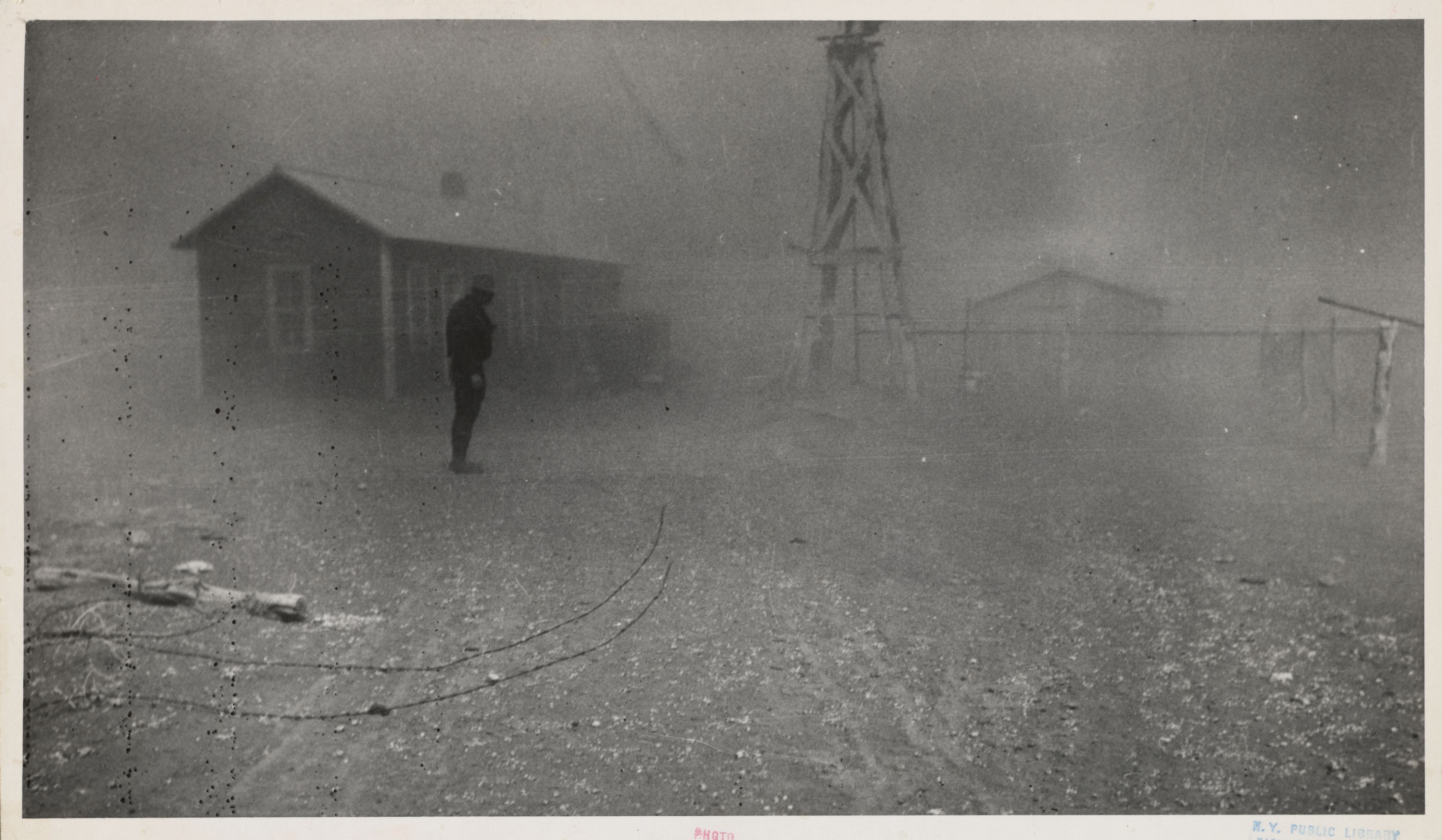

Compounding the urban and industrial financial crises was an ecological disaster unfolding in the American heartland. A severe drought, beginning in 1930 and lasting for nearly a decade, devastated agricultural production in the Great Plains. Known as the Dust Bowl, this period saw massive dust storms that not only destroyed crops but also displaced hundreds of thousands of destitute farmers, adding to the migratory pressures and urban unemployment plaguing the cities.

International Trade and Protective Tariffs

The global nature of the depression was further deepened by trade policies. The enactment of the Smoot-Hawley Tariff in 1930, which raised tariffs on thousands of imported goods to record levels, prompted retaliatory tariffs from America’s trading partners. This tariff war contributed to a significant decrease in international trade, furthering the global economic decline and preventing the world economy from stabilizing or recovering.

Conclusion of Causes

In conclusion, the causes of the Great Depression were numerous and interconnected. The stock market crash stripped away wealth and confidence, bank failures destroyed the financial system’s stability, the reduction in consumer purchasing curtailed production and led to mass unemployment, and the Dust Bowl and poor trade policies exacerbated the situation. These factors combined to create an economic downturn that would challenge the very fabric of American society.

Social and Cultural Impacts

The Great Depression exacted a heavy toll not only on the economy but also on the social and cultural fabric of American society. The widespread hardship and poverty reshaped daily life, altered family dynamics, and led to significant changes in the country’s cultural landscape.

Unemployment and the American Worker

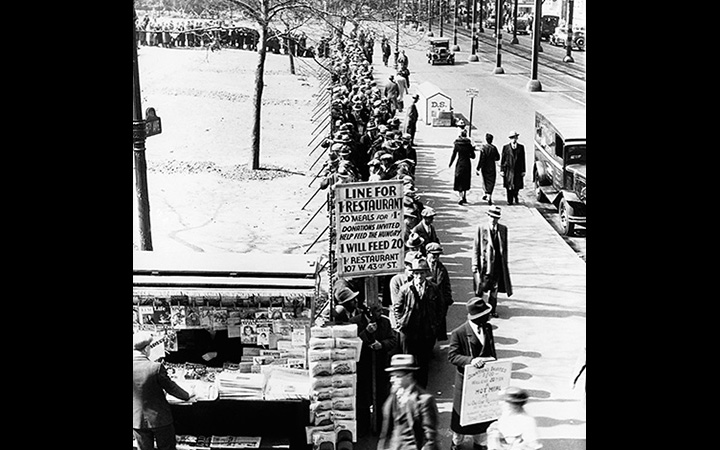

At the height of the Depression in 1933, the unemployment rate in the United States approached 25%, leaving one in four workers without a job. The psychological and material impact of this massive unemployment was profound. Men, traditionally the breadwinners in the family, faced the demoralizing reality of being unable to provide for their households. This led to a range of social problems, including increased rates of malnutrition, illness, and strained family relationships.

Migration and the Search for Work

The economic pressures of the Dust Bowl, combined with the overall lack of jobs, instigated a significant internal migration within the United States. Thousands of families, particularly from Oklahoma, Texas, and neighboring states, referred to as “Okies,” traveled westward to California and other states, seeking work and better living conditions. These mass movements of people altered the demographics and social structures of many communities.

Hoovervilles and Shantytowns

The widespread homelessness caused by the Depression led to the creation of shantytowns, derogatorily named “Hoovervilles” after President Herbert Hoover, who was widely blamed for the economic downturn. These makeshift communities, constructed of cardboard, tar paper, glass, lumber, and other scavenged materials, became a common sight across America’s cities.

The Changing American Family

The strain of the Great Depression had significant effects on the American family. Marriage rates declined, as did birth rates. Many young people delayed marriage and starting a family due to economic instability. Gender roles within the family shifted as well, with some women entering the workforce to help make ends meet, challenging the traditional view of the male as the sole provider.

Cultural Expression During Hard Times

The harsh realities of the Depression were reflected in the era’s cultural expressions. Literature, music, and visual arts echoed the despair, resilience, and hope of the American people. Works like John Steinbeck’s “The Grapes of Wrath” captured the plight of the dispossessed and the indignities of poverty. Folk and blues music gave voice to the suffering and hardships faced by the common folk, with artists like Woody Guthrie becoming the musical chroniclers of the era.

Social Unrest and Political Radicalization

The economic desperation led to increased social unrest, with a rise in strikes, protests, and the radicalization of politics. Organizations such as the Communist Party USA gained members, and socialist ideas became more popular as people searched for alternatives to the failing capitalist economy.

Conclusion of Social and Cultural Impacts

In conclusion, the Great Depression left an indelible mark on American society. The widespread suffering led to fundamental changes in family dynamics, prompted significant internal migration, and fostered a cultural climate rich with artistic expression born from adversity. The era shaped a generation and redefined the country’s social and cultural landscape, the effects of which are still discernible today.

Government Response

The Great Depression required an unprecedented response from the United States government. The initial reaction under President Herbert Hoover was widely viewed as insufficient, but the election of Franklin D. Roosevelt in 1932 marked a significant shift in the federal government’s role in economy and welfare.

Hoover’s Policies

President Hoover, who took office in 1929, the year the crisis began, was initially reluctant to intervene drastically in the economy. He held the view that federal aid should be handled at the local level and that the government should not step in to prop up wages or prices. However, as the Depression worsened, Hoover began to implement some measures, such as the Reconstruction Finance Corporation (RFC) to provide emergency funding to banks, life insurance companies, and railroads.

The New Deal

With the election of Roosevelt, a new approach was introduced, known as the New Deal. The New Deal was a series of programs, public work projects, financial reforms, and regulations enacted by President Roosevelt between 1933 and 1939. It included initiatives such as the Civilian Conservation Corps (CCC), the Public Works Administration (PWA), and later, the Works Progress Administration (WPA), which aimed to provide immediate relief through job creation.

Social Security Act

One of the cornerstones of the New Deal was the Social Security Act of 1935, which provided a safety net for the elderly, the poor, and the sick. The act established unemployment insurance and aid to families with dependent children as well.

Banking Reforms

To stabilize the financial system, the Roosevelt administration implemented a series of banking reforms, including the Emergency Banking Act, which declared a four-day bank holiday, allowing banks to get their affairs in order to prevent insolvency. The Glass-Steagall Act was also passed to separate commercial and investment banking, reducing the risk of future collapses.

Agricultural Adjustments

The Agricultural Adjustment Act (AAA) was enacted to provide relief to farmers by reducing production to raise prices. Though initially successful in raising agricultural prices, it was not without controversy, as it displaced many tenant farmers and sharecroppers.

The Second New Deal

In response to continuing economic struggles and criticism, Roosevelt launched the Second New Deal in 1935, which focused on more extensive social welfare benefits, stricter controls over business, stronger support for unions, and higher taxes on the wealthy.

Long-term Impacts of the New Deal

The New Deal fundamentally changed the relationship between the government and the American people. It led to the establishment of a range of social safety nets and regulatory bodies intended to prevent future economic crises of this magnitude. While the New Deal did not end the Great Depression, it did alleviate some of the worst of its hardships, and many of its programs and reforms had lasting impacts on the nation.

Conclusion of Government Response

In conclusion, the government response to the Great Depression, particularly under the leadership of Franklin D. Roosevelt, represented a radical shift in the way the federal government interacted with the economy and addressed social issues. This response was characterized by a wave of new legislation and public works projects that not only aimed to provide immediate relief but also sought to reform the economic system and prevent future depressions.

The Great Depression and the Arts

The Great Depression had a profound impact on the arts in the United States. As the nation grappled with economic hardships, artists of all types captured the struggles, resilience, and life during these trying times. This period saw the emergence of significant cultural works and a new level of government involvement in the support of the arts.

Visual Arts and Government Support

Under the New Deal, the Works Progress Administration (WPA) established the Federal Art Project, which funded artists to create murals, paintings, and sculptures for public buildings. This initiative not only provided employment to artists but also aimed to boost national morale and bring art into everyday life. Artists like Thomas Hart Benton and Grant Wood portrayed the everyday lives of Americans, their work often reflecting the social realities and hardships of the time.

Literature as Social Commentary

The era’s literature often provided a critique of society and a voice for the downtrodden. John Steinbeck’s “The Grapes of Wrath” and “Of Mice and Men” addressed the plight of the poor and the migrant workers. Meanwhile, Zora Neale Hurston’s “Their Eyes Were Watching God” examined the African American experience in the South during this period.

Theatre and Performances

Theatre thrived as a form of escapism and social commentary. The Federal Theatre Project, another WPA program, produced plays that entertained while addressing social issues such as poverty and injustice. Notable productions like “The Cradle Will Rock” discussed the struggles of the working class and criticized the growing power of corporations and the wealthy.

Music as Reflection and Relief

Music during the Great Depression served both as a reflection of the tough times and a form of solace. Jazz, blues, and folk were especially popular, with artists like Billie Holiday and Woody Guthrie using their music to address social issues and express the mood of the nation.

Photography Documenting Reality

Photographers such as Dorothea Lange and Walker Evans worked for the Farm Security Administration to document the Depression’s impact. Their poignant images of displaced families and struggling farmers became iconic representations of the era, highlighting the human cost of the economic collapse.

Hollywood’s Golden Age

Despite—or perhaps because of—the economic hardships, the 1930s are often considered the Golden Age of Hollywood. The film industry provided an escape from the grim realities of daily life. Movies like “Gone with the Wind” and “The Wizard of Oz” became cultural landmarks that offered a sense of hope and adventure.

Conclusion of The Great Depression and the Arts

In conclusion, the Great Depression left an indelible mark on the American arts scene. With the federal government’s support, artists were able to produce work that not only served to document and provide commentary on the era but also offered a form of escape and comfort to a beleaguered populace. These contributions have since become a crucial part of America’s cultural heritage, reflecting a time of great adversity and the resilience of the human spirit.

Economic Recovery and the End of the Great Depression

The path to economic recovery from the Great Depression was long and arduous. It involved a combination of New Deal reforms, shifts in economic policy, and the onset of global circumstances that would ultimately lead to the end of the economic downturn in the United States.

Fiscal Policy Changes

The shift towards Keynesian economics, which advocated for increased government expenditures to counteract economic downturns, was a fundamental change in fiscal policy during this period. The Roosevelt administration, though initially conservative in its spending, began to increase government investment in the economy, leading to modest improvements in employment and production.

Industrial Mobilization and World War II

Arguably, the most significant boost to the American economy came with the advent of World War II. The need for military supplies and the reinstatement of the draft absorbed a large part of the labor force, substantially reducing unemployment. Factories that had lain dormant during the Depression sprang to life as the United States ramped up production to meet the demands of the war, facilitating a return to full employment and increased industrial output.

Shifts in Monetary Policy

Monetary policy also played a critical role in recovery. The United States’ departure from the gold standard in 1933 allowed for a more flexible monetary policy, which helped to stabilize the banking system and increase liquidity in the economy. This, in turn, facilitated investment and spending.

International Trade and the End of Isolationism

As the United States emerged from its isolationist stance in the late 1930s and early 1940s, increased international trade also contributed to the recovery. The Lend-Lease Act of 1941 allowed the U.S. to supply Allied nations with goods and services, further stimulating American industry.

The Impact of the New Deal Revisited

While the New Deal had provided immediate relief to many Americans, its long-term economic impact was a subject of debate. However, the structural reforms and social programs initiated during the 1930s laid the groundwork for a more robust and resilient economy that could support the wartime and postwar booms.

Postwar Prosperity

Following the end of World War II, the United States experienced an era of significant economic growth and prosperity. The GI Bill, a lasting piece of New Deal-inspired legislation, provided education and housing benefits for returning veterans, facilitating their reintegration into a peacetime economy that was more diversified and dynamic than the pre-Depression economy.

Conclusion of Economic Recovery and the End

In conclusion, the end of the Great Depression was the result of a multifaceted approach that included government intervention, industrial mobilization for war, and shifts in economic policy. The recovery was slow, and it took nearly a decade and a global conflict to fully achieve it. Nevertheless, the foundations laid during the Depression for economic management and social welfare would influence American policies and economic thought for generations to come.

The Great Depression remains one of the most profound events in American history, leaving an indelible mark on the nation’s collective memory. It was a period characterized by immense economic hardship, widespread unemployment, and profound social and cultural shifts. Yet, it was also a time of remarkable resilience, innovation, and change.

Through the examination of its causes, we have seen how a confluence of factors such as stock market speculation, banking failures, and flawed economic policies combined to trigger the worst economic downturn in modern history. The Depression’s social and cultural impacts were vast, influencing everything from family dynamics and societal roles to creative expressions in the arts. It challenged traditional values, provoked new forms of social activism, and brought about significant changes in American culture and lifestyle.

The role of the U.S. government, particularly under the leadership of President Franklin D. Roosevelt, was transformative. The New Deal marked a new era in federal involvement in the economy, providing relief, recovery, and reform through a series of bold and controversial programs. While not without its critics, the New Deal reshaped the relationship between the American people and their government, laying the groundwork for the modern welfare state.

The Great Depression and its aftermath also led to profound changes in economic thought and policy. The disaster spurred innovations in monetary and fiscal policy, influenced international trade policies, and led to the establishment of institutions and regulations intended to prevent such a crisis from recurring. It also served as a catalyst for economic recovery and growth, particularly as the nation mobilized for World War II, which would ultimately bring an end to the economic hardship of the 1930s.

In the arts, the Depression sparked a creative explosion that both reflected the struggles of the time and offered an escape from them. Works of literature, visual arts, theatre, music, and film from the era continue to resonate today, standing as testaments to the enduring human spirit in the face of adversity.

In the wake of the Great Depression, the United States emerged as a changed nation. The economic policies and institutions that were created in response to the crisis have shaped the economic landscape for decades. The experiences of those who lived through it fostered a greater sense of shared purpose and contributed to the unity and resolve that the nation would draw upon in the years to come, particularly during World War II and the postwar era.

As we look back on the Great Depression, it serves not only as a cautionary tale about the excesses and inequities that can lead to economic collapse but also as a story of hope, resilience, and the capacity for renewal. It is a period that underscores the importance of adaptability, the value of social and economic safety nets, and the critical role of government in mitigating the impacts of financial crises. The lessons learned from the Great Depression continue to inform our policies and our societal values, reminding us of the importance of vigilance and preparedness in ensuring economic stability and prosperity for future generations.

Class Notes on Causes and Effects of the Great Depression

- Overproduction

- Laissez Faire policies that left the economy unregulated

- Over speculation on the stock market

- Decline in foreign trade

While we have spoken about the 20’s as a time of great prosperity, it was a tad deceptive. Problems lie under the surface that would not be dealt with by the conservative administrations of Harding, Coolidge and Hoover.

The Great Depression did not begin in 1929 with the fall of the over inflated stock market. In fact the Depression began ten years earlier in Europe. As the depression raged on in Europe American’s believed they would be immune to its effects. Isolationist sentiments and conservative doctrine held that the less we had to do with Europe the better. As a result American polices never addressed the possibility of the United States entering a depression as well. Actually American policies actually contributed to our entry into the depression.

The early warning signs first came in the agricultural sector. Farmers continued to produce more and more food due to technological advances like the tractor. As production grew farm prices dropped. It was simply a matter of supply and demand. Framers reacted in the traditional manner and boosted production even further. Prices plummeted. Farmers began to default on their loans and the banks foreclosed. To make matters worse the central part of the nation was hit with a terrible drought. Farmers were devastated. The drought turned that portion of America into what was called “ The Dustbowl .”

In the 1920’s American economic policy was laissez faire. Businesses were left alone and for sometime things appeared to fine. American businesses reported record profits, production was at an all time high. The problem was that while earnings rose and the rich got richer, the working class received a disproportionally lower percentage of the wealth.

This uneven distribution of wealth got so bad that 5% of America earned 33% of the income. What this meant was that there was less and less real spending. Despite the fact that the working class had less money to spend businesses continued to increase production levels.

Purchasing dropped internationally as well. Since Europe was in a depression people there weren’t buying as much as businesses had estimated. Then the Fordney McCumber Tariff and the Hawley Smoot Tariff raised tariff levels to as much as 40%. Europe which was already angered at US foreign actions responded with high tariffs of their own. International trade was at a standstill.

At this point you should be asking the question “If no one buying and companies were increasing production levels, wasn’t there going to be a problem?” BINGO!!! The problem is known as overproduction . American businesses were producing far more than could be consumed. The result was lost profits and eventually debts. After a while many companies went out of business. Why would these companies continue to overproduce? There are several reasons. Some were managed poorly. Others were part of holding companies that placed layers and layers of companies, each relying on the others production levels like a pyramid. If one company in the pyramid reported lower production levels the others fell off and it looked bad. In many cases however crooked company owners reported earnings that were higher than they were actually were in order to drive up the stock price.

As a result of World War I America had emerged as the worlds leading creditor nation. Foreign powers owed the United States and its companies about a billion dollars annually. With declining trade in America, a demand for reparation from the United States and the continuing European depression this debt went unpaid .

Throughout this period of time Americans (and it seems this included Harding, Coolidge and Hoover.) Truly felt they would be prosperous forever. They didn’t see or were unwilling to see the warning signs. With this confidence Americans began to increasingly invest in the stock market. The market began an unprecedented rise in 1928. By September 3 rd 1929 the market reached a record high of 381. Then the decline began. Many didn’t think it would last but on October 24 th panic selling began as 12.8 million shares changed hands. Then came Black Tuesday , October 29 th 1929. The market plummeted. By July the Dow reached a low of 41.22. Millions upon millions of dollars had been lost. Many who had bought on margin (credit) had to pay back debts with money they didn’t have. Some opened up the windows and jumped to their deaths. The depression had arrived.

Banks that had invested heavily in the stock market and real estate lost their depositors money. A panic ensued as people lined up at the banks to get their money. unfortunately for many the money just wasn’t there. As the amount of money in circulation dropped deflation hit. Money was worth more but there was little money to be had. The fed which had the power to put more money into circulation did nothing (laissez faire). Workers were fired as thousands of businesses closed down. Unemployment rose to 25-35%. In Toledo Ohio fully 80% of the workers were unemployed! Real estate investments flopped because with deflation a building that was once worth ten million was now worth five. The mortgage and debt stayed the same but the income was gone. Banks foreclosed on loans and took possession of worthless properties that nobody could afford to buy. Between 1930 and 1932 over 9000 banks failed.

With all of this there Hoover announced to Americans that they should “stay the course” that the ship would right itself. After all, Hoover was a self made man, a rugged individualist. By the time Hoover recognized he had to do something it was too little and much too late.

Frequently Asked Questions about the Great Depression

The Great Depression was the result of a multitude of factors, each compounding the severity of the economic decline. One primary cause was the stock market crash of October 1929, which wiped out thousands of investors and eroded public confidence. However, the crash was just the tipping point following a decade of economic imbalance where the wealth gap was significantly widened by policies that favored the rich, and consumer spending was driven by credit rather than actual financial power.

The agricultural sector had already been suffering due to a decline in commodity prices and an overproduction crisis. This was exacerbated by poor land management practices that led to the Dust Bowl, further destabilizing rural economies. Banking failures were another major cause, as bank runs and the subsequent collapse of financial institutions wiped out savings and constricted the flow of money through the economy.

International trade also suffered due to protectionist policies, such as the Smoot-Hawley Tariff Act of 1930, which placed heavy taxes on imports, leading to a decline in trade volume and retaliatory measures from other countries. Lastly, a failure of leadership and policy to address these issues early on allowed the crisis to deepen, with the Federal Reserve failing to stabilize the banking system and the government initially reluctant to intervene significantly in the economy.

The Great Depression brought about unprecedented hardship for the American populace. Unemployment soared to around 25%, leaving families without steady incomes. This led to a widespread inability to afford basic necessities such as food, clothing, and shelter. Soup kitchens, bread lines, and Hoovervilles (shantytowns named derisively after President Hoover) became common sights.

The lack of economic security put a strain on family life. Many men, traditionally the breadwinners of their households, found themselves unable to support their families, which led to a sense of shame and despair. Some abandoned their families in search of work elsewhere, while the roles within the household often shifted, with women and children increasingly contributing to the family income.

The psychological impact of the Depression was also significant, with many Americans suffering from stress-related illnesses and mental health issues due to financial strain and uncertainty. Education was disrupted as schools faced closures and shortened academic years due to budget cuts, affecting literacy and career prospects for a generation of young Americans.

Despite the hardships, the Depression also fostered a sense of community and solidarity among many Americans, who banded together to help one another through charity, barter systems, and cooperative living arrangements.

The Dust Bowl was a severe environmental disaster that occurred during the 1930s in the American and Canadian prairies, at the same time as the Great Depression. It was characterized by a series of dust storms caused by prolonged periods of drought and decades of extensive farming without crop rotation, fallow fields, cover crops, or other techniques to prevent erosion. The loose, dry, topsoil was picked up by the winds and resulted in massive dust storms that blackened skies and damaged the agricultural capacity of the region.

This environmental catastrophe exacerbated the economic struggles of the Great Depression, particularly for farmers. As crops failed and farms became untenable, many agrarian families were forced to leave their land in search of work in other parts of the country, notably California. These migrants, often called “Okies” because so many came from Oklahoma, faced intense competition for jobs, discrimination, and difficult living conditions.

The Dust Bowl highlighted the vulnerabilities in agricultural practices and the need for sustainable farming methods. In response, the U.S. government instituted a range of new policies and programs designed to promote soil conservation and support farmers, changing the face of American agriculture and aiming to prevent such a disaster from occurring again.

The end of the Great Depression is largely attributed to the economic boom caused by World War II. The war effort led to a massive increase in industrial production as the United States became the “Arsenal of Democracy” for the Allied powers. The mobilization for war created millions of jobs, reinvigorating industries that had been dormant during the Depression and effectively ending widespread unemployment.

The U.S. government’s fiscal policies changed dramatically during the war. Expenditures increased substantially to fund the war effort, significantly boosting economic activity. The New Deal programs of the 1930s also laid the groundwork for recovery by providing relief to the unemployed, reforming financial systems, and investing in public infrastructure, although these alone were not sufficient to end the Depression.

Furthermore, the war brought about profound changes in the labor market. As men joined the military, women entered the workforce in unprecedented numbers, which not only supported the war economy but also led to shifts in social attitudes about gender roles and employment.

In essence, the economic demands of World War II necessitated an increase in production and labor that the Depression’s idle factories and unemployed workers could meet, thus pulling the United States out of the economic downturn. The post-war period then cemented the recovery, as returning soldiers contributed to a robust consumer economy, and policies like the GI Bill fostered educational opportunities and home ownership.

The Great Depression had a devastating impact on the global economy. It was not solely an American phenomenon; the economic downturn was felt worldwide. After the stock market crash in the United States, a wave of financial instability spread through Europe and beyond. Many countries were already struggling with the debts incurred during World War I and were reliant on American loans and investments, which dried up as the U.S. economy contracted.

International trade suffered significantly due to a combination of shrinking markets and protectionist tariffs like the United States’ Smoot-Hawley Tariff, which caused global trade to plummet. This led to a reduction in production and a sharp rise in unemployment around the world. Countries that were part of the gold standard found themselves unable to devalue their currencies to deal with the crisis, which worsened the deflationary spiral.

The economic distress contributed to political instability in many countries, leading to the rise of extremist movements, most notably the National Socialists in Germany. The economic conditions created by the Depression are often cited as factors that led to World War II, as countries sought ways to reinvigorate their economies through militarization and territorial expansion.

The Bonus Army was a group of 43,000 demonstrators – made up of 17,000 U.S. World War I veterans, together with their families and affiliated groups – who gathered in Washington, D.C., in mid-1932 to demand early cash redemption of their service certificates. These certificates were a form of bonus that had been promised to them for their service during World War I, to be paid in 1945.

The Bonus Army’s occupation of Washington represented the desperation and unrest felt by many Americans during the Depression. The veterans were struggling to make ends meet and saw the promised bonus as a lifeline. Their peaceful protests and encampments were met with a harsh response from the government, which included the use of cavalry, infantry, tanks, and tear gas to disperse the veterans – an action that led to widespread public outrage.

The clash highlighted the failure of the federal government to address the needs of the people adequately and represented the growing demand for more direct relief and economic reform. It also served as a catalyst for later legislation under the Roosevelt administration to provide more immediate support to struggling Americans.

The Great Depression had a profound effect on American politics, leading to a significant shift in the relationship between the government and the governed. The perceived failure of President Herbert Hoover’s administration to adequately address the crisis contributed to the landslide election of Franklin D. Roosevelt in 1932.

Under Roosevelt, the federal government took on a much more active role in the economy and the welfare of the people through the implementation of the New Deal, a series of programs, public work projects, financial reforms, and regulations. This period saw the creation of many institutions and policies that are still in place today, including Social Security, federal insurance of bank deposits, minimum wage laws, and the Securities and Exchange Commission (SEC) to regulate the stock market.

The political ideology in the country shifted from a preference for limited government to an expectation that the government should play a substantial role in economic stabilization and social welfare. This change laid the foundation for the modern American political landscape and shaped the policy debates that continue to this day.

Some of the key New Deal programs included the Civilian Conservation Corps (CCC), which provided jobs in environmental conservation; the Works Progress Administration (WPA), which created a variety of public works projects; the Tennessee Valley Authority (TVA), which aimed to modernize the region with electricity and flood control; and the Social Security Act, which established a system of old-age benefits, unemployment insurance, and welfare for the disabled and needy families.

The success of these programs is a matter of historical debate. Critics argue that they expanded federal power beyond its constitutional limits and did not end the Depression. Proponents, however, contend that the New Deal offered critical relief to millions of Americans and was instrumental in reforming the nation’s financial systems to prevent future depressions.

Economically, while the New Deal helped to lower unemployment and stimulate economic activity, it was not until the industrial mobilization of World War II that the Depression truly ended. Nevertheless, the New Deal’s social programs had a lasting positive impact, providing a safety net for the vulnerable, transforming the American landscape with new infrastructure, and reshaping the role of the federal government in the lives of Americans.

- History Classics

- Your Profile

- Find History on Facebook (Opens in a new window)

- Find History on Twitter (Opens in a new window)

- Find History on YouTube (Opens in a new window)

- Find History on Instagram (Opens in a new window)

- Find History on TikTok (Opens in a new window)

- This Day In History

- History Podcasts

- History Vault

Great Depression History

By: History.com Editors

Updated: October 20, 2023 | Original: October 29, 2009

The Great Depression was the worst economic crisis in modern history, lasting from 1929 until the beginning of World War II in 1939. The causes of the Great Depression included slowing consumer demand, mounting consumer debt, decreased industrial production and the rapid and reckless expansion of the U.S. stock market. When the stock market crashed in October 1929, it triggered a crisis in the international economy, which was linked via the gold standard. A rash of bank failures followed in 1930, and as the Dust Bowl increased the number of farm foreclosures, unemployment topped 20 percent by 1933. Presidents Herbert Hoover and Franklin D. Roosevelt tried to stimulate the economy with a range of incentives including Roosevelt’s New Deal programs, but ultimately it took the manufacturing production increases of World War II to end the Great Depression.

What Caused the Great Depression?

Throughout the 1920s, the U.S. economy expanded rapidly, and the nation’s total wealth more than doubled between 1920 and 1929, a period dubbed “ the Roaring Twenties .”

The stock market, centered at the New York Stock Exchange on Wall Street in New York City , was the scene of reckless speculation, where everyone from millionaire tycoons to cooks and janitors poured their savings into stocks. As a result, the stock market underwent rapid expansion, reaching its peak in August 1929.

By then, production had already declined and unemployment had risen, leaving stock prices much higher than their actual value. Additionally, wages at that time were low, consumer debt was proliferating, the agricultural sector of the economy was struggling due to drought and falling food prices and banks had an excess of large loans that could not be liquidated.

The American economy entered a mild recession during the summer of 1929, as consumer spending slowed and unsold goods began to pile up, which in turn slowed factory production. Nonetheless, stock prices continued to rise, and by the fall of that year had reached stratospheric levels that could not be justified by expected future earnings.

Stock Market Crash of 1929

On October 24, 1929, as nervous investors began selling overpriced shares en masse, the stock market crash that some had feared happened at last. A record 12.9 million shares were traded that day, known as “Black Thursday.”

Five days later, on October 29, or “Black Tuesday,” some 16 million shares were traded after another wave of panic swept Wall Street. Millions of shares ended up worthless, and those investors who had bought stocks “on margin” (with borrowed money) were wiped out completely.

As consumer confidence vanished in the wake of the stock market crash, the downturn in spending and investment led factories and other businesses to slow down production and begin firing their workers. For those who were lucky enough to remain employed, wages fell and buying power decreased.

Many Americans forced to buy on credit fell into debt, and the number of foreclosures and repossessions climbed steadily. The global adherence to the gold standard , which joined countries around the world in fixed currency exchange, helped spread economic woes from the United States throughout the world, especially in Europe.

Bank Runs and the Hoover Administration

Despite assurances from President Herbert Hoover and other leaders that the crisis would run its course, matters continued to get worse over the next three years. By 1930, 4 million Americans looking for work could not find it; that number had risen to 6 million in 1931.

Meanwhile, the country’s industrial production had dropped by half. Bread lines, soup kitchens and rising numbers of homeless people became more and more common in America’s towns and cities. Farmers couldn’t afford to harvest their crops and were forced to leave them rotting in the fields while people elsewhere starved. In 1930, severe droughts in the Southern Plains brought high winds and dust from Texas to Nebraska, killing people, livestock and crops. The “ Dust Bowl ” inspired a mass migration of people from farmland to cities in search of work.

In the fall of 1930, the first of four waves of banking panics began, as large numbers of investors lost confidence in the solvency of their banks and demanded deposits in cash, forcing banks to liquidate loans in order to supplement their insufficient cash reserves on hand.

Bank runs swept the United States again in the spring and fall of 1931 and the fall of 1932, and by early 1933 thousands of banks had closed their doors.

In the face of this dire situation, Hoover’s administration tried supporting failing banks and other institutions with government loans; the idea was that the banks in turn would loan to businesses, which would be able to hire back their employees.

FDR and the Great Depression

Hoover, a Republican who had formerly served as U.S. secretary of commerce, believed that government should not directly intervene in the economy and that it did not have the responsibility to create jobs or provide economic relief for its citizens.

In 1932, however, with the country mired in the depths of the Great Depression and some 15 million people unemployed, Democrat Franklin D. Roosevelt won an overwhelming victory in the presidential election.

By Inauguration Day (March 4, 1933), every U.S. state had ordered all remaining banks to close at the end of the fourth wave of banking panics, and the U.S. Treasury didn’t have enough cash to pay all government workers. Nonetheless, FDR (as he was known) projected a calm energy and optimism, famously declaring "the only thing we have to fear is fear itself.”

Roosevelt took immediate action to address the country’s economic woes, first announcing a four-day “bank holiday” during which all banks would close so that Congress could pass reform legislation and reopen those banks determined to be sound. He also began addressing the public directly over the radio in a series of talks, and these so-called “ fireside chats ” went a long way toward restoring public confidence.

During Roosevelt’s first 100 days in office, his administration passed legislation that aimed to stabilize industrial and agricultural production, create jobs and stimulate recovery.

In addition, Roosevelt sought to reform the financial system, creating the Federal Deposit Insurance Corporation ( FDIC ) to protect depositors’ accounts and the Securities and Exchange Commission (SEC) to regulate the stock market and prevent abuses of the kind that led to the 1929 crash.

The New Deal: A Road to Recovery

Among the programs and institutions of the New Deal that aided in recovery from the Great Depression was the Tennessee Valley Authority (TVA) , which built dams and hydroelectric projects to control flooding and provide electric power to the impoverished Tennessee Valley region, and the Works Progress Administration (WPA) , a permanent jobs program that employed 8.5 million people from 1935 to 1943.

When the Great Depression began, the United States was the only industrialized country in the world without some form of unemployment insurance or social security. In 1935, Congress passed the Social Security Act , which for the first time provided Americans with unemployment, disability and pensions for old age.

After showing early signs of recovery beginning in the spring of 1933, the economy continued to improve throughout the next three years, during which real GDP (adjusted for inflation) grew at an average rate of 9 percent per year.

A sharp recession hit in 1937, caused in part by the Federal Reserve’s decision to increase its requirements for money in reserve. Though the economy began improving again in 1938, this second severe contraction reversed many of the gains in production and employment and prolonged the effects of the Great Depression through the end of the decade.

Depression-era hardships fueled the rise of extremist political movements in various European countries, most notably that of Adolf Hitler’s Nazi regime in Germany. German aggression led war to break out in Europe in 1939, and the WPA turned its attention to strengthening the military infrastructure of the United States, even as the country maintained its neutrality.

African Americans in the Great Depression

One-fifth of all Americans receiving federal relief during the Great Depression were Black, most in the rural South. But farm and domestic work, two major sectors in which Black workers were employed, were not included in the 1935 Social Security Act, meaning there was no safety net in times of uncertainty. Rather than fire domestic help, private employers could simply pay them less without legal repercussions. And those relief programs for which African Americans were eligible on paper were rife with discrimination in practice since all relief programs were administered locally.

5 Causes of the Great Depression

By 1929, a perfect storm of unlucky factors led to the start of the worst economic downturn in U.S. history.

How Bank Failures Contributed to the Great Depression

Were financial institutions victims—or culprits?

9 New Deal Infrastructure Projects That Changed America

The Hoover Dam, LaGuardia Airport and the Bay Bridge were all part of FDR's New Deal investment.

Despite these obstacles, Roosevelt’s “Black Cabinet,” led by Mary McLeod Bethune , ensured nearly every New Deal agency had a Black advisor. The number of African Americans working in government tripled .

Women in the Great Depression

There was one group of Americans who actually gained jobs during the Great Depression: Women. From 1930 to 1940, the number of employed women in the United States rose 24 percent from 10.5 million to 13 million Though they’d been steadily entering the workforce for decades, the financial pressures of the Great Depression drove women to seek employment in ever greater numbers as male breadwinners lost their jobs. The 22 percent decline in marriage rates between 1929 and 1939 also created an increase in single women in search of employment.

Women during the Great Depression had a strong advocate in First Lady Eleanor Roosevelt , who lobbied her husband for more women in office—like Secretary of Labor Frances Perkins , the first woman to ever hold a cabinet position.

Jobs available to women paid less but were more stable during the banking crisis: nursing, teaching and domestic work. They were supplanted by an increase in secretarial roles in FDR’s rapidly-expanding government. But there was a catch: over 25 percent of the National Recovery Administration’s wage codes set lower wages for women, and jobs created under the WPA confined women to fields like sewing and nursing that paid less than roles reserved for men.

Married women faced an additional hurdle: By 1940, 26 states had placed restrictions known as marriage bars on their employment, as working wives were perceived as taking away jobs from able-bodied men—even if, in practice, they were occupying jobs men would not want and doing them for far less pay.

Great Depression Ends and World War II Begins

With Roosevelt’s decision to support Britain and France in the struggle against Germany and the other Axis Powers, defense manufacturing geared up, producing more and more private-sector jobs.

The Japanese attack on Pearl Harbor in December 1941 led to America’s entry into World War II, and the nation’s factories went back into full production mode.

This expanding industrial production, as well as widespread conscription beginning in 1942, reduced the unemployment rate to below its pre-Depression level. The Great Depression had ended at last, and the United States turned its attention to the global conflict of World War II.

Photo Galleries

HISTORY Vault

Stream thousands of hours of acclaimed series, probing documentaries and captivating specials commercial-free in HISTORY Vault

Sign up for Inside History

Get HISTORY’s most fascinating stories delivered to your inbox three times a week.

By submitting your information, you agree to receive emails from HISTORY and A+E Networks. You can opt out at any time. You must be 16 years or older and a resident of the United States.

More details : Privacy Notice | Terms of Use | Contact Us

Home — Essay Samples — History — Great Depression — The Great Depression: Causes, Effects, and Lessons Learned

The Great Depression: Causes, Effects, and Lessons Learned

- Categories: Great Depression

About this sample

Words: 763 |

Published: Jan 29, 2024

Words: 763 | Pages: 2 | 4 min read

Table of contents

Causes of the great depression, effects of the great depression, references:, stock market crash of 1929, overproduction and underconsumption, bank failures and the collapse of the banking system, economic effects, social effects, political effects.

- Worster, D. (1979) Dust Bowl: The Southern Plains in the 1930s

- Klein, M. (2003). The Defining Moment: The Great Depression and the American Economy in the Twentieth Century.

- Soule, G. (1996). The Greatest American Bank Robbery: The Collapse of the Savings and Loan Industry.

Cite this Essay

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Dr. Karlyna PhD

Verified writer

- Expert in: History

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

3 pages / 1404 words

2 pages / 944 words

2 pages / 1046 words

2 pages / 775 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Great Depression

Cinderella Man, directed by Ron Howard and released in 2005, is a film that portrays the struggle of an individual during the Great Depression. The movie provides a glimpse into the social issues and challenges faced by the [...]

The Great Depression of the 1930s remains one of the most catastrophic economic downturns in the history of the United States. This essay delves into the multifaceted factors that contributed to the Great Depression, its [...]

In conclusion, John Steinbeck's writings on the Great Depression offer a profound and empathetic exploration of the era's challenges and hardships. His novels, such as "The Grapes of Wrath" and "Of Mice and Men," provide a deep [...]

In John Steinbeck’s novel Of Mice and Men, the character of Curley’s wife stands out as a lonely and isolated figure. Despite being married to the ranch owner’s son, she is constantly seeking attention and companionship from [...]

The unemployment rate rose sharply during the Great Depression and reached its peak at the moment Franklin D. Roosevelt took office. As New Deal programs were enacted, the unemployment rate gradually lowered. ( Bureau of Labor [...]

Famed American novelist F. Scott Fitzgerald could not have anticipated what was on the horizon when he penned The Great Gatsby in 1925. Fitzgerald was no prophet, but he seemed to have an innate sensibility that allowed him to [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?