Business Administration: PhD

About the Program

The Berkeley Haas PhD Program offers six fields of academic study, for a curriculum of unusual richness and breadth. Since the program enrolls only 14 to 16 new PhD students each year, you will work very closely with the faculty members in their chosen specialties. This close partnership, coupled with the diverse academic and cultural backgrounds of our PhD students, fosters an atmosphere of close collaboration and intellectual curiosity.

The Berkeley Haas PhD Program is strongly oriented toward discipline and research. Emphasis is placed on preparing you to evaluate the state of knowledge in your particular field and to advance it through the application of theory from the social sciences, mathematics, or statistics.

Upon applying to the program, you are required to choose a field of study, which will not only determine your course work but also focus your future employment opportunities. You may choose from the following six fields:

- Business and Public Policy

- Management of Organizations

- Real Estate

Visit School Website

Admission to the University

Applying for graduate admission.

Thank you for considering UC Berkeley for graduate study! UC Berkeley offers more than 120 graduate programs representing the breadth and depth of interdisciplinary scholarship. The Graduate Division hosts a complete list of graduate academic programs, departments, degrees offered, and application deadlines can be found on the Graduate Division website.

Prospective students must submit an online application to be considered for admission, in addition to any supplemental materials specific to the program for which they are applying. The online application and steps to take to apply can be found on the Graduate Division website .

Admission Requirements

The minimum graduate admission requirements are:

A bachelor’s degree or recognized equivalent from an accredited institution;

A satisfactory scholastic average, usually a minimum grade-point average (GPA) of 3.0 (B) on a 4.0 scale; and

Enough undergraduate training to do graduate work in your chosen field.

For a list of requirements to complete your graduate application, please see the Graduate Division’s Admissions Requirements page . It is also important to check with the program or department of interest, as they may have additional requirements specific to their program of study and degree. Department contact information can be found here .

Where to apply?

Visit the Berkeley Graduate Division application page .

Admission to the Program

Review the Program Criteria and Application Instructions before applying. Some of the factors that are taken into account during our admissions process are:

- A high level of scholarly ability, involving both quantitative and qualitative skills

- The motivation to complete a challenging and strenuous academic program

- Career objectives consistent with the PhD degree

- Unique experience, perspective, or research interests

Applicants are not required to have:

- Previous graduate work or completion of an MBA degree

- A minimum score on the GMAT/GRE exam

- A specific academic or professional background

Doctoral Degree Requirements

Accounting field.

See current requirements.

Business and Public Policy Field

Finance field, management of organizations field , marketing field, real estate field, phdba 219s research seminar in economic analysis and policy 1 - 3 units.

Terms offered: Fall 2024, Spring 2024, Fall 2023 The research seminar presents new research on economics applied to business management issues. Research Seminar in Economic Analysis and Policy: Read More [+]

Rules & Requirements

Repeat rules: Course may be repeated for credit without restriction.

Hours & Format

Fall and/or spring: 8 weeks - 1.5 hours of seminar per week

Additional Format: One and one-half hours of Seminar per week for 8 weeks.

Additional Details

Subject/Course Level: Ph.D. in Business Administration/Graduate

Grading: Offered for satisfactory/unsatisfactory grade only.

Research Seminar in Economic Analysis and Policy: Read Less [-]

PHDBA 229A Doctoral Seminar in Accounting I 3 Units

Terms offered: Fall 2024, Fall 2023, Spring 2023 A critical evaluation of accounting literature with emphasis on seminar contributions. Topics covered include research methodology in accounting, the private and social value of information. Doctoral Seminar in Accounting I: Read More [+]

Prerequisites: Business Administration 202A or equivalent, and Economics 201A-201B

Credit Restrictions: Students will receive no credit for 229A after taking 239A.

Fall and/or spring: 15 weeks - 3 hours of seminar per week

Additional Format: Three hours of Seminar per week for 15 weeks.

Grading: Letter grade.

Formerly known as: Business Administration 223A

Doctoral Seminar in Accounting I: Read Less [-]

PHDBA 229B Doctoral Seminar in Accounting II 3 Units

Terms offered: Spring 2024, Fall 2019, Spring 2018 A critical evaluation of recent accounting literature involving empirical research. Doctoral Seminar in Accounting II: Read More [+]

Prerequisites: Business Admimistration 202A or equivalent, and Economics 201A-201B

Formerly known as: Business Administration 223B

Doctoral Seminar in Accounting II: Read Less [-]

PHDBA 229C Doctoral Seminar in Accounting III 3 Units

Terms offered: Fall 2024, Fall 2023, Spring 2023 A critical evaluation of recent accounting literature with emphasis on financial accounting. Doctoral Seminar in Accounting III: Read More [+]

Formerly known as: Business Administration 223C

Doctoral Seminar in Accounting III: Read Less [-]

PHDBA 229D Doctoral Seminar in Accounting IV 2 Units

Terms offered: Spring 2020, Fall 2013, Spring 2011 Exploration of issues related to the internal accounting systems of large firms. The first part of the course focuses on the theory of mechanism design, while the second part applies this theory to a variety of managerial accounting questions. Doctoral Seminar in Accounting IV: Read More [+]

Fall and/or spring: 15 weeks - 2 hours of seminar per week

Additional Format: Two hours of Seminar per week for 15 weeks.

Formerly known as: Business Administration 223D

Doctoral Seminar in Accounting IV: Read Less [-]

PHDBA 229S Research Seminar in Accounting 2 - 4 Units

Terms offered: Fall 2024, Spring 2024, Fall 2023 Advanced study in the field of Accounting. Topics will vary from year to year and will be announced at the beginning of each semester. Research Seminar in Accounting: Read More [+]

Fall and/or spring: 15 weeks - .5-3 hours of seminar per week

Additional Format: to Three hours of Seminar per week for 15 weeks.

Research Seminar in Accounting: Read Less [-]

PHDBA 239E Dynamic Game Theory and Applications 3 Units

Terms offered: Spring 2016, Spring 2015, Spring 2014 This course focuses on repeated games and optimal mechanism design, with an emphasis on dynamics. The course presents a mix of pure theory and applications from many economics-related fields, particularly finance, macroeconomics and bargaining. Dynamic Game Theory and Applications: Read More [+]

Fall and/or spring: 15 weeks - 3 hours of lecture per week

Additional Format: Three hours of Lecture per week for 15 weeks.

Instructor: Fuchs

Dynamic Game Theory and Applications: Read Less [-]

PHDBA 239FA Asset Pricing Theory 3 Units

Terms offered: Fall 2024, Fall 2023, Fall 2022 Asset pricing and portfolio choice in partial equilbrium and asset pricing in General Equilibrium. Specifically, static and intertemporal theories of choice under risk and uncertainity and portfolio choice. Includes two-fund separation, Capital Asset Pricing Model, and the Arbitrage Pricing Theory. In a General Equilibrium framework, it covers the notion of complete markets and welfare theorems. Also, some macro-asset pricing models are developed in addition to an analysis of incomplete markets. Asset Pricing Theory: Read More [+]

Formerly known as: Ph.D. in Business Administration 239A

Asset Pricing Theory: Read Less [-]

PHDBA 239FB Corporate Finance Theory 3 Units

Terms offered: Fall 2024, Fall 2023, Fall 2022 Study of the financial decisions made by firms and the effect of such decisions on observables. These can include debt/equity ratios, dividend policies, or the cross section of returns. In addition, corporate finance considers conflicts of interest between shareholders and managers and between different financial claimants. Corporate Finance Theory: Read More [+]

Prerequisites: Graduate course in contract or game theory recommended

Additional Format: Three hours of lecture per week.

Formerly known as: Ph.D. in Business Administration 239DB

Corporate Finance Theory: Read Less [-]

PHDBA 239FC Empirical Asset Pricing 3 Units

Terms offered: Spring 2024, Spring 2023, Spring 2022 Introduction and guide to issues in empirical asset pricing. Students learn key features of asset-price behavior and study how researchers test various theoretical models from finance and economics, focusing on advantages and disadvantages of research designs. Intuition behind practical econometric tools is developed and applied to asset pricing questions. By critically evaluating research, students determine which characteristics of an empirical paper influence the finance profession. Empirical Asset Pricing: Read More [+]

Prerequisites: Graduate level econometrics recommended

Additional Format: Three hours of seminar per week.

Formerly known as: Ph.D. in Business Administration 239C

Empirical Asset Pricing: Read Less [-]

PHDBA 239FD Empirical Corporate Finance 3 Units

Terms offered: Spring 2024, Spring 2023, Spring 2022, Fall 2020, Spring 2020 This course provides a theoretical and empirical treatment of the core topics in corporate finance including internal corporate investment; external corporate investment (mergers and acquisitions); capital structure and financial contracting; bankruptcy; corporate governance. Empirical Corporate Finance: Read More [+]

Prerequisites: ECON 240A -240B or equivalent

Credit Restrictions: Students who have passed ECON 234C are not eligible to also receive credit for passing ECON C234C .

Instructor: Malmendier

Also listed as: ECON C234C

Empirical Corporate Finance: Read Less [-]

PHDBA 239S Research Seminar in Finance 2 - 4 Units

Terms offered: Fall 2024, Spring 2024, Fall 2023 Advanced study in the field of Finance. Topics will vary from year to year and will be announced at the beginning of each semester. Research Seminar in Finance: Read More [+]

Research Seminar in Finance: Read Less [-]

PHDBA 249A Doctoral Seminar in Operations Management I 2 Units

Terms offered: Spring 2013, Fall 2011 Advanced study in the field of Operations Management with an emphasis on the interface between Operations Management and Marketing. Specific topics will vary from year to year. Doctoral Seminar in Operations Management I: Read More [+]

Prerequisites: Economics 201A; Industrical Engineering and Operations Research 262A; 263A; 250, 253 or 254

Doctoral Seminar in Operations Management I: Read Less [-]

PHDBA 249B Doctoral Seminar in Operations Management II 2 Units

Terms offered: Fall 2013, Fall 2011 Advanced study in the field of Operations Management with an emphasis on the interface between Operations Management and Marketing. Specific topics will vary from year to year. Doctoral Seminar in Operations Management II: Read More [+]

Doctoral Seminar in Operations Management II: Read Less [-]

PHDBA 249C Doctoral Seminar in Management III 2 Units

Terms offered: Spring 2014 Advanced study in the field of operations management with an emphasis on the role of rational consumer behavior. Specific topics will vary year to year. Doctoral Seminar in Management III: Read More [+]

Prerequisites: Indrustial Engineering and Operations Research 262A, 263A, 250 or 253 or 254, and Economics 201A

Doctoral Seminar in Management III: Read Less [-]

PHDBA 259A Research in Micro-Organizational Behavior 3 Units

Terms offered: Fall 2024, Fall 2023, Fall 2022 Review of the research literature of micro-organizational behavior, including its social psychological and psychological foundations. Topics include: job design, work attitudes, organizational commitment, organizational culture, control and participation in organizations, creativity, personality, socialization leadership, industrial organization psychology. Research in Micro-Organizational Behavior: Read More [+]

Prerequisites: Ph.D. student or consent of instructor

Formerly known as: Business Administration 254A

Research in Micro-Organizational Behavior: Read Less [-]

PHDBA 259B Research Seminar in Macro-Organizational Behavior 3 Units

Terms offered: Fall 2024, Fall 2022, Fall 2020 Review of the research literature of macro-organizational behavior, including its sociological and economic foundations. Topics include: social networks, organizational culture, status hierarchies, social influence, innovation and organizational diversity. Research Seminar in Macro-Organizational Behavior: Read More [+]

Formerly known as: Business Administration 254B

Research Seminar in Macro-Organizational Behavior: Read Less [-]

PHDBA 259C Research Workshop on Macro Organizational Behavior 3 Units

Terms offered: Fall 2023, Fall 2021, Spring 2005 Review of the research literature of macro-organizational behavior, including its sociological and economic foundations. Topics include: social networks, organizational culture, status hierarchies, social influence, innovation and organizational diversity. Research Workshop on Macro Organizational Behavior: Read More [+]

Research Workshop on Macro Organizational Behavior: Read Less [-]

PHDBA 259E Research Seminar in Behavioral Science 4 Units

Terms offered: Fall 2020 Advanced study in the field of behavioral science. Topics will vary from year to year and will be announced at the beginning of each semester. Research Seminar in Behavioral Science: Read More [+]

Repeat rules: Course may be repeated for credit without restriction. Students may enroll in multiple sections of this course within the same semester.

Fall and/or spring: 15 weeks - 1.5 hours of colloquium per week

Additional Format: One and one-half hours of colloquium per week.

Research Seminar in Behavioral Science: Read Less [-]

PHDBA 259S Research Seminar in Management of Organizations 2 - 4 Units

Terms offered: Fall 2024, Spring 2024, Fall 2023 Advanced study in the field of Management of Organizations. Topics will vary from year to year and will be announced at the beginning of each semester. Research Seminar in Management of Organizations: Read More [+]

Fall and/or spring: 15 weeks - 0.5-3 hours of seminar per week

Additional Format: One-half to three hours of seminar per week.

Research Seminar in Management of Organizations: Read Less [-]

PHDBA 269A Seminar in Marketing: Buyer Behavior 3 Units

Terms offered: Fall 2024, Spring 2022, Fall 2018 Advanced topics seminar intended principally for Ph.D. students but open to advanced MBA students. Seminar in Marketing: Buyer Behavior: Read More [+]

Prerequisites: Consent of instructor

Formerly known as: Business Administration 269A

Seminar in Marketing: Buyer Behavior: Read Less [-]

PHDBA 269B Seminar in Marketing: Choice Modeling 3 Units

Terms offered: Spring 2023, Spring 2021, Spring 2019 Advanced topics seminar intended principally for Ph.D. students but open to advanced MBA students. Seminar in Marketing: Choice Modeling: Read More [+]

Formerly known as: Business Administration 269B

Seminar in Marketing: Choice Modeling: Read Less [-]

PHDBA 269C Seminar in Marketing: Marketing Strategy 3 Units

Terms offered: Fall 2024, Fall 2022, Fall 2020 Advanced topics seminar intended principally for Ph.D. students but open to advanced MBA students. This section will focus on marketing theory and the development of marketing thought. (Course offered alternate years.) Seminar in Marketing: Marketing Strategy: Read More [+]

Formerly known as: Business Administration 269C

Seminar in Marketing: Marketing Strategy: Read Less [-]

PHDBA 269D Special Research Topics in Marketing 3 Units

Terms offered: Fall 2024, Fall 2023, Fall 2022 Review of special research topics in marketing not ordinarily covered in BA 269A, 269B, 269C. Content varies from year to year. (Course offered alternate years.) Special Research Topics in Marketing: Read More [+]

Formerly known as: Business Administration 269D

Special Research Topics in Marketing: Read Less [-]

PHDBA 269E Seminar in Marketing: Behavioral Science 4 Units

Terms offered: Fall 2020 Advanced study in the field of behavioral science. Topics will vary from year to year and will be announced at the beginning of each semester. Seminar in Marketing: Behavioral Science: Read More [+]

Seminar in Marketing: Behavioral Science: Read Less [-]

PHDBA 269S Research Seminar in Marketing 2 - 4 Units

Terms offered: Fall 2024, Spring 2024, Fall 2023 Advanced study in the field of Marketing. Topics will vary from year to year and will be announced at the beginning of each semester. Research Seminar in Marketing: Read More [+]

Research Seminar in Marketing: Read Less [-]

PHDBA C270 Workshop in Institutional Analysis 2 Units

Terms offered: Fall 2024, Spring 2024, Fall 2023, Fall 2015, Fall 2014, Fall 2013 This seminar features current research of faculty, from UC Berkeley and elsewhere, and of advanced doctoral students who are investigating the efficacy of economic and non-economic forms of organization. An interdisciplinary perspective--combining aspects of law, economics, and organization--is maintained. Markets, hierarchies, hybrids, bureaus, and the supporting institutions of law and politics all come under scrutiny. The aspiration is to progressively build toward a new science of organization. Workshop in Institutional Analysis: Read More [+]

Prerequisites: Economics 100 or 101; Business Administration 110 or equivalent; or consent of instructor

Fall and/or spring: 15 weeks - 2 hours of lecture per week

Additional Format: Two hours of Lecture per week for 15 weeks.

Also listed as: ECON C225

Workshop in Institutional Analysis: Read Less [-]

PHDBA 279PA Political Economy: Frameworks 3 Units

Terms offered: Spring 2024 The course focuses on collective action phenomena, their connections to material conditions, their consequences for public policy, and their impact on economic performance and welfare. The focus is broad, covering mainly theory while tracing testable implications and occasionally delving into empirical evidence. Topics include conflict, state formation, state capacity, collective decision-making, voting, lobbying, theories of influence and corruption, the efficiency of democracy, political selection, electoral discipline and political accountability. Political Economy: Frameworks: Read More [+]

Political Economy: Frameworks: Read Less [-]

PHDBA 279PB Theories of the Firm and Market Failures 3 Units

Terms offered: Spring 2024 This course is designed to help students understand the role of the government in addressing market failures and improving social welfare. The course has two broad objectives. The first is to develop an in depth understanding of empirical methods and research designs that are commonly used in applied microeconomics. The second is to familiarize students with important empirical findings and lines of inquiry at the frontier (and intersection) of public economics and industrial organization. Theories of the Firm and Market Failures: Read More [+]

Theories of the Firm and Market Failures: Read Less [-]

PHDBA 279PC Political Economy: Empirics 3 Units

Terms offered: Spring 2023 This graduate course in political economy addresses the interactions among citizens, profit-maximizing firms and a vast class of non-market agents, such as governments, public administration and regulatory institutions. The class emphasizes the operative implications of non-market institutions in affecting and constraining firm strategy and individual behavior. Topics and cases cover economic and political institutions, economic policy, lobbying, clientelism, bureaucracy , regulation, antitrust, activism and the media. We corroborate the analytical framework with real-world applications, ranging from the US historical experience to cross-country comparisons, to develop insight in interpreting fundamental politico-economic constraints. Political Economy: Empirics: Read More [+]

Additional Format: Two hours of lecture per week.

Political Economy: Empirics: Read Less [-]

PHDBA 279PD The Economic Institutions of Capitalism in Historical Perspective 3 Units

Terms offered: Spring 2023 The main focus of this course is on the economic institutions of capitalism. These institutions are studied in relation to the development of the state and the interplay of political and economic elites in the process that led to the Industrial Revolution. To properly conceptualize that process and get a long-run perspective, we use a comparative approach across regions of the world and over different historical periods. The Economic Institutions of Capitalism in Historical Perspective: Read More [+]

Formerly known as: Ph.D. in Business Administration 279D

The Economic Institutions of Capitalism in Historical Perspective: Read Less [-]

PHDBA 279S Research Seminar in Business and Public Policy 2 - 4 Units

Terms offered: Fall 2024, Spring 2024, Fall 2023 Advanced study in the field of Business and Public Policy. Topics will vary from year to year and will be announced at the beginning of each semester. Research Seminar in Business and Public Policy: Read More [+]

Research Seminar in Business and Public Policy: Read Less [-]

PHDBA C279I Economics of Innovation 3 Units

Terms offered: Fall 2020, Fall 2018, Fall 2016, Spring 2016, Fall 2015 Study of innovation, technical change, and intellectual property, including the industrial organization and performance of high-technology industries and firms; the use of economic, patent, and other bibliometric data for the analysis of technical change; legal and economic issues of intellectual property rights; science and technology policy; and the contributions of innovation and diffusion to economic growth. Methods of analysis are both theoretical and empirical, econometric and case study. Economics of Innovation: Read More [+]

Also listed as: ECON C222

Economics of Innovation: Read Less [-]

PHDBA 289A Doctoral Seminar in Real Estate 4 Units

Terms offered: Spring 2024, Spring 2023, Spring 2022 Doctoral real estate seminar, covering topics related to real estate investment, finance, and market analysis. The course is rigorous and technical, applying financial and economic analysis to the subject areas of real estate finance, urban real estate economics, and real estate evaluation. Doctoral Seminar in Real Estate: Read More [+]

Prerequisites: Ph.D. equivalents of micro and macro economics, finance/or accounting, statistics and econometrics

Repeat rules: Course may be repeated for credit with instructor consent.

Formerly known as: Business Administration 289A

Doctoral Seminar in Real Estate: Read Less [-]

PHDBA 289S Research Seminar in Real Estate 2 - 4 Units

Terms offered: Fall 2024, Spring 2024, Fall 2023 Advanced study in the field of Real Estate. Topics will vary from year to year and will be announced at the beginning of each semester. Research Seminar in Real Estate: Read More [+]

Research Seminar in Real Estate: Read Less [-]

PHDBA 297A Research and Theory in Business: Economics and Management Science 3 Units

Terms offered: Prior to 2007 The course begins with individual decision making under uncertainty, and goes on to cover game theory, including both static and dynamic games with perfect, imperfect, and incomplete information. The course also covers market equilibrium with uncertainty and imperfect information, including topics such as signalling, screening, adverse selection, and moral hazard. Research and Theory in Business: Economics and Management Science: Read More [+]

Credit Restrictions: Course is required for first year students in accounting, finance, and management science.

Formerly known as: Business Administration 292A

Research and Theory in Business: Economics and Management Science: Read Less [-]

PHDBA 297B Research and Theory in Business: Behavioral Science 3 Units

Terms offered: Spring 2023, Fall 2021, Spring 2021 The focus is upon defining a research problem, designing and employing specialized techniques to solve the problem. Topics will include concepts of causality, analysis of variance; experimental design; survey research; observation and multivariate analytical techniques. Research and Theory in Business: Behavioral Science: Read More [+]

Prerequisites: Ph.D. student or consent of instructor; previous work in statistics and probability theory

Formerly known as: Business Administration 292B

Research and Theory in Business: Behavioral Science: Read Less [-]

PHDBA 297T Doctoral Topics in Business Administration 0.5 - 3 Units

Terms offered: Fall 2024, Spring 2024, Fall 2023 Advanced study in the field of Business Administration. Topics will vary from year to year and will be announced at the beginning of each semester. Doctoral Topics in Business Administration: Read More [+]

Fall and/or spring: 15 weeks - .5-3 hours of lecture per week

Summer: 6 weeks - 1.5-7.5 hours of lecture per week

Additional Format: to Three hours of Lecture per week for 15 weeks. One and one-half to Seven and one-half hours of Lecture per week for 6 weeks.

Doctoral Topics in Business Administration: Read Less [-]

PHDBA 299A Individual Research in Business Problems 0 - 12 Units

Terms offered: Summer 2015 10 Week Session, Summer 2012 10 Week Session, Spring 2011 Individual Research in Business Problems: Read More [+]

Prerequisites: PhD student standing and consent of instructor

Credit Restrictions: Forty-five hours of work per unit per term.

Fall and/or spring: 15 weeks - 0-12 hours of independent study per week

Summer: 6 weeks - 0-20 hours of independent study per week 8 weeks - 0-24 hours of independent study per week

Additional Format: Zero to twelve hours of independent study per week. Zero to twenty four hours of independent study per week for 8 weeks. Zero to twenty hours of independent study per week for 6 weeks.

Individual Research in Business Problems: Read Less [-]

PHDBA 375 Teaching Business 3 Units

Terms offered: Spring 2024, Spring 2023, Spring 2022 This course will cover the broad range of knowledge and skills necessary to teach in top business schools. Teaching business effectively requires a myriad of pedagogical styles and techniques, as well as the confidence and preparation necessary to convey the course material. This course seeks to prepare doctoral students for careers as faculty in business schools, giving them the insight and experience that will make their first courses successful ones. Students will learn effective teaching strategies by observing faculty mentors, reading pedagogical texts, and openly discussing the challenges and rewards of business instruction with experienced faculty and graduate student instructors. Teaching Business: Read More [+]

Subject/Course Level: Ph.D. in Business Administration/Professional course for teachers or prospective teachers

Teaching Business: Read Less [-]

PHDBA 602 Individual Study for Doctoral Students 1 - 8 Units

Terms offered: Spring 2010, Spring 2009, Spring 2008 Individual study in consultation with the major field adviser, intended to provide an opportunity for qualified students to prepare themselves for the various examinations required of candidates for the Ph.D. degree. Individual Study for Doctoral Students: Read More [+]

Prerequisites: Graduate standing

Credit Restrictions: Course does not satisfy unit or residence requirements for doctoral degree.

Repeat rules: Course may be repeated for credit up to a total of 16 units.

Fall and/or spring: 15 weeks - 1-8 hours of independent study per week

Summer: 8 weeks - 5.5-45 hours of independent study per week

Additional Format: One to Eight hour of Independent study per week for 15 weeks. Five and one-half to hours of Independent study per week for 8 weeks.

Subject/Course Level: Ph.D. in Business Administration/Graduate examination preparation

Formerly known as: Business Administration 602

Individual Study for Doctoral Students: Read Less [-]

PHDBA 602C Curricular Practical Training Internship 0.0 Units

Terms offered: Spring 2024, Spring 2023, Spring 2022 This is an independent study course for international students doing internships under the Curricular Practical Training program. Requires a paper exploring how the theoretical constructs learned in academic courses were applied during the internship. Curricular Practical Training Internship: Read More [+]

Fall and/or spring: 15 weeks - 0 hours of independent study per week

Summer: 10 weeks - 0 hours of independent study per week

Additional Format: Zero hour of independent study per week. Zero hour of independent study per week for 10 weeks.

Curricular Practical Training Internship: Read Less [-]

Contact Information

Haas school of business.

545 Student Services Building

Phone: 510-642-1409 or 510-642-3944

Executive Director

Melissa Hacker

Associate Director, Student Affairs

Lisa Sanders Villalba

Faculty Director, PhD Program

Francesco Trebbi

Tyrell Williams

Print Options

When you print this page, you are actually printing everything within the tabs on the page you are on: this may include all the Related Courses and Faculty, in addition to the Requirements or Overview. If you just want to print information on specific tabs, you're better off downloading a PDF of the page, opening it, and then selecting the pages you really want to print.

The PDF will include all information unique to this page.

Faculty Profiles

A passion for teaching.

The cornerstone of the entire Berkeley MFE program is its distinguished faculty and the high quality of their courses. At Haas, effective teaching is the top priority. MFE faculty members have regularly earned a median score of "Club 6" in their student evaluations-that is, their median ratings are 6 or higher on a 7-point scale.

In the Berkeley MFE classroom, faculty members emphasize both theory and practice by using a variety of teaching methods. Case studies, seminars, simulations, guest speakers, and group projects all facilitate the learning process.

Kevin Coldiron

Terrence Hendershott

Cheryl and Christian Valentine Chair

Ali Kakhbod

Assistant Professor

Amir Kermani

Associate Professor

Gregory La Blanc

Continuing Professional Faculty

Eben Lazarus

Martin Lettau

Dmitry Livdan

Ananth Madhavan

Terrance Odean

Christine Parlour

David Sraer

Richard Stanton

Johan Walden

Nancy Wallace

Professor and Chair of the Real Estate Group

Learn More & Apply

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer sed varius ante. Phasellus sit amet rhoncus mi. In vehicula dapibus lorem fermentum accumsan. Nulla et fermentum enim. Cras sit amet eros leo. Nam nec vehicula odio. Donec molestie congue pulvinar.

Business Administration PhD

The Berkeley Haas PhD Program offers six fields of academic study, for a curriculum of unusual richness and breadth. Since the program enrolls only 14 to 16 new PhD students each year, you will work very closely with the faculty members in their chosen specialties. This close partnership, coupled with the diverse academic and cultural backgrounds of our PhD students, fosters an atmosphere of close collaboration and intellectual curiosity.

The Berkeley Haas PhD Program is strongly oriented toward discipline and research. Emphasis is placed on preparing you to evaluate the state of knowledge in your particular field and to advance it through the application of theory from the social sciences, mathematics, or statistics.

Upon applying to the program, you are required to choose a field of study, which will not only determine your course work but also focus your future employment opportunities. You may choose from the following six fields:

- Business and Public Policy

- Management of Organizations

- Real Estate

Contact Info

Inquiry Form

2220 Piedmont Ave

Berkeley, CA 94720

At a Glance

Department(s)

Admit Term(s)

Application Deadline

December 2, 2024

Degree Type(s)

Doctoral / PhD

Degree Awarded

GRE Requirements

- Our Culture

- Our Location

- Developing Leaders

- Diversity & Inclusion

- Sustainability

- Academic Approach

- Career Development

- Learn from Business Leaders

- Corporate Recruiters

- Dean's Speaker Series

- Dean’s Hosted Speaker Events

- Our History

- Acclaimed Alumni

- Commencement Speakers

- Dean Ann Harrison

- Haas School Board

- Full-time MBA

- Evening & Weekend MBA

- MBA for Executives

- Compare the MBA Programs

- Master of Financial Engineering

- Bachelor of Science in Business

- Berkeley M.E.T. (Management, Entrepreneurship, & Technology)

- Global Management Program

- Robinson Life Sciences Business and Entrepreneurship Program

- BASE Summer Program for Non-business Majors

- BCPA Accounting Summer Program

- Berkeley Haas Global Access Program

- Michaels Graduate Certificate in Sustainable Business

- Boost@Berkeley Haas

- Berkeley Business Academy for Youth

- Executive Education

- Research & Insights

- Media Contacts

- Faculty Experts

- Faculty Directory

- Academic Groups

- Research Institutes & Centers

- Faculty Initiatives

- Case Studies

- Research Labs

- California Management Review

- Nobel Laureates

- Teaching Awards

- Visiting Executives & Scholars

- Faculty in Public Policy

- Faculty Recruitment

- Alumni Network

- Chapters, Groups, & Networks

- Slack Alumni Workspace

- Alumni Directory

- Email (Alumni Email Services)

- Student-Alumni Connections

- Professional Resources

- For BS, MA, MFE, & PhD Alumni

- For MBA Alumni

- Lifelong Learning

- Worldwide Alumni Events Calendar

- Give to Berkeley Haas

- Impact & Recognition

- Haas Leadership Society

- How to Give

Give to Haas

Your investments drive excellence

Full-time MBA Program

- Career Advantage

- Career Support

- Career Paths

- Consulting/Strategy

- Energy & Clean Technology

- Entrepreneurship

- Real Estate

- Social Impact

- Employment Report

Where Finance, Technology, Entrepreneurship, and Impact Intersect

The Finance Program at Berkeley Haas reflects the Bay Area at large; we live and excel here at the global intersection of finance, technology, entrepreneurship, and impact.

Finance is top-3 among career paths that out MBAs pursue. The San Francisco Financial District, which is a short train ride from Berkeley, is the finance hub for the western half of the U.S. This provides ease of access for students to meet with alumni and other finance professionals for individual networking and interviews and for professionals to come to campus for recruiting, networking, guest speaker roles, and as faculty.

The San Francisco Bay Area is also the global capital of the Tech and Venture Capital industries, which underlie much of corporate finance, M+A, IPO and investment activity.

The Finance Program is perennially ranked in the top 10 by U.S. News & World Report , with faculty members who are leading researchers or leading practitioners in M&A, asset management, private equity, venture capital, impact investing, and fintech.

MBA students lead Finance , Investment , Private Equity , Fintech , and Venture Capital clubs and participate in national competitions like the Alpha Challenge, Sustainable Investing Challenge, and private equity competitions.

Video: Finance student perspectives

Video: Finance Industry Club Spotlight (2023)

Sample Finance Coursework

- New Venture Finance

- Asset Management

- Private Equity

- Venture Capital

- Mergers and Acquisitions

- Corporate Finance

- Search Funds

- Sustainable and Impact Finance courses including Impact Investing Landscape

- Speaker Series courses in Investment Banking, Venture Capital, Investment Management, Private Equity, and Fintech

- Some finance students also choose to take quantitative finance courses in our Master of Financial Engineering program

Experiential Learning Opportunities in Finance

Haas Sustainable Investment Fund

The Haas Sustainable Investment Fund is the first and largest student-managed socially responsible investment fund within a leading business school. You gain real-world experience in delivering strong financial returns and positive social impact. Since 2008, the student principals have more than quadrupled the initial investment to over $4 million.

Haas Impact Fund

Student teams receive training on sourcing, evaluating, and conducting due diligence for double bottom line impact investing opportunities, and then compete to analyze and pitch such ventures to a panel of judges, for up to $7,500 equity investment.

Impact Investing Practicum

Student teams lead projects for impact investing firms over ten weeks.

Hedge Fund Strategies

In Hedge Fund Strategies, student teams develop, test, and pitch their own investment strategies to a panel of investment professionals.

See the full list of Berkeley MBA experiential learning opportunities .

Finance Scholarships and Fellowships

All scholarship and fellowship recipients are awarded scholarship money, are paired with a mentor in their field of interest, and receive priority enrollment in finance electives.

Investment Banking and Asset Management Fellowships

$5,000 scholarships and pairing with a mentor in investment banking or asset management, with applications in fall semester.

Entrepreneurial Finance Fellowship

For students with career goals in finance at startups, venture capital, impact investing, and fintech. $5,000 scholarships and pairing with a mentor in an entrepreneurial finance field, with applications in fall semester.

CJ White Fellowship

Scholarships of up to $100,000 and mentorship, awarded upon admission.

Finance Faculty Spotlight

Professor Ulrike Malmendier researches corporate finance, behavioral economics and finance, the economics of organizations, contract theory, law and economics, and law and finance. She is the recipient of the 2013 Fischer Black Prize in Economics, which honors the top finance scholar under the age of 40.

Professor Annette Vissing- Jørgensen studies empirical asset pricing and household finance (particularly stock market participation), private equity and entrepreneurship, and disclosure regulation. She teaches the core Finance course.

Professor Adair Morse is a Founding Faculty Director for the Sustainable and Impact Finance Initiative. She has taught Haas Sustainable Investment Fund, Haas Impact Fund, and New Venture Finance. She studies sustainable and impact investing, entrepreneurship, pension asset management, and served under Janet Yellen at U.S. Treasury.

Peter Goodson is a member of the professional faculty and a private equity pioneer, having served as an early stage partner at Clayton, Dubilier & Rice, one of the first management buyout firms. He teaches Mergers & Acquisitions and Private Equity.

As executive director of strategic programs for the Berkeley Haas Finance Group, William Rindfuss d evelops programs to complement the finance curriculum and expands partnerships with the finance community and alumni. He previously worked as head of credit risk management for the West Coast at JPMorgan Investment Bank.

Meet more finance faculty .

Finance Co-Curriculars

The Finance Club organizes activities to assist members in evaluating careers in finance, including investment banking, and connects members with alumni and other finance professionals. The club runs a highly active calendar of events, in conjunction with other related clubs, that includes speakers, teach-ins, and workshops on topics from fintech to fixed income and financial modeling, as well as treks to firms such as Goldman Sachs, Morgan Stanley and JPMorgan.

The Venture Capital Club provides training and promotes fellowships, internships and jobs in venture capital.

The FinTech Club connects students with career opportunities and prepares them to succeed as leaders in the fintech space. The club hosts speakers on topics such as blockchain and fintech for good.

The Investment Club supports student interest in investment and financial analysis and helps them conduct job searches in the investment management industry, with a focus on fostering relationships with West Coast firms. The club holds an internal stock pitch competition each year and fields teams for national competitions such as the UNC Alpha Challenge and the Cornell Stock-Pick Challenge. Students also lead treks to Bay Area and LA-based firms.

The Private Equity Club offers opportunities for professional development and industry exposure, focusing on the range between growth equity and leveraged buyouts. Members compete in LBO competitions.

Support for Finance Careers

Students leverage their co-curricular experience, the Berkeley Haas Alumni Network, and the Career Management Group to pursue careers in finance. They benefit from training and advising from CMG professionals, workshops, treks to and visits from target firms, networking events, easy access to alumni and other professionals, and promotion of internships and job opportunities.

Students have access to online training in financial modeling from Wall Street Prep and a workshop on Valuation by Training the Street.

Goldman Sachs, JPMorgan, Morgan Stanley, BlackRock, Parnassus, Square (and other FinTech startups) are just few of the employers who recognize the value a Berkeley MBA has to offer in finance. Additionally, firms such as Google and Amazon choose Berkeley MBA grads for in-house finance roles.

- REQUEST INFO

- ATTEND AN EVENT

Claudia Silva Fajuri

Fixed Income Strategy Associate BlackRock

"Haas brought me up to speed in different asset classes, current industry trends, and different investment philosophies. It also helped me develop useful managerial and leadership skills, and I gained both the hard and soft skills that were vital in my recruiting process. In my current role at BlackRock, I'm able to achieve my professional goal of improving access to financial securities and diversification for all kinds of investors."

Learn More about Claudia

Assistant Professor - Finance - Haas School of Business Apply now to Assistant Professor - Finance - Haas School of Business

- Haas School of Business / Haas School of Business / UC Berkeley

Position overview

Assistant Professor, Finance

Application Window

Open date: July 29, 2024

Next review date: Monday, Nov 25, 2024 at 11:59pm (Pacific Time) Apply by this date to ensure full consideration by the committee.

Final date: Monday, Nov 25, 2024 at 11:59pm (Pacific Time) Applications will continue to be accepted until this date.

Position description

The Haas School of Business at the University of California, Berkeley invites applications for a tenure-track faculty position in Finance with an expected start date of July 1, 2025.

We seek candidates who will help advance the research, teaching, and service missions of the Finance group. We are interested in those conducting research in any area of Finance. Successful candidates will have demonstrated a strong record and promise for continued productivity.

Berkeley Haas is committed to recruiting the most diverse students, faculty and staff which enhances our mission, community, and academic excellence. We seek to provide an inclusive environment where everyone is treated fairly and has equal access to opportunities, a commitment that lies at the heart of Berkeley’s mission as a public university. With this focus, we frame and inform our teaching and student learning experiences to equip our students to lead in a diverse world. This quest is supported by our shared commitment to our four Defining Leadership Principles: Question the Status Quo, Confidence Without Attitude, Students Always, and Beyond Yourself.

Berkeley Haas is committed to addressing the family needs of faculty, including dual career couples and single parents. We are also interested in candidates who have had non-traditional career paths or who have taken time off for family reasons, or who have achieved excellence in careers outside academia. For information about potential relocation to Berkeley, or career needs of accompanying partners and spouses, please visit: http://ofew.berkeley.edu/new-faculty .

The University of California is committed to creating and maintaining a community dedicated to the advancement, application, and transmission of knowledge and creative endeavors through academic excellence, where all individuals who participate in University programs and activities can work and learn together in a safe and secure environment, free of violence, harassment, discrimination, exploitation, or intimidation. Consistent with this commitment, UC Berkeley requires all applicants for Senate faculty positions to complete, sign, and upload an Authorization of Information Release form into AP Recruit as part of their application. If an applicant does not include the signed authorization, the application will be considered incomplete, and as with any incomplete application, will not receive further consideration. Although all applicants for faculty recruitments must complete the entire application, applicants will only be subject to reference checks if and when they are selected as the candidate to whom the hiring unit would like to extend a formal offer. More information is available on this website .

Qualifications

Applicants must have a PhD (or equivalent international degree) or be enrolled in a PhD (or equivalent international degree) granting program at the time of application.

We are especially interested in applicants with a Ph.D. in Finance, Economics, or other closely related fields. We prefer applicants who currently have a PhD or who have advanced to Ph.D. candidacy and will complete the doctoral degree or equivalent degree within six months of the start date.

Application Requirements by Level

Assistant professor (new phd/postdoc).

Position title: Assistant Professor, Finance

New/recent PhDs or Post Docs (or an equivalent degree or position) who have never held an Assistant Professor position or a position equivalent to an Assistant Professor. Please note that this level determination is only for application review purposes, not the ultimate appointment level of the finalist.

Curriculum Vitae - Your most recently updated C.V.

Job Market Paper

Statement of Research

Statement of Teaching

Statement on Contributions to Advancing Diversity, Equity, and Inclusion - Statement on your contributions to diversity, equity, and inclusion, including information about your understanding of these topics, your record of activities to date, and your specific plans and goals for advancing equity and inclusion if hired at Berkeley. More Information and guidelines .

Authorization to Release Information Form - A reference check will be completed only if you are selected as the candidate to whom the hiring unit would like to extend a formal offer. Download, complete, sign, and upload the Authorization to Release Information form .

Cover Letter (Optional)

Additional Research Paper (Optional)

- 3 letters of reference required

Please ask three references to upload their letters of recommendation into your application. In order to be equitable to all candidates we only accept three (3) letters per candidate.

Assistant Professor (Advanced)

Applicants who currently hold (or have held) an Assistant Professor or untenured Associate Professor position or a position equivalent to an Assistant Professor or untenured Associate Professor position. Please note that this level determination is only for application review purposes, not the ultimate appointment level of the finalist.

Teaching Evaluations (Optional)

- 3 required (contact information only)

References will be contacted for candidates who move to the interview stage of the process. You will be notified before your references are contacted.

Help contact: [email protected]

About UC Berkeley

UC Berkeley is committed to diversity, equity, inclusion, and belonging. The excellence of the institution requires an environment in which the diverse community of faculty, students, and staff are welcome and included. Successful candidates will demonstrate knowledge and skill related to ensuring equity and inclusion in the activities of their academic position (e.g., teaching, research, and service, as applicable).

The University of California, Berkeley is an Equal Opportunity/Affirmative Action Employer. All qualified applicants will receive consideration for employment without regard to race, color, religion, sex, sexual orientation, gender identity, national origin, disability, age, or protected veteran status.

Please refer to the University of California’s Affirmative Action Policy and the University of California’s Anti-Discrimination Policy .

In searches when letters of reference are required all letters will be treated as confidential per University of California policy and California state law. Please refer potential referees, including when letters are provided via a third party (i.e., dossier service or career center), to the UC Berkeley statement of confidentiality prior to submitting their letter.

As a University employee, you will be required to comply with all applicable University policies and/or collective bargaining agreements, as may be amended from time to time. Federal, state, or local government directives may impose additional requirements.

Job location

Pedro David Espinoza, BS 17 Founder & CEO, Pan Peru USA

“My mom’s an engineer, and one of her dreams was to give back to her hometown,” Espinoza says. “She taught me the power of making a difference and the power of generosity.”

Those lessons have guided Espinoza’s career path ever since.

When he applied for a scholarship to Berkeley, an interviewer gave Espinoza an idea: Turn Pan Peru into a social venture connecting nonprofits with large corporations seeking to make social investments.

So in 2014, Espinoza launched SmileyGo.com. The startup produced an app that matched companies with nonprofits to help them track their corporate responsibility investments and measure the impact.

SmileyGo grew to more than 30 branches in 51 countries, indexing the data of 1.4 million nonprofits in the U.S. alone, Espinoza says.

Espinoza eventually left SmileyGo to launch Pan Peru USA—a nonprofit that helps underserved communities in Peru, and Alpaca Pan Peru—an online marketplace and entrepreneurship program for women of Pampas Grande to sell handmade alpaca apparel. About 100 women have joined the program.

“These women have been able to pay healthcare and educational expenses for their kids while learning about product design and marketing,” he says.

Now, he’s inspiring others toward social entrepreneurship.

“I speak at Fortune 500 companies about my immigrant, entrepreneurial story to inspire thousands of people to be relational rather than transactional and to serve rather than receive,” Espinoza says.

linkedin.com/in/pedrodavidespinoza

- Operations & IT Management

- Sustainability

- Economic Analysis & Policy

- Business & Public Policy

- Social Impact

- Diversity, Equity, and Inclusion

- Innovation & Technology

- Real Estate

- Entrepreneurship

- Energy & Environment

- Faculty News

- Student News

- School News

- Perspectives

- News Releases

- Alumni News

- Our Culture

- Our Location

- Developing Leaders

- Diversity & Inclusion

- Sustainability

- Academic Approach

- Career Development

- Learn from Business Leaders

- Corporate Recruiters

- Dean's Speaker Series

- Dean’s Hosted Speaker Events

- Our History

- Acclaimed Alumni

- Commencement Speakers

- Dean Ann Harrison

- Haas School Board

- Full-time MBA

- Evening & Weekend MBA

- MBA for Executives

- Compare the MBA Programs

- Master of Financial Engineering

- Bachelor of Science in Business

- Berkeley M.E.T. (Management, Entrepreneurship, & Technology)

- Global Management Program

- Robinson Life Sciences Business and Entrepreneurship Program

- BASE Summer Program for Non-business Majors

- BCPA Accounting Summer Program

- Berkeley Haas Global Access Program

- Michaels Graduate Certificate in Sustainable Business

- Boost@Berkeley Haas

- Berkeley Business Academy for Youth

- Executive Education

- Research & Insights

- Media Contacts

- Faculty Experts

- Faculty Directory

- Academic Groups

- Research Institutes & Centers

- Faculty Initiatives

- Case Studies

- Research Labs

- California Management Review

- Nobel Laureates

- Teaching Awards

- Visiting Executives & Scholars

- Faculty in Public Policy

- Faculty Recruitment

- Alumni Network

- Chapters, Groups, & Networks

- Slack Alumni Workspace

- Alumni Directory

- Email (Alumni Email Services)

- Student-Alumni Connections

- Professional Resources

- For BS, MA, MFE, & PhD Alumni

- For MBA Alumni

- Lifelong Learning

- Worldwide Alumni Events Calendar

- Give to Berkeley Haas

- Impact & Recognition

- Haas Leadership Society

- How to Give

Give to Haas

Your investments drive excellence

Berkeley MBA Blog

Collaboration is an easy stretch for Flex cohort

Will everyone else already know more than me? Who will be in my cohort? Will I be able to network?

Pretty much everyone considering an MBA program has questions like these. And it’s fair to say that being part of the inaugural Berkeley Haas Evening & Weekend MBA program’s Flex cohort amplified these and other questions.

“Will I be able to be in person enough to really feel like I'm part of the overall student body? The overall university?” Alecia Wall, MBA 25, a senior manager in channel acquisition with Atlassian in Austin, Texas, wondered. After just a few months, she had her answers: “I've been so pleased that, I can say yes to all of those things.”

Students who choose the Flex option take their core courses online from wherever is convenient for them, meeting twice a week at a set time with their professors and classmates. Electives, in the second half of the program, can be taken in person or online. And while the in-person WE Launch orientation gives everyone a chance to meet face-to-face, opportunities for serendipitous encounters in the courtyard or café are limited once the semester starts.

Nonetheless, Amanda Sultan, MBA 25, previously a strategic projects lead with Waymo in Detroit, happily realized that “everyone comes into this program being really, really open, and you feel like you have an instant family.”

Some of that sense of connection is due to the attention paid to the technology of the virtual classroom, which allows for plenty of interaction and discussion with the professors and classmates. But even more fundamentally, the connections are evidence of the collaborative culture nurtured in all of the Berkeley Haas graduate business school programs.

For Nour Abi Samra, MBA 25, a senior product solutions architect with Certinia, Berkeley Haas feels “like a safe space where you can give your thoughts, and be accepted, not feel judged.” Emily Harmon, MBA 25, who participates in classes from Seattle, where she is an HR integration program manager at Microsoft, describes being “surrounded by classmates and faculty who truly care about each other's success. It's a very collaborative, very supportive environment.”

That feeling extends to an 18-year veteran of the U.S. Marine Corps, Aidan Steele, MBA 25, who was “nervous about not having the language and not having the professional context to be in the business school environment” yet found a “universal” welcome from his cohort. Aidan joins classes from England, where he is now chief of staff at XLCC.

Universal is an apt way to describe a cohort that includes students from 17 U.S. states. Students share their professional insights of course, but “Beyond just hearing about people's different experiences at different companies or even in different industries, you're hearing about what they're seeing in the world around them, [things] that I would otherwise really never have a view into,” Alecia said.

Both online and in person, faculty welcome every opportunity to deepen relationships with Flex students. In addition to staying after class to continue a lively Q&A exchange, “we've had professors schedule small groups, little meetups, virtual meetups so that they can get to know other people in the class,” said Lisa Dalgleish, a manager of Talent Strategy & Innovation with Deloitte in Austin, Texas. Lisa and her fellow Texan, Alecia, agreed that whenever Flex students are on campus, faculty show up, say hi, and even join students for dinner, eager to get to know them in person.

Amanda sees the collaborative culture as a concrete example of the Beyond Yourself Defining Leadership Principle . “It's about, yes, growing in yourself and in your life, but doing it in such a positive way that you're helping those around you as well,” she said. “People are always thinking beyond themselves: How can we impact our community? How can we have a positive impact on the world through business? If you see yourself as someone who wants to learn more about business, but also have a positive impact in your community, Haas is a hundred percent the place to go.”

Interested in pursuing your MBA but worried about how it will fit in with your busy life? Learn more about the Berkeley Haas Flex MBA today!

More Stories for You

Haas culture | 3 MIN READ

How the Berkeley Haas leadership principles define the MBA experience

Haas culture | 7 MIN READ

The Berkeley Haas scholarship guide for full-time and part-time MBA students

Entrepreneurship | 3 MIN READ

Is the Berkeley MBA a good fit for you? Ask yourself these four questions to find out

Sign up for our newsletter.

Get a curated collection of the latest trends, insights and happenings from Berkeley Haas delivered to your inbox each month.

New process vaporizes plastic bags and bottles, yielding gases to make new, recycled plastics

Graduate student RJ Conk adjusts a reaction chamber in which mixed plastics are degraded into the reusable building blocks of new polymers. Photo courtesy of Robert Sanders, UC Berkeley.

Berkeley — A new chemical process can essentially vaporize plastics that dominate the waste stream today and turn them into hydrocarbon building blocks for new plastics.

The catalytic process, developed at the University of California, Berkeley, works equally well with the two dominant types of post-consumer plastic waste: polyethylene, the component of most single-use plastic bags; and polypropylene, the stuff of hard plastics, from microwavable dishes to luggage. It also efficiently degrades a mix of these types of plastics.

The process, if scaled up, could help bring about a circular economy for many throwaway plastics, with the plastic waste converted back into the monomers used to make polymers, thereby reducing the fossil fuels used to make new plastics. Clear plastic water bottles made of polyethylene tetraphthalate (PET), a polyester, were designed in the 1980s to be recycled this way. But the volume of polyester plastics is minuscule compared to that of polyethylene and polypropylene plastics, referred to as polyolefins.

"We have an enormous amount of polyethylene and polypropylene in everyday objects, from lunch bags to laundry soap bottles to milk jugs — so much of what's around us is made of these polyolefins," said John Hartwig , a UC Berkeley professor of chemistry who led the research. "What we can now do, in principle, is take those objects and bring them back to the starting monomer by chemical reactions we've devised that cleave the typically stable carbon-carbon bonds. By doing so, we've come closer than anyone to give the same kind of circularity to polyethylene and polypropylene that you have for polyesters in water bottles."

Hartwig, graduate student Richard J. "RJ" Conk, chemical engineer Alexis Bell , who is a UC Berkeley Professor of the Graduate School, and their colleagues will publish the details of the catalytic process on Aug. 29 in the journal Science.

Plastics to Building Blocks v4

This video by UC Berkeley graduate student RJ Conk explains how a new catalytic process turns plastic waste into gases that are the building blocks for new plastics, thus enabling a circular economy for plastics. (Video credit: Richard J. “RJ” Conk, UC Berkeley)

A circular economy for plastics

Polyethylene and polypropylene plastics constitute about two-thirds of post-consumer plastic waste worldwide. About 80% ends up in landfills, is incinerated or simply tossed into the streets, often ending up as microplastics in streams and the ocean. The rest is recycled as low-value plastic, becoming decking materials, flowerpots and sporks.

To reduce this waste, researchers have been looking for ways to turn the plastics into something more valuable, such as the monomers that are polymerized to produce new plastics. This would create a circular polymer economy for plastics, reducing the need to make new plastics from petroleum, which generates greenhouse gases.

Two years ago, Hartwig and his UC Berkeley team came up with a process for breaking down polyethylene plastic bags into the monomer propylene — also called propene — that could then be reused to make polypropylene plastics. This chemical process employed three different bespoke heavy metal catalysts: one to add a carbon-carbon double bond to the polyethylene polymer and the other two to break the chain at this double bond and repeatedly snip off a carbon atom and, with ethylene, make propylene (C 3 H 6 ) molecules until the polymer disappeared. But the catalysts were dissolved in the liquid reaction and short-lived, making it hard to recover them in an active form.

Chemists John Hartwig and RJ Conk discuss the experimental apparatus that reduces plastics to their monomer precursors, which can then be used to make new plastics. Photo courtesy of Robert Sanders, UC Berkeley.

In the new process, the expensive, soluble metal catalysts have been replaced by cheaper solid ones commonly used in the chemical industry for continuous flow processes that reuse the catalyst. Continuous flow processes can be scaled up to handle large volumes of material.

Conk first experimented with these catalysts after consulting with Bell, an expert on heterogeneous catalysts, in the Department of Chemical and Biomolecular Engineering.

Synthesizing a catalyst of sodium on alumina, Conk found that it efficiently broke or cracked various kinds of polyolefin polymer chains, leaving one of the two pieces with a reactive carbon-carbon double bond at the end. A second catalyst, tungsten oxide on silica, added the carbon atom at the end of the chain to ethylene gas, which is constantly streamed through the reaction chamber, to form a propylene molecule. The latter process, called olefin metathesis, leaves behind a double bond that the catalyst can access again and again until the entire chain has been converted to propylene.

The same reaction occurs with polypropylene to form a combination of propene and a hydrocarbon called isobutylene. Isobutylene is used in the chemical industry to make polymers for products ranging from footballs to cosmetics and to make high-octane gasoline additives.

Surprisingly, the tungsten catalyst was even more effective than the sodium catalyst in breaking polypropylene chains.

"You can't get much cheaper than sodium," Hartwig said. "And tungsten is an earth-abundant metal used in the chemical industry in large scale, as opposed to our ruthenium metal catalysts that were more sensitive and more expensive. This combination of tungsten oxide on silica and sodium on alumina is like taking two different types of dirt and having them together disassemble the whole polymer chain into even higher yields of propene from ethylene and a combination of propene and isobutylene from polypropylene than we did with those more complex, expensive catalysts."

Like a string of pearls

One key advantage of the new catalysts is that they avoid the need to remove hydrogen to form a breakable carbon-carbon double bond in the polymer, which was a feature of the researchers' earlier process to deconstruct polyethylene. Such double bonds are an Achilles heel of a polymer, in the same way that the reactive carbon-oxygen bonds in polyester or PET make the plastic easier to recycle. Polyethylene and polypropylene don't have this Achilles heel — their long chains of single carbon bonds are very strong.

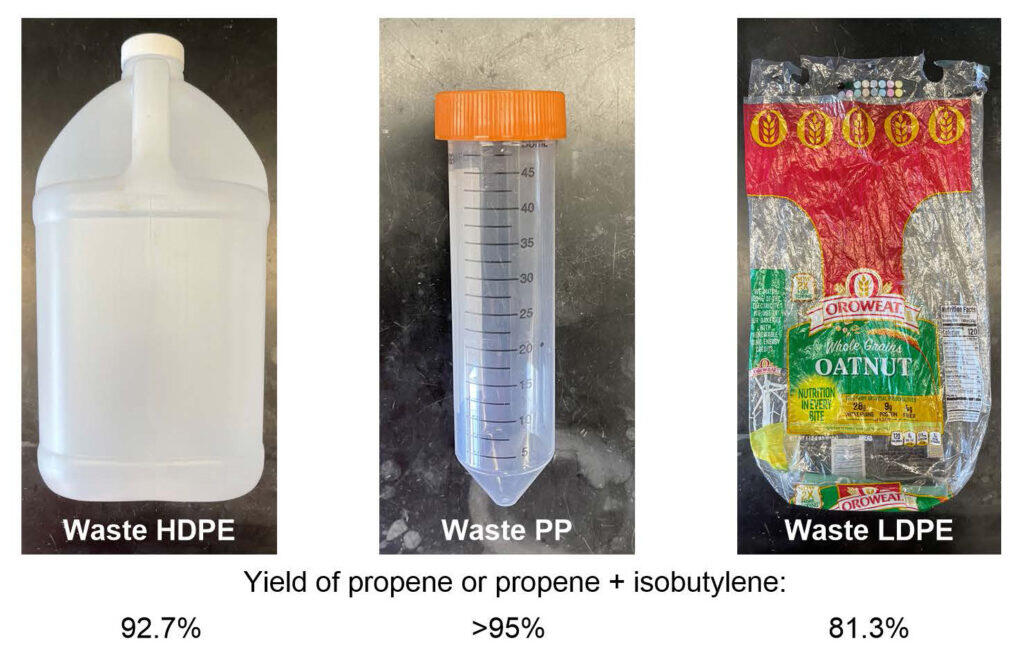

Examples of the types of plastics the new process can handle. Left to right, a jug made of high density polyethylene, a test tube of polypropylene and a low density polyethylene bread bag. The numbers below each image are the percentage yield of monomers that can be used to make new plastic polymers. Photo courtesy of John Hartwig and RJ Conk, UC Berkeley.

"Think of the polyolefin polymer like a string of pearls," Hartwig said. "The locks at the end prevent them from falling out. But if you clip the string in the middle, now you can remove one pearl at a time."

The two catalysts together turned a nearly equal mixture of polyethylene and polypropylene into propylene and isobutylene — both gases at room temperature — with an efficiency of nearly 90%. For polyethylene or polypropylene alone, the yield was even higher.

Conk added plastic additives and different types of plastics to the reaction chamber to see how the catalytic reactions were affected by contaminants. Small amounts of these impurities barely affected the conversion efficiency, but small amounts of PET and polyvinyl chloride — PVC — significantly reduced the efficiency. This may not be a problem, however, because recycling methods already separate plastics by type.

Hartwig noted that while many researchers are hoping to redesign plastics from the ground up to be easily reused, today's hard-to-recycle plastics will be a problem for decades.

"One can argue that we should do away with all polyethylene and polypropylene and use only new circular materials. But the world's not going to do that for decades and decades. Polyolefins are cheap, and they have good properties, so everybody uses them," Hartwig said. "People say if we could figure out a way to make them circular, it would be a big deal, and that's what we've done. One can begin to imagine a commercial plant that would do this."

Other co-authors of the paper are graduate students Jules Stahler, Jake Shi, Natalie Lefton and John Brunn of UC Berkeley and Ji Yang of Lawrence Berkeley National Laboratory. Shi, Hartwig and Bell are also affiliated with Berkeley Lab. The work was funded by the Department of Energy (DE-AC02-05CH11231).

RELATED INFORMATION

- Polyolefin waste to light olefins with ethylene and base-metal heterogeneous catalysts (Science)

- Process converts polyethylene bags, plastics to polymer building blocks (September 2022)

- Upcycling: Turning plastic bags into adhesives (December 2020)

- Hartwig Lab website

John Hartwig , [email protected] , (510) 642-2044 RJ Conk , [email protected]

- Catalysis topic page

- Climate Science topic page

- Discoveries topic page

- Green Chemistry topic page

- Materials Chemistry topic page

- Organic Chemistry topic page

- Plastics topic page

IMAGES

VIDEO

COMMENTS

A Haas PhD student interested in finance needs a strong course background in mathematics and statistics. This is a prerequisite to the sequence of doctoral seminars in finance (PHDBA 239 A-D and PHDBA 229C). Students also attend frequent seminars to gain exposure to ongoing research, with speakers featured from other universities throughout the ...

PhD Program. In the last decade, the academic study of finance has experienced an infusion of new concepts and quantitative methodologies that places it among the most sophisticated and dynamic areas of business and economics. New developments in the traditional areas of finance—theory of rational investor portfolio choice, interpretation and ...

Dissertation titles and job placements for our graduates in Finance Maris Jensen, 2023 University of Iowa Finance and Factory-Built Housing Dominik Jurek, 2023 Cornerstone Research Essays on Innovation and Finance Sooji Kim, 2023 Cornerstone Research Essays in Financial Intermediation and Macroeconomics Melissa Wang, 2023 Yendo Essays on Behavioral Finance and […]

Finance Group The Berkeley Haas finance program has long been held in high regard by both researchers and finance practitioners, both domestically and around the world. Finance here is a top-ranked program, including as #7 by U.S. News again in 2021. Finance courses feature rigorous training from top scholars, firm grounding in real-world methods, and exposure to the experience and insights of ...

PhD Program in Business Administration Welcome to the Berkeley Haas PhD Program! Partner with world-class faculty for a rigorous academic program in one of eight fields of study. Join a premier business school and a leading research university with a Nobel Prize-winning tradition - where you can seek new ideas and make an impact on global business and education.

Berkeley Haas Admissions The Berkeley Haas PhD program is a fully-funded, five-year, full-time, in-residence program resulting in a PhD in Business Administration. Applicants must select from one of our fields to apply to our program.

Our faculty are both thought leaders and practitioners in quantitative finance and data science. Their groundbreaking research has moved the field forward with the development of financial instruments, software, and strategies. These pioneering scholars are joined by some of the leading minds in today's financial and technology communities.

The Berkeley Haas PhD Program offers six fields of academic study, for a curriculum of unusual richness and breadth. Since the program enrolls only 14 to 16 new PhD students each year, you will work very closely with the faculty members in their chosen specialties. This close partnership, coupled with the diverse academic and cultural ...

Launch your career in finance, data science, or technology in just one year with the Master's in Financial Engineering Program at Berkeley Haas.

Berkeley Haas announced the 2022 Finance Fellows, first-year, full-time MBA students pursuing careers in finance fields.

Undergraduate Program. In the Undergraduate Program students pursue a Bachelor of Science degree with a broad-based Business Administration major. Undergraduates study with faculty who are leading experts in their fields. The curriculum includes Introduction to Finance as a core course, as well as multiple elective courses that allow for deeper ...

Meet some MFE faculty members, thought leaders and practitioners who share theories and frameworks shaping the future of quantitative finance and data science.

Berkeley Haas named 11 first-year full-time Haas MBA students among its 2023 Finance Fellows, who received mentorship and scholarships.

Berkeley Haas names 2021 Finance Fellows. As a Black woman, Mallory Bell is on a mission to change the face of venture capital. "My personal goal is to diversify what the venture capital world looks like," said Bell, MBA 23, one of 11 students recently named 2021 Finance Fellows at Berkeley Haas. "Money is fuel and if you are in venture ...

Overview. The Berkeley Haas PhD Program offers six fields of academic study, for a curriculum of unusual richness and breadth. Since the program enrolls only 14 to 16 new PhD students each year, you will work very closely with the faculty members in their chosen specialties. This close partnership, coupled with the diverse academic and cultural ...

Two Finance Scholars Join Haas Faculty. May 23, 2013 | by Pamela Tom. Two professors, both recognized by the Journal of Finance for their insightful research, have joined the Haas Finance Group as permanent faculty members. Professor Annette Vissing-Jørgensen, formerly a professor at Northwestern University's Kellogg School of Management ...

Berkeley Haas awards finance fellowships every year to full-time MBA students interested in investment banking, private equity, venture capital, impact investing, public-markets investing, and fintech.

Studying finance in the MBA program at Berkeley Haas means living and excelling at the global intersection of finance, tech, entrepreneurship & impact. Explore everything from hedge funds and private equity to impact investing and fintech for good.

Meet the faculty: Top-tier researchers join Berkeley Haas for 2024-25; FTMBA students in class of 2026 begin their journeys; New research shatters outdated pay-gap myth that women don't negotiate; Research shows how airline pricing really works; Q&A: Saikat Chaudhuri on the new Berkeley Haas Entrepreneurship Hub

Rising to a critical need for more research and leadership in climate finance, Berkeley Haas has joined a group of top universities worldwide in offering an innovative online PhD course focused on the intersection of climate economics and sustainability.

Position description The Haas School of Business at the University of California, Berkeley invites applications for a tenure-track faculty position in Finance with an expected start date of July 1, 2025. We seek candidates who will help advance the research, teaching, and service missions of the Finance group.

PhD, Public Policy, Harvard University; AB, Public and International Affairs, Princeton University ... Why you decided to join Berkeley Haas: ... Asiff Hijiri, Finance/Entrepreneurship & Innovation; queen jaks, Management of Organizations (spring 2025) Bianca Datta, Sustainable & Impact Finance (spring 2025)

Other Graduate Master of Financial Engineering ... Ewell credits Haas courses Venture Finance and Impact Accounting for preparing her to lead in the health industry. "I learned how to bootstrap a company and to build businesses with a triple bottom line," she says. ... Top-tier researchers join Berkeley Haas for 2024-25; FTMBA students in ...

Meet the faculty: Top-tier researchers join Berkeley Haas for 2024-25; FTMBA students in class of 2026 begin their journeys; New research shatters outdated pay-gap myth that women don't negotiate; Research shows how airline pricing really works; Q&A: Saikat Chaudhuri on the new Berkeley Haas Entrepreneurship Hub

Our Vision & Mission A world of abundant opportunities and choices where all youth and their communities can achieve their full potential. Through mentorship, business skills and college advising, we give underserved youth a boost throughout high school, preparing them for future academic and career endeavors.

Trial versions of these solutions usually come pre-installed on most new laptops. But as a Berkeley student/staff/faculty you may also be eligible to download a licensed copy from software.berkeley.edu. Alternately, you may also perform tasks through similar bDrive solutions, such as Google Docs, Google Sheets, and Google Slides.

But even more fundamentally, the connections are evidence of the collaborative culture nurtured in all of the Berkeley Haas graduate business school programs. For Nour Abi Samra, MBA 25, a senior product solutions architect with Certinia, Berkeley Haas feels "like a safe space where you can give your thoughts, and be accepted, not feel judged."

Other Graduate Master of Financial Engineering PhD Undergraduate Bachelor of Science in Business Berkeley M.E.T. (Management, Entrepreneurship, & Technology) ... Boost@BerkeleyHaas has the ability to engage with students on the UC Berkeley Haas campus, high school campuses, and via one on one meetings with the DCAC College Advisor and other ...

Graduate Office 419 Latimer Hall University of California Berkeley, CA 94720-1460 (510) 642-5882. Dept of CHEMICAL & BIOMOLECULAR ENGINEERING. Graduate Office 201 Gilman Hall University of California Berkeley, CA 94720-1462 (510) 642-2291

Richard Lyons listens to the marching band after addressing the freshman class at the Haas Pavilion in Berkeley on Aug. 22. ... as did a 761-bed site for graduate students in Albany. It's UC ...