- Case Studies

- Brief Cases

Sales & Marketing

Natureview Farm

Natureview Farm ^ 2073

Are you an educator.

Register as a Premium Educator at hbsp.harvard.edu , plan a course, and save your students up to 50% with your academic discount.

Product Description

Publication Date: June 07, 2007

Source: HBS Brief Cases

Available with this Brief Case: a Case Preview, updated Teaching Note, and an English-language audio version. A Case Preview is an optional, customizable resource that provides students with a lens through which to consider the case, including a snapshot of the case situation and key questions to consider. The updated Teaching Note features a new section that provides insights for teaching the case in an undergraduate classroom. Explores channel management issues in the U.S. food industry. Natureview Farm, a Vermont-based producer of organic yogurt with $13 million in revenues, is the leading national yogurt brand (24% market share) sold into natural foods stores. It has achieved this through its special yogurt manufacturing process and through cultivating personal relationships with dairy buyers in the natural foods channel. Set in 2000, when the company faces financial pressure to grow revenues to $20 million by the end of 2001 due to a planned exit by its venture capital investors. The immediate decision point that the protagonist, Natureview's vice president of marketing, faces is whether to achieve this revenue growth by expanding into the supermarket channel.

This Product Also Appears In

Buy together, related products.

3DP Incorporated (A): Patrick Guten

Ample Hills Creamery

Copyright permissions.

If you'd like to share this PDF, you can purchase copyright permissions by increasing the quantity.

Order for your team and save!

The marketplace for case solutions.

Natureview Farm – Case Solution

The case study Natureview Farm explores channel management problems in the U.S. food industry. The Vermont-based producer of yogurt is the leading national yogurt brand until, in 2000, the company faces financial pressure to further grow revenues due to a planned exit by its venture capital investors. Natureview's vice president of marketing faces the decision of how to increase revenue by expanding into the supermarket channel.

Karen Martinsen Fleming Harvard Business School ( 2073-PDF-ENG ) Juni 07, 2007

Case questions answered:

Case study questions answered in the first solution:

- What option should Natureview Farm pursue? Why?

- Analyze the three options and explain your recommendations. (Financials on the three options are expected).

- Would it help if the VC extended their deadline for another year or more? What channel conflicts arise in the various options?

Case study questions answered in the second solution:

- How has Natureview Farm succeeded in the natural foods channel?

- What are the two primary growth strategies under consideration by Natureview?

- What are the strategic advantages and risks of each option? What channel management and conflict issues are involved?

- What action plan should the company pursue?

Case study questions answered in the third solution:

- How do the three options compare financially in terms of yearly revenue, gross margin, required investment, and profit potential? What are the advantages, risks, and potential channel conflict issues? Think about both quantitative and qualitative factors.

- What action plan should the company pursue? What changes in the marketing mix do you recommend in order to implement the plan? Note: In order to determine the quantitative factors in #2, please use the Natureview Financials .xls file on Canvas. Solve the “Margin” tab using data from the case and exhibits. Then, use the gross margins you calculate to solve the revenue and profit figures for each option on the tab “Revenue_Profit.”

Not the questions you were looking for? Submit your own questions & get answers .

Natureview Farm Case Answers

This case solution includes an Excel file with calculations.

You will receive access to three case study solutions! The second and third solutions are not yet visible in the preview.

Executive Summary – Natureview Farm

In this report, we provide business recommendations to Natureview Farm to help increase its revenue to meet the goal of $20 million by the end of 2001.

We discuss the Channel Analyses, the Alternatives with Financial Analyses, and the recommendation of which alternative Natureview Farms should choose.

Channel Analyses and Market Share

The channel analyses provide a brief overview of the distribution channels of the supermarket and the natural food market.

We also analyze the current market share held by different types of yogurt and the key competitors within both the Supermarket and Natural Food Channels.

Alternatives with Financial Analyses

The alternatives with financial analyses will discuss three options that have been proposed. The first two options involve entering the supermarket channel.

The first option is to expand six SKUs of the 8-oz. size into the eastern and western Supermarket regions. The second option is to expand four SKUs of the 32-oz. size nationally into the supermarket channel. The third option involves continuing with the traditional natural foods channel by introducing two children’s multi-packs into the natural foods channel.

Under each alternative, one will find both the advantages and disadvantages of choosing that option. We have also included the financial impact that each option will have on the company’s goal of reaching $20 million by 2001.

Recommendation

The first and the second options both allow Natureview Farm to reach the $20 million mark. We recommend that it move forward with option 1. This option will help Natureview Farms not only reach its goal of $20 million by 2001.

Still, it will also help break into the supermarket channel and obtain new customers without the added risk of trying to expand to 64 supermarkets in a short period of time.

Introduction – Natureview Farm

Natureview Farm manufactured and marketed refrigerated cup yogurt since 1989. The unique family yogurt recipe used all-natural ingredients, which gave the yogurt its unique smooth and creamy texture and 50-day shelf life, which was around 20 days longer than that of its competitor’s products, which used artificial thickeners.

Currently, the yogurt produced by Natureview Farms is sold only in the Natural Foods stores, where the shoppers are more educated and earn higher incomes than the typical shopper at a supermarket.

According to 58% of US households, they would buy more organic products if they were relatively cheaper.

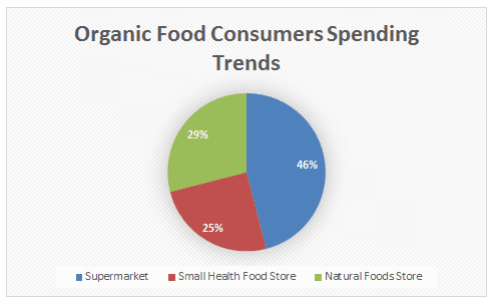

Looking at the consumer spending trends in the adjacent graph, we conclude that it would be very beneficial to enter the supermarket as consumers have started spending more and more on organic food in the supermarkets.

The price of yogurt will also be lower in supermarkets as compared to the natural foods store. More people will be likely to make purchases of the product. The loss in revenue due to the reduction in the price will increase due to the sale of a higher number of units.

Situation Overview

Natureview Farm wants to grow its revenue by over 50% to reach the target of $20 million in revenue in 2011. Previously, it reached $13 million in 1999.

To achieve this goal, it needs to select the appropriate course of action from the three available alternatives.

Channel Analyses

Supermarket Channel

The supermarket channel is comprised of several supermarket chains spread in the Northeast, Midwest, Southeast, and West regions of the country. The market share by region is shown in the graph.

The supermarket channel has four steps in its distribution cycle, viz. manufacturer, distributor, retailer, and customer. The supermarket channel sells around 97% of the total amount of yogurt consumed, giving the Natural Foods channel only 3%.

Looking at these figures, it is inevitable that Natureview Farm has to…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster! Michael MBA student, Boston

How do I get access?

Upon purchase, you are forwarded to the full solution and also receive access via email.

Is it safe to pay?

Yes! We use Paypal and Stripe as our secure payment providers of choice.

What is Casehero?

We are the marketplace for case solutions - created by students, for students.

Exploring the Implications of the Natureview Farm Harvard Business Case in Today’s Market Trends

The Natureview Farm Harvard Business Case is a unique study that delves into the business strategies and management of a small, all-natural yogurt company seeking to expand its operations. Given today’s rapidly evolving market trends and shifting consumer demands, it is worth exploring the implications of this case study as it can offer meaningful insights for businesses operating in similar industries.

Natureview Farm was posed with a critical business challenge – how should it expand its channels in the most lucrative manner to achieve a revenue target of $20 million within a year? To attain this, the company grappled with several potential strategies, which included expanding into the supermarket channel, growing its natural food channel, or exploring an acquisition or exit strategy. Each of these options presented varying levels of risk and potential reward, setting the stage for the case study’s research.

First, let’s delve into the heart of the Natureview Farm Harvard Business Case and identify its key lessons in terms of market trends and strategies. The case underscored the importance of understanding and aligning with consumer needs. In their business model, Natureview Farm anchored on an all-natural approach to yogurt production, banking on the growing demand for natural and organic food products. This was a strategic market positioning that not only set the company apart from its competitors but also played well into the emerging trend of health-conscious consumption.

In today’s market, this is even more critical as consumers increasingly prioritize green, sustainable, and health-enhancing products. Brands that align their product development and marketing with these trends can establish a more robust clientele base and ultimately drive business growth.

Furthermore, the case study emphasized the significance of the distribution channel decision. For Natureview, the venture into the supermarket channel was a major consideration. It presented the potential for substantial revenue growth but also implied straddling between their established natural food channel and a completely different market segment. Key concerns included a potential dilution of brand image and the need for extensive marketing and advertising investments.

Examining today’s market trends, companies are faced with a similar predicament. The rise of e-commerce has offered an entirely new distribution channel for businesses to explore. Similar to Natureview’s dilemma, businesses are left to weigh the potential profits against the accompanying risks. Moreover, both scenarios underscore the necessity of a carefully formulated channel strategy, taking into account factors such as target audience, product-market fit, and associated costs.

The Natureview Farm Harvard Business Case also presents vital implications for the concept of scalability. The question surrounding their growth strategy, whether to expand or maintain their standing, is reflective of the challenges many companies face when looking to scale their operations. Much can be learned from how Natureview navigates this crossroads, particularly the importance of conducting extensive market research and financial analysis to make informed decisions.

Lastly, the case study presents valuable insights on brand differentiation, suggesting that a strong unique selling proposition (USP) enhances long-term market survivability. Natureview capitalized on their all-natural and farm-fresh image to establish their USP and distinguish themselves from mass-market yogurt brands. Similarly, in today’s highly saturated market, the business lesson here is to clarify and reinforce your brand’s unique attributes, effectively conveying the value proposition to your target audience and thus establishing a competitive edge.

To conclude, the Natureview Farm Harvard Business Case proposes insightful strategies that remain fitting in today’s market trends. It provides rich lessons on navigating growth and scalability challenges, the importance of aligning with consumer trends, channel strategy formulation, and the need for a robust USP. As companies seek to steer themselves within an increasingly dynamic marketplace, these lessons could very well serve as guides in achieving business growth and competitive advantage.

Natureview Farm: Problem Case Case Study

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

Introduction

Problem analysis, action plan.

Natureview is facing a rather daunting challenge ever since its inception in 1989. The farm’s attempt to maintain its profitability saw the hiring of Jim Wagner as chief financial officer whose central role was to formulate and implement strategies that would ensure continued growth in profits.

It is in this regard that Wagner’s recommendation for an equity infusion from a venture capital to help fund strategic plans sailed through the board meeting unopposed. Now, the venture capital firm wants to withdraw its cash investments from Natureview.

To counter the potentially devastating financial blow about to be dealt on Natureview, the management has limited options: to find another investor or put itself up for acquisition (Fleming, 2007). The management preferred the second option and that meant that Natureview had to increase its revenues in order to achieve the highest possible valuation.

It is in this regard that Wagner advised the management to increase the firm’s revenues from $13 million to $20 million before the end of 2001 (Fleming, 2007). The first option was not preferred because finding an alternative investor would be difficult unless the venture capital firm cashed out first (Fleming, 2007). This would leave Natureview in a critical position.

Natureview Farm is facing imminent insolvency should the venture capital firm cash out. Although Natureview has been realizing increased profits every year, the decision to enlist a venture capital firm to finance its strategic programs is likely to plunge it into financial abyss.

To avoid this problem, the management has to find ways and means of increasing its revenues so as to achieve the highest possible valuation as it prepares for takeover. Thus, a $7 million increase is required in order to put the farm firmly on track (Fleming, 2007).

This problem was brought about by the inappropriate strategies that were used to diversify Natureview’s sales. The farm’s chief financial officer blundered by outsourcing finance to fund strategic investments. Apparently, these strategic investments have not yielded enough revenues to enable the farm stand on its own feet. Instead, they have resulted into financial dependency on the venture capital firm.

Natureview Farm management is sharply divided on the marketing strategies to be implemented. The bone of contention revolves around the option of venturing into supermarkets as a way of increasing sales. Whereas the option has great potential in boosting sales, it would shake Natureview to its very core as a breach of confidence with the long-time business partners, the retailers (Fleming, 2007).

Natureview’s condition was precipitated by stiff competition from other organic food manufacturers. The natural foods market was concentrated by four top competitors: Dannon, Yoplait, Breyers and Columbo (Fleming, 2007). The four competing companies dominated a fair share of the market. This could have slowed down the rate of growth of the profits for Natureview.

Another cause for the declining sales could have been the change in consumer tastes and preferences. Among the factors considered by customers before buying yoghurt included package type, flavor, taste, and price among others (Fleming, 2007).

It was observed that 6 oz and 8 oz yoghurt cups were the most popular product sizes, followed by multipacks consisting of 4 oz cup servings (Fleming, 2007). Natureview Farm management may have failed to notice the changes in tastes and preferences of the customers and adjust accordingly.

Weather changes could also have impacted on Natureview’s sales. There are some weather patterns that do not favor the consumption of yoghurt, especially the cold seasons. During such seasons, customers would prefer hot drinks rather than have yoghurt.

Weather changes could have pushed Natureview to venture into other investments in order to raise their sales. Meeting the challenges associated with new business ventures may have had a far-reaching impact on the farm’s financial position. This must have forced the management to resort to external financing.

To compete favorably with the four top firms, Natureview should consider improving on the quality of their yoghurt products in order to make them more appealing to customers. The management could also embark on an extensive marketing campaign targeting all sections of the society. Repackaging of their brands is also another viable alternative.

Stiff competition and changes in consumer tastes and preferences played a major role in pushing Natureview into a financial dependency due to insufficient profits. Therefore, the strategic plans put in place by Wagner could not produce enough finance to cover the costs.

That is why cash out by the venture capital firm would sound a death knell for Natureview Farm. In trying to adapt to the changes in customer preferences, the farm may have encountered more expenditure, hence lessening their profit margins.

Concerning the changes in consumer tastes and preferences, Natureview should conduct regular market research to establish current trends on the market. Information gained from these studies is very crucial as it would help the manufacturers create yoghurt brands that meet the changing consumer tastes and preferences. As for weather changes, Natureview could consider expanding their production scope to include hot drinks suitable for cold weather conditions.

However, the decision to use supermarkets as outlets of the products received strong resistance from some members of the management team. This was informed by the CEO’s assertion that they should keep in mind the role played by their distribution agents, who have been the retailers (Fleming, 2007).

Some members, like Christine Walker, could not come to terms with the possible repercussions of such a move. Christine Walker wonders whether such a cause of action would result into price concessions, and worse still whether the retailers would feel betrayed and pull yoghurt products from Natureview off their shelves (Fleming, 2007).

The chief goal of the plan to bail out Natureview Farm is to raise the $20 million revenue sales needed to put the farm in a better financial position in preparation for acquisition. In addition to this, the farm needs to keep up with its competitors and formulate appropriate policies that would safeguard it from the ravages of a concentrated market. Most importantly, Natureview Farm must struggle to remain solvent.

In order to achieve these goals, three possible approaches may be considered. The first option is to expand six SKUs of the 8 oz product line into selected supermarket regions (Fleming, 2007). This is because the 8 oz yoghurt cups represent the largest dollar and unit share and thus has a significant revenue potential.

Secondly, there are other natural foods companies that have successfully expanded into supermarket channels and experienced a 200% revenue increase within the first two years (Fleming, 2007). Thirdly, Natureview would enjoy the first-mover advantage since no other natural foods farm had ventured into supermarkets.

The second approach is to expand four SKUs of the 32 oz nationally. This option is informed by three reasons. One, the 32 oz cups are currently generating an above-average gross profit margin for Natureview Farm (Fleming, 2007).

This is in spite of their representation of a smaller dollar and unit share of the yoghurt market. Two, there is less competition on the 32 oz yoghurt package. This would be further ameliorated by the fact that Natureview products have a longer shelf life than most of their competitors.

This puts Natureview at a strong competitive advantage. Lastly, it would enjoy lower promotional expenses since the 32 oz cups are promoted only twice in a year. It would lessen production costs and hence reduce dependency on external sources of finance. Reduction in operating expenses translates into increased profits.

The third approach is to introduce two SKUs of a children’s multi-pack into the natural foods channel – and discard the supermarket options (Fleming, 2007). This is informed by various reasons. First, Natureview already has strong relationships with the leading natural food retailers.

Entry into the supermarket arena would compromise this strong solid base. Yoghurt is a source of both revenue and profits to the retailers. Second, Natureview’s all-natural ingredients are a perfect base for launching the children multi-pack products.

Third, children’s multi-pack has an attractive financial potential with the projected yearly revenue for the two multi-pack SKUs approximated at 10% of the natural food dollar category sales (Fleming, 2007).

The fast rate of growth of the natural foods channel will further boost yoghurt sales. This is especially important since Natureview is already venturing into some new products, as stated earlier in this paper. Furthermore, industry market research has shown that that the projected unit growths CAGR of yoghurt in the natural foods channel is 15% (Fleming, 2007).

In general, these steps will help Natureview Farm achieve its objectives, which include staying financially afloat as well as providing quality products to its customers (Fleming, 2007). The farm will also be able to fulfill its mission of financial independence.

However, these plans are, to some extent, fraught with risks. The greatest risk is unprecedented losses occurring as a result of unexpected competition from other firms. This is because supermarkets are already stocked with alternative products from other companies.

A good example of such products is soft drinks from the coca cola company. Therefore, the expansion of six SKUs of the 8 oz cups into supermarkets should be done with a lot of care. Research needs to be conducted in order to establish the viability of this action.

The expansion of the four SKUs of the 32 oz nationally could lead into further costs that would reduce the anticipated profit margins. Natureview would need to find ways of minimizing costs in order to attain financial freedom. Extensive marketing procedures required for this move could further dent the farm’s financial outlook.

Natureview would consider liaising with nationwide distributors who also engage in marketing promotions. The fast growth of natural foods channels may be suddenly checked by unforeseen economic problems such as inflation and recession. Natureview Farm needs to develop a solid financial base, which would act as a sure back up should economic disasters strike.

Finally, the expansion of the six SKUs of the 8 oz cups would be the best option since it would rake in the highest anticipated incremental retail unit sales of $35 million (Fleming, 2007).

Fleming, K. M. (2007). Natureview Farm. Brief Cases No. 2073 . Harvard: Harvard Business Publishing.

- Dairy Crest Company's Balanced Scorecard

- Diversity Audit of Goldman Sachs

- Benetton and Yeo Valley Companies Marketing Communication

- Human resource management - the Oz Company

- Customer Driven marketing strategy for Only Oz

- Benefits Offered by the Introduction of the Textile Alliance Limited Vendor Managed Inventory

- TAL Apparel Limited: Stepping Up the Value Chain

- The New Zealand International Business

- Nestlé’s Outsourcing Issues

- Bilinga, a Growing Suburb in Sydney

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2019, July 10). Natureview Farm: Problem Case. https://ivypanda.com/essays/natureview-farm-problem-case/

"Natureview Farm: Problem Case." IvyPanda , 10 July 2019, ivypanda.com/essays/natureview-farm-problem-case/.

IvyPanda . (2019) 'Natureview Farm: Problem Case'. 10 July.

IvyPanda . 2019. "Natureview Farm: Problem Case." July 10, 2019. https://ivypanda.com/essays/natureview-farm-problem-case/.

1. IvyPanda . "Natureview Farm: Problem Case." July 10, 2019. https://ivypanda.com/essays/natureview-farm-problem-case/.

Bibliography

IvyPanda . "Natureview Farm: Problem Case." July 10, 2019. https://ivypanda.com/essays/natureview-farm-problem-case/.

IMAGES

COMMENTS

Explores channel management issues in the U.S. food industry. Natureview Farm, a Vermont-based producer of organic yogurt with $13 million in revenues, is the leading national yogurt brand (24% market share) sold into natural foods stores. It has achieved this through its special yogurt manufacturing process and through cultivating personal relationships with dairy buyers in the natural foods ...

Explores channel management issues in the U.S. food industry. Natureview Farm, a Vermont-based producer of organic yogurt with $13 million in revenues, is the leading national yogurt brand (24% market share) sold into natural foods stores. It has achieved this through its special yogurt manufacturing process and through cultivating personal ...

As a major brand in the natural foods channel, Natureview Farm had developed strong relationships with leading natural foods retailers, including the chains Whole Foods ($1.57 billion revenues in 1999) and Wild Oats ($721 million revenues). The organic foods market, worth $6.5 billion in 1999, was predicted to grow to $13.3 billion in 2003.2.

The case study Natureview Farm explores channel management problems in the U.S. food industry. The Vermont-based producer of yogurt is the leading national yogurt brand until, in 2000, the company faces financial pressure to further grow revenues due to a planned exit by its venture capital investors. Natureview's vice president of marketing ...

Natureview Case Study assignment for Bridget Akinc's Marketing Principles section - received A- in course natureview case analysis name november 11th, 2015. ... 2015 Marketing Principles Name 2 Natureview Yogurt's Current Objective and Scope Natureview Farm, Inc., a small yogurt manufacturer of Cabot, Vermont, was started in 1989 using the ...

Explores channel management issues in the U.S. food industry. Natureview Farm, a Vermont-based producer of organic yogurt with $13 million in revenues, is the leading national yogurt brand (24% market share) sold into natural foods stores. It has achieved this through its special yogurt manufacturing process and through cultivating personal relationships with dairy buyers in the natural foods ...

The Natureview Farm Harvard Business Case is a unique study that delves into the business strategies and management of a small, all-natural yogurt company seeking to expand its operations. Given today's rapidly evolving market trends and shifting consumer demands, it is worth exploring the implications of this case study as it can offer ...

Get a custom case study on Natureview Farm: Problem Case. It is in this regard that Wagner's recommendation for an equity infusion from a venture capital to help fund strategic plans sailed through the board meeting unopposed. Now, the venture capital firm wants to withdraw its cash investments from Natureview.

13 Natureview Farm: HBS Case Situation Analysis 1989 - Founded - Revenue $100 K. Yogurt products . Introduced 2 Flavors 1996 - Jim Wagner Hired to steady profits 1997 - CFO Jim Wagner got VC capital Infused capital in 1999 Today Feb 2000. Annual Revenue was $13 million in 1999.

Natureview farm case - HARVARD gggggEss 2| ?3 IL'NIE T-... Pages 11. Total views 100+ Hanyang University. BUSINESS. BUSINESS 512. neokaf. ... Previewing 11 of 11 pages Upload your study docs or become a member. View full document. End of preview. ... View BibliU-Print-1001281231618.pdf from BUSINE 2257 at Meadowvale Secondary School. 35 ...