9 Reasons Why Walmart Failed in Germany (Full Guide)

Walmart‘s attempt to expand into Germany from 1997 to 2006 stands as one of the company‘s biggest international failures. This retail giant found itself struggling to gain a foothold in the large German market. Walmart was forced to fully withdraw from Germany in 2006 after accumulating over $1 billion in losses.

So why couldn‘t this retail juggernaut find success in Germany? Let‘s closely examine the 9 major factors that led to Walmart‘s failure in Germany:

- Legal restrictions on undercutting competitor prices

- Clash with German labor laws and trade unions

- Underestimating entrenched local retail chains

- Overall struggles in the mature German retail sector

- Rejection of Walmart‘s corporate culture by employees

- Failure to understand German shopping habits

- Lack of focus in Walmart‘s broad product offerings

- Refusal to adapt the business model to the German economy

- Insufficient research prior to entry into the German market

By exploring each of these reasons in depth, we can gain insight into why Walmart was unable to replicate its American success on German soil. Understanding Walmart‘s German challenges also provides valuable lessons for international retailers seeking to expand into new markets.

Overview of German Retail Landscape Prior to Walmart‘s Arrival

Before diving into the specifics of why Walmart failed, it is helpful to understand the German retail landscape leading up to Walmart‘s market entry in 1997. This provides useful context for many of the challenges Walmart later faced.

Germany had a well-established retail industry dominated by small- to mid-size local and regional chains. The country‘s retail scene was characterized by the spread of discount grocers like Aldi and Lidl, which had captured the loyalty of German consumers seeking value. Germany also had a number of mid-size chains like Spar, Edeka, and Reewe serving various retail segments.

Unlike the American retail landscape filled with massive national big-box retailers, even the largest German chains had only captured single digit market share. Retail consolidation was happening at a much slower pace compared to the rapid rise of national chains in the US.

The German grocery sector in particular was known for being a challenging market with razor thin margins. Growth was slow across the entire German retail industry leading up to Walmart‘s arrival, averaging just 0.3% annual growth between 1996 and 2001.

With mature retailers entrenched across the country, limited prime retail locations, and discount chains capitalizing on the value-focused German shopper, the competitve conditions were far from ideal for a foreign newcomer like Walmart.

Reason 1: Legal Restrictions on Price Undercutting

Walmart built its American retail empire on aggressively low prices enabled by an efficient supply chain and economies of scale. A key part of Walmart‘s playbook has been undercutting competitors‘ prices to rapidly steal market share upon entry into new markets.

However, in Germany, Walmart‘s strategy of pricing below competitors ran afoul of strict German regulations. Germany prohibits companies from engaging in predatory pricing or selling goods below cost in order to protect small businesses from unfair competition.

In 2004, after years of complaints from German retailers, Germany‘s Federal Cartel Office ordered Walmart to raise its prices after proving the retailer was violating these laws. This legal restriction prevented Walmart from using its pricing advantage to achieve the same rapid success it enjoyed in the United States and other international markets.

Jürgen Weber, president of Germany’s Federal Cartel Office in 2004, stated Walmart’s obsession with low prices “was hurting retailers in Germany.” This dealt a major blow to Walmart’s core retail strategy.

Reason 2: Clash With German Labor Laws and Trade Unions

Walmart also encountered major obstacles trying to replicate its labor model in Germany. The company adamantly opposed German labor laws and clashes with trade unions created severe public relations challenges.

In the US, Walmart has taken a staunch anti-union stance, even closing down stores that voted to unionize. Walmart also pays low wages without benefits which enables its discount pricing.

Attempting to import this labor model into Germany brought Walmart into direct conflict with the country‘s strong labor laws and retail sector trade unions. German retail employees represented by unions were accustomed to higher wages due to collective bargaining.

When Walmart refused to join collective wage negotiations, the workers‘ unions staged protests and strikes in 2000 to demand higher pay. This conflict resonated strongly in labor-friendly Germany and gave Walmart a reputation for mistreating workers.

In 2006, Walmart again faced union protests over plans to cut hundreds of jobs and slash wages by over 25% for some workers after taking over a German retail chain.

Walmart failed to realize the political strength of German retail unions and importance of collective wage negotiations. Their resistance to adhering to local labor laws created backlash that hurt market share and amplified the challenges they already faced competing with established German chains.

Reason 3: Underestimating the Power of Established Local Retailers

Industry experts noted that Walmart failed to recognize how difficult it would be to compete with smaller German discount grocers like Aldi and Lidl. While Walmart anticipated big success based on its size and scale, the market realities in Germany differed greatly.

Aldi and Lidl had fine tuned efficient lean operations that allowed them to remain price competitive with Walmart, despite Walmart‘s greater size. These discount chains had cultivated decades of brand loyalty among German consumers seeking reliable value.

Local retailers knew the regional German markets intricately which gave them advantages in managing supply chains and store locations compared to Walmart‘s US-style operations.

Walmart incorrectly assumed that German shoppers would flock to its stores based on the reputation of its American success. But German shoppers remained loyal to their local discount brands, which had national market share of 40% combined by the mid-2000s.

Deep Dive into German Shopping Habits and Values

To fully understand the competitive challenges Walmart faced, it is essential to highlight key differences between American and German shopping habits and cultural values.

Surveys showed German customers cared more about consistent quality and brand loyalty over getting the absolute lowest price. As one retail analyst described it: "Germans will rarely go more than 100 meters out of their way to save 5% on their groceries."

Additionally, German shoppers preferred small, specialized local stores they could walk to rather than driving to distant retail warehouses offering one-stop shopping convenience. Environmental consciousness was also stronger among German consumers.

Beyond shopping habits, Walmart‘s overly friendly and enthusiastic American corporate culture clashed with German cultural norms. Service with a constant smile was seen as strange compared to the more muted service style in German stores.

Mandatory morning stretches and company chants failed to resonate with German employees who preferred a clear separation between their personal and work lives.

This extended to dating policies which restricted employees from having romantic relationships. While common in the US, in Germany this was seen as an intrusion into workers‘ privacy rather than an acceptable corporate guideline.

In these areas, Walmart misjudged the market by relying on false assumptions from its American success that German shoppers would prioritize ultra-low prices over factors like quality, brand relationships and corporate values.

Profile of Major German Retail Competitors

To highlight the competitive challenges Walmart faced in Germany, it is worth profiling a few of the major incumbent players that fought to maintain market share against the American retail giant:

Aldi – With roots dating back to 1913, Aldi had established itself as the dominant discount grocery chain in Germany with over 2,200 stores by the 1990s. Aldi had mastered no-frills efficiency which enabled it to compete aggressively on price against larger new entrants. Its brand reputation for value kept German shoppers loyal even when big retailers tried to undercut prices.

Edeka – As the largest supermarket corporation in Germany, Edeka posed a formidable competitor to Walmart in the grocery segment. With over 13,000 stores under a cooperative model, Edeka already had scale and substantial buying power on par with Walmart. Edeka focused on high quality produce and goods to differentiate itself.

KarstadtQuelle – This department store and mail order company was created via a merger in 1999, forming one of Germany‘s largest diversified retailers. Its department store channel generated over $15 billion in sales, creating a massive incumbent retailer for Walmart to try to compete against.

These established retail giants, along with other strong local and regional chains, made the German market inhospitable for Walmart from the start.

Reason 4: Germany‘s Mature and Stagnant Retail Sector

As highlighted earlier, beyond the challenges of local competitors, Walmart entered Germany during a period of stagnation for the entire retail sector.

From 1996 to 2001, food retail chains in Germany were only growing revenues by 0.3% per year on average. Non-food retail was similarly stagnant with minimal growth annually over that period.

Germany‘s dense population and developed economy meant that opportunities for retail expansion were far more limited compared to growing international markets. For example, Walmart saw 14.5% annual sales growth when it entered China in 1996 compared to the 0.3% sluggishness in German retail.

The mature nature of German retail meant a tortoise-like battle for each percentage point of market share rather than rapid growth potential. Facing this reality, the viability of achieving a reasonable return on Walmart‘s investments in Germany was dubious from the outset.

Reason 5: Rejection of Walmart‘s Corporate Culture

As highlighted earlier when contrasting American and German cultural values, significant aspects of Walmart‘s corporate culture failed to resonate in Germany.

From requiring hourly cheers to banning relationships between coworkers, Walmart‘s attempts to impose its own values were rejected by German employees. Worker morale and productivity at Walmart locations suffered as a result.

German workers were accustomed to a separation between professional and private lives. Walmart‘s corporate culture blurred this line substantially compared to German retail norms.

For example, when a female Walmart employee was demoted due to a relationship with a lower level male employee, she sued the company in Germany. Courts ruled in her favor, stating that Walmart had violated German constitutional rights to make personal life choices. This exemplified Walmart‘s friction with German cultural values.

Reason 6: Failure to Understand German Shopping Habits

Earlier we touched on a few aspects of how German shopper motivations differed from the American consumers Walmart built its business around. Here are some additional statistics that highlight key habit differences:

91% of Germans lived within a 10 minute walk of the nearest grocer, compared to 36% of Americans, making convenience less important.

The number one factor for Germans choosing a grocery store was quality of products (43%), followed by proximity (29%), then price (18%).

Germans made grocery trips 3.5 times per week on average compared to 1.5 times for Americans, with smaller daily purchases.

Car ownership rates were lower in Germany‘s urban areas. Walking and public transport were more common.

The average size of a German grocery store was 5,000 square feet whereas Walmart stores averaged 180,000 square feet.

Walmart attempted to replicate its American big-box suburbs and convenience-focused shopping experience despite clear data showing significant differences in how Germans shopped.

Reason 7: Unfocused Retail Strategy in Germany

Rather than home in on a particular segment where it may have stood a chance, Walmart attempted a broad retail expansion in Germany across grocery, general merchandise, restaurants, and clothing.

Critics pointed out Walmart may have fared better by acquiring a single discount chain and focusing on improving operations in that one brand.

But Walmart‘s ambitions were far grander, envisioning replacing Germany‘s many leading retailers with one new national big box chain. This strategy clearly did not resonate with German shoppers who were familiar and comfortable shopping at their existing local specialty businesses.

With so many different retail categories to compete in with entrenched incumbents, Walmart spread itself too thin in Germany and lacked focus.

Reason 8: Refusal to Adapt to the German Retail Ecosystem

At its core, Walmart failed in Germany because the company was unwilling to adapt in fundamental ways to accommodate significant differences from its successful US model.

As we‘ve explored, there were major contrasts between America and Germany in regulations, labor laws, incumbent competitors, and shopping culture. Rather than acknowledge these barriers, Walmart rigidly clung to what had worked well in America.

From corporate structures to supply chains to pricing, Walmart made half-hearted German concessions only when forced. In the eyes of German shoppers and employees, Walmart refused to become a genuine German company.

As one retail consultant noted: “You can’t just transplant a foreign system into a country and not adapt it to local conditions." Walmart took the opposite approach.

Reason 9: Lack of Research Prior to Entry

Many industry experts noted that Walmart did not do its homework prior to entering Germany. Its misguided strategy indicates a lack of research into German regulations, competitors, and shopper preferences.

Had Walmart invested time studying German retail and cultural norms, some of the brewing challenges would have become apparent before sinking billions into its doomed expansion.

Instead, Walmart relied on assumptions of easy market domination due to its scale and clout. But major international expansions require due diligence to understand subtle but crucial differences in local markets.

Rather than data-driven strategic planning, Walmart‘s confidence led to blindness that made failure in Germany nearly inevitable.

Conclusion and Lessons Learned

Walmart‘s failure in Germany stands as a classic business school case study in how cultural arrogance can blind a successful company from seeing dangers in a new market.

Walmart failed to deeply research the German retail landscape, regulations, and culture. They projected false assumptions based on their American model rather than gathering data. When problems surfaced, Walmart remained inflexible instead of adapting.

For international retailers, Walmart‘s German cautionary tale reinforces the need to think globally but act locally. What works in one market may fail in another. Companies must be willing to adapt practices, policies, and even corporate values to accommodate local conditions and differences.

Without flexibility and humility, international expansion attempts can suffer the same costly fate Walmart endured in Germany.

How useful was this post?

Click on a star to rate it!

Average rating 4.7 / 5. Vote count: 10

No votes so far! Be the first to rate this post.

Share this:

You may like to read,.

- Does Walmart Sell Lottery Tickets in 2022? Yes, Here‘s Your Complete Guide to Buying Lottery Tickets at Walmart

- Does Walmart Have Layaway in 2022? Your Complete Guide to Holiday Layaway

- Got Headphones You Need To Return? Here‘s Walmart‘s 2023 Policy

- Why Steelyard Walmart is Considered the Worst Walmart in America for 2024

- Does Walmart Sell Victoria’s Secret Gift Cards In 2023?

- How Does Walmart Track Shoplifting In 2024? (Warning)

- Does Walmart Use TeleCheck and Certegy to Verify Checks in 2024?

- Is Dollar General Owned By Walmart In 2022?

- Artificial Intelligence (AI)

- Web Scraping

- For Small Business

Anatomy of a Retail Failure: Walmart‘s Misadventure in Germany

- April 21, 2024

- by Tom Wells

Introduction

In the annals of retail history, Walmart‘s ill-fated foray into Germany stands out as a cautionary tale of hubris and miscalculation. The world‘s largest retailer, known for its relentless efficiency and "everyday low prices," met its match in the idiosyncratic German market. After acquiring two local retail chains in 1997-98, Walmart Germany battled with regulators, unions, competitors, and consumers, before beating a hasty retreat in 2006, having racked up over $1 billion in losses.

As a retail industry expert and picky shopper, I‘ve long been fascinated by Walmart‘s German debacle. How could a company renowned for its meticulous supply chain management, market research, and competitive strategy have failed so badly? Let‘s delve into 7 key reasons behind the mismatch and extract some hard-earned lessons.

1. Underestimating the Competition

Walmart thought they could easily crush the German discounters with their low prices and "stack ‘em high" merchandising approach. They severely misjudged how entrenched and efficient players like Aldi and Lidl were. – Retail analyst James Baxter

Walmart entered Germany supremely confident of its ability to dominate the market with its tried-and-true model of leveraging massive scale to undercut rivals on price. However, it failed to fully appreciate just how concentrated and competitive the German grocery market was.

As of 1997, the top 5 grocery retailers – Edeka, Rewe, Aldi, Metro, and Lidl – controlled over 60% of the market, as shown in the table below. Each had strong brands, loyal shoppers, and finely-tuned operations. German discounters Aldi and Lidl were particularly formidable with their ruthlessly efficient hard-discount model.

| Retailer | Market Share (1997) |

|---|---|

| Edeka | 21.8% |

| Rewe | 16.1% |

| Aldi | 11.5% |

| Metro | 8.8% |

| Lidl | 5.4% |

Data Source: Retail Intelligence Reports

Walmart assumed its economies of scale and buying power would easily crush these rivals, but underestimated their entrenched market positions, brand equity, and efficiency. The German chains proved incredibly tough competitors on Walmart‘s signature dimension of price.

2. Rigid Adherence to American Business Practices

A second key mistake was Walmart‘s dogged adherence to its standard US business playbook without sufficiently adapting to Germany‘s very different economic system and cultural norms. Some examples:

Predatory Pricing: Germany has strict laws against selling below cost to stifle competition. Walmart‘s aggressive loss-leading and even selling staples below-cost to drive traffic violated these laws. The retailers‘ association sued and forced Walmart to raise prices by 20-30% in key categories.

Labor Relations: Walmart‘s virulently anti-union stance was anathema in a country where labor unions and works councils wield significant power. Ver.di, one of Germany‘s largest unions, organized strikes against Walmart for refusing to engage in industry-wide collective bargaining.

Store Ambiance: Walmart‘s signature emphasis on friendly associate-customer engagement, exemplified by the door greeter, fell flat. As one shopper remarked, "Why would I want to chat with the person checking me out?" Germans favor a more functional interaction.

Employment Policies: Walmart‘s attempts to impose restrictions on workplace dating and enforce participation in team-building chants felt invasive and infantilizing to Germans, breeding worker resentment and low morale.

As researcher Beate Huber concluded, "Walmart underestimated the differences between the American and German culture of consumption and systems of capitalism." Its unwillingness to localize backfired badly.

3. Mismatch with German Shopping Habits

Germans expect to get in and out of a store quickly. Walmart‘s big-box format clashed with their preference for easy store navigation and fast checkouts. – German retail expert Matthias Queck

Another strike against Walmart was a fundamental disconnect between its store formats and merchandise mix and German consumers‘ ingrained shopping habits. A few key points of difference:

One-stop shopping: While Americans favor large weekly grocery trips to stock up, Germans prefer frequent visits and buying smaller quantities. Walmart‘s massive hypermarkets felt overwhelming and inconvenient.

Localization: Germans prioritize locally-sourced goods and are skeptical of unknown brands. Walmart‘s assortment featured many American-made products (60%+ in some categories) that didn‘t resonate.

Private Label: Over 30% of German grocery sales were private label in the late 1990s, much higher than the US. Walmart underestimated the importance and sophistication of competitors‘ own-brand programs.

Non-Food Merchandise: general merchandise drives profitability at Walmart US, but apparel, electronics and housewares generated little interest among German shoppers in a grocery setting.

In essence, Walmart needed to Germanize its model far more aggressively to appeal to local tastes and preferences. Instead, it assumed the American approach to assortment and shopping would translate.

4. Real Estate Disadvantages

Location, location, location is everything in retail. Walmart bet on big suburban plots in a market where shoppers favor accessible urban locations. They had inferior real estate from day one. – Property consultant Hannah Schmidt

Real estate also played a significant role in Walmart Germany‘s struggles. In the US, Walmart leverages its clout to secure prime suburban and exurban locations with ample parking for its big-box stores. In Germany, however:

Land-use laws are much more restrictive with tighter zoning controls on large-scale retail developments. Getting approvals was slow and costly.

Population density is higher and car ownership lower, so foot traffic and accessibility by public transport are critical. Many of Walmart‘s locations were seen as inconvenient.

The acquisition targets had weaker real estate portfolios situated outside major cities. Walmart had a tough time securing better urban locations post-acquisition.

Ultimately, Walmart ended up with stores that were too big, too far from population centers, and a mismatch for how Germans prefer to shop. This further exacerbated its competitive disadvantages.

5. Supply Chain Stumbles

Walmart‘s world-class supply chain capabilities, so integral to its success elsewhere, also hit snags in Germany. Executives struggled to reconfigure the distribution network of the two acquired retailers. According to BCG analysis, Walmart‘s German inventory turnover (5.1) lagged key rivals in 1999:

| Retailer | Inventory Turnover (1999) |

|---|---|

| Aldi | 12.4 |

| Lidl | 10.6 |

| Rewe | 9.5 |

| Edeka | 8.4 |

| Walmart | 5.1 |

Data Source: Boston Consulting Group

Lower turnover meant more capital tied up in unsold inventory, weighing on profitability. Walmart also experienced friction with German suppliers, many of whom resented its aggressive cost-cutting demands and "pay-to-play" tactics like slotting fees. Walmart failed to build a robust local vendor base and logistics infrastructure.

6. Lack of Acquisition Synergies

On paper the combination of Wertkauf and Interspar looked like it would give Walmart immediate scale. But integrating two different cultures on top of Walmart‘s own proved an enormous challenge. – M&A advisor Lukas Müller

Many of Walmart Germany‘s woes trace back to the messy acquisition and integration process. Walmart paid $1.6 billion in 1997-98 for 21 Wertkauf hypermarkets and 74 Interspar supermarkets. The rationale was to quickly gain footprint and buying clout. But numerous problems emerged:

Interspar had only recently been acquired by Spar and was still digesting that merger when Walmart swooped in. Grafting on yet another corporate culture compounded the confusion.

The two chains had very distinct assortments, store layouts, and customer bases. Attempting to switch them to Walmart‘s model created additional disruption and erased some of their brand equity with shoppers.

Walmart struggled to integrate the two head offices, IT systems, and distribution networks, never fully realizing back-end synergies. Layoffs and culture clashes ensued.

Key personnel defected during the rocky transition period, taking valuable institutional knowledge with them. Frequent management turnover hampered continuity.

Rather than a smooth scaling up, Walmart ended up with a muddle of store banners and a complex integration mess that distracted from innovating and honing the customer value proposition.

7. Failure to Course-Correct

The warning signs mounted quickly after Walmart‘s market entry, from market share losses to labor unrest to shopper complaints. Yet management proved sluggish to react and adapt:

Sales fell from €2.9 billion in 2001 to €2.5 billion by 2003 as store traffic and basket sizes slumped. Efforts to refresh store layouts and tweak assortment failed to win back shoppers.

Walmart cycled through 4 different Germany CEOs in 6 years, creating a leadership vacuum. Executives seemed to hunker down and double down on misfiring tactics rather than boldly rethinking strategy.

While it eventually introduced some private-label brands and sought more local suppliers, these moves came late. Rivals meanwhile strengthened their value propositions.

A brief attempt to expand into small-format urban stores fizzled. Walmart lacked the capabilities to excel in this arena against the hard discounters.

Ultimately, after 9 years and accumulated losses over $1 billion, Walmart threw in the towel in 2006, selling its 85 stores to Metro. Despite its immense resources and retailing acumen, management proved too slow to recognize and course-correct the multiple, fundamental disconnects with the German market.

Key Takeaways

Walmart Germany offers a vivid case study of how a brilliant retailer can badly misfire when it fails to acknowledge and bridge gaps between its core model and a foreign market. To recap, some of the key lessons:

Rigorously asses the competitive landscape and don‘t underestimate entrenched local rivals. Walmart overestimated its ability to overwhelm competitors.

Adapt practices to the regulatory, economic, and cultural environment. Walmart‘s adherence to American norms backfired in Germany‘s distinct system.

Localize your value proposition to domestic consumer needs and habits. Walmart imposed its format, assortment, and experience rather than tailoring them.

Secure strategic store locations that align with your target shoppers‘ needs. Walmart‘s real estate left it poorly positioned to capitalize on foot traffic.

Build robust local supply chains and vendor relationships. Walmart struggled to translate its logistical prowess and effectively serve stores.

Seek acquisitions you can effectively integrate into a cohesive model. Walmart bit off more than it could chew assimilating two disparate chains.

Recognize market shifts and rapidly pivot if the initial proposition isn‘t resonating. Walmart reacted slowly as financial losses and industry grumbling mounted.

Fortunately, Walmart learned from its German misadventure, taking a more localized tack with subsequent entries into Japan, Chile, and South Africa. As for Germany, it remains a challenging market for foreign retailers, with hard discounters still dominating and even Amazon struggling to make inroads. Cracking Germany requires deep customization, not a cookie-cutter approach.

The retail graveyard is littered with examples of great companies misstepping abroad, from Tesco‘s "Fresh & Easy" flop in the US to Carrefour‘s retreat from Asia. Success at home does not necessarily translate to new markets. Walmart Germany‘s rise and fall shows the perils of hubris and the necessity of adaptation for even the most formidable retail juggernaut.

Why Walmart Failed in Germany and Europe: The Main Reasons

Walmart is a multinational american company that runs chains of large discount department stores, supermarkets, and warehouse stores. it sells a variety of products, but they are most well-known for its low prices on groceries and household items. walmart operates retail stores in various retailing formats in all 50 states in the united states. also, it serves customers and members more than 200 million times per week at more than 8,416 retail units under 53 different banners in 15 countries. as one of the most successful retailers, it might come as a surprise that walmart has not been successful when expanding in europe. throughout this content, we will demonstrate what went wrong in germany that led walmart to fail in the eu to sustain there..

Why did Walmart Fail in Germany?

Walmart’s story in the EU has begun with its attempt to expand its business in Germany. In 1997, Walmart entered the German market with the acquisition of the Wertkauf and Interspar hypermarket chains. But Walmart’s global fame and aggressive entry into foreign markets didn’t work out well in Germany. Walmart’s German stores struggled because its business model wasn’t working there. It tried hard, but after 9-years, Walmart sold its 85 outlets in Germany in 2006 resulting in a $3 billion loss.

There were several factors that contributed to Walmart’s Failure in Germany. From the very start, amazing management oversights have affected Walmart’s German operations. We have figured out some of the important reasons behind their failure.

1. Below-Cost Strategy: Walmart wanted to follow the below-cost strategy, But the German business owners didn’t like Walmart’s low-cost pricing tactic as well as the German government. As a result, the American giant was ordered to raise its prices by the German high court which became an obstacle for it to having a customer base.

2. Walmart and German Unions Were Incompatible: In the United States, Walmart is notorious for playing low wages and suppressing unions. In Germany, unlike in the US, unions are very much a part of the culture and have broad support amongst the government, the community, and even businesses. Walmart didn’t understand that in Germany, companies and unions are closely connected. Also, The German workforce is accustomed to negotiating their pay with their union. This caused friction between the workers and the company.

When Walmart refused to join Germany’s regional wage bargaining system, the worker’s union went on strike. Walmart was taken aback for this reason. This also gave them a bad reputation in the community and likely affected their sales.

3. Walmart Underestimated Their Competition: In the USA, Walmart has primarily been considered a low-cost, one-stop shop for just about anything a person could need.

In Germany, however, the people value the quality of products as much as they value the price. They weren’t about to abandon the small grocery chains they had always shopped at. Walmart did not expect such resilience from the 14 hypermarket chains that were popular across Germany, and they failed to adapt even after they found out.

4. Retail Chains Were Already Doing Poorly in Germany: Part of the problem with Walmart’s transition into Germany is that retail chains were growing at an alarmingly low rate at the time. In fact, when Walmart came into Germany, the average growth rate for a retail chain was just 0.3% per year. This acted as an immediate disadvantage in Walmart’s journey towards sustainable growth in the country.

5. Employees Felt Uncomfortable With Walmart’s Practices: It wasn’t just the pay and lack of worker rights that upset Walmart employees. It was also some “team-building” practices that many Germans didn’t feel comfortable doing.

At Walmart, workdays started with light exercises and motivational chants. While in US culture, these activities can sometimes bring a team closer together, in Germany, they are entirely unexpected and only served to make the employees uncomfortable.

6. Employees Felt That Walmart Overreached Into Their Personal Lives: In the United States and in many countries, it is taken as a given that employees that work in the same department cannot engage in romantic relationships. In Germany, however, this is not the standard. In fact, it is considered a huge overstep in a person’s life.

7. Walmart Failed to Take Into Account Cultural Differences Surrounding Shopping: In the United States, it is considered commonplace or almost by default that people like to drive out to one store and buy everything they need there at a reduced price. This is part of why Walmart has been so successful in the US.

In Germany, on the other hand, shoppers have different habits, and the way the economy is structured lends more significance to smaller discount chains. Below are just a few differences in culture, which caused fewer Germans to go to Walmart and more to go to smaller chains.

Many Germans like to shop at places that are within walking distance. The idea of “service with a smile” is not as emphasized in Germany and came across as odd and uncomfortable. Smaller discount chains in Germany can sell goods at lower prices than big retail chains by law.

Walmart enforced a corporate culture that ran counter to the values of many Germans. On the other hand, the small chains were in line with their beliefs.

8. Walmart Didn’t Focus Their Services Enough: Walmart sells just about anything a person would need; food, clothes, entertainment, car parts, gardening supplies, and more. Given the German population’s tendency to shop at smaller, more focused stores, this didn’t work on a cultural level.

It also didn’t work on an economic level. Part of the reason Walmart can sell so many goods at such a low price in the US is that they receive tax subsidies and pay workers a lower wage.

As we’ve seen previously, they were challenged on all of these issues. Still, they tried a more focused approach, perhaps on groceries or home goods, they could have carved out a corner of the market.

9. Walmart Failed to Adapt to Germany’s Economy: You put all this together, you get the primary reason why Walmart failed to gain any steam in Germany. They could not, and would not, adapt to the different economic systems.

To conclude, Walmart failed in Germany and eventually in the EU due to a variety of factors including the inability to adapt to german retail market conditions, lack of competitive prices against Garman stores, underestimated local competition, environmental cultural differences, and different organizational rules, and corporate culture for Walmart employees. If the folks at Walmart had been more proactive in studying Germany’s economic system and consumer habits, their stores might not have failed. We hope that you understand why Walmart failed in Europe. If you have found our conversation helpful, please leave a comment, share our post, and subscribe to our blog.

Related Posts

E-commerce Update – June 2024 | Amazon Prime Day, Walmart Virtual Packs & More

Exciting changes are happening on major e-commerce platforms like Amazon, Walmart, TikTok, and Temu! This month, Amazon announced Prime Day, new AI investments, and better…

Amazon South Africa & It’s New Return Processing Fee Updates for May 2024

Guess what! Many interesting updates are coming on e-commerce platforms like Amazon, Walmart, eBay, TikTok, etc. Every e-commerce platform is gearing up for updates that…

Top 5 Walmart Seller Mistakes KILLING Your Walmart Sales & How to FIX Them

Are you a Walmart seller looking to boost your sales and increase your success on the platform? If so, you’ll have to pay close attention…

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search form

You are here.

- Case, example of product failure: Wal-Mart in Germany, 1997 to 2006

Wal-Mart is the biggest food retailer in the world and has a presence in several nations. In some nations (e.g. the US, Canada, China), Wal-Mart is a great success. However, Wal-Mart has failed in some countries (e.g. Germany, South Korea). First, we describe Wal-Mart’s failure in Europe’s largest economy. Second, we use Wal-Mart’s experiences in Germany to illustrate some key principles related to product failure and product deletion (see Table 13.4 ). Wal-Mart’s experiences are also an example of the importance to adapt to culture when starting a business in a new country.

The German grocery industry

There is fierce competition in the German grocery industry, due to the increasing number of discount supermarket chains (KPMG 2006). As a result, there is low profitability in the food retail sector; profit margins range from 0.5 per cent to 1 per cent which is one of the lowest profit margins in Europe (Frankfurter Rundschau 2007). By contrast, profit margins in Great Britain are 5 per cent, in this same sector. In particular, Metro is a tough competitor, and it already applies some of Wal-Mart’s successful strategies (e.g. related to economics of scale and low prices). Of course, Wal-Mart is interested in other metrics beyond profit (e.g. shareholder wealth, market share), but, as indicated above, profitability and margins are of key concern to retailers.

Wal-Mart: strategic concept

Wal-Mart is the world’s largest retailer with approximately 6,500 stores worldwide (Business 2006). The main feature of Wal-Mart’s business model is to cut costs (continuously) and therefore offer lower prices than their competitors. For instance, Wal-Mart has introduced new logistical technologies such as radio-frequency identification (RFID) to optimize its logistic processes. RFID is an automatic identification method, relying on storing and remotely retrieving data using devices called RFID tags or transponders. Wal-Mart tries to minimize labor costs by offering minimal health care plans. Wal-Mart pressures its suppliers to cut costs, on a continuous basis. In brief, Wal-Mart’s managers are constantly seeking out ways to cut costs, and some of their successes are passed on to shoppers, in terms of lower prices.

Wal-Mart’s entry into the german market

In 1997, Wal-Mart acquired over 21 stores from the supermarket chain “Wertkauf.” One year later, Wal-Mart bought an additional 74 stores from the supermarket chain “Interspar”. As a result, Wal-Mart became the fourth biggest operator of supermarkets in Germany (Lebensmittelzeitung 2006). The objective was to expand to 500 stores in Germany. However, the number of stores never exceeded the 95 stores that were originally purchased in the first two years. Wal-Mart’s position in the marketplace deteriorated over the years. In 2002, Wal-Mart had some financial difficulties due to a low turnover which resulted in the dismissal of some employees. At the end of 2006, Wal-Mart was bought out by “Metro”, one of Germany’s largest retail groups. Finally, Wal-Mart left the German market with a loss of one billion dollars before tax (Manager-Magazin 2006).

Mis-steps in the german market

In general, there are five key issues related to Wal-Mart’s ultimate withdrawal from Germany: ( a) market structure; (b) business model (these first two are discussed together here); c) cultural and communication; (d) politics and regulation; and (e) product/service failure. Each of these issues is discussed in turn. Note also that these five issues are highlighted in Table 13.4 .

Market structure and business model

A retailer that wants to follow Wal-Mart’s strategy of low prices needs to expand rapidly. In Germany, there not enough appropriate locations to support such expansion (see Table 13.4 ). As previously mentioned, Wal-Mart did not build their own stores but took over 21 existing “Wertkauf” supermarkets that had a totally different business model. The stores themselves were very small and had a limited range of goods. A related problem is that these stores were located far apart, which resulted in high logistical costs.

When entering a new market, it is important to anticipate competitors’ reactions. In Germany, Wal-Mart’s biggest competitor, Metro, wanted to expand their stores; at the same time, Metro wanted to prevent Wal-Mart from executing their expansion plans (Senge 2004). Many times, a product has to be deleted because the competition is too strong.

With the strategy of “Every day low prices,” Wal-Mart is very successful in the United States and also in many other countries. In Germany, there is extreme competition in the retail food sector. Therefore, the German customer is quite accustomed to the low prices that are offered by numerous discount supermarket chains. For this reason, Wal-Mart’s strategy of offering low prices did not create sufficient competitive advantage (see Table 13.4 ).

Culture and communication

When products are introduced, it is important to consider cultural factors. In this case, corporate culture played a key role. Wal-Mart’s top executives decided to operate the German locations from their offices in the United Kingdom. Thus, Wal-Mart’s “corporate language” was English. However, many of the older Wal-Mart managers in Germany do not speak English. As a result, there were often breakdowns in communication. Some managers of the acquired stores did not stay on after the Wal-Mart acquisition. Key business connections were lost. As a result, several key suppliers (e.g. Adidas, Samsonite, Nike) declined to work as suppliers for Wal-Mart. Wal-Mart did not just lose important suppliers; they also lost an important part of their range of goods (Senge 2004). The situation could have been improved by retaining and communicating effectively with the German managers who had know-how about the local market (see Table 13.4 ).

Politics and regulation

The managers of Wal-Mart were not sufficiently familiar with the laws and regulations in Germany, as they violated them several times. One of Wal-Mart’s fundamental principles is to stay union free. However, in Germany, unions have a powerful position. Through collective bargaining and related tactics, they can have a strong influence on political decision making. Ver.di is a German union in the service sector. With 2.4 million members, it is one of the largest independent, trade unions in the world (Ver.di 2008).

According to the German Commercial Code, all incorporated companies are obligated to publish a financial statement, including a profit and loss statement. Due to the fact that Wal-Mart refused to publish their financial statements for the years 1999 and 2000, Ver.di sued in a court of law. Wal-Mart was sentenced to pay a fine. The coverage of this law suit in the German press led to a negative public image for Wal-Mart.

After the expansion strategy failed due to the lack of suitable store locations, Wal-Mart began a price war to drive small competitors out of business. The intention was to take over the stores of the insolvent supermarket chains and convert them into Wal-Mart stores. One part of the price war was to introduce a private label called “Smart Brand” and sell most of these products below manufacturing costs. The reaction of many competitors was to decrease their prices, which led to a profit setback for the entire industry. However, the Federal Cartel Office interceded and stopped the price war because there is a law in Germany that enjoins companies from selling goods below manufacturing costs on a continuing basis (Knorr and Arndt 2003).

Product/ service failure

Wal-Mart planned to introduce a sophisticated customer service program which threatened many of its competitors because German discount supermarket chains often do not provide good customer service. Therefore, good customer service, combined with low prices, could have been a new market niche in Germany. One part of Wal-Mart’s customer service program was called the “ten foot rule”. Every ten feet, a service employee offered some help to the customer (Knorr and Arndt 2003). However, the customer reaction was rather negative, because customers who normally do their grocery shopping in discount supermarket chains are used to self-service. They do not necessarily expect to talk with employees.

Therefore, the “ten foot rule” was perceived as rather annoying and did not result in a reputation for providing good customer service.

Wal-Mart also imported the idea of placing a “greeter” at the entrance to the store. Again, German customers were not used to this custom, and they did not adopt this “service” with any enthusiasm.

Conclusion of Wal-Mart Mini-case

Wal-Mart tried to apply its US success formula in an unmodified manner to the German market. As a result, they didn’t have sufficient knowledge about the market structure and key cultural / political issues. In addition, structural factors prevented Wal-Mart from fully implementing its successful business model. Also, there were some instances of product or service failure. The final outcome was that Wal-Mart had to abandon its offerings in Germany.

| Reasons for Failure | Examples of Wal-Mart in Germany |

|---|---|

| Insufficient demand (MS / BM) | Wal-Mart’s low price strategy didn’t create any competitive advantage since many German local retailers were already using that strategy. |

| Existing competitors are too strong (MS) | Wal-Mart’s biggest competitor, Metro, took specific counter-measures to prevent Wal-Mart from executing their expansion plan. |

| Failure to develop and communicate unique selling propositions (USP) (BM) | The profit margins in the German retail industry were already low before Wal-Mart entered. Wal-Mart was not able to convince German consumers that their prices were really that much lower than the competition. |

| Unexpected change in the environment— Economic downturn | N/A for Wal-Mart case |

| Competing new technology successfully introduced | N/A for Wal-Mart case |

| Change in culture (i.e. change in corporate culture, change in consumer taste or fashion) (C) | Wal-Mart did not adapt well to the German corporate culture. |

| Changing standard of government regulations (P) | Managers were not familiar with German laws and regulations, so there were violations. In general, Wal-Mart’s anti-union policies conflicted with the strong German union. Wal-Mart also tried to sell their products below manufacturing costs, which is illegal in Germany. |

| The price is too high, so trial is discouraged | N/A for Wal-Mart case |

| Poor promotion/communication plan (C) | Language barrier between English-speaking managers and older German business people who don’t speak English. |

| In retailing, failure to secure attractive sites (MS) | There were not enough appropriate locations for Wal-Mart stores available in Germany. |

| Product failure (PF) | Stores were often located far apart. As a result, logistics costs were high. One of Wal-Mart’s main success factors is to minimize costs, but this goal was restricted by high logistical costs. |

| Poor service quality—during or after sales (PF) | Some of Wal-Mart’s methods for providing service were not accepted by German customers. For instance, the customers did not like the concept of the “greeter”. |

| Failure to get corporation from key supply-chain members (BM) | Several key suppliers refused to supply goods, for members (BM) fear of tarnishing their corporate image. |

| Notes for : The reasons for deletion are divided into five categories according to the following legend: MS: Market structure; BM: Business model; C: Culture and communication; P: Politics and regulation; PF: Product failure | |

- 44845 reads

- Are entrepreneurs born or made? “The Mindset of an Entrepreneur”

- When to plant your market opportunity seeds “Stop and Go Signs for Accessing Market Opportunity Matrix”

- What will I sell?

- Places for inspiration

- Financing: the fundamental rim on the wheel

- Strategy: the tactical rim on the wheel

- Branding coaching What is the brand advantage?

- The Brand Identity Guide: A blueprint toward success

- The stems of growing startups: definitions of “startup stakeholder arrow” selected terms

- Making good: elements of a values-based company culture

- Going green on a shoe string

- Water your plants: operations hydrate your startup

- A new product bud is blooming: introducing the “New Venture Instructional Manual to Operational Excellence” “New Venture Instructional Manual to Operational Excellence”

- Let the fruits of your labor blossom: the new product/service launch event plan “Checklist for a New Product Launch Event

- The public relations practitioner’s tool kit

- Mentor insights: the “Where the Rubber Meets the Road” spokes on the wheel Jay Milbrandt’s Journal Entries from Bangladesh - Not Just Statistics Jay Milbrandt’s Journal Entries from Bangladesh - Why I Have Hope Jay Milbrandt’s Journal Entries from Bangladesh - Moving the Mountains of Poverty Jay Milbrandt’s Journal Entries from Bangladesh - What Third World?

- About this author and acknowledgements

- Entrepreneurial mindset enhancing activities

- Chapter summary

- Examples of successful business models

- Model implementation/testing pre-requisites

- Real expectations outcome: benefits

- Success factors

- Conclusions

- The product model vs the marketing model

- The marketing model

- Maslow’s Hierarchy of Needs

- Identifying customer’s wants successfully

- Models of industry attractiveness; the strategic perspective

- The BCG matrix

- The McKinsey matrix

- Downes’ three new forces

- Market research to determine the potential market for funeral services in Monterrey, Mexico

- Discussion questions

- Introduction

- Organizational issues

- Organizational stages of growth

- Departmentation by function

- Departmentation by products

- Departmentation by projects

- Departmentation by matrix

- Flat organizations

- Tall organizations

- Centralized

- Decentralized

- Chapter summary Us legal issues

- Competitive advantage through human resource management

- Providing employee voice and influence

- Managing differences in organizations

- Methods of recruitment

- Evaluating recruiting policies

- Selective hiring

- Behavioral interview

- Situational interview

- Selection tests

- Background checks

- Benefits of training

- Need for training

- Training methods

- Training in the context of global business

- Aligning employee career development with organizational growth Best of East and West

- Purpose of appraisals

- Creating an appropriate appraisal process

- Appraisal methods

- Performing the appraisal

- Giving feedback

- Receiving feedback

- Internal equity

- External equity

- Combining internal and external equity

- The benefit of benefits

- Detriments of benefits

- Compensation techniques

- Components of pay for performance

- Pay secrecy

- Good outcomes of paying for performance

- Folly of reward systems in different organizations

- Cautions for introducing a pay system

- Elements to job design

- Brief history of traditional approaches to job design

- Current approaches to job design

- Steps to effective job design

- How meaningful job design can impact an organization

- Defining marketing

- Macromarketing versus micromarketing

- Service marketing versus goods marketing

- For-profit marketing versus nonprofit marketing

- Mass marketing, direct marketing, and Internet marketing

- Local, regional, national, international, and global marketers

- Consumer goods marketing and business-to-business (industrial) marketing

- Standardization and customization

- Reasons for entering international markets

- Reasons to avoid international markets

- The stages of going international

- Joint ventures

- Direct investment

- US commercial centers

- Trade intermediaries

- The corporate level

- The business level

- Marketing objectives

- The functional level

- Product/promotion

- Distribution and logistics

- Evaluating results

- Business norms

- Religious beliefs

- Political stability

- Monetary circumstances

- Trading blocs and agreements

- Expropriation

- The technological environment

- The economic environment

- The competitive environment

- One of three strategic functions

- Strategic versus tactical operations decisions

- Operations management provides competitive advantage!

- The input/output transformation model

- Inventory decisions

- Capacity decisions

- Quality decisions

- Scheduling decisions

- Process decisions

- Technology decisions

- Location decisions

- Quality costs

- TQM’s seven basic elements

- Quality awards and standards

- Causes of the bullwhip effect

- Counteracting the bullwhip effect

- Other factors affecting supply chain management

- Supplier selection

- Inventory reduction to expose waste

- Demand-pull production system

- Quick setups to reduce lot sizes

- Uniform plant loading

- Flexible resources

- Line/cellular flow layouts

- Total Quality Management

- Employee empowerment

- Conclusion: The evolution of JIT into “lean operations”

- Trends in management

- Trust: the foundation for a successful relationship

- Functional relationship

- Relational partnership

- Strategic partnership

- Foundations of successful relationships

- Phases of relationship development

- Skills for building positive relationships

- Outsourcing

- Potential external relationship obstacles

- Why an accounting system is important

- Basic types of accounts

- Chart of accounts

- Basic financial statements

- A short history of accounting and double entry bookkeeping

- Types of ledgers

- Cash flow forecasts

- Working capital analyses

- Profitability analyses (e.g. by customer, product, region)

- Sources of financing for your organization

- The technology sub-system

- The process sub-system

- Relationships between the four components

- Some practical advice for start-ups

- Acquiring a suite of commonly-used programs

- When to think about using database management software

- Creating a Web presence

- Know the basics

- eMarket your website

- Competitive advantage

- Porter and competitive advantage

- Have the IS department set priorities

- Have a cross-functional steering committee set priorities

- Develop a formal plan for information systems

- Project management risks

- Security risks

- Internet risks

- Summary of IS risk management

- Detecting competitive threats

- Eliminating or lessening surprises

- Enhancing competitive advantages by lessening reaction time

- Finding new opportunities

- Human intelligence

- Fee based companies

- What is an industry?

- Industry structural characteristics

- Concept of strategic groups

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitute products

- The intensity of competitive rivalry

- Personal ethics: four ethical approaches

- Management: the meta profession

- The paradox of the public pledge

- The paradox of pay

- Corporate Social Responsibility

- Product categories

- Examples of business models from the music industry

- Traditional business model

- Digital music stores

- Open content

- Artist-centered website hub

- Artist’s personal website

- Non-traditional “record labels”

- Tax-the-device model

- Summary of new business models

- Evaluating new products

- Product failure

- Case: “Apples: Newton and Pippin”

- What is globalization? Case: United States Domestic Automaker, Ford

- Elements of economic globalization

- Negative effects of globalization for developing country business

- Positive effects of globalization for developing country business

- Globalization and the small business entrepreneur

- Phone, Fax and SMS

- Technology for the business entrepreneur

- Host country research and cultural implications

- Cross-culture training

- Cultural classification

- Hofstede’s 5 Cultural Dimensions

- Ethical considerations

- What is political risk?

- Forms of investment and risk

- Protection from political risk

- Government policy changes and trade relations China establishes a new employment contract law for 2008 (www.aon.com)

- What is legal risk?

- Political and legal risk for the small business entrepreneur

- Case: Toyota has a vehicle for every market

- What is global marketing?

- The 4 P’S of the Marketing Mix (NetMBA, 2008)

- Importance of culture on markets

- Global branding—creation of a marketing strategy

- Global marketing and the small business entrepreneur

- Exchange rates

- Foreign exchange market

- Introduction to currency risk

- Introduction to derivatives

- International accounting standards board

- Global finance and the small business entrepreneur

- International division

- Global functional structure

- Product structure

- Area/geographic structure

- Matrix structure

- Beyond the matrix

- Staffing choices in a globally far-flung company

- Trends and challenges in a global HR environment

- Corporate Social Responsibility and sustainable development defined

- CSR and corporate strategy

- Case: Built to Last by Jim Collins

- Successful Implementation of CSR and Sustainable Development

- CSR, Sustainable Development, and the Future of Businesses

- CSR and the small business entrepreneur

- Definition and statistics

- Growth models

- Growth through buying out other companies

- Growth through cooperation

- Stopping growth by selling the firm

- Growth through innovation

- Management mistakes

- Incompatibility of growth strategies and organizational structure

- Inadequate or incorrect marketing, cooperation, finance, or HR strategies

- Inadequate or incorrect internal accounting

- Dependence on third parties

- Acculturation problems when buying companies

- References, and further literature

- About the chapter author

- About the chapter editor

- Back Matter

This action cannot be undo.

Choose a delete action Empty this page Remove this page and its subpages

Content is out of sync. You must reload the page to continue.

New page type Book Topic Interactive Learning Content

- Config Page

- Add Page Before

- Add Page After

- Delete Page

Why Walmart Failed In Germany

It's a place where you can buy your weekly grocery order and get your prescriptions refilled in one visit. It's a place where you catch up on the local gossip with your neighbor in the cereal aisle or watch a fellow shopper in ill-fitting pajama pants buy a single rotisserie chicken. For all its ups and downs, Walmart is no doubt a genuine American institution. Originally a simple five-and-dime general store in Bentonville, Arkansas — a place that still exists as the official Walmart Museum – Sam Walton's store has a long history. While you can find a Walmart superstore just about anywhere in the United States, you're probably not going to hear the name if you head over to Europe.

That doesn't mean Walmart didn't try to expand over in Europe, however. In the final years of the '90s, Walmart attempted to bring old-fashioned American productivity, low prices, and efficiency to the German public (via New York Times ). Unfortunately, Walmart had to say auf wiedersehen to its grand plans in the country by 2006. Just what exactly happened that made Walmart abandon its plans?

Germans simply didn't understand Walmart culture

While we are not vastly different than our neighbors over in Germany, it's safe to say that our customs and culture are not totally alike. Germans are stoic, friendly people who strive for the best in their lives (via LiveScience ), so one would expect that Walmart could thrive as a company that aims to meet all their customer's needs in one store. The reality is that Walmart, with all of its American values, simply didn't fit into German culture. As reported by The New York Times , the worker unions typical in the country were not embraced by the company.

The Global Millennial detailed three more reasons for the failure of Walmart in Germany. The first reason was that Walmart's "employee motivation training" like team-building exercises outside of the store may have come across as too regimented or too silly. Another issue was that German people were uncomfortable with Walmart employees smiling at them so much. Smiling awkwardly at the cashier in line may have been strange for people who typically reserved smiles for close friends and family. The third reason was due to conflicts with Walmart's ethic codes, which required employees to monitor each other in case of misconduct.

Whatever the reasons, it was clear that the corporation's American customs did not align with the culture in Germany. Perhaps one day, Germans and Americans can bond over what foods you should never buy at Walmart .

- Harvard Business School →

- Faculty & Research →

- April 2004 (Revised July 2019)

- HBS Case Collection

Wal-Mart in Europe

- Format: Print

- | Language: English

- | Pages: 25

About The Author

Gunnar Trumbull

Related work.

- Faculty Research

- Wal-Mart in Europe By: J. Gunnar Trumbull and Louisa Neissa

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Walmart's Downfall in Germany: A Case Study

Related Papers

Hafez Shurrab

International Journal of Retail & Distribution Management

John Fernie

Elmar Kulke

Cornelia Scott

The year 2020 required many changes in all areas of life as a result of the Covid-pandemic. Both privately and professionally, we had to deal with new challenges. The economy in Germany and especially the in-store retail sector was affected severely by the lock-downs. Small retail businesses are especially threatened because of their low financial reserves and many insolvencies are imminent. This is very dramatic because, on the one hand, many livelihoods are directly linked to these small retailers. On the other hand about 94% of the sectors are currently so called micro or small enterprises with less than 10 or 50 employees and an annual turnover under 2 or 10 million euros. These “local shops” are a characteristic of city centers and important for the economic stability and diversity of the country. To support these businesses, the state has introduced various direct financial aids and indirect ones such as short-time work or guarantees. Regardless of the difficulties associated ...

Guenter Schamel

Journal of Retailing and Consumer Services

Andreas Hemming

Urban Geography

Yuko Aoyama

Environment and Planning A

alan Hallsworth

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

RELATED PAPERS

Rolf T Wigand , Roman Beck

Journal of Business Case Studies

Bahaudin Mujtaba

Springer eBooks

Jeanne Munger

Angelika Epple

Murray Rice

Law and World, N1

Mikheil Bichia

Paper to be presented at conference on Global …

Barry Eidlin

Journal of Marketing Research

Joannes Steenkamp

Walmart Policy and Sustainability Challenges

Oketch Michael

Philip Kamenov

Tijdschrift voor Economische en Sociale Geografie

Johan G Borchert

Business History Review

Lydia Langer

Konrad Popławski

Kyle Stiegert

leigh sparks

Anca Chirita

SSRN Electronic Journal

Mark Wahrenburg

Sustainability

Frank Othengrafen

Law & Pol'y

John W. Cioffi

American Journal of Economics and Sociology

Jeremiah Gitaga

Teoh Shulyn , Assoc. Prof. Dr. Rashad Yazdanifard

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

MBA Knowledge Base

Business • Management • Technology

Home » Management Case Studies » Case Study: Why Walmart Failed in Germany?

Case Study: Why Walmart Failed in Germany?

Wal-Mart, the mega-retailer, was founded by Sam Walton in 1962 in Bentonville, Arkansas. It started with $700,000 in its first year and scaled up to $5.4 million by 1974. The retailer continues to grow while others struggled with inflation and recessions. In 1980, Wal-Mart became the youngest US retailer to exceed $1 billion in net sales. During the 1980s, Wal-Mart began to further expand and thus pushing some retailers to closing some of their regional stores. The company engaged in diversification by creating membership-stores such as Sam’s Club, smaller, more conventional pharmacy/grocery stores called Neighborhood Markets, and finally Supercenters with a wide selection of consumer goods. And, in 1991, Wal-Mart became the world’s largest retailer.

Wal-Mart had been able to implement its Every Day Low Price strategy by focusing on 1) developing a sophisticated logistics system with heavy information technology investments, 2) efficient distribution system by placing retail stores close to distribution centers and using RFID technology , and 3) being a non-union employer.

With the largest economy in Europe, Germany comprised around 15% of Europe’s annual retail market in 2001. In 1997, Wal-Mart moved into the German market through acquiring the Wertkauf chain (24 stores) and unprofitable Interspar chain (74 stores). The two chains made up only less than 3% of the market. The Interspar stores were in poor repair and in poor locations. The leading German retailer was Metro Group followed by Rewe Group. Germany’s top ten retailers captured 30% of the total retail sales in 2001.

Retail market growth rates had averaged at 0.3% per year in the 1990s. Profit margins in Germany were also low for retailers compared to retailers’ margins in other European countries. Bankruptcy filings were numerous. In 2002, 10,000 retail stores filed for bankruptcy. This points towards a competitive landscape that might prove to be challenge for Wal-Mart to succeed in.

According to a Goldman Sachs report, Wal-Mart could be trusted to implement its US strategy and gain efficiency, low prices, and inventory control and thus propel the underdeveloped German market into the future. However, to the contrary, an analyst in a DG Bank report warned of many foreign retailers failing in Germany because of land-use restrictions.

Germany had limited store hours, price regulations (prohibiting retailers from selling below costs), and stringent zoning requirements. Also, Unions were more influential than their US counterparts.

Opening a large retail store outside urban area was possible however require multiple steps. The retailer would be required to create a building use plan that would cover a comprehensive development concept that accounted for environmental, conservation, and private legal concerns. An example would be the new site could not sell products that would compete directly with stores in nearby towns. The plan would need to be first approved by the town or city council and then regional planning boards at the state and national level. This resulted in little to no success rate especially since the German government did not want retail businesses to pull away customers to outside of a town leaving old buildings and monuments in the city center vacant. This would be extremely problematic for Wal-Mart because all of its stores in Germany were Supercenters.

Germany service sector union Ver.di , the largest union in the world, filed a lawsuit against Wal-Mart for not releasing year-end figures that could be used to negotiate wages. This ultimately led brought Wal-Mart to the negotiating table with Ver.di . As a result, the retailer conceded a salary increase that was 0.5% over negotiated retail-sector levels.

Unlike many of its German competitors, Wal-Mart offered credit card payment and free bags for goods purchased, improved store interiors, and friendly customer service. Since German customers were not accustomed to friendly greetings, they focused more on how much more is Wal-Mart charging customers for these additional services. Not having to hire greeters helped mitigate costs from having to pay higher wages per worker compared to the UK. Customers were also loyal to the domestic large players in the retailing industry including Metro, Aldi, and Rewe.

Wal-Mart experienced great difficulties in dealing with suppliers. The retailer did not have the bargaining power to buy goods from suppliers at low cost and also did not have a reputation of low prices with German consumers. And, upon implemented its centralized distribution system, they experienced high backorder rates (20% vs. industry average of 7%) and thus successfully implemented new scanning systems to better manage inventory .

Higher costs, lower margins, smaller stores, undeveloped supply chain relationships, and price sensitive customers loyal to German chains forced Wal-Mart’s stores to only have a margin of less than 1% while Wal-Mart’s ASDA had 6-8% in the UK. Yet, this problem also affected other foreign companies such as GAP and Marks & Spencer, who both decided to leave the German market.

Unfortunately, Wal-Mart had decided that its successful track record in US, Mexico, and the UK would serve as a sufficient prerequisite in entering Germany through acquisition. Also, it assumed that its country-dependent advantages would be able to transfer over such as supplier relationships and consumer market knowledge. As a result, the company’s German stores are facing shrinking margins and thus low profitability.

Related posts:

- Case Study: Wal-Mart’s Failure in Germany

- Case Study: Why Woolworths Failed as a Business?

- Case Study: Euro Disney Failure – Failed Americanism?

- Case Study of Nike: The Cost of a Failed ERP Implementation

- Case Study: Inventory Management Practices at Walmart

- Case Study of Walmart: Procurement and Distribution

- Case Study: Supply Chain Management of Walmart

- Case Study: How Walmart Enhances Supply Chain Management with ERP Initiatives?

- Case Study: Lenovo’s “PC Plus” Strategy

- Case Study: The International Growth of Zara

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Pardon Our Interruption

As you were browsing something about your browser made us think you were a bot. There are a few reasons this might happen:

- You've disabled JavaScript in your web browser.

- You're a power user moving through this website with super-human speed.

- You've disabled cookies in your web browser.

- A third-party browser plugin, such as Ghostery or NoScript, is preventing JavaScript from running. Additional information is available in this support article .

To regain access, please make sure that cookies and JavaScript are enabled before reloading the page.

IOE - Faculty of Education and Society

- Departments and centres

- Innovation and Enterprise

- Teacher Education College

Monopsony power and poverty: The unequal consequences of Walmart supercenter openings

23 October 2024, 1:00 pm–2:00 pm

Join this event to hear Zach Parolin discuss how Walmart Supercenter openings affect poverty and tax/transfer outcomes among individuals in affected counties.

This event is free.

Event Information

Availability.

Prior research suggests that Walmart Supercenters exert substantial power over the low-wage labor market, though the consequences of Supercenter openings on household incomes and public finances are less clear.

In this event, Zach will talk about his research, which uses restricted-access U.S. Panel Study of Income Dynamics data from 1970 to 2019. He will discuss the effects of Walmart’s monopsony power.

This event will be particularly useful for researchers.

Please note this is a hybrid event and can be joined either in-person or online.

Related links

- QSS and CLS seminar series

- Quantitative Social Science

- Centre for Longitudinal Studies

- Social Research Institute

About the Speaker

Zach parolin.

Associate Professor of Social Policy at Bocconi University in Milan and a Senior Research Fellow at Columbia University's Center on Poverty and Social Policy

At Bocconi, Zach directs the ExpPov Poverty and Inequality Research Lab, which is funded by an ERC Starting Grant.

Related News

Related events, related case studies, related research projects, press and media enquiries.

UCL Media Relations +44 (0)7747 565 056

Blog The Education Hub

https://educationhub.blog.gov.uk/2024/08/20/gcse-results-day-2024-number-grading-system/

GCSE results day 2024: Everything you need to know including the number grading system

Thousands of students across the country will soon be finding out their GCSE results and thinking about the next steps in their education.

Here we explain everything you need to know about the big day, from when results day is, to the current 9-1 grading scale, to what your options are if your results aren’t what you’re expecting.

When is GCSE results day 2024?

GCSE results day will be taking place on Thursday the 22 August.

The results will be made available to schools on Wednesday and available to pick up from your school by 8am on Thursday morning.

Schools will issue their own instructions on how and when to collect your results.

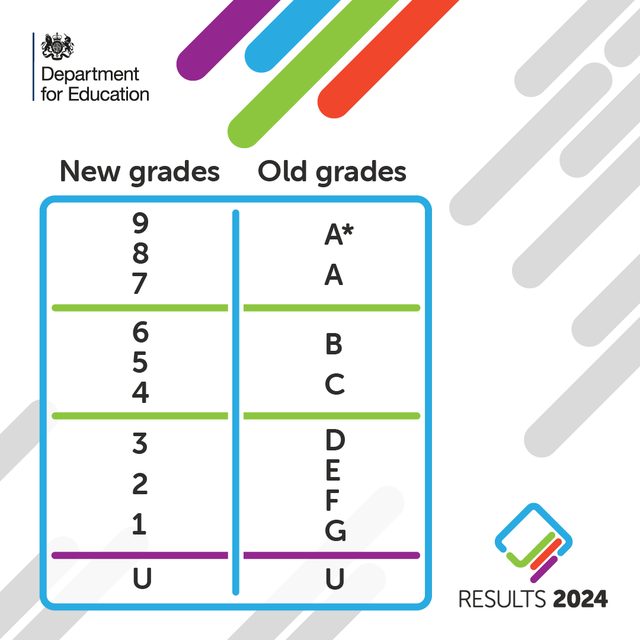

When did we change to a number grading scale?

The shift to the numerical grading system was introduced in England in 2017 firstly in English language, English literature, and maths.

By 2020 all subjects were shifted to number grades. This means anyone with GCSE results from 2017-2020 will have a combination of both letters and numbers.

The numerical grading system was to signal more challenging GCSEs and to better differentiate between students’ abilities - particularly at higher grades between the A *-C grades. There only used to be 4 grades between A* and C, now with the numerical grading scale there are 6.

What do the number grades mean?

The grades are ranked from 1, the lowest, to 9, the highest.

The grades don’t exactly translate, but the two grading scales meet at three points as illustrated below.

The bottom of grade 7 is aligned with the bottom of grade A, while the bottom of grade 4 is aligned to the bottom of grade C.

Meanwhile, the bottom of grade 1 is aligned to the bottom of grade G.

What to do if your results weren’t what you were expecting?

If your results weren’t what you were expecting, firstly don’t panic. You have options.

First things first, speak to your school or college – they could be flexible on entry requirements if you’ve just missed your grades.

They’ll also be able to give you the best tailored advice on whether re-sitting while studying for your next qualifications is a possibility.

If you’re really unhappy with your results you can enter to resit all GCSE subjects in summer 2025. You can also take autumn exams in GCSE English language and maths.

Speak to your sixth form or college to decide when it’s the best time for you to resit a GCSE exam.

Look for other courses with different grade requirements

Entry requirements vary depending on the college and course. Ask your school for advice, and call your college or another one in your area to see if there’s a space on a course you’re interested in.

Consider an apprenticeship

Apprenticeships combine a practical training job with study too. They’re open to you if you’re 16 or over, living in England, and not in full time education.

As an apprentice you’ll be a paid employee, have the opportunity to work alongside experienced staff, gain job-specific skills, and get time set aside for training and study related to your role.

You can find out more about how to apply here .

Talk to a National Careers Service (NCS) adviser

The National Career Service is a free resource that can help you with your career planning. Give them a call to discuss potential routes into higher education, further education, or the workplace.